How To Save Up to 40% on Credit Card Processing Fees With Interchange Optimization

- 2 min read

With interchange optimization, you can greatly reduce your cost of accepting credit card payments, helping you provide the convenient payment experience customers are looking for. Learn how you can save up to 40% with cheaper credit card processing fees in this blog.

Offering your customers a variety of payment options has many advantages, like the potential to increase your revenue by nearly 30%. But of course, accepting payment methods like credit cards comes with a price. Think of it as a tradeoff—in return for giving your customers the convenience of paying by credit card, you accept that you’ll pay fees on every transaction.

With credit card processing fees amounting on average to 2% of every transaction, many businesses are hesitant to push credit card payments. Thankfully, merchants can reduce their processing fees and reap the associated benefits through interchange optimization.

In this blog, we’ll cover how B2B credit card processing works, what interchange fees are, how interchange optimization works, and how partnering with the right integrated payment processor can help with notably cheaper credit card processing fees.

How does credit card processing work?

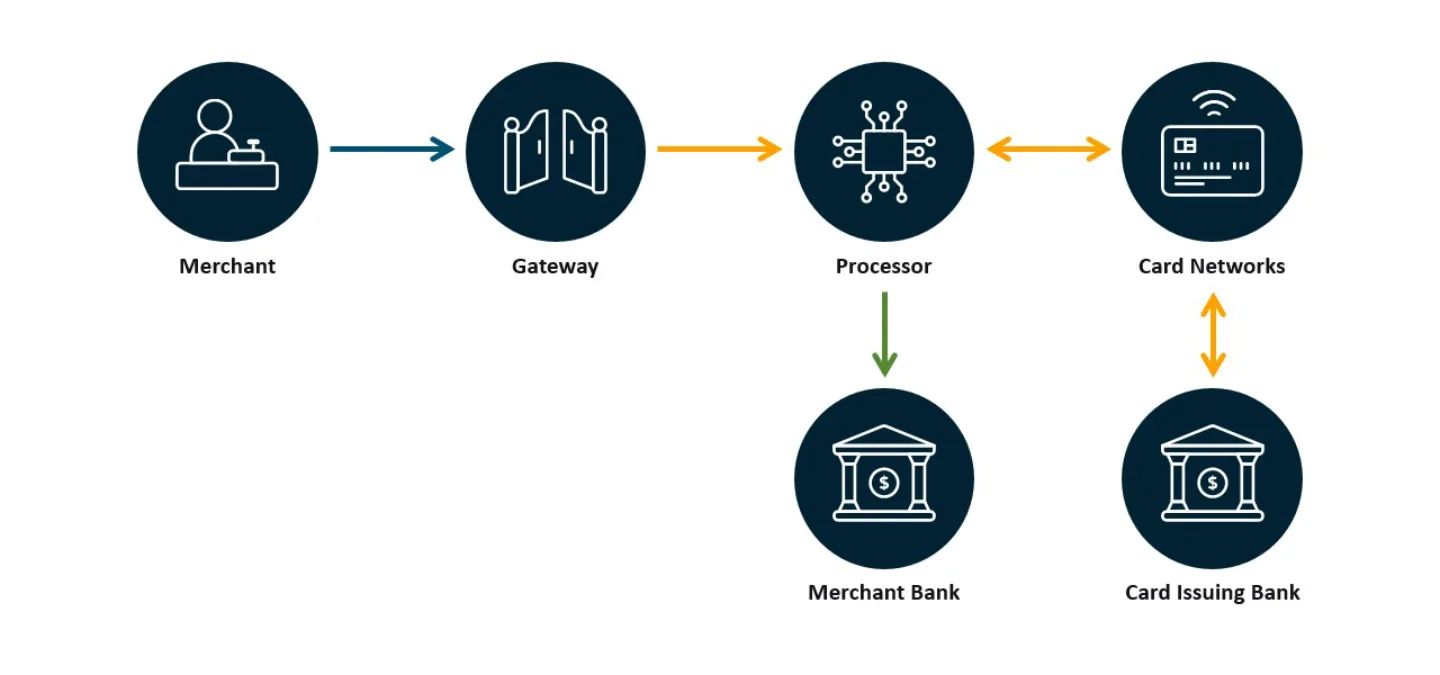

When a customer makes a purchase with a credit card—via an ecommerce site, a point-of-sale (POS) system, a click-to-pay invoice, or by phone—the transaction goes through a payment gateway. The payment gateway is the channel of communication that securely transmits the payment data to the payment processor (the entity executing the transaction) for approval.

Behind the scenes, the payment processor then connects with the card brands (for example Visa, Mastercard, American Express, or Discover) to authorize the transaction. The issuing bank (the cardholder’s bank, who supplied them with the credit card) approves or denies the transaction and sends that message back to the processor.

Once the payment processor has that approval, they fund the merchant. The issuing bank sends the funds through the payment processor to the merchant’s bank (the acquiring bank), who then pays the merchant.

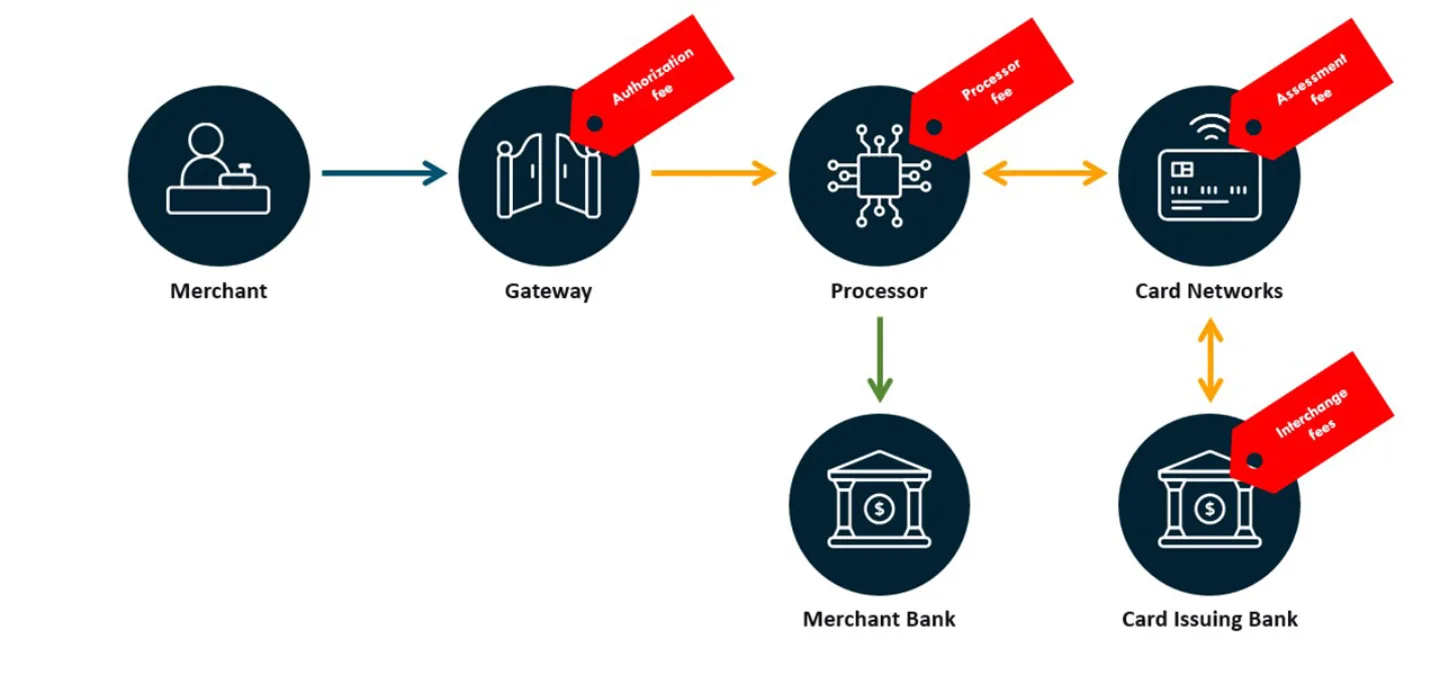

For their role in carrying out the entire payment process, each player takes a fee, which gets bundled in the rate a merchant pays to their payment processor.

- Authorization fee: collected by the gateway

- Transaction fee: collected by the processor

- Assessment fee: collected by the card network (the inherent fees of transmitting the payment information, which you can think of like a toll booth)

- Interchange fees: collected by the issuing bank

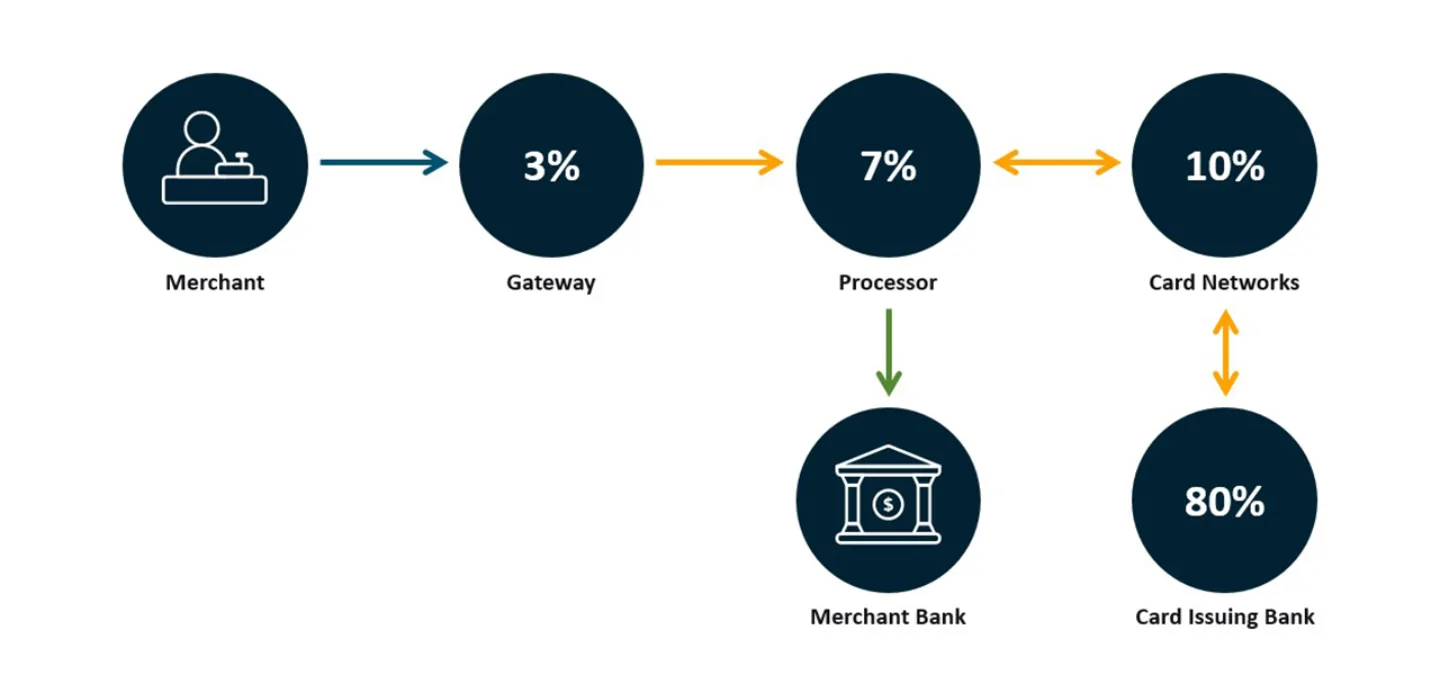

The extent of these fees all vary. Of the average 2% of every transaction, the authorization fee at the gateway will account for 3%, the processor’s fee will account for 7%, the assessment fee will account for 10%, and the interchange fees will account for the vast majority at around 80%.

What are interchange fees?

Interchange is what’s paid to the issuing bank (the cardholder’s bank) by the acquiring bank (the merchant’s bank) to cover any costs associated with the risk involved in approving the payment.

Interchange rates are decided by the card brands and are regularly updated (Visa and Mastercard adjust their rates twice a year, in April and October). Each card brand sets their interchange rates differently, amounting to over 300 different levels of interchange between all the card networks.

There are many factors that impact the level of interchange fees on a transaction, some that are in the realm of your control as a merchant and some that are not. These include:

- The card type (e.g., debit, travel rewards, purchasing, corporate, etc.): Credit cards are considered higher risk than debit cards with PINs, so they have higher rates. Rewards cards have higher rates to pay for the perks their users enjoy.

- The way the card was processed (e.g., whether it was swiped, keyed, or chipped): How a credit card is processed will dictate how risky the transaction is. For instance, a card that was chipped or accompanied by a signature at a POS carries less risk than a purchase made with card-not-present (CNP).

- The data sent along with the transaction: Sending additional details about the transaction helps the card issuer know that the transaction is less risky. What we call Level 2 and Level 3 processing are what help transactions qualify for a lower interchange rate.

What is interchange optimization?

Some aspects of interchange fees can be influenced, others can't. The amount of data you send along with each transaction is something you can control, with help from the right payment processor. The practice of fine-tuning the conditions of a transaction according to best practices to qualify for the lowest interchange rates possible is what’s known as interchange optimization.

Given that interchange represents the largest portion of merchants’ processing fees (these are all wrapped up in the merchant discount, which is what the merchant pays to the processor and includes other costs like POS terminals and customer support), reducing interchange fees will have the biggest impact on your overall credit card processing fees.

With Level 2 and Level 3 processing, you send additional data to the issuing bank about the transaction that tells them this payment is lower risk. The more data you can provide about a transaction, the better. With Level 3 credit processing you get the highest volume of supporting information, including data like the merchant’s industry (some industries have higher rates), where the product is shipping to and from, the invoice number, and the line-item details of that invoice.

How integrated payments help with interchange optimization

When payment processing services integrate seamlessly with your Enterprise Resource Planning (ERP) platform—such as NetSuite, Microsoft Dynamics 365, or Sage Intacct—there’s a distinct advantage for interchange optimization.

The depth of integration that solutions like Versapay afford makes it easy to automatically send that precious data along with the transaction, with no extra effort for you, the merchant. Because information like your customers’ invoice number, number of items purchased, sales tax, and customer code already lives within your ERP, you can easily qualify for much lower interchange rates by layering payment processing on top of your existing system.

Making credit card payments more accessible to business-to-business (B2B) buyers should be a top priority for businesses, as buyer behavior has trended exponentially towards digital channels, and B2B buyers increasingly expect their payment experiences to reflect the convenience of the consumer world.

How Versapay helps you save on credit card processing fees

Understanding how B2B credit card processing fees work will make it easier to evaluate payment processors and find the offering that works best for your unique business. If your customers are primarily other companies, you process payments with high dollar amounts, and you’re already using an ERP, then a solution that offers integrated payments and Level 3 data processing is a natural fit.

Before you start working with Versapay, we complete a detailed cost analysis of your most recent merchant statement. We look at everything you’re paying now and where you can qualify for better rates, breaking down everything by line item and showing you your potential savings, right down to the penny.

When you process payments through Versapay, you can save up to 40% on your overall cost of acceptance through our unique integrations with your ERP. We can provide you with interchange optimization on a transactional level and offer reauthorization management, Level 2, and Level 3 processing seamlessly and automatically.

Want to learn more about how interchange optimization works and how we perform detailed costs analyses? Check out our webinar “How Interchange Optimization Achieves Faster ROI,” available on-demand now.

About the author

Nicole Bennett

Nicole Bennett is the Senior Content Marketing Specialist at Versapay. She is passionate about telling compelling stories that drive real-world value for businesses and is a staunch supporter of the Oxford comma. Before joining Versapay, Nicole held various marketing roles in SaaS, financial services, and higher ed.