The AR Pulse Check Survey

This report highlights how Collaborative AR is a strategic change agent to a business area struggling with speed-to-payment, manual collections, inefficient and disorganized processes, and siloed legacy systems.

How The AR Pulse Check Survey Reveals An Urgent Need For Instant Customer Engagement

SSON + Versapay

March 1st, 2022

This report highlights how Collaborative AR is a strategic change agent to a business area struggling with speed-to-payment, manual collections, inefficient and disorganized processes, and siloed legacy systems.

In this report you'll:

- Explore the communication breakdown between accounts receivable (AR) and customers

- Learn to improve AR performance and customer service through client portals

- Discover how Collaborative AR improves the collections process

- Examine real-life examples of how AR query response rates were halved

- Be presented with industry insights from Versapay's leadership, and

- Much, much more!

Take a peek inside the report

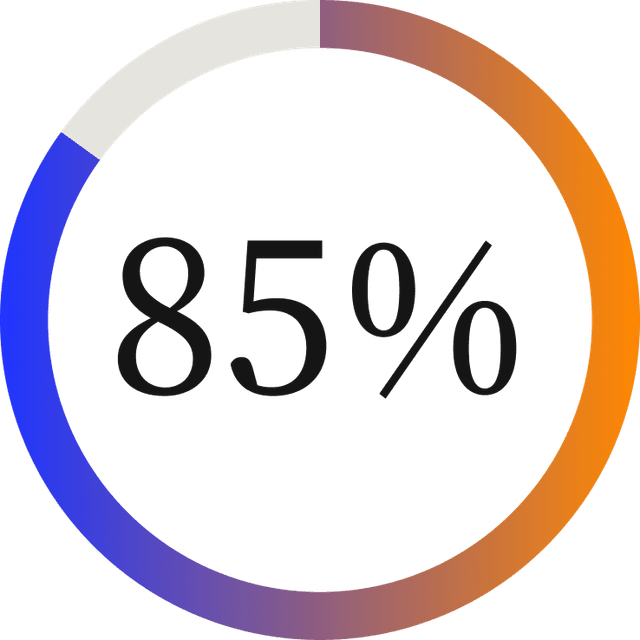

... of respondents are still manually matching payments with remittance

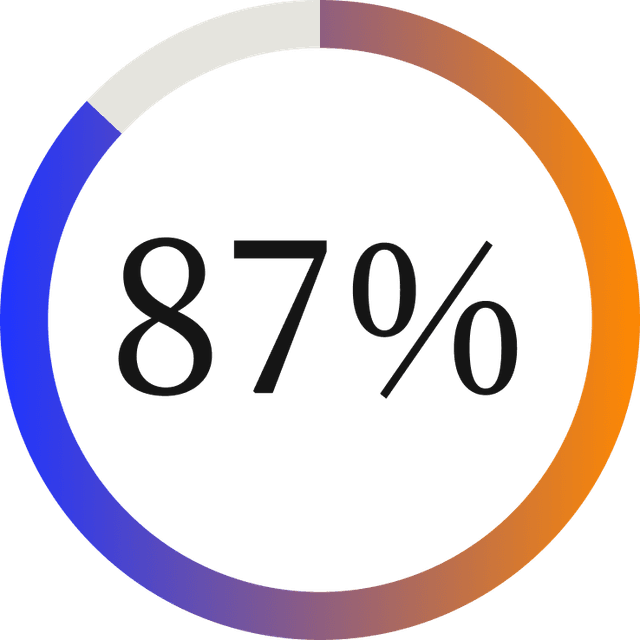

... of respondents identified phone or email as the primary customer contact method

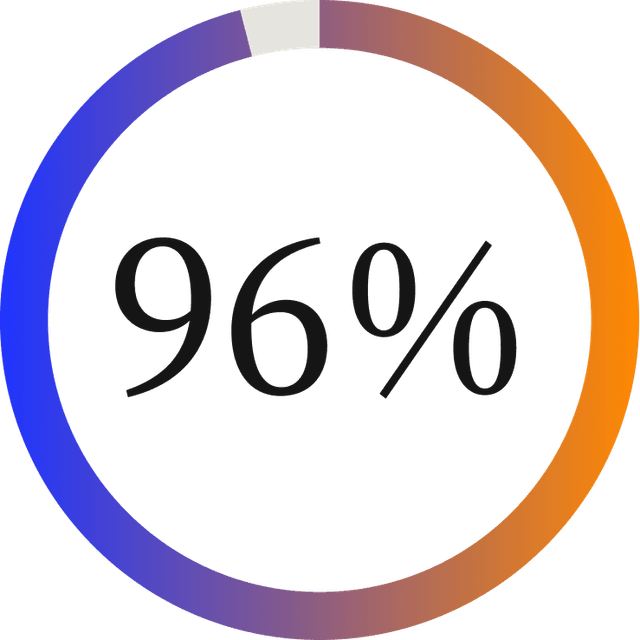

... of respondents said that customer experience is important in the accounts receivable process

The AR Pulse Check Survey is just a few clicks away!

Abstract

SSON’s 2022 AR Pulse Check survey of 103 Shared Services and Outsourcing (SSO), Global Business Services (GBS), and Finance leaders reveals that 50% of the market surveyed has invested in cloud. However, 26% of the surveyed market is currently deliberating while another 23% has no plans to transition.

And yet, whether they’ve invested in cloud solutions or not, it’s clear that AR teams are struggling to reduce manual administration and streamline customer contact. The survey reports approximately 85% of respondents are still manually matching payments with remittance. Another 87% identified phone or email as the primary customer contact method.

The survey reveals that regardless of investment in cloud solutions, there’s a disconnect between customer needs and the business processes set-up to support AR. To bridge the gap, what’s needed is a platform that reduces manual processes to improve cash flow and improves customer collection.