Accounts Receivable Automation vs Transformation: Why Cloud-Based Software Is Necessary for Boosting CX

- 8 min read

In this blog, you'll learn:

- What accounts receivable transformation is

- What cloud-based accounts receivable technology is

- What to consider when choosing a cloud-based AR automation solution

Customer experience (CX) is a top priority for companies of all sizes. And through digital transformation initiatives, technology is playing a critical role in boosting CX by helping teams prioritize data and automate everyday workflows.

However, one critical department is lagging technologically, hampering their ability to transform.

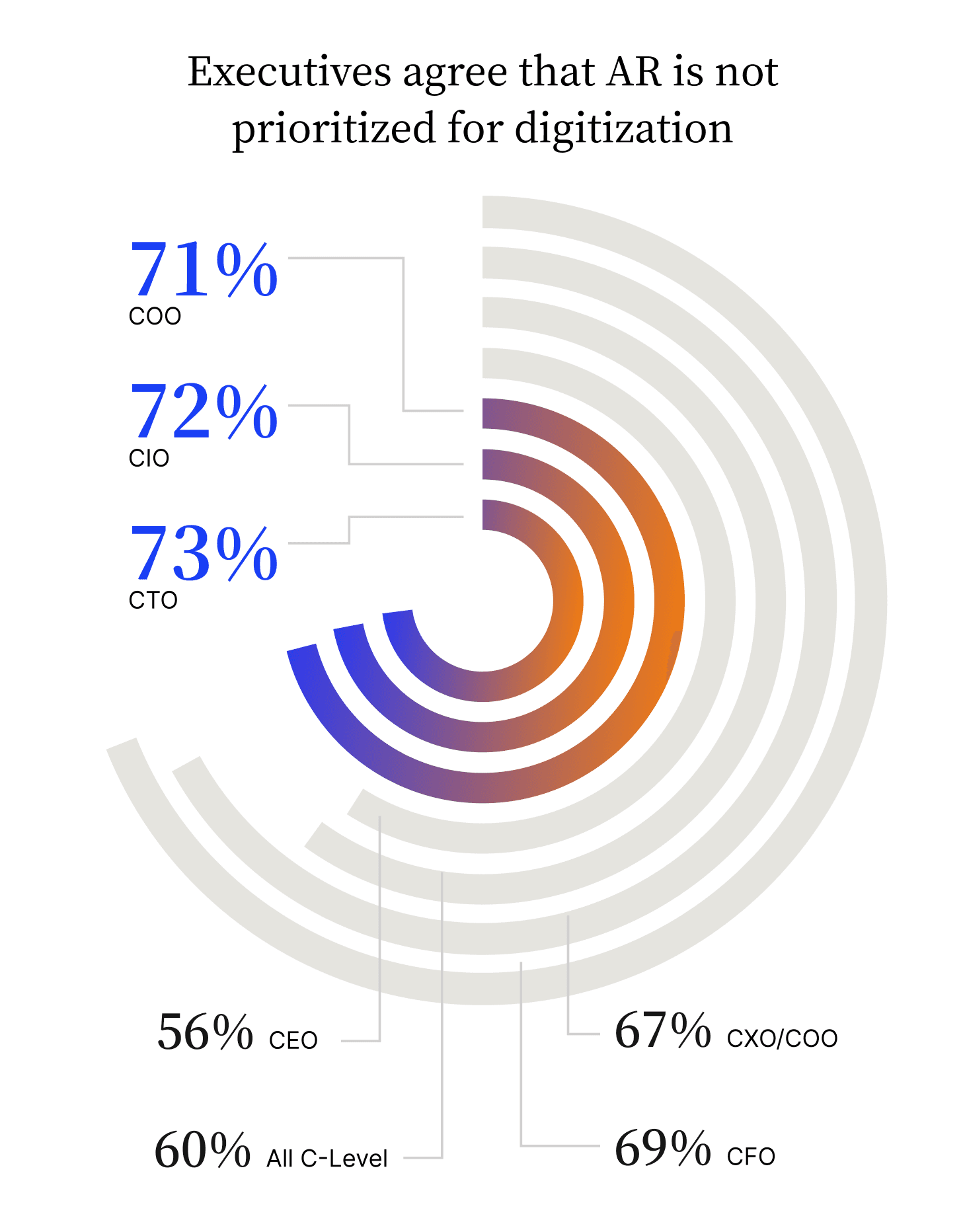

Accounts receivable (AR) is a major CX driver yet does not attract the technological investment it deserves. Versapay and Wakefield's report on the State of Digitization in B2B Finance revealed that 60% of C-level executives have not yet prioritized upgrading AR as part of their digital transformation initiatives.

One reason for this is leaders mistaking automation for transformation, and thinking that automation alone is capable of driving significant change. Automation though, unlike transformation, does not redesign processes for greater efficiency. It simply streamlines existing workflows, which are often flawed and fail to consider the customers’ experience.

Automation, through digital transformation programs, works best when companies embrace cloud-based technology. The cloud’s flexibility, scalability, and cost-effectiveness makes it a compelling investment for companies looking to boost CX.

This article explores why organizations must embrace AR transformation through cloud-based technology and stop relying on mere automation.

Jump to a section:

What is accounts receivable transformation?

Accounts receivable transformation is a collection of workflows that leverage AR as a key driver of CX. It involves using cloud-based technology to drive visibility and transparency to reorient traditional back office functions towards customers.

AR transformation achieves these goals by prioritizing collaboration throughout the process. For instance, you can offer your customers a real-time payment portal that preserves digital payment methods, lists outstanding invoices and supporting documentation, dispute statuses, and offers a direct communication channel with your sales and AR teams for speedy resolution.

Compare this to an electronic, on-premise automation-only workflow where your AR team sends outstanding payment reminder emails to clients. The former offers clients more visibility into your processes and brings all parties on the same page. The latter applies a digital veneer to a manual process.

Transformation represents a change in the way you think about accounts receivable and use it to build strong customer relationships.

—

🚨 If you're looking to boost CX and improve your collections experience, take our six-minute assessment and get personalized recommendations for how to transform your accounts receivable

4 factors making accounts receivable transformation a necessity

Accounts receivable is currently treated as a back-office function in many enterprises. However, this approach undersells the department’s importance. From handling cash flow to managing customer relationships (and disputes), AR plays a significant role in building an organization’s image.

Here are four factors that underline why you must transform your AR instead of merely automating it.

- 1) AR errors can stunt business growth—Invoicing errors cost you future business. As reported in our State of Digitization in B2B Finance report, 42% of respondents admitted to losing business opportunities due to issues in the invoicing phase. 35% of respondents reported losing revenue due to these errors. Transformation, not automation, is the solution to these problems

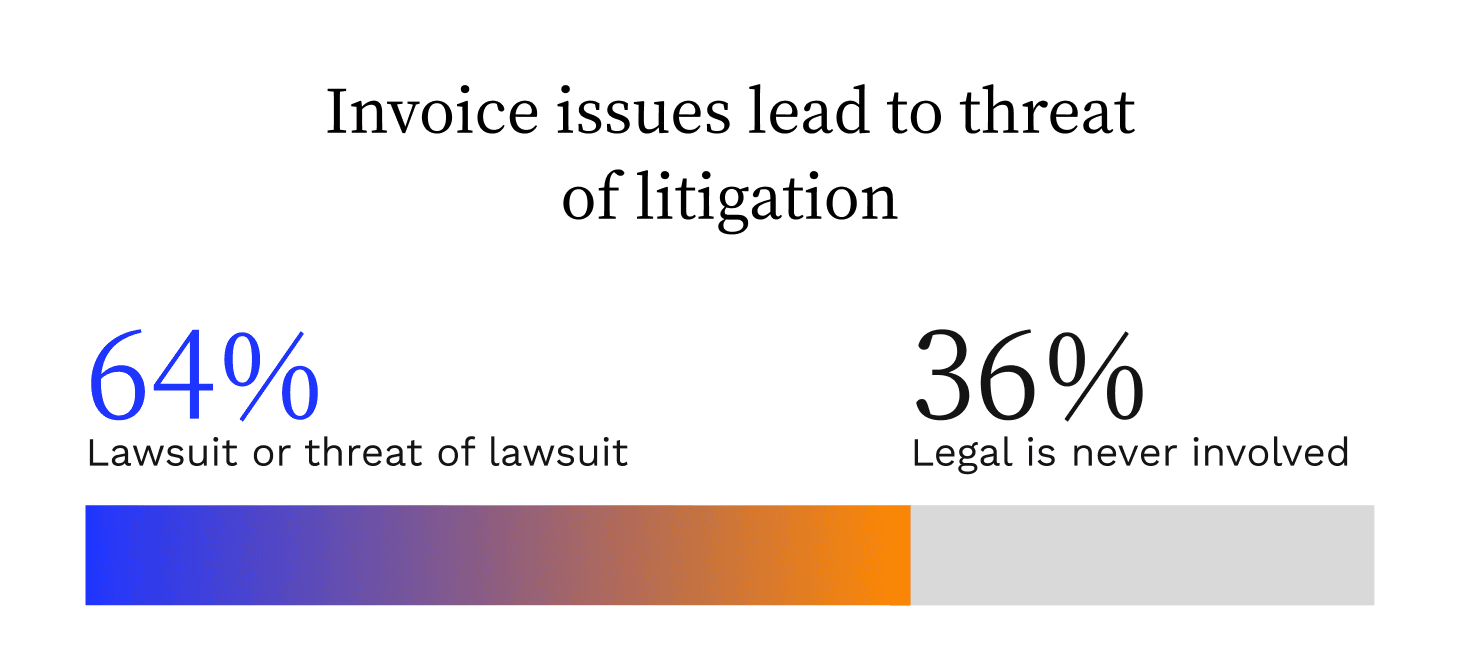

- 2) AR inefficiencies can damage your reputation—Inefficient AR, hampered by a lack of transformation in its processes, can sink your reputation. In the same report mentioned above, 64% of respondents reported they suffered lawsuit threats due to miscommunication in the invoice dispute resolution process. These legal procedures levy additional costs on a business—highly avoidable ones.

- 3) Businesses need more financial resilience—Economic conditions are forcing businesses to prioritize financial efficiency over a growth-at-all-costs approach. AR transformation builds efficiency from the ground up, giving you greater control over cash flow and working capital positions.

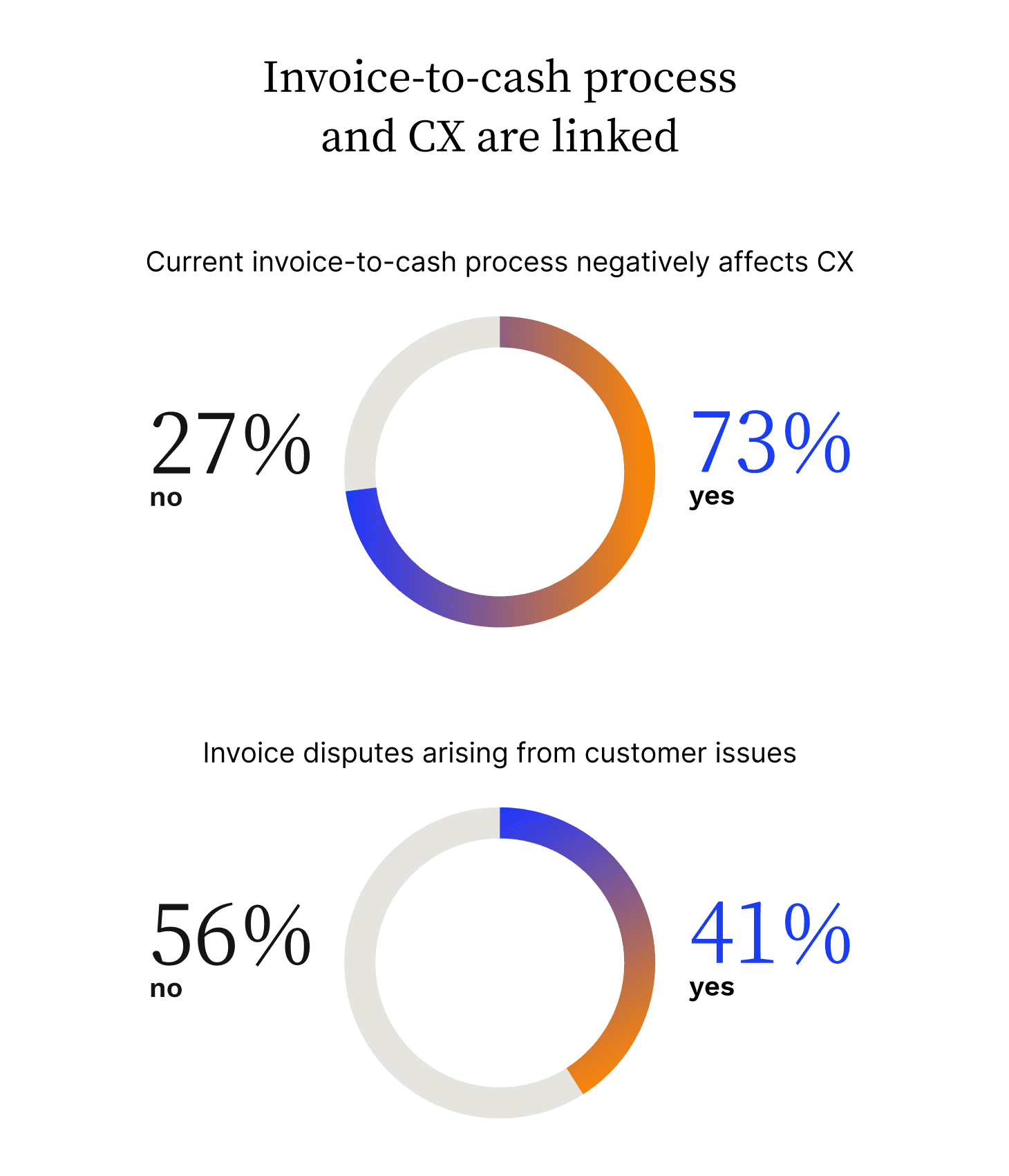

- 4) Invoice-to-cash is a CX-driver—Every business needs strong customer relationships to flourish in the long run. In the report we cited above, 73% of respondents reported their current invoice-to-cash process negatively affects CX, proving the link between invoice-to-cash and customer relationships and that automation merely papers over existing cracks in AR workflows.

4 ways on-premise automation fails to deliver AR transformation

Automation-only accounts receivable solutions typically leverage on-premise infrastructure instead of utilizing cloud-based technology. While automation introduces more efficiency to your processes, it cannot fix the AR Disconnect.

This term refers to the chasm that forms between you and your customers during the payment process due to a lack of transparency into receivables, ineffective communication methods, and a reliance on manual workflows. This is the isolation AR departments experience from customer value drivers, despite being a critical CX cog.

Here are four ways an on-premise automation-only solution fails to deliver ground-up transformation:

- 1) On-premise automation offers a technological veneer—Automation speeds up existing processes, removing manual and clerical work from them. However, if your underlying processes are broken, automation does not solve them. For example, if customers frequently report discounting errors in your invoices, automation will not solve this issue or impact CX. It cannot boost collaboration—a critical factor in reducing the AR disconnect.

2) On-premise automation increases capital expenditures—On-premise solutions need a complex infrastructure to work. From local servers to routine maintenance, the one-time costs these solutions present might be prohibitive to most organizations. The result is a significant impact on cash flow

3) On-premise automation draws you away from core expertise—Complex infrastructure demands highly-qualified personnel and resources to maintain it. If your core business does not revolve around IT services and infrastructure, an on-premise solution will draw valuable resources away from your core, profit-generating business lines.

4) On-premise automation reduces flexibility—An on-premise solution isn't a one-off investment. It needs constant upgrades, security patches, and feature rollouts to remain relevant. These IT processes reduce your technological flexibility, creating roadblocks for customer-facing teams—and teams like accounts receivable who should strive to become more customer-oriented

While on-premise solutions give you complete control over your data, the consequences of owning it (more maintenance, greater security needs, reduced expertise, more capex, etc.) might dwarf the advantages.

What is cloud-based accounts receivable technology?

Cloud-based accounts receivable technology refers to platforms that use the cloud to boost collaboration between all parties throughout the AR workflow. They introduce flexibility, scalability, and efficiency in AR. Most importantly, they help deliver greater customer experiences.

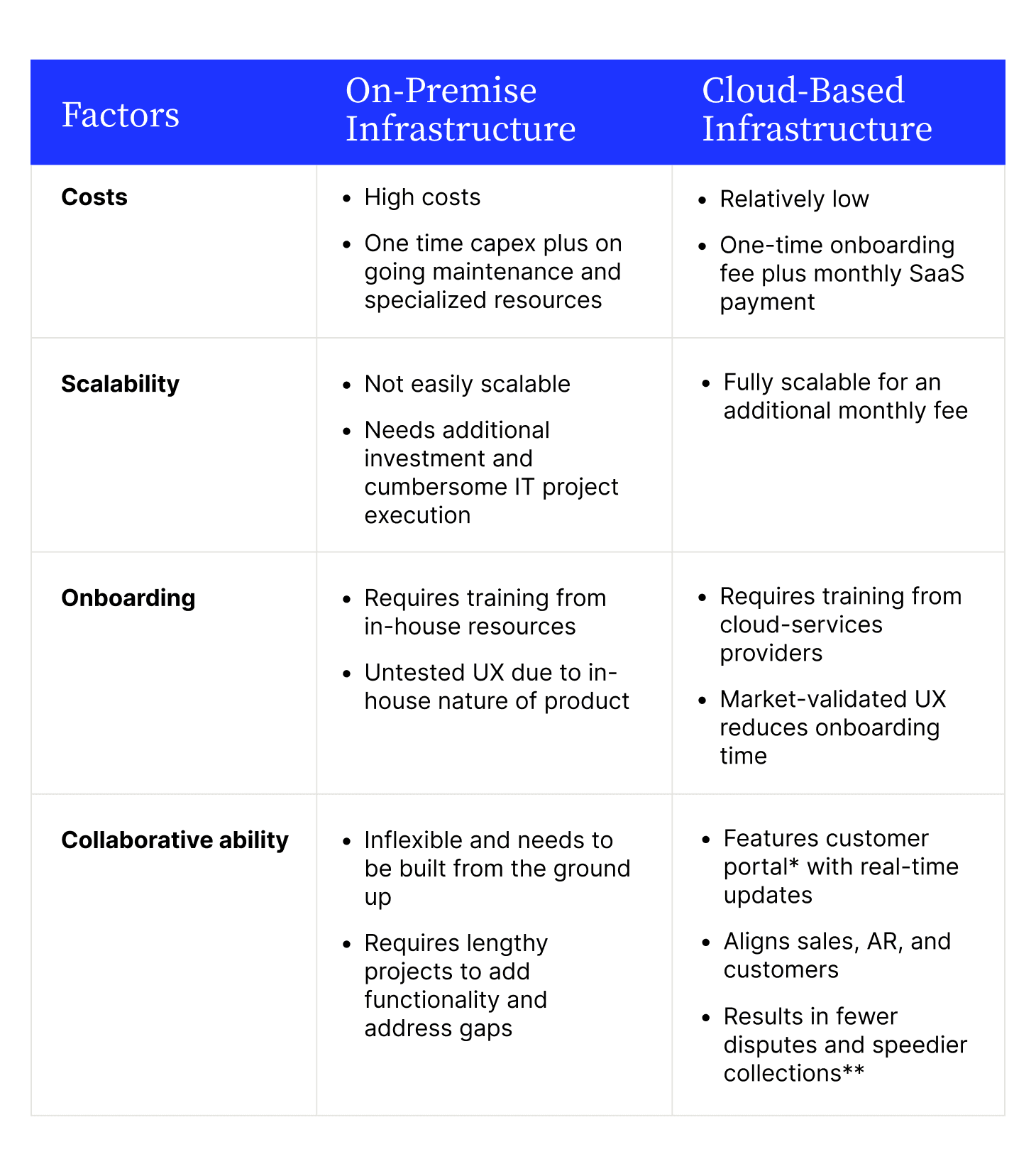

Cloud-based technology is a critical pillar to realizing the benefits of AR transformation. Here are some differences between an on-premise automation solution and a cloud-based AR automation platform:

* Basic vs. Collaborative Payment Portals: Why Accounts Receivable Teams Should Know the Difference

**How Cloud-Based, Collaborative AR Gets You Paid FasterWhy cloud-based technology is critical to AR transformation

While automation introduces efficiencies into your existing accounts receivable workflows, it does not address deep-seated issues. AR transformation is the key to unlocking greater efficiency in organizations seeking to use the payments experience as a key CX contributor.

Here's how the cloud assists you in achieving these transformational goals.

- Easier organizational alignment—The cloud makes it easy for sales, AR, and your customers to arrive on the same page. In addition to giving your customers an environment where they can collaborate with your team in real-time to address disputes and make payments, the cloud can ensure fewer miscommunications occur between sales and AR that create invoice errors and customer disputes in the first place.

- Instant upgrade to software best practices—Cloud-based platforms automatically upgrade their technology, giving you instant access to a suite of software best practices. From security to the latest collaborative functionality, the cloud makes it easy to release and distribute software updates.

- Better CX—Collaboration is easy with the cloud thanks to real-time syncing and outsourced technology maintenance. The result is close to no downtime and visibility into your AR workflows–and visibility for your customers into their account statuses. The AR Disconnect reduces as well, speeding up collections and reducing unpaid invoices.

- Better UX—AR teams need quick access to data to address customer disputes and prevent invoicing errors. A cloud-based platform centralizes relevant data by integrating with different systems—like your ERP. No more manual data gathering and sourcing (and dealing with the errors that process produces). Plus, some cloud solutions surface important accounts receivable KPIs, helping you better optimize your AR processes.

- More flexibility—Cloud-based platforms scale with your business automatically and cost-effectively. Thanks to quick onboarding and inbuilt automation, transformation doesn't stop as you grow.

What to consider when choosing a cloud-based AR software

Choosing the right cloud-based accounts receivable software platform can be daunting. Here's a helpful guide to choosing AR automation software that will guide you through the process.

Automation and transformation are very different objectives. The former introduces efficiency in existing processes, while the latter leverages cloud-based technology to rethink entire business workflows. It's time for AR to realize its potential and drive CX to greater heights.

How can you get started with AR transformation? Take our six-minute assessment to receive your personalized accounts receivable transformation roadmap.

—

Versapay’s collaborative AR platform is designed to grow with your business and deliver memorable customer experiences. Get in touch with us to learn how Versapay can help you reach your AR goals.

About the author

Vivek Shankar

Vivek Shankar is a content writer specializing in B2B fintech and technology. He is ambivalent about the Oxford comma and covers the institutional finance markets for industry trade publications. An avid traveler and storyteller, Vivek previously worked in the financial sector as a data analyst.