Efficient virtual card acceptance for you and your customers

Simplify virtual credit card payments processing and reconciliation with ease and increase efficiency to accomplish more.

Versapay Virtual Card Connect drives efficiency, accelerates cash flow, and delivers a better payment experience for your customers. And, it works with other Versapay products.

Offer more payment methods to meet your customers' evolving needs

Simplify the payment process and improve overall customer satisfaction by offering a variety of payment options, including B2B virtual card payments.

Eliminate costly manual workflows

Say goodbye to time-intensive processes. Virtual Card Connect automatically processes incoming emails, parses remittance and card number details, and processes the payments. Straight-through payment processing technology, powered by Boost Payment Solutions, increases match accuracy rates for payment parsing.*

Find peace of mind with secure payment acceptance

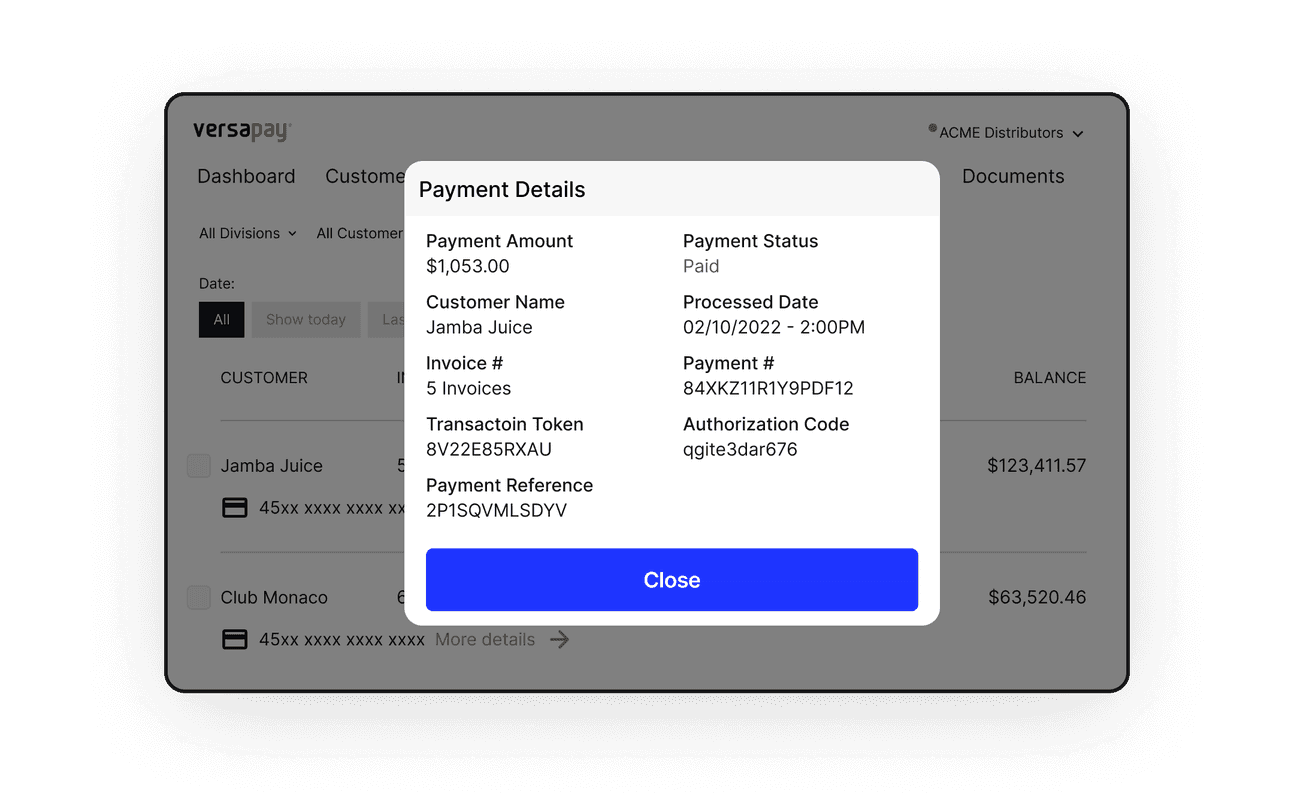

Safely collect payments with Versapay’s PCI DSS compliant payment processing solutions that help minimize fraud and chargeback risks. Your business remains safe as all your customers’ payments are tokenized and encrypted for a more secure payment experience.

Accelerate cash flow with faster processing

Get touch-free, straight-through payment processing for virtual cards at rates optimized for B2B transactions with interchange optimization and Level 3 data processing.

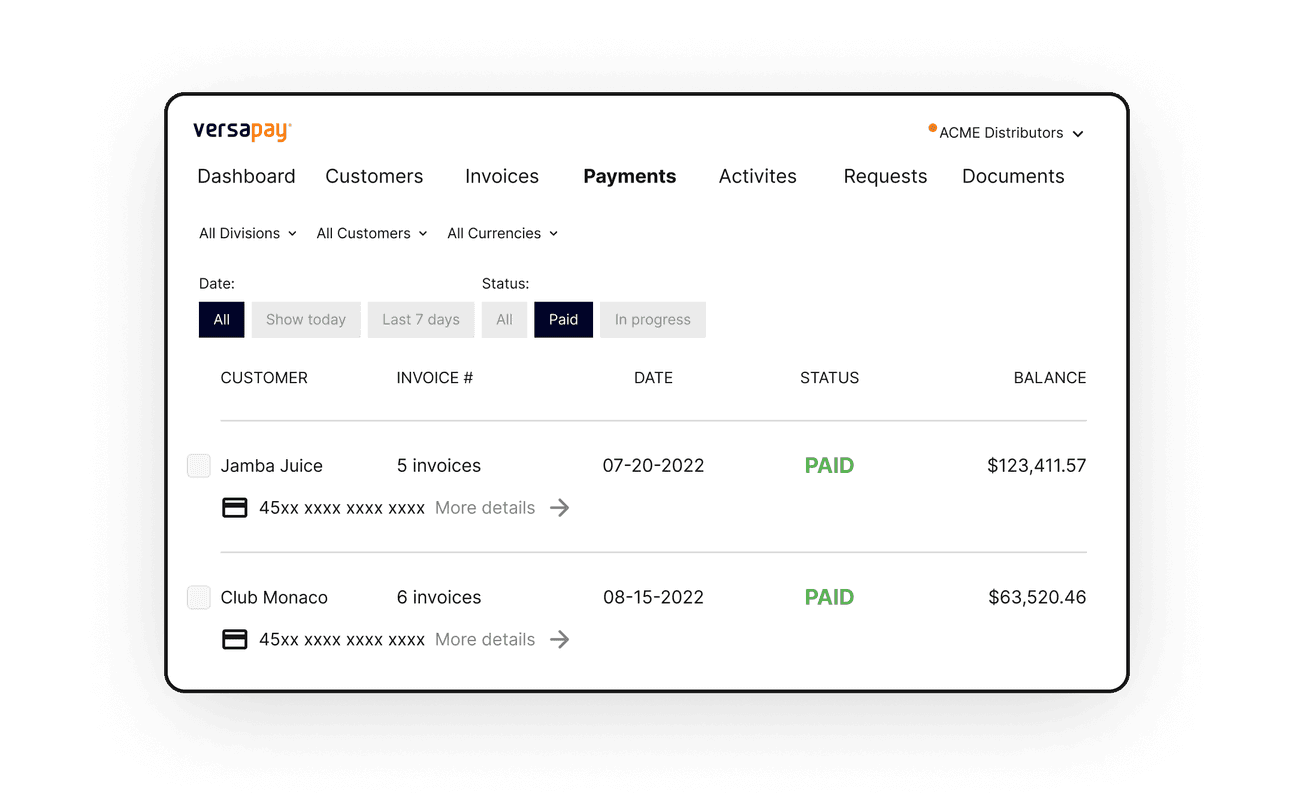

Automate reconciliation and reporting

Streamline ERP reconciliation with access to detailed virtual card reporting data that can be scheduled and exported directly to your ERP.

With our integrated solutions for ERP Payments and Collaborative AR, ERP reconciliation with open AR is fully automated.

Accepting Virtual Credit Cards is Business Critical. Are You Ready?

Customers want to pay with virtual cards, and over half are willing to switch vendors if you don't provide that option. This study shows why virtual cards are becoming increasingly critical and how you can turn them into a competitive advantage.

*Boost Intercept® straight-through processing is a patented solution provided by Boost Payment Solutions. All related names and logos are registered trademarks owned by Boost Payment Solutions, Inc.