Take control of how you get paid

Accept ACH, card, and wire payments in an integrated payments platform. Enjoy faster onboarding, better economics, and total visibility.

Process payments faster and manage cash flow without disruption

processed annually

transactions annually

faster payments

customer satisfaction rate

Payments should strengthen your business, not drain it

Many B2B payment processing solutions create manual work, limit flexibility, and chip away at your margins. We help you move faster, reduce costs, and take control of every transaction.

"[Versapay] is the most responsive payment processing partner. They understand our business, ensure we reduce our processing costs, and improve funding timeframes."

Nicholas Cordero, President, Las Vegas Expo

More than a processor

With Versapay, you own the payment processing experience, end-to-end

As a B2B payment service provider, we give you full control of the payment flow, and access to a built-in network connecting you with millions of buyers and sellers. The result? Streamlined customer payments and improved B2B collections.

Start accepting payments immediately

Control your payments, without the processor middleman

As an integrated payments platform, we streamline your processing, integrate payment acceptance within your ERP, get you onboarded faster, and lower your processing costs.

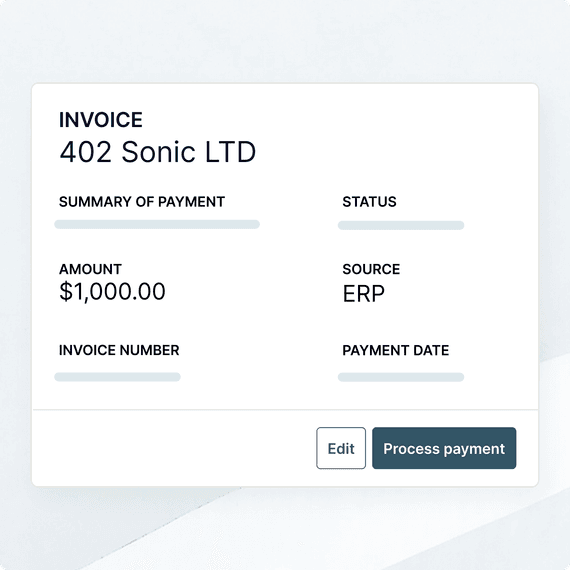

Embedded erp payments

Collect and apply payments without leaving your ERP

ERP-integrated B2B payment processing enables customers to pay invoices directly, with automatic posting and faster reconciliation.

Control your costs

Automatically lower your payment acceptance costs

Versapay intelligently routes ACH, card, and wire payments to minimize costs and maximize payment visibility. Built-in interchange optimization ensures you're never overpaying on card transactions.

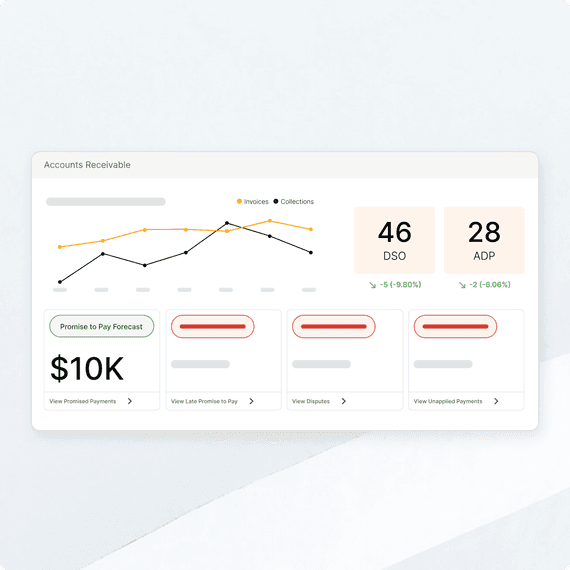

Payments & accounts receivable

Unify invoicing, B2B payments, and cash application

Versapay connects your accounts receivable processes, from invoicing to collections to reconciliation, eliminating system silos and accelerating cash flow.

b2b online payment solution

Everything you need to process B2B payments, already baked in

Accept digital payments and simplify your business payment processing using our B2B payment processing solution. As a leading B2B payment service provider, we offer ERP-integrated payment processing, payment automation, and secure, PCI-compliant technology.

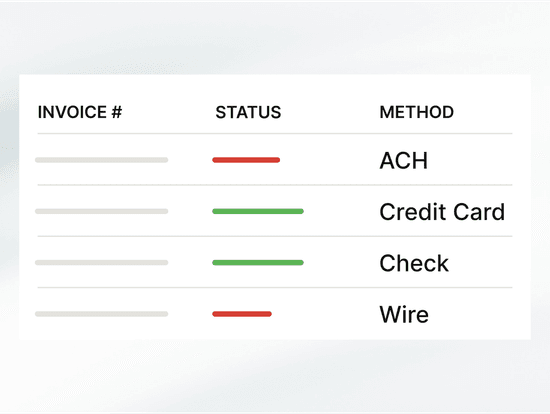

Accept all major payment types

ACH, credit cards, virtual cards, wire transfers, and checks are all supported and fully integrated

Process payments in your ERP

ERP integrated payments reduce manual handoffs and speed up reconciliation

Optimize interchange rates

Automatically pass level 2 & 3 data to qualify for lower processing fees

Get paid faster

• Next-day funding

• Recurring payment support

• Streamlined onboarding

Keep payments secure

• PCI-compliant tokenization

• All your data, one place

• Built-in protections

Rely on proven experts

• Trusted by finance leaders

• Tailored for your business

• Dedicated support

"We could not be happier with our decision to transition to Versapay for our credit card processing needs. We've seen a significant decrease in processing costs."

Kathy Chudow, VP of Finance, Medicine On Time

frictionless payments

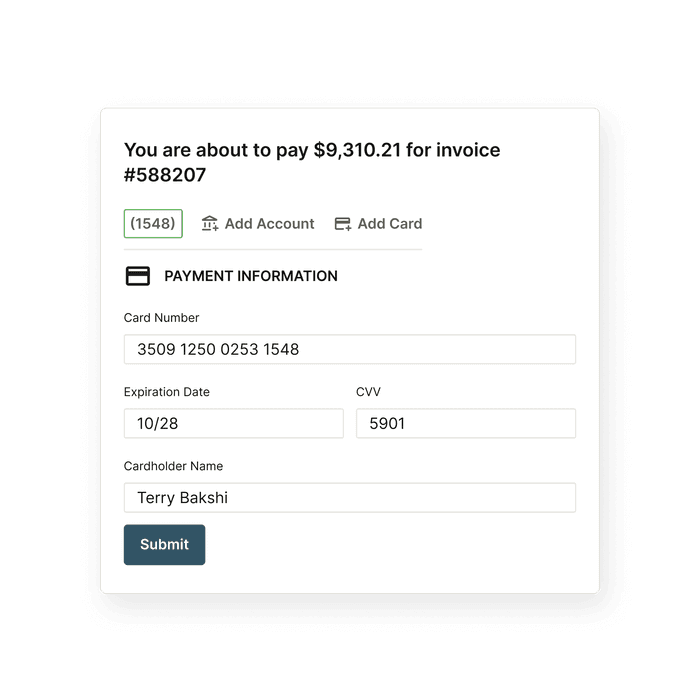

Safely accept and apply payments faster, across any channel, at any time

Easily accept payments by card, ACH, or wire—online, by phone, or in person. Behind the scenes, we’ll reduce processing fees, simplify compliance, and ensure payments are applied in your ERP.

level 2 & 3 credit card processing

Optimize interchange fees and lower costs

Minimize processing fees up to 40% and maximize margins by qualifying for the best possible interchange rates.

- Lower rates with data enrichment

- ERP-integrated for easy qualification

- Supports credit and virtual cards

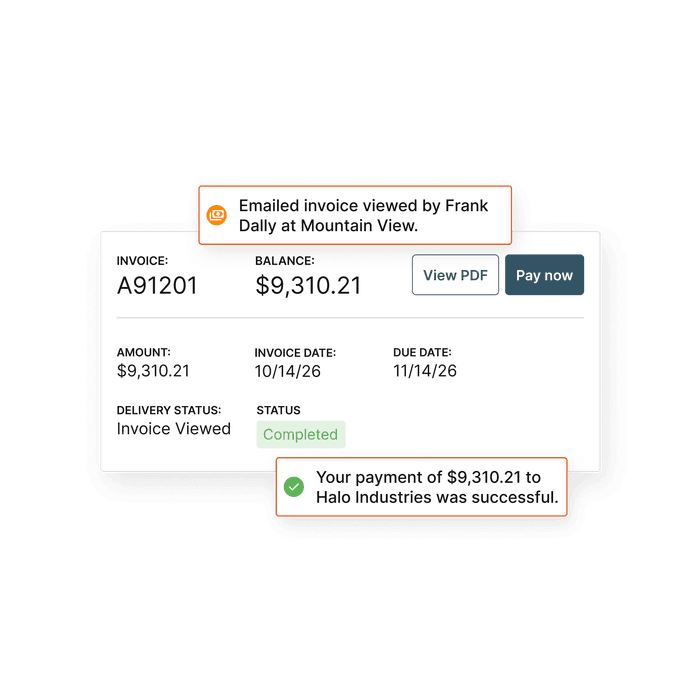

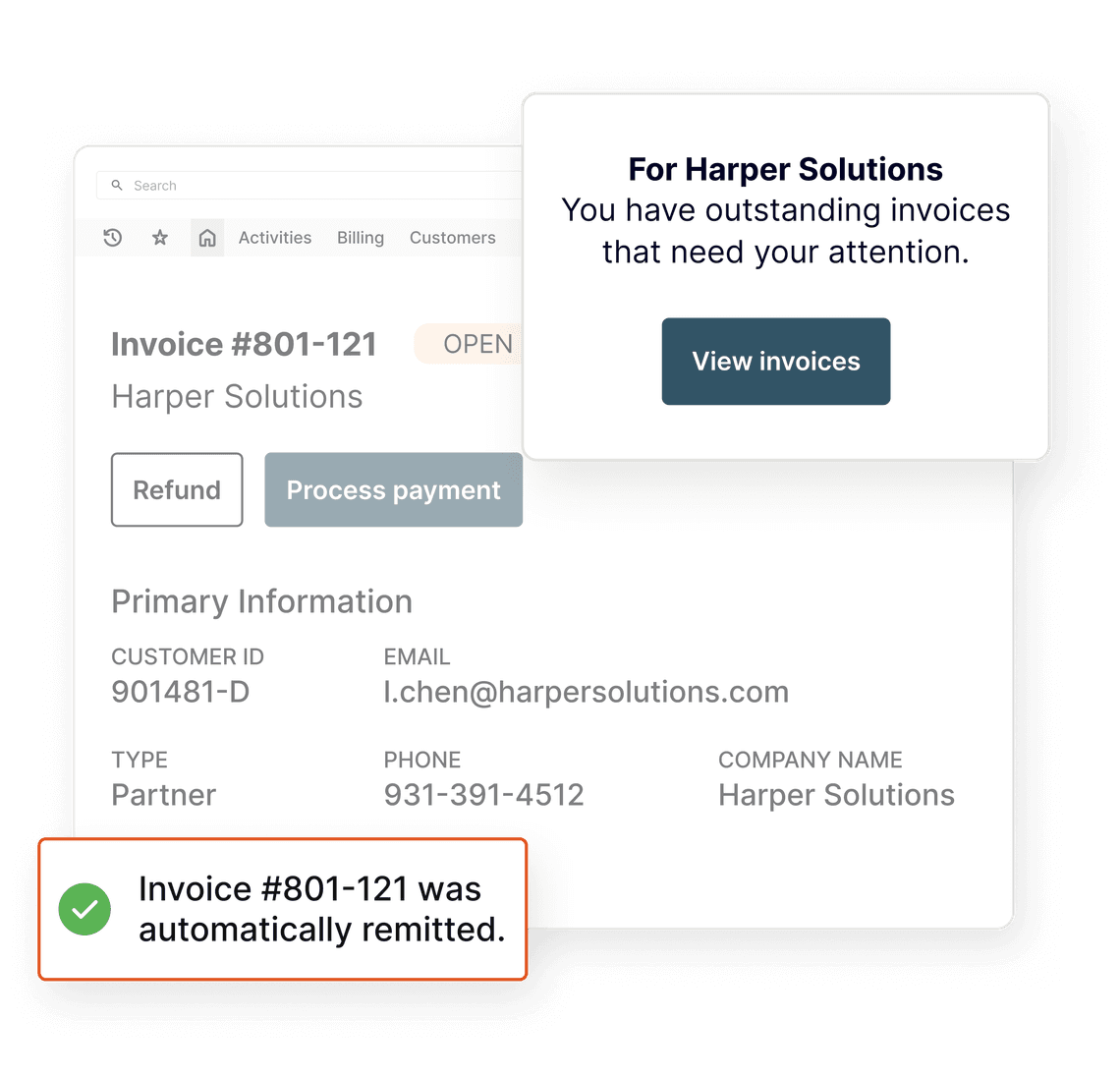

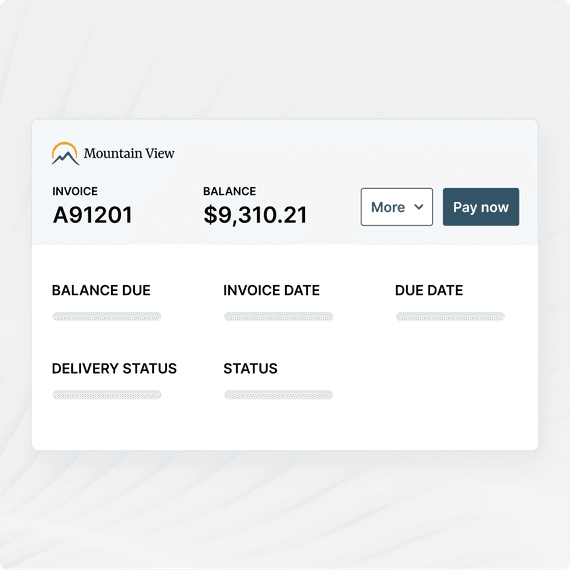

streamline customer payments

Make it easy for customers to pay

Give your customers a frictionless, modern payment experience. Accept payments through digital invoices, customer portals, and virtual terminals.

- Digital payment experiences

- Hosted payment pages & portals

- Support ACH, credit cards, and more

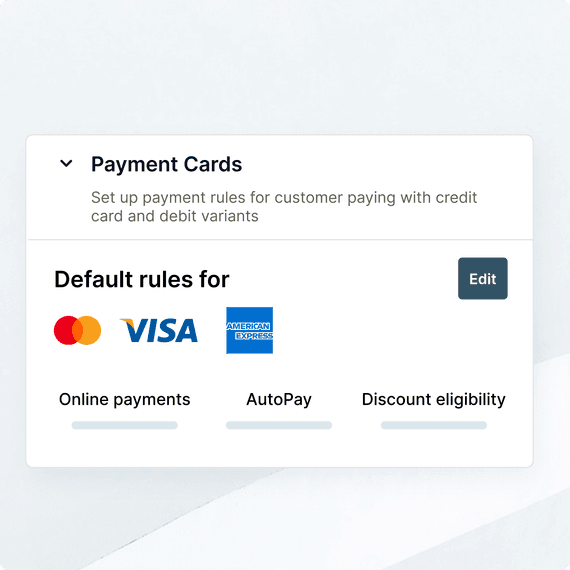

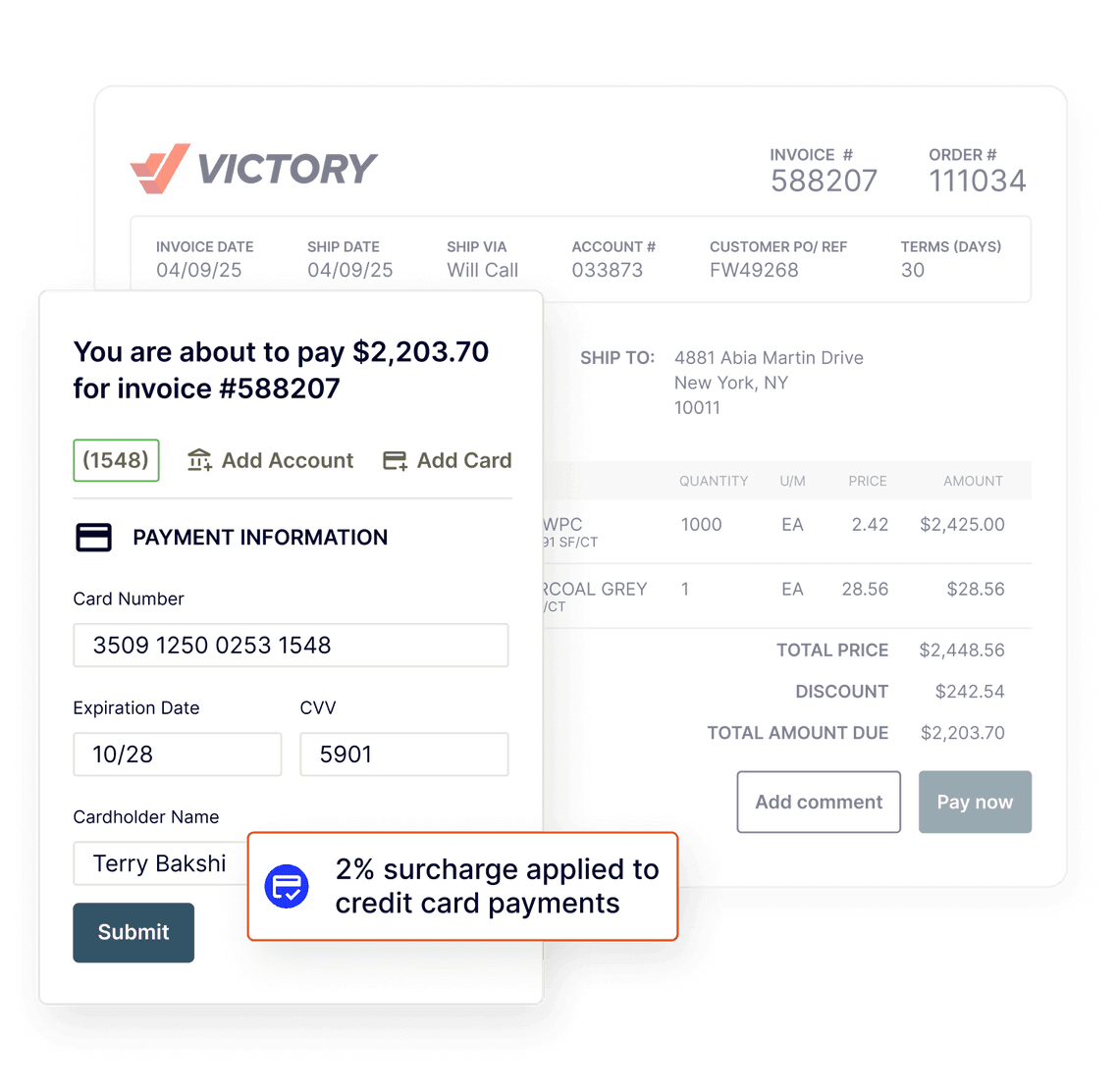

surcharge for cost recovery

Offset credit card processing fees

Recover costs on credit card transactions with automated surcharging. Apply card surcharges based on payment method, location, or transaction type.

- Automatic, rules-based surcharges

- Compliant with card network rules

- Reduce or eliminate acceptance costs

Secure B2B Payment Processing

Built-in protection for every transaction

Reduce your PCI scope and protect payment data at every touchpoint. We handle compliance so you don’t have to.

- Tokenization across all channels

- PCI DSS compliance support

- Less exposure to cardholder data

- Fraud protection & risk mitigation tools

Built to scale

Support higher payment volumes without any added complexity

Works your way

Customize flows to match how you work

Always up-to-date

Accept the latest digital payment methods

Global ready

Multi-currency and localization built-in

MORE THAN JUST PAYMENTS

Pair processing with AR automation for total control over the invoice to cash cycle

Digital invoicing & customer portal

Automate billing and get your invoices paid faster than ever

Let customers view, pay, and manage invoices freely while streamlining collections with automated invoicing.

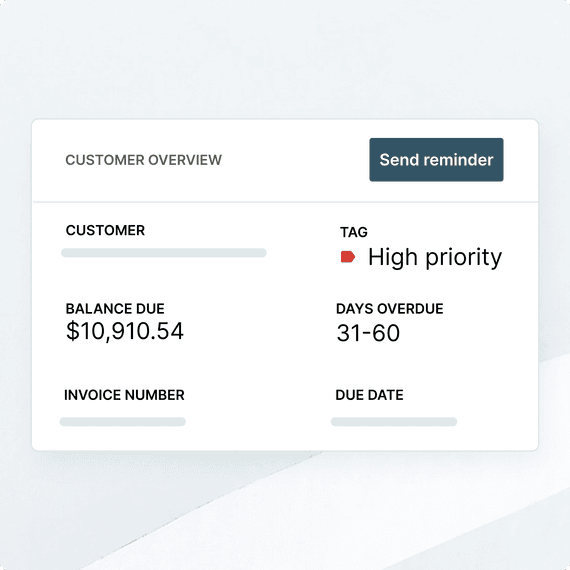

collections management

Collect with confidence and stop chasing overdue invoices manually

Automate collections, predict delinquencies, prioritize high-risk accounts, and maintain visibility.

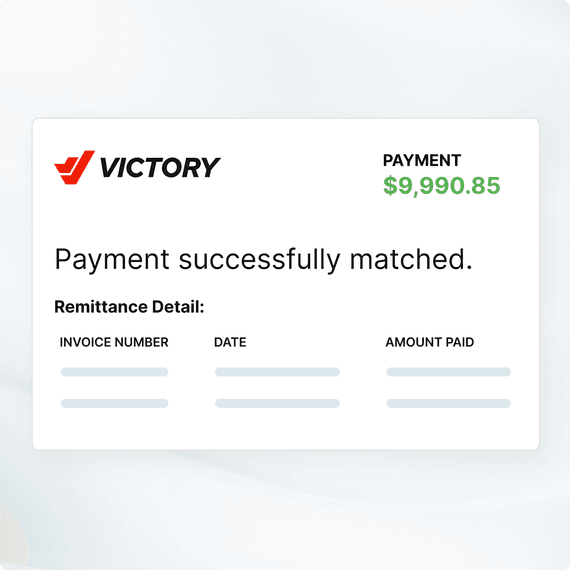

Cash application

Reconcile payments automatically, with zero guesswork

Automatically match payments to invoices, no matter how or where customers remit.

Reporting & reconciliation

Forecast cash flow and close faster

Track essential AR metrics, visualize collections trends, and act on payment risks before reconciliation begins.

Save time and effort, improve cash flow, and fuel growth

Resources for efficient processing

While transactions can happen in a matter of minutes, there's a lot happening behind the scenes. Learn more about the ins and outs of payment processing.

BLOG

High fees? How merchants can reduce credit card processing fees

BLOG

6 top payment processors reviewed: What B2B companies must look for

BLOG

Credit card surcharges: Overview (and solutions) for merchants accepting credit cards