Are you ready to accept virtual credit cards?

This study will show you why virtual cards are becoming increasingly critical and how you can turn them into a competitive advantage.

Accepting Virtual Credit Cards is Business Critical. Are You Ready?

EXCLUSIVE STUDY

August 15th, 2024

Customers want to pay with virtual cards, and over half are willing to switch vendors if you don't provide that option. This study shows why virtual cards are becoming increasingly critical and how you can turn them into a competitive advantage.

Virtual cards aren’t the future—they’re already here

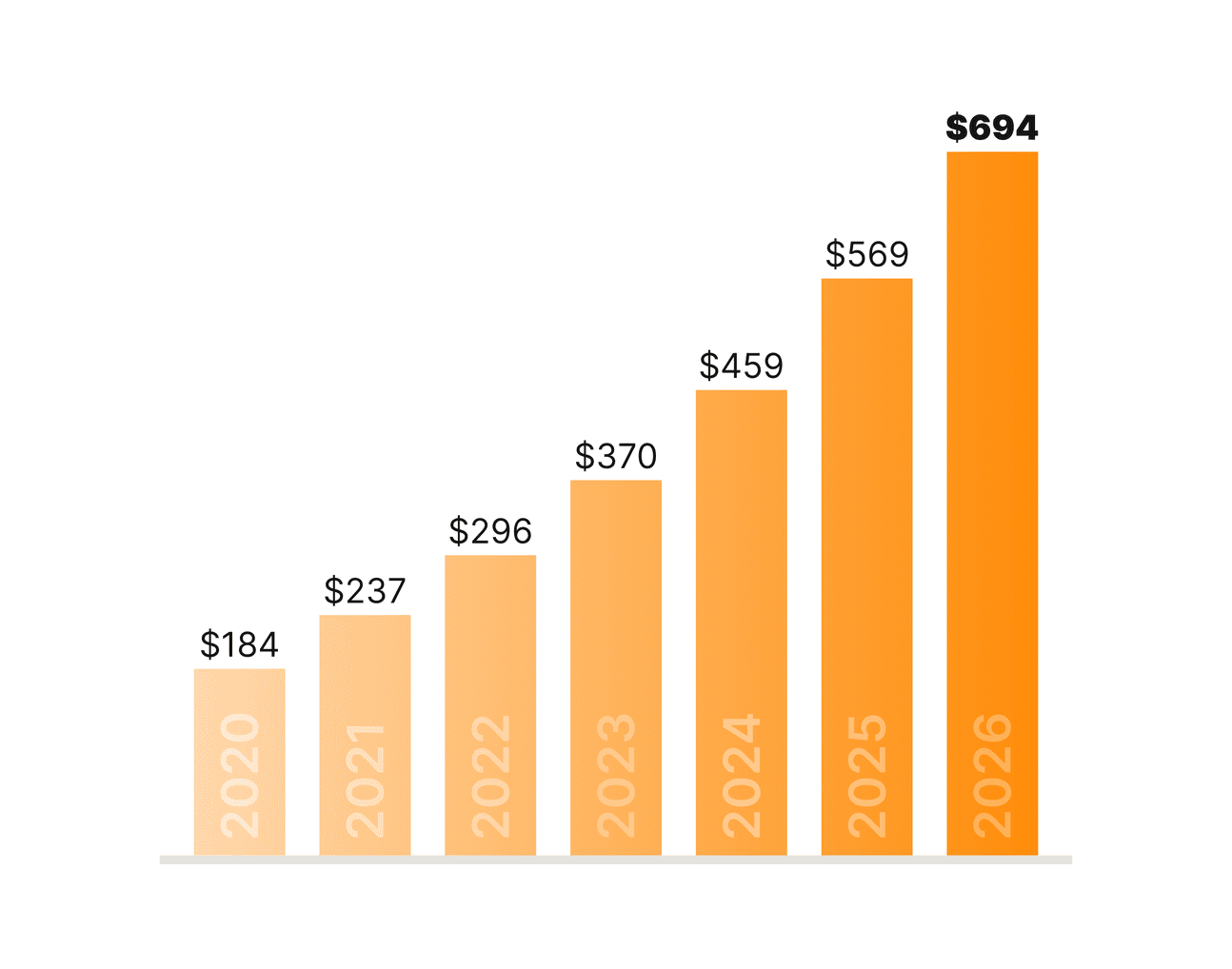

The North American virtual card market is expected to grow 24% annually, hitting $694 billion by 2026. The faster you embrace this new reality, the more likely your customers are to stick with you.

Denying virtual cards will cost you

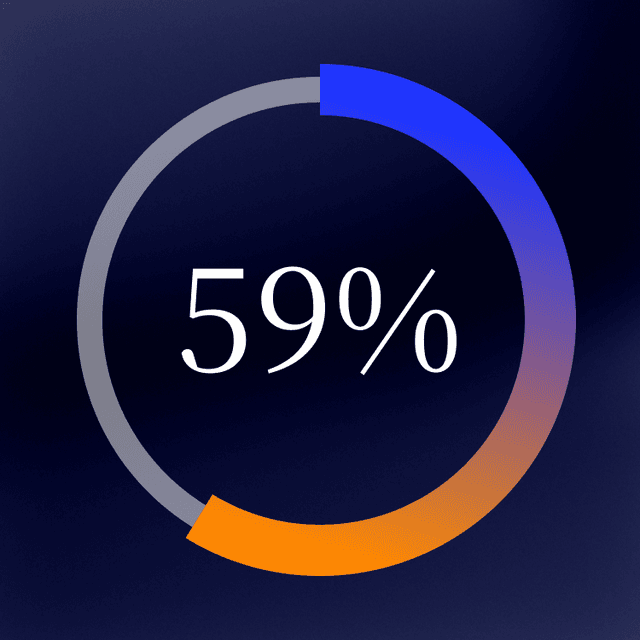

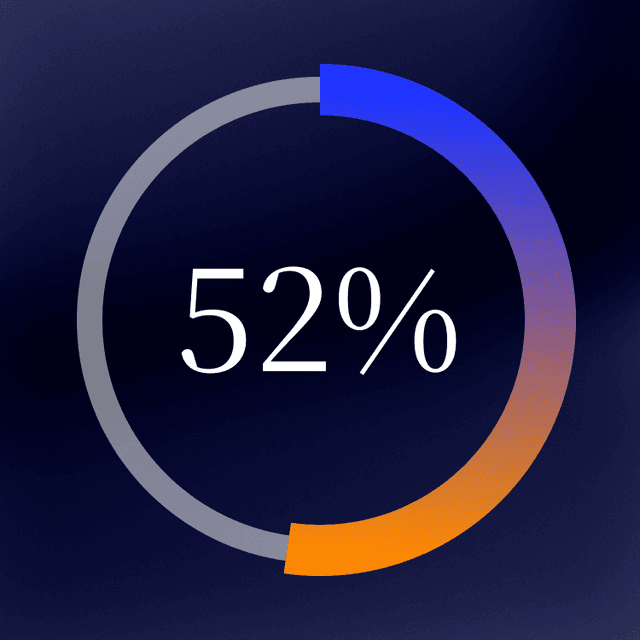

It’s highly frustrating when a business denies your payment method in your personal life. Business payments are no different. In fact, nearly 60% of AP leaders said they’d consider selecting (or switching to) a competing vendor because of their ability to accept virtual credit card payments.

Why are buyers using virtual cards?

Benefits like these are a big deal to your customers. Without accepting virtual cards, you prevent your buyers from enjoying them.

Manage risk & control large vendor spending with merchant-specific cards

Instantly create and issue cards, worry-free, to employees

Avoid unwanted charges by limiting cards to single uses

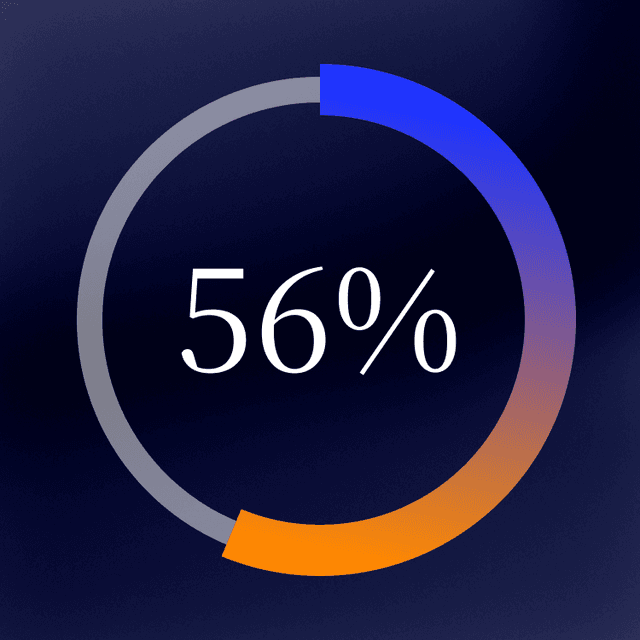

More payment options = More retention

80% of buyers prefer working with sellers who accept virtual cards. Keeping customers is easier than finding new ones—why give them a reason to leave?