The State of Accounts Receivable Digitization in Real Estate

Learn what's driving the need for AR digitization in real estate

The State of Accounts Receivable Digitization in Real Estate

Wakefield + Versapay

April 17th, 2023

163 C-level executives in real estate weigh-in on the challenges their AR teams face and the digital solutions they're looking at to solve them.

What to expect from the report

This report explores how real estate executives are digitizing their AR departments to add efficiencies to help overcome the immediate challenges impacting their businesses today. In it, you'll learn:

✓ The benefits real estate executives seek in digitizing AR

✓ What's causing invoice disputes among real estate customers

✓ How a lack of collaboration increases challenges for AR and AP teams

✓ Why digital transformation efforts must solve the AR Disconnect

✓ And more

Take a peek inside the report

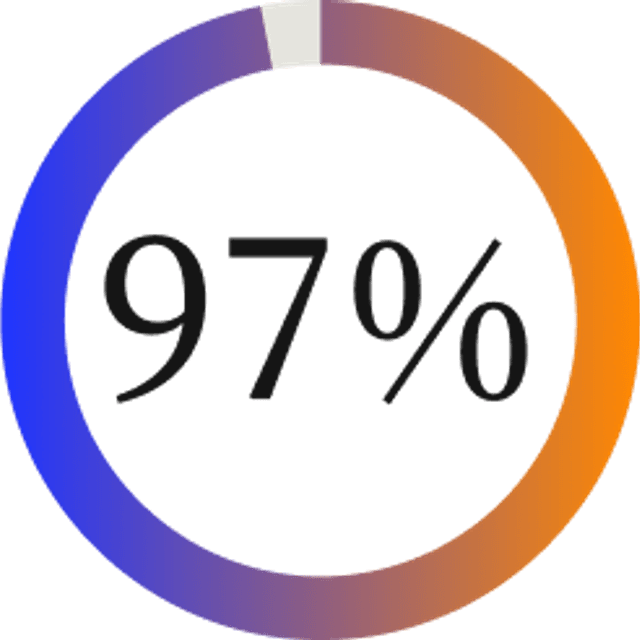

... of real estate executives say work is left to do to digitize their accounts receivable processes

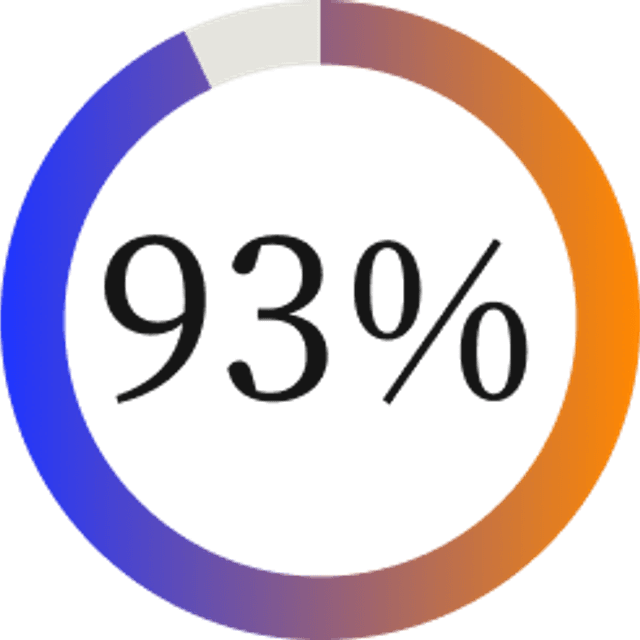

... of real estate executives agree that to reach peak performance, every department needs to digitize

... of real estate executives say that poor communications between AR teams and customers has led to collecting less than owed

The State of Accounts Receivable Digitization in Real Estate is just a few clicks away!

About the research

The State of Accounts Receivable Digitization in Real Estate was conducted by Versapay and Wakefield Research among 163 US C-level executives at companies in real estate, retail, and wholesale industries with a minimum annual revenue of $100m USD.