Representation Matters: Elevating Women in Finance and Fintech

- 9 min read

In traditionally male-dominated industries like finance and fintech, initiatives targeted at elevating women pave the way for future generations of women to excel. This Women’s History Month and beyond, we want to recognize the gains women are making within the finance industry and the work ahead for achieving gender equity.

International Women’s Day is an opportunity to celebrate the achievements of women and recognize the progress they’ve made to break down barriers in various industries. It’s also a reminder of the work that businesses have ahead of them to challenge and dismantle the structural inequalities women still face.

In an industry like ours that brings together two historically male-dominated verticals—finance and technology—this is an important conversation to have year-round.

In this blog, we’ll look at how finance and fintech fare when it comes to gender equity, share experiences from women leaders across Versapay and beyond, and explore how the industry can hope to close its gender gap.

The current gender gap in finance and fintech

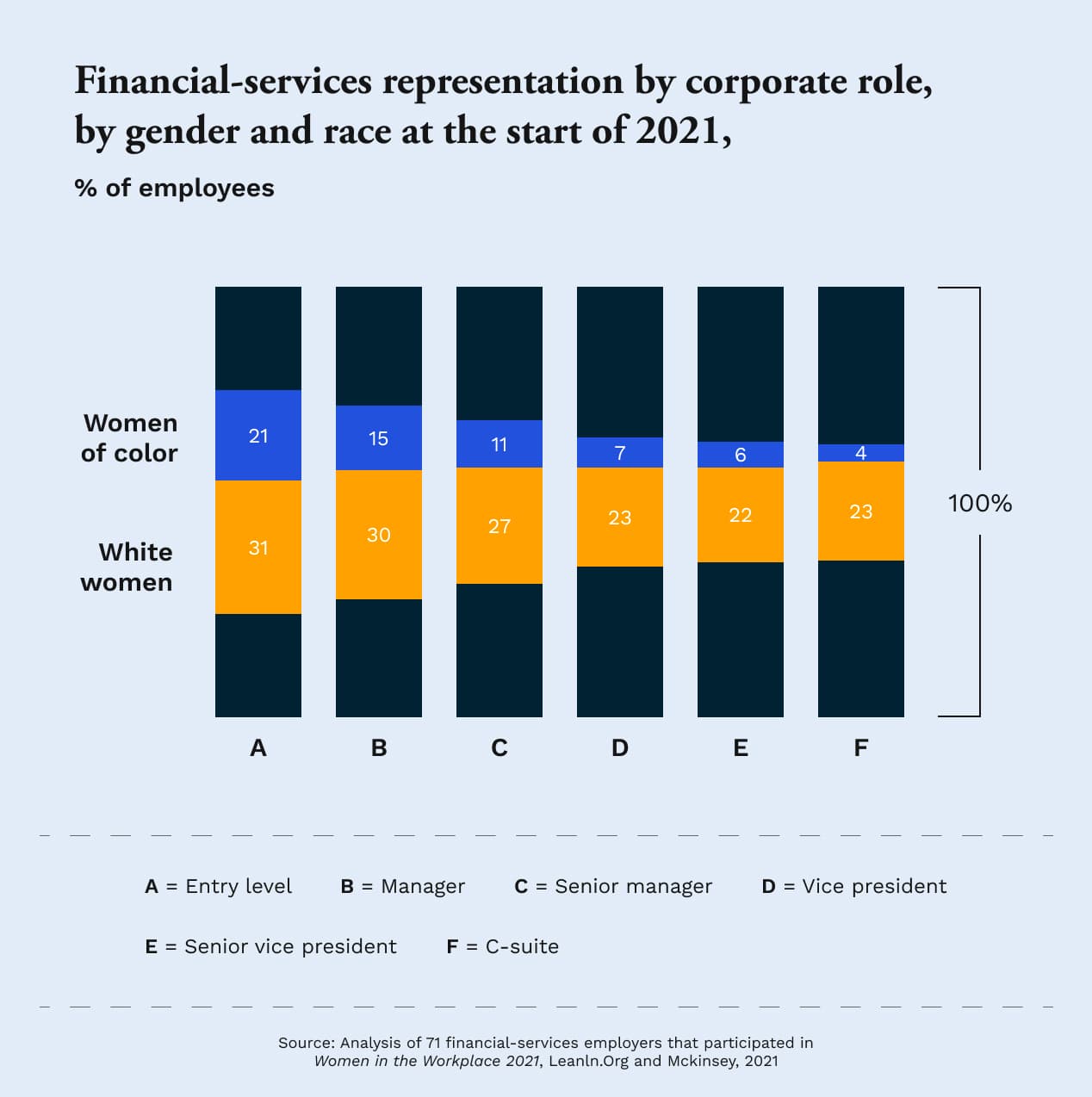

While men and women enter financial careers at approximately the same rate, for each step up the career ladder, fewer and fewer women are represented. This drop off is especially pronounced at the step from entry level to manager and carries on further up the corporate hierarchy.

Joint research from McKinsey and LeanIn.Org found that women comprise 52% of entry-level roles in financial services. At the manager level, this representation falls off to 45%, then to 38% at the senior manager level. By the time you get to the C-suite, women only make up 27% of leaders.

This leaky pipeline is even more pronounced for women of color. Already underrepresented at the entry level in comparison to white women (at 21% and 31% respectively), representation for women of color falls by 80% from entry level to C-suite.

And within fintech, the numbers aren’t any better.

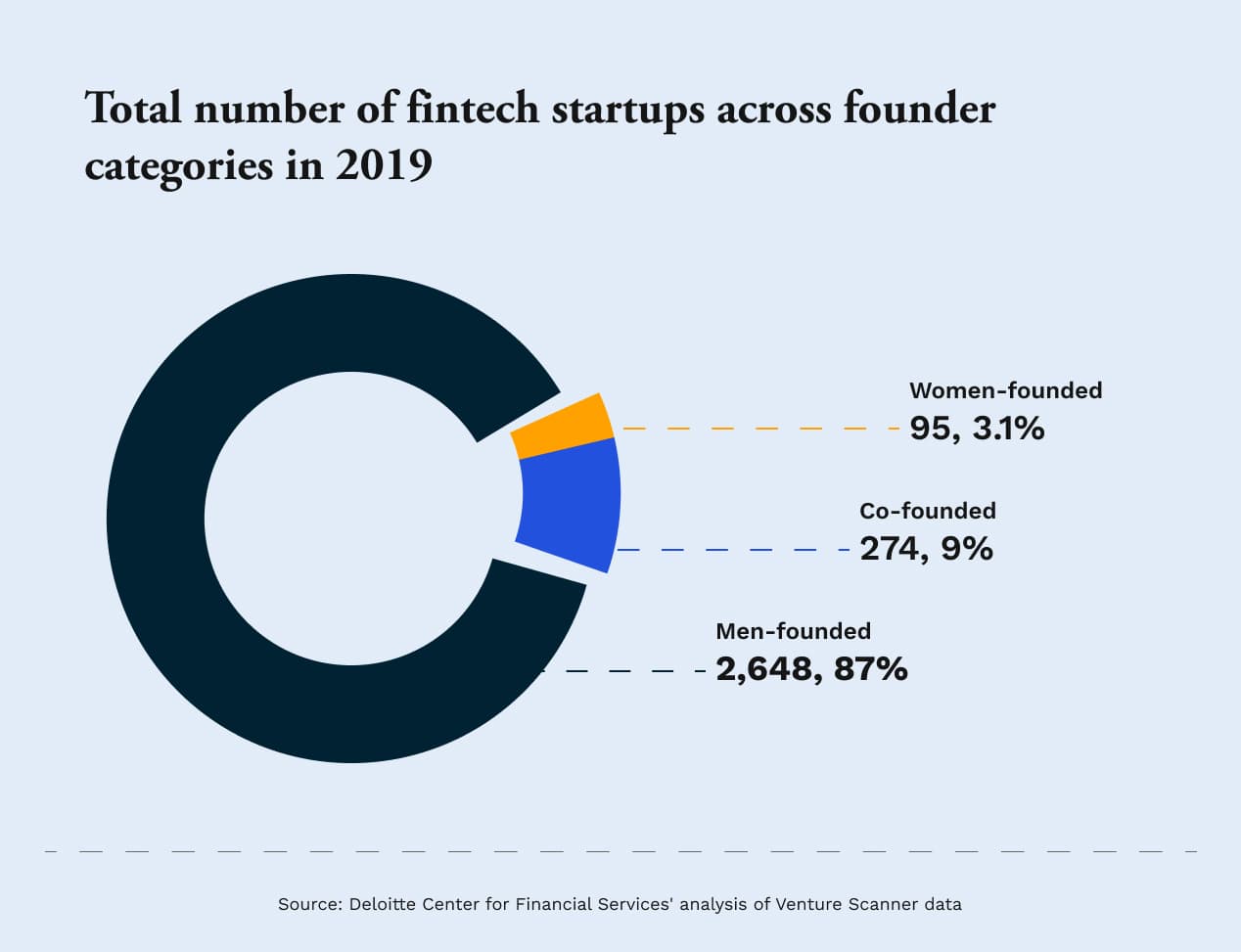

A 2018 survey by Lend Academy found that women only make up 37% of employees working in fintech. This gap widens the higher you move up the corporate ladder and is most pronounced at the founder level. According to a Deloitte study, women make up just 7% of the fintech founder community.

So why is the gender gap so pronounced within finance and fintech?

With few women visible in the industry at the leadership level, biases undoubtedly arise. In her early days as an entrepreneur in the Payments industry, this is something Jayme Moss, Executive Vice President of Payments and board member at Versapay, saw first-hand. During her start, it was not unusual for Jayme to be one of the only women in the room.

In 2004, Jayme co-founded Solupay, a leading payment services provider that then merged with Versapay. She recalls what it was like to attend industry events with her male co-founder: “Every time we would go to these large events, everybody inevitably thought we were married,” she said. “That was basically saying, there’s no chance you’re the owner of this organization.”

Although such brazen comments would be harder to find nowadays, bias is still alive and well in the finance and fintech industries.

Many women are juggling dual roles

Another challenge women often face in career advancement is managing their return to work after having children. In many cases, organizations simply don’t have strong maternity leave offerings.

In a recent Versapay webinar in which women serving on corporate boards discussed their career journeys, Rachael Jackson, Head of Global Finance Operations at Indivior, shared what preparing to go on her first maternity leave was like.

“About five years ago, I got pregnant with my first child. As I began researching maternity leave options, I found them to be a bit lacking,” she said. “I started feeling nervous about my future and whether my job would look the same when I got back. I thought, how much time can I really take off without jeopardizing my career mobility?

When I voiced these concerns to several leaders within the organization, one of the most honest responses I got was from somebody in the executive committee of my company. He said, ‘this is so embarrassing, but I had never thought about our maternity leave policies. I had no idea what we offered and had just never thought about it.’”

Although nearly half of working mothers do take an extended break from work after having children, many of them face significant challenges when returning to work, among which is the perceived stigma that parenthood precludes women from being fully committed to their jobs.

It’s a long-standing struggle that leads some women to delay or simply not have children for fear of limiting their career progression. “I had this conflict in my head of being a career woman and determining when it would be okay to start a family,” said Carrie Barkes, Vice President of Finance at Versapay.

“My husband and I were married for almost fifteen years before we had our first child. My plans for having our first baby were always delayed because I would tell myself ‘I need to do X in my career before I become a mom.’ I would tell myself that I wouldn’t have the same drive or commitment because I’d be focused on being a mom. I was incredibly mistaken. From my personal experience, my commitment and passion for my job have only elevated after becoming a mom. You can be a working mom and you can excel in your career.”

Fighting imposter syndrome

When women do ascend to higher levels of the corporate ladder, any imposter syndrome (the notion of doubting one’s abilities and feeling like a fraud) they might have doesn’t necessarily go away.

In the Versapay webinar we mentioned earlier, Caroline Donahue, a board member at Versapay, shared how she experienced imposter syndrome in her first appointment to a corporate board.

“It was a pretty large nonprofit board, and most of its members—I would say probably 85 to 90% were men,” she said. “Almost all of them were technologists, and here I was, this sales and marketing person. I had such bad imposter syndrome that for the first couple of meetings I did not open my mouth once. And then finally I realized, wow, there are things these technologists might not understand about our customers and sales and marketing. There are ways I can help.”

Escaping these feelings of self-doubt doesn’t come easy—especially when structural inequities continuously reinforce them. When women have the support of leaders in the room—both men and women—they can more readily break free from this discomfort.

“Very early in my career as a senior staff accountant I got to sit in on business reviews with the CEO and CFO and I would have knots in my stomach,” said Rachael. “I would sit there thinking ‘I hope they don’t realize that I shouldn’t be here.’ Meeting after meeting carried on like that, until I was able to remind myself that my manager had invited me there because they knew I had something to bring to the table. Once you get past those lies you tell yourself in your head, you’ll realize some important things.”

Setting precedents by uplifting individual women

Women’s representation within finance and fintech leadership has significant impacts for helping other women rise within their organization. Deloitte research found that for each woman added to a C-suite position in fintech, the number of women in senior leadership roles increased threefold.

When women see themselves represented in leadership positions, it illustrates that the same advancement is possible for them. Mentorship programs are a great way to empower women in finance and fintech with the tools to ascend to higher levels of management, where the corporate career pipeline tends to be leaky.

Even without formal mentorship programs, women can share their knowledge and experiences with other women and inspire them with the examples they set throughout their leadership.

“I’ve been really fortunate to have a great support system in my career,” said Carrie. “I’ve been empowered through a mentor that really paved the way for my career by providing the right guidance and opportunities for growth. She built a workplace around accountability and transparency. You knew when you were doing things well, and you had constructive feedback when you needed it.”

Feeling comfortable tapping into these support networks and accepting guidance from others is also essential in women’s path to success. “I had some people along the way who gave me a chance and I took that chance and ran with it,” said Jayme. “Each decision I made led me to where I am. There were a lot of people along the way who helped me, and I was willing to accept that help.”

What businesses must do to drive change

More companies are stating their objectives to improve diversity throughout their organization. Because real change must come from the top, an important area to increase women’s representation is on corporate boards.

“It wasn’t until while in my last operational role that I started to get exposure to the board, presenting to and meeting with them” said Leah Sweet, another board member at Versapay.

“I started to realize that real decisions for the company get made in the boardroom. I knew how hard the employee base worked and how many ideas they brought to the table, which don’t always make it up to the top. I thought, you know what, I want a seat at this table as well.”

For those goals to come to fruition, companies also need to assess what their own unique challenges are for maintaining diverse talent and creating programs and initiatives targeted at solving them.

Businesses can start to see incremental change by:

- Creating or spotlighting peer-to-peer networks and mentorship opportunities

- Focusing on retaining women and not just recruiting them

- Recruiting women for senior positions, addressing the leaky pipeline for women moving from entry-level to leadership

- Treating diversity holistically and widening discussions beyond gender

The business case for gender parity

Although gender parity deserves its own relentless pursuit simply on the merits of fairness and equality, we know that businesses are extra incentivized to take action when there are quantifiable returns.

And the research shows that elevating and empowering women at work is good for businesses’ bottom line. McKinsey & Company found that in 2020, companies that performed in the top quartile for gender diversity were 25% more likely to have above-average profitability than companies that performed in the bottom quartile.

Greater representation for women in finance and fintech at all levels not only provides monetary benefits, but helps companies better serve their customers.

“Women are needed at all levels to shape the conversations for our evolving organizations,” said Karli Vold, Vice President of Customer Success at Versapay. “Women are needed to reflect the voice of our market and clients. Women are needed in executive positions not just to show the value of representation, but to help us make better decisions.”

“When you look at the workforce, it’s a very diverse group of people. And if boards are the ones making decisions and influencing the direction companies go in, then it’s important that they actually represent their stakeholders,” said Rachael.

“If you want to see the change, you’ve got to become the change. And this could mean just getting a seat at the table so that someone else you know can see this and think well I can do that too. Because representation matters.”

—

This blog was originally published in March 2021 and has been updated for relevancy and comprehensiveness.

About the author

Nicole Bennett

Nicole Bennett is the Senior Content Marketing Specialist at Versapay. She is passionate about telling compelling stories that drive real-world value for businesses and is a staunch supporter of the Oxford comma. Before joining Versapay, Nicole held various marketing roles in SaaS, financial services, and higher ed.