Accounts receivable collections software automates the accounts receivable collection process, helping businesses track outstanding invoices, follow up on overdue payments, and reduce manual effort.

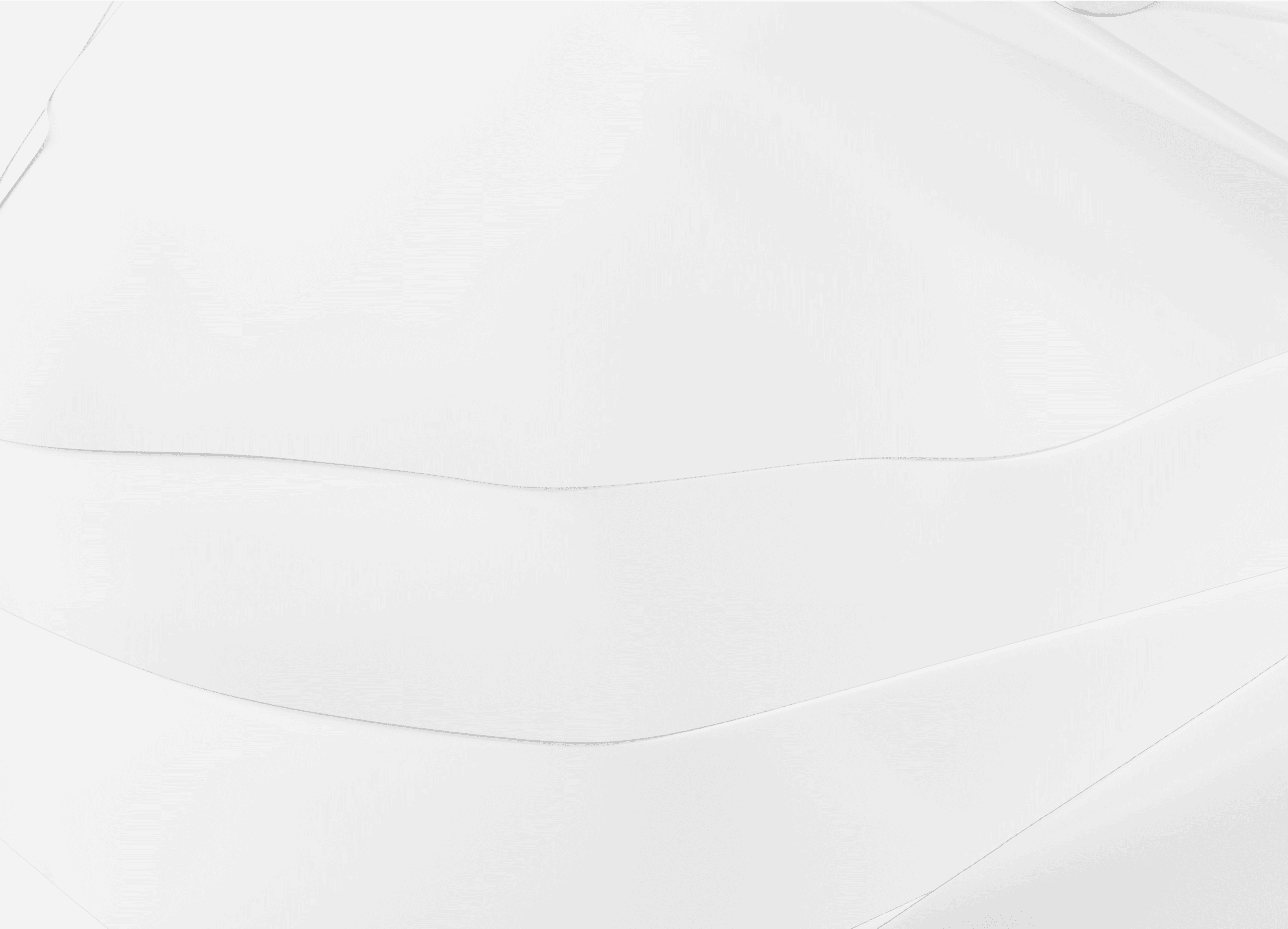

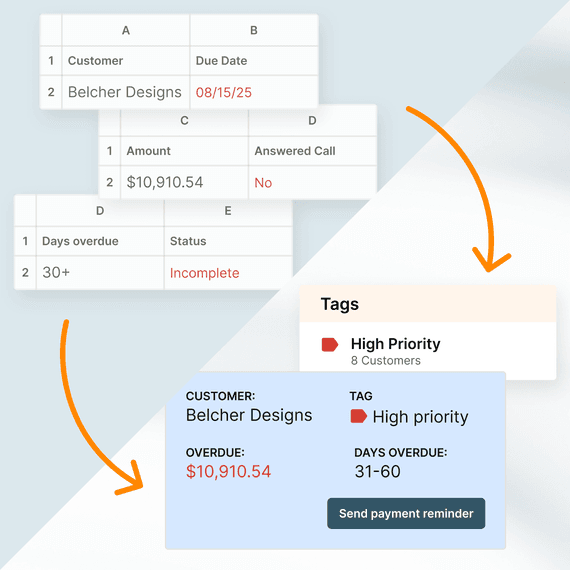

Instead of relying on spreadsheets or manual workflows, AR collections platforms provide automated reminders, real-time payment tracking, and data-driven insights to improve efficiency. With tools for invoice collections automation, businesses can predict delinquencies, prioritize high-risk accounts, and maintain better cash flow visibility.

How Versapay helps: Our collections automation software ensures that every outstanding invoice is accounted for, reducing missed follow-ups and helping your team collect faster with less effort.