Collections management

Smooth collections. Steady cash flow.

Stop chasing overdue invoices manually. Our accounts receivable collections software helps you automate collections, predict delinquencies, prioritize high-risk accounts, and maintain visibility—so cash keeps flowing.

Collect with confidence. Expect more predictable cash flow.

50%

less time managing receivables

25%

faster payments

30%

fewer past-due invoices

95%

customer satisfaction rate

New in collections management

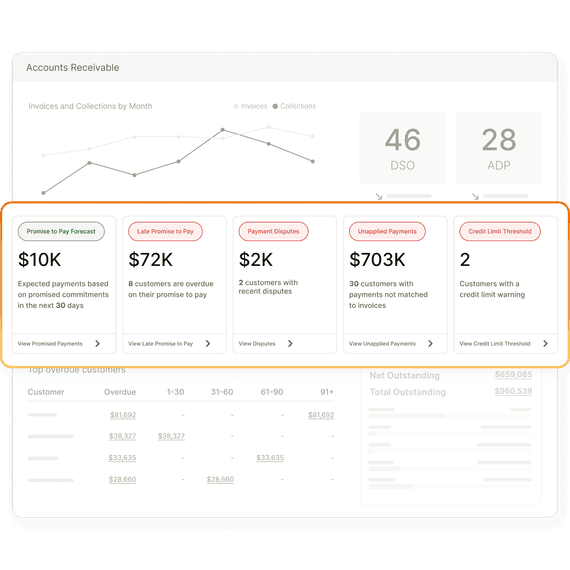

Smarter insights. Faster cash.

Forecast cash flow with confidence using our refreshed collections dashboard. New dynamic insights cards offer real-time payment insights to prioritize outreach, spot risks earlier, and take action without digging through spreadsheets.

What if your collections simply... flowed?

Managing collections with spreadsheets, ERPs, and inefficient workflows means missed follow-ups, unpredictable cash flow, and endless back-and-forth. Our collections automation software eliminates manual headaches and helps you prioritize high-risk accounts, ensuring you always know where your cash is.

Everything you need to bring clarity and control to your collections

Managing overdue invoices demands precision and a proactive approach. See how Versapay’s collections management software puts you in command of your cash flow.

Segment customers by delinquency risk

Prioritize collections tasks and activities

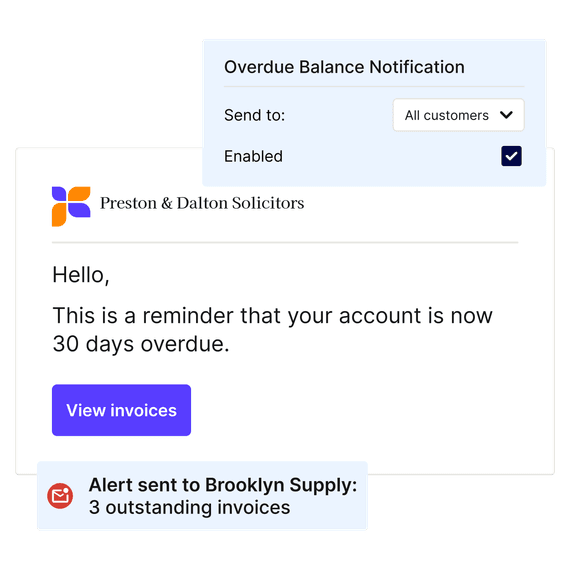

Deliver timely payment notifications

Automate reminders and follow-ups

Track promised payments

Track customer behavior in real-time

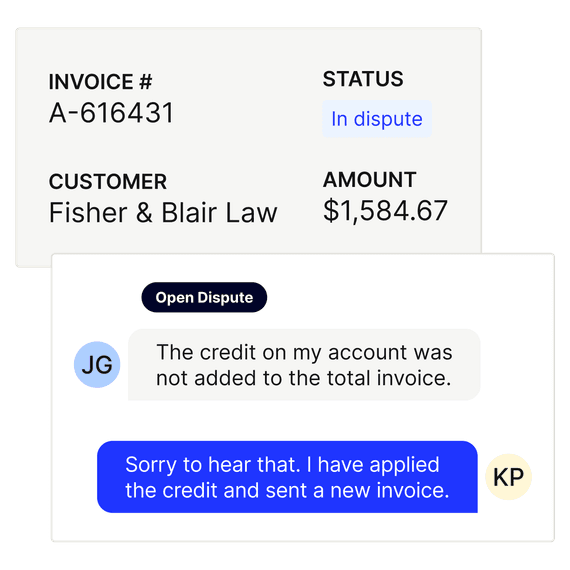

Manage disputes with customer collaboration

View customer adoption reports

“Our goal is to prevent having to get more employees. To me, Versapay is doing the work of three employees right now.”

Andrew Ceccorulli, Manager, Credit & Collections, Laticrete

Tour Versapay's collections management software

EndlessLY rewarding

Getting paid for what you're owed should be easy. Take the guesswork out of collections.

Versapay's automated accounts receivable solution features built-in collections workflows that help automate follow-ups and provide cash flow insights.

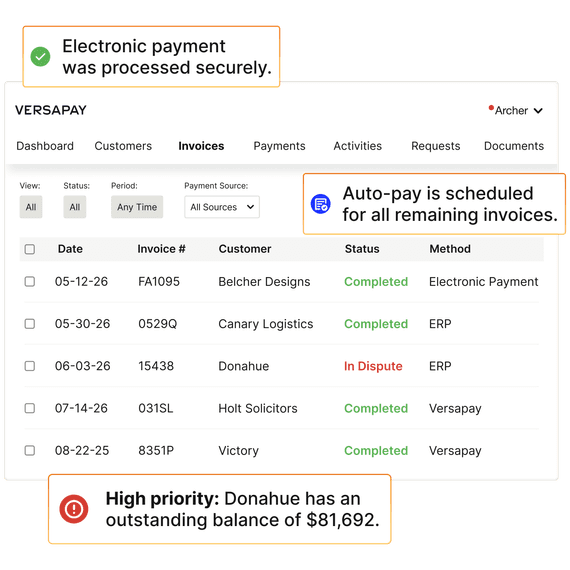

Get ahead of collections with a secure, self-service portal

Give customers an easy and convenient way to understand what they owe and make payments 24/7. Equip them with the tools to:

- Manage their full account and view invoices

- Store payment methods and set up auto-payments

- Use flexible payment options, like credits and payment plans

- Communicate with you to ask questions and register disputes

Significantly reduce manual collections work

Automate the time-consuming, routine accounts receivable collection processes to free your team for strategic priorities.

- Configure 100+ dunning notifications

- Segment customers using tags into high- and low-priority

- Add follow-up reminders on customers or invoices

- Log contact dates and identify customers needing contact

Make confident, data-backed collections decisions

Focus your efforts with actionable insights into your outstanding receivables using online payment collection software.

- Get real-time analytics into DSO, ADP, and aging statistics

- Filter outstanding payments by customer and division

- Find trends, prioritize activities, and make informed decisions

- Log customer contacts and follow-up timelines

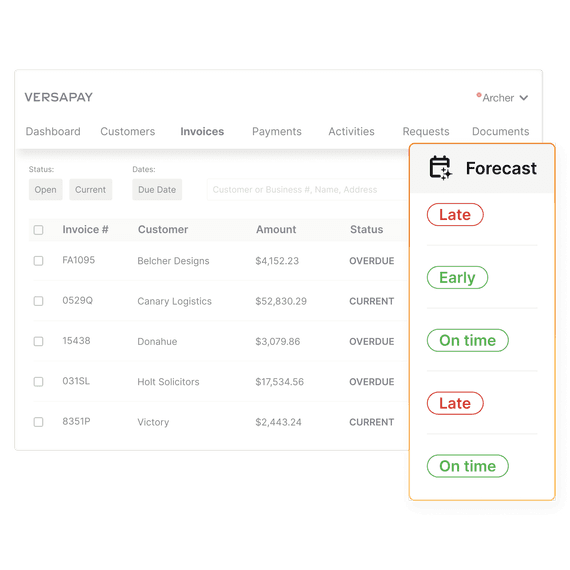

Predict account delinquencies and speed up cash flow

Analyze past payment patterns with machine learning. Use AI-powered collections automation software to prioritize the right accounts and forecast cash flow.

- Predict which customers are likely to pay and when

- Prioritize your largest collection opportunities

- Collect more efficiently with AI-generated follow-up tips

Easily track and manage outstanding payments

From "pending" to paid. Capture and monitor promised payments for outstanding invoices and proactively send reminders before they become overdue with collections automation software.

- Secure customer commitments for outstanding invoices

- Request promises on all open invoices or fixed amounts

- Filter open promise to pays by customer

Resolve disputes and build better customer relationships

Address slow payment issues by letting customers log disputes, short-pay invoices, and flag payment discrepancies.

- Intuitive collaboration tools make resolving disputes a breeze

- Loop colleagues into ongoing conversations at the right time

- Avoid lengthy dispute timelines using reporting filters

Collect delayed cash, faster

Offer customers flexible payment options to help them manage their overdue invoices, reducing your outstanding cash balances.

- Accept payments like credit cards, ACH, and virtual cards.

- Payment plans enable customers to pay invoices over time

- Make partial payments on behalf of customers in the portal

Still have questions? We've got answers!

Accounts receivable collections software automates the accounts receivable collection process, helping businesses track outstanding invoices, follow up on overdue payments, and reduce manual effort.

Instead of relying on spreadsheets or manual workflows, AR collections platforms provide automated reminders, real-time payment tracking, and data-driven insights to improve efficiency. With tools for invoice collections automation, businesses can predict delinquencies, prioritize high-risk accounts, and maintain better cash flow visibility.

How Versapay helps: Our collections automation software ensures that every outstanding invoice is accounted for, reducing missed follow-ups and helping your team collect faster with less effort.

Collections automation software helps reduce overdue invoices by automating reminders, prioritizing collection efforts, and providing real-time insights into customer payment behaviors. Instead of manually tracking due dates or sending follow-up emails, automated workflows ensure that invoice collection activities happen consistently and at the right time.

By leveraging machine learning and AI, modern AR collections solutions can also analyze historical payment patterns to predict which accounts are at risk of delinquency, allowing finance teams to take proactive action before an invoice becomes overdue.

How Versapay helps: Our automated payment collection tools ensure that follow-ups, payment reminders, and escalations happen seamlessly—so you spend less time chasing payments and more time driving strategic growth.

A strong collections management system should include:

→ Automated reminders and follow-ups that ensure invoices are paid on time with scheduled outreach

→ Risk-based prioritization that identify high-risk accounts and focus efforts where they matter most

→ Customer collaboration tools that enable direct communication with customers to resolve disputes quickly

→ Promise-to-pay tracking that logs payment commitments and sets proactive reminders

→ AI-driven insights that use predictive analytics to forecast cash flow and prevent delinquencies

→ ERP integration that syncs payment and invoice data in real-time with your financial systems.

How Versapay helps: Our collections automation platform gives you all these capabilities, helping your team manage collections efficiently while improving customer relationships.

Invoice collections software integrates with your ERP to create a seamless, automated collections workflow. This integration allows businesses to:

→ Sync invoice and payment data to ensure that outstanding receivables are always up to date

→ Automate dunning emails and reminders to reduce manual effort while maintaining consistent communication

→ Gain real-time visibility into customer payment behaviors to track overdue invoices, disputed amounts, and promised payments

→ Streamline cash application to automatically match payments to invoices for accurate reconciliation.

ERP-integrated collections software reduces the risk of errors, eliminates duplicate data entry, and improves efficiency across finance teams.

How Versapay helps: Our AR collections platform integrates seamlessly with leading ERPs, allowing businesses to manage invoice collections directly within their financial ecosystem without extra work.

Yes! AR collections software plays a critical role in improving cash flow predictability by providing finance teams with data-driven insights into payment behaviors, overdue invoices, and customer commitments. With AI-powered analytics, businesses can:

→ Identify customers at risk of delinquency and spot trends in late payments and take action early

→ Forecast expected cash inflows and predict when payments will be received and plan accordingly

→ Improve working capital management and reduce reliance on external financing by maintaining steady cash flow

→ Ensure proactive collections efforts and automate and prioritize outreach based on real-time risk scoring.

How Versapay helps: Our collections automation software helps finance teams move from reactive to proactive collections, ensuring they always have a clear view of expected cash flow.