Why CFOs Should up the Urgency on AR Digital Transformation

Digital transformation efforts are accelerating it's time for B2B payments to evolve. Here are five reasons CFOs should champion digitizing accounts receivable ASAP.

5 Reasons CFOs Should up the Urgency on Accounts Receivable Digital Transformation

Versapay + CFO Dive: Exclusive Report

September 14th, 2023

The last several years have seen an acceleration of the digital transformation that businesses have been moving toward for decades. B2C digital payments have skyrocketed and now it’s time for B2B payments to follow suit.

Download this exclusive report for five reasons CFOs should champion digitizing accounts receivable ASAP.

In this report you'll:

- Learn why CFOs cannot delay in prioritizing digitizing accounts receivable, and

- Hear from Versapay's CFO, Russell Lester, on how CFOs can improve their company's bottom lines by enhancing CX, improving efficiency, and reducing the human error common in outdated AR practice

"If you can arm your accounts receivable team with a tool that allows them to be very fast with insights... that puts them in a position of being a strategic advisor. It gives them a seat at the table."

— Russell Lester, CFO, Versapay

Take a peek inside the report

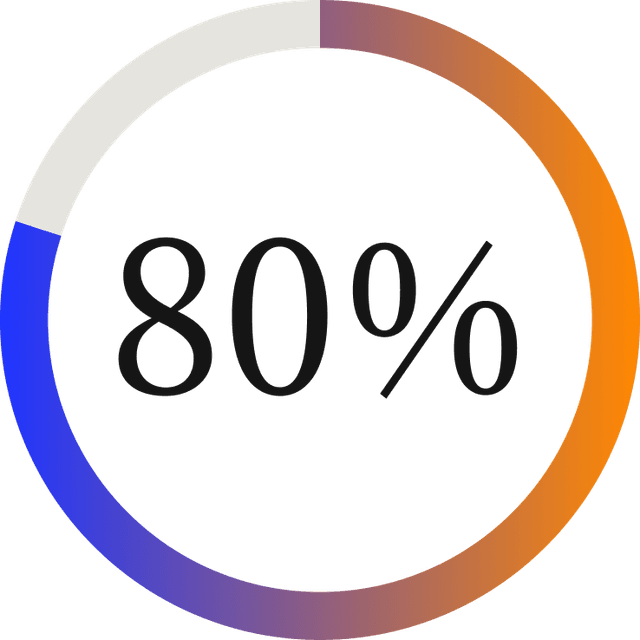

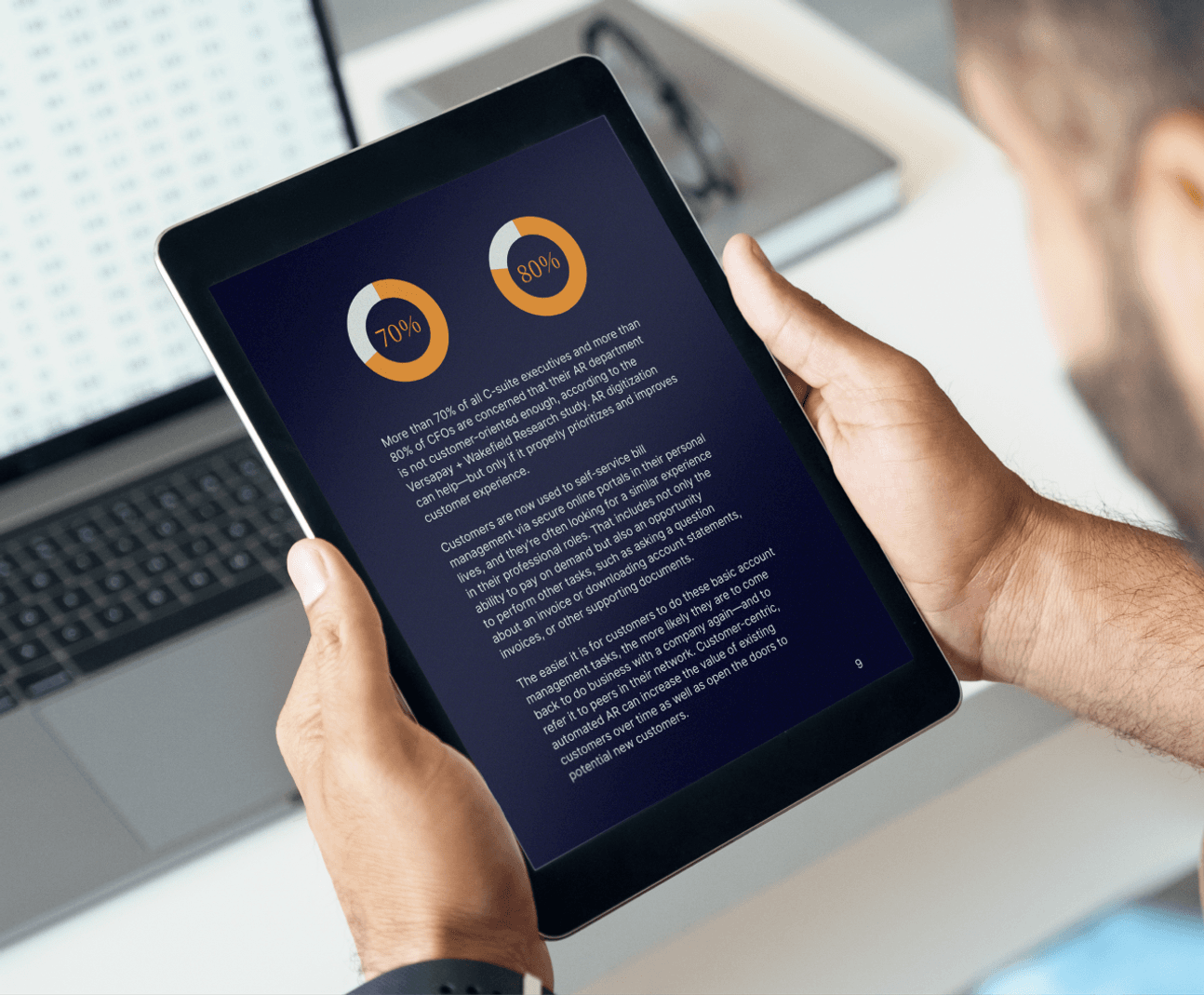

More than 80% of CFOs are concerned that their AR department is not customer-oriented enough.

More than 90% of executives now agree that every department in an organization must digitize.

Versapay's CFO, Russell Lester, discusses why (and how) the finance function can be viewed as a key enabler of growth.

Level up your accounts receivable

Cloud technology, automation, and machine learning are necessary for businesses to succeed in today’s world, but they’re not enough.

While traditional AR digitization, which includes automated invoices and payment reconciliation, can certainly move the needle on efficiency and cash flow for a company, a more collaborative, transformative approach can propel an organization even further into the digital age.