The Essential Guide to Accounts Receivable Automation

Automating your manual accounts receivable processes will deliver tremendous benefits across billing, payments, collections, reporting, and more.

The Essential Guide to Accounts Receivable Automation

FREE DOWNLOAD

August 9th, 2023

Automating your manual accounts receivable processes will deliver tremendous benefits across billing, payments, collections, reporting, and more. With this guide you'll:

→ Learn the benefits of AR automation

→ Read about successful AR automation implementation stories

→ See how transformation drives modern enterprises forward

In this guide you'll learn about:

- Why it's essential your accounts receivable operation continually evolves

- What forces are driving accounts receivable toward automation

- Why AR automation is necessary for elevating customer experience

- The risks and costs of avoiding automation

- The benefits of AR automation

- And more!

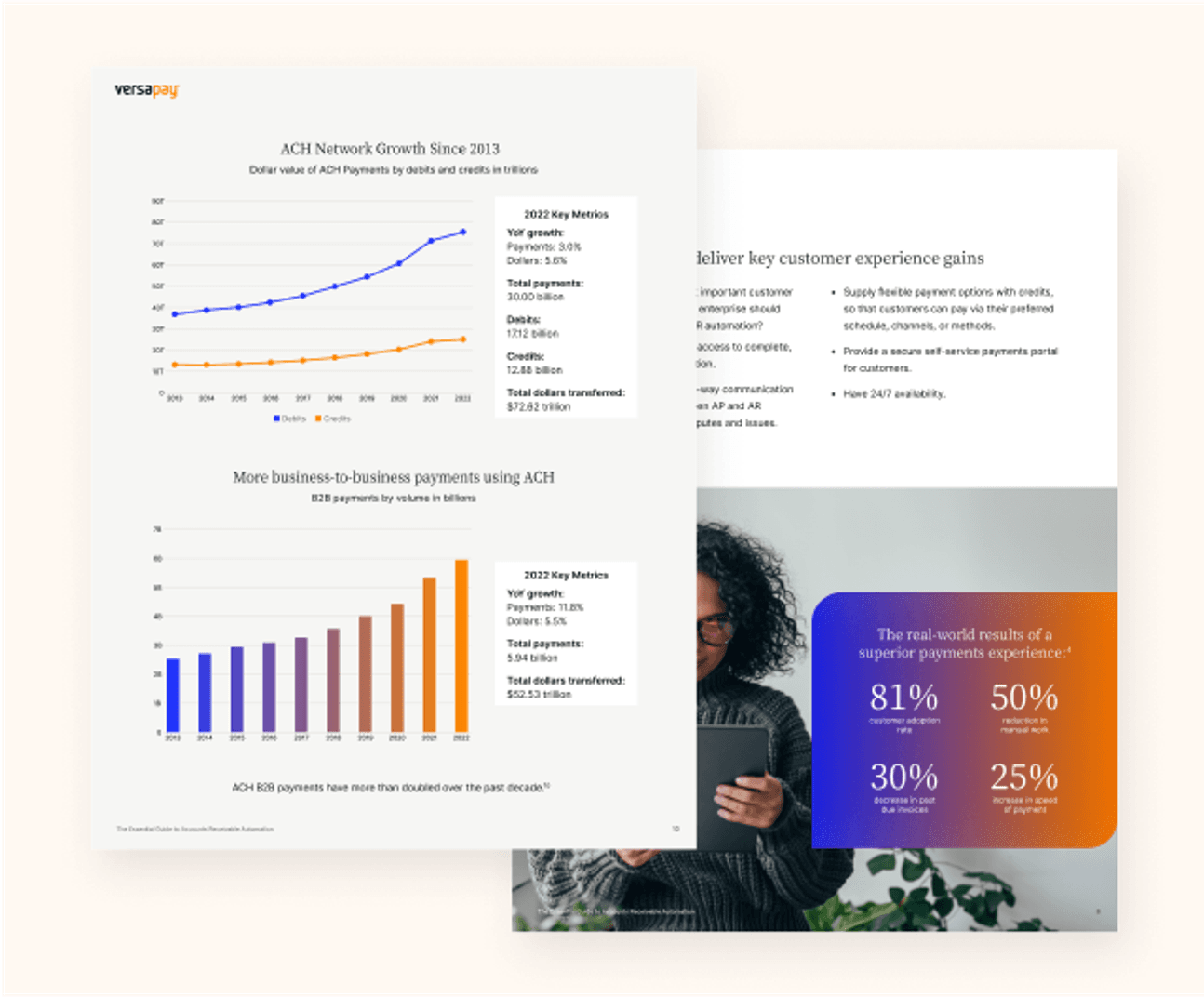

Take a peek inside the guide

It's every teams' job to elevate customer experience. Accounts receivable automation delivers key CX gains and alleviates customer frustrations, boosting their attitudes toward your business.

Explore three accounts receivable automation success stories from real Versapay customers, including: Boston Properties, TireHub, and Sharp Canada

The benefits of AR automation are plenty! This guide highlights how AR automation solves 15 common challenges; it also shares the impact Versapay could have on a hypothetical enterprise.

The Essential Guide to Accounts Receivable Automation is just a few clicks away!

Abstract

Effectively managing accounts receivable is crucial for effective business accounting, which encompasses billing, payments, collections, and tracking. Your organization’s success depends on its ability to manage this AR lifecycle consistently and efficiently.

AR automation streamlines and enhances AR operations by applying

digital technology to the low-value, manual tasks that make up a great

deal of accounts receivable work. By reducing hands-on labor and

errors, efficiencies are created, and customer payment experiences

are improved, making cash flow more predictable and secure.