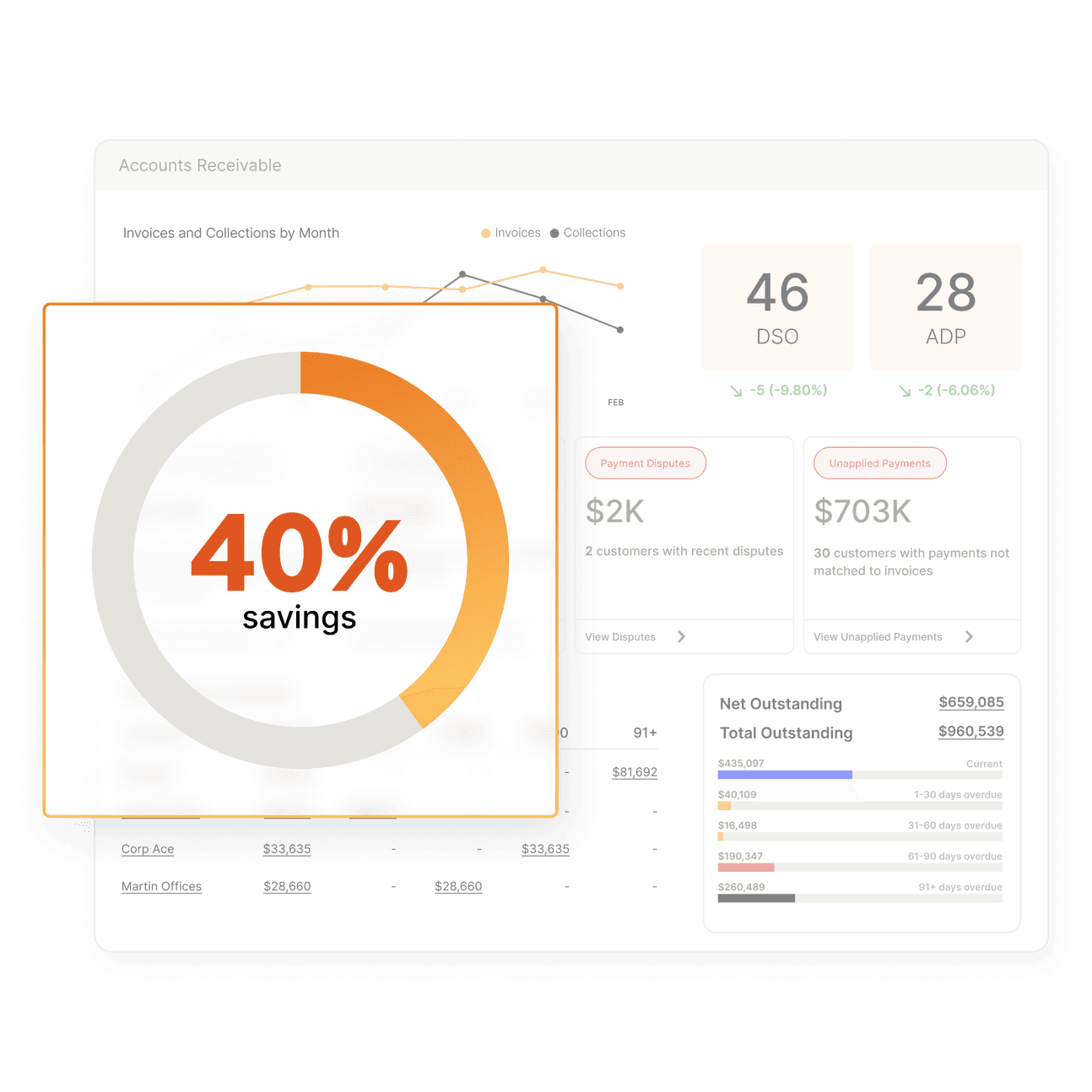

Reduce manual processes by up to 50%

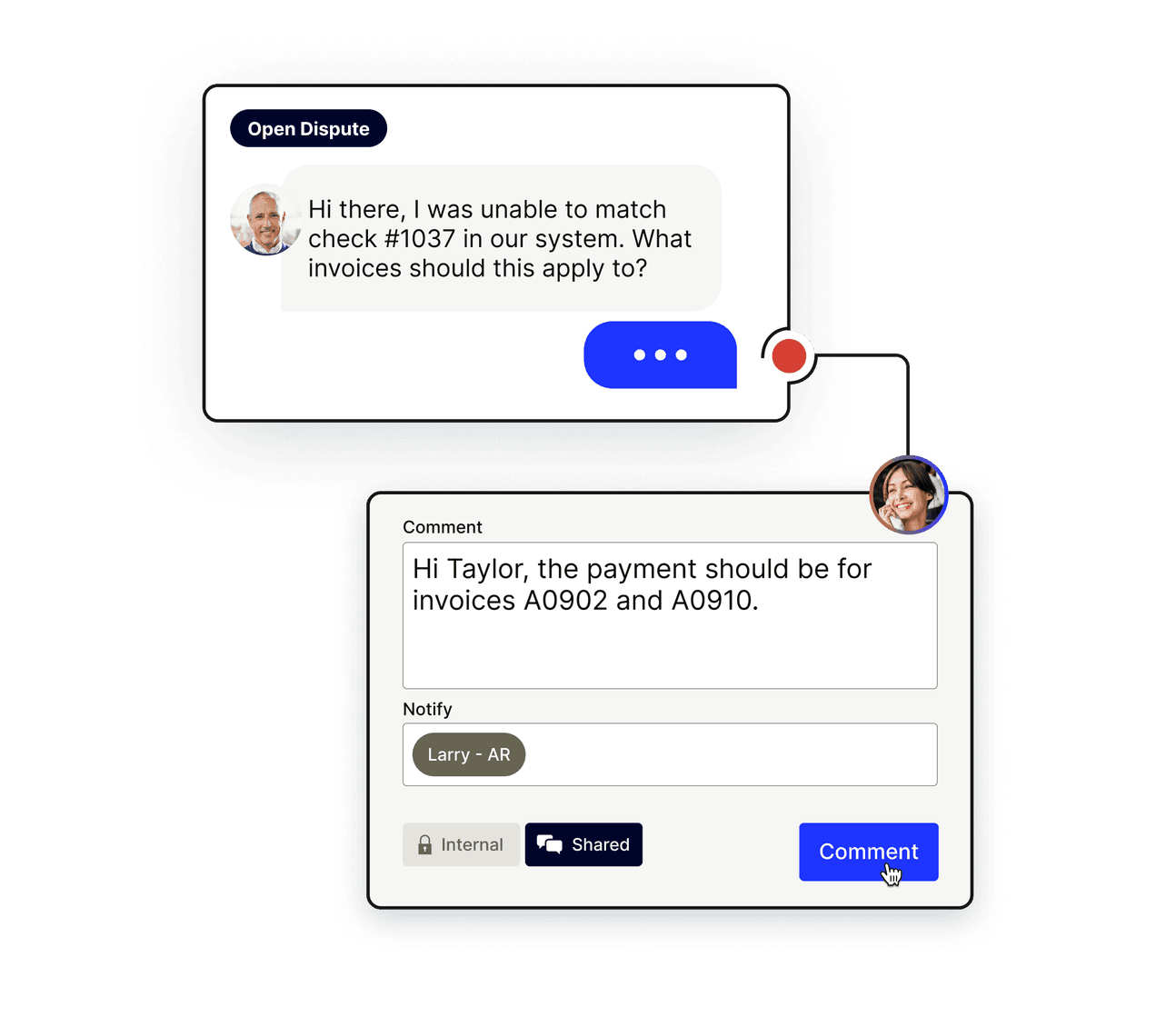

Capturing and storing settlement data within an embedded payments solution lets you perform payment reconciliation in real time, saving the effort of tracking down files and manually matching payments with bank statements.