Everything B2B Merchants Need To Know About Credit Card Processing Fees

- 17 min read

Improved customer satisfaction. Superior payment experiences. Lower churn rates. Higher-value transactions. Increased cash flow. Greater revenue.

If business-to-business (B2B) merchants could achieve even a few of these lifts, they’d likely do it in a heartbeat—until you tell them the key to it all is accepting credit cards.

As a business-to-business (B2B) merchant, accepting credit card payments makes doing business with you considerably easier. The catch? Credit card processing fees.

While these fees can quickly cut into your profit margins, the benefits that come with accepting credit cards are hard to pass up. In this article, we’ll break down everything you need to know about B2B credit card processing.

Table of contents

- What are credit card processing fees?

- How are B2B credit card processing fees decided?

- Who gets credit card processing fees?

- What makes up credit card processing fees?

- What factors influence interchange rates?

- 3 ways to lower credit card processing fees

- More frequently asked questions about credit card processing fees

What are credit card processing fees?

Credit card processing fees are the fees a merchant must pay whenever their customers elect to pay by credit card. They typically account for 2.87% to 4.35% of each transaction (not including fees charged for merchant services).

This means the good deed of providing payment flexibility for your customers does not go unpunished. Every transaction comes with a cost, which happens to be predetermined by your merchant services provider.

We’ll detail these components later in the article, but credit card processing fees are generally made up of a combination of smaller fees and charges, including:

- Credit card processor fees

- Interchange fees

- Assessment fees

- Authorization fees

- Other fees

How are credit card processing fees decided?

Payment processors look at multiple factors to provide a custom credit card processing fee for your business. Those factors generally include your industry, business and credit history, and sales volume. If your transaction volume is high (and your business is considered lower risk), you’ll likely have lower credit card processing fees. If you’re not yet established and lack payment history (or if you operate in a riskier industry), you can expect to pay higher fees.

Who gets credit card processing fees?

Credit card transaction fees are distributed between several players who help facilitate the various stages of a transaction. These entities include:

- The credit card issuer

- The credit card network

- The payment processor

1. The credit card issuer

The organization (often a bank) that issues the credit card receives 80% of processing fees (through interchange fees), by far the lion’s share of them.

These fees vary based on several factors, including:

- Credit card network (Visa, Mastercard, American Express, etc.)

- Payment processing method (POS vs card-not-present)

- Merchant category code (category codes with higher risk fees include MCC 5816 [Digital Goods Games (betting)], MCC 6051 [Non-Financial Institutions (Crypto currency)]).

2. The credit card network

Receiving roughly 10% of total fees for credit card processing and generated through the assessment fee, the credit card network receives the second largest share. While the factors that determine this fee vary from network to network, they often include card type (debit vs credit), transaction volume, and even the country in which the transaction was made.

3. The payment processor

At roughly 7% of total fees and generated through the transaction fee, the payment processor also receives their share for each transaction.

4. The payment gateway provider

Collecting 3% of total fees through the authorization fee, the payment gateway provider receives this portion for their role of ensuring the customer has sufficient funds prior to a transaction being approved.

More on how these fees are further broken down can be found below.

What makes up credit card processing fees (and what are the average fees)?

Credit card processing fees are comprised of smaller fees charged by the organizations that facilitate transactions. There are 5 different transaction fees, including:

- Credit card processor fees

- Interchange fees

- Assessment fees

- Authorization fees

- Other fees

Adding up all the fees associated with accepting credit card payments, merchants should expect to pay between 1.3% and 3.5% on each transaction. The average is roughly 2%.

Below is an estimate of the various processing fees charged by the credit card networks (curated by Value Penguin). Keep in mind that these are only estimates as there are a number of factors (like the types of processing fees outlined earlier) that will influence how much a merchant ends up paying.

- Visa: 1.43%–2.4%

- Mastercard: 1.55%–2.6%

- Discover: 1.56%–2.3%

- American Express: 2.5%–3.5%

1. Credit card processor fees (7% of total processing cost)

Credit card processor fees are those that a merchant pays to a vendor in order to access their credit card processing services. These services involve the processor moving money from the issuing bank to the acquiring bank. The fee varies based on a few factors, including the amount and value of the transactions processed, and the pricing model you choose.

There are also payment processors who serve as the payment gateway, meaning they’ll facilitate payment acceptance, securely send the payment data to card networks and banks, and fund the merchant (that’s you).

2. Interchange fees (80% of total processing cost)

Interchange fees are paid to the issuing bank (the cardholder’s bank) by the acquiring bank (the merchant’s bank) to cover the costs associated with the risk of approving the payment. Because it’s such a critical function, this fee makes up 80% of the cost of accepting credit cards.

Individual credit card payment networks like Visa, MasterCard, American Express, and others have published, percentage-based interchange fees. Some payment processors also add a fixed dollar amount per transaction, typically from $0.10 to $0.30 as part of the interchange fee. This cost varies by processing company.

As a merchant, you pay interchange fees to the payment processor, who pays the interchange fee to the credit card issuer. The credit card issuer will then pay it to the issuing bank.

Different credit cards are charged different interchange fees. A basic card will have lower interchange fees than an international business card with plenty of rewards. The rate also depends on the brand and type of the card, as some will have higher rates than others. The interchange rate for a debit card is around 0.3%, while the average credit card has an interchange rate of about 1.81%.

3. Assessment fees (10% of total processing cost)

Assessment fees are paid by merchants directly to their card network. It’s a small fee (10% of total processing cost) and is generally paired with interchange fees.

- Mastercard charges 0.13% for transactions under $1,000 and 0.14% for transactions of $1,000 or more

- Visa charges 0.14% for credit card transactions

- American Express (for OptBlue merchants) charges 0.15% per transaction

4. Authorization fees (3% of total cost)

Credit card authorization is the process of ensuring a customer has sufficient funds before a transaction can be approved. This is run through the payment processor, who gets in touch with the issuing bank. If the customer has sufficient funds, a hold in the amount of the transaction will be placed on their card and a message will be relayed to the processor that the transaction can be completed.

Credit card networks will charge a small fee to complete this process on every transaction, which the processor passes onto the merchant. Even if a transaction isn’t approved, merchants are subject to this fee.

If your business falls victim to credit card testing (where bad actors use your ecommerce site to test stolen credit card details), these small fees can amount to significant losses, so it’s important to be aware of them.

5. Other fees

In addition to those above, there are also a variety of credit card processing fees you could end up paying, including batch fees, wireless access fees, and hosting fees. Here’s a fuller list of potential other fees:

- Payment gateway: The facilitation of passing funds from your merchant account to your payment processor

- PCI compliance: A security standard all businesses must comply with to accept credit cards

- Chargeback: A fee you incur whenever a customer issues a chargeback for a payment

- POS software (monthly SaaS fees): An amount you pay your POS software provider each month

- POS hardware rental: A cost to rent your POS terminal hardware and other associated equipment each month

- Batch fees: Also called “batch header fees”, this is a charge for the settling your deposits daily

- Hosting fees: A fee for supporting traditional server-based POS systems

- Wireless access fee: Charge for a cloud-based POS terminal instead of a phone line

- AVS: Short for “Address Verification System”, it applies to manually entered transactions and matches customer billing information to the card on file (charged on a per-transaction basis)

- Monthly statement/support and service fees: You may find that payment processors charge a flat monthly fee for activities such as customer support, as well as printing and mailing your monthly statements

- Minimum monthly fee: A charge between your monthly GPV (credit card dollars processed) and the monthly minimum you agreed upon

What factors influence interchange rates?

Interchange rates are influenced by three different factors, which include:

- The credit card network

- Data levels

- Merchant category codes

1. The credit card network

Credit card networks are what make credit card transactions actually work. In the United States, there are four main networks: Visa, Mastercard, American Express, and Discover.

Each network sets their own interchange fees. Generally, that fee is made up of a percentage plus a fixed amount. Here’s a look at the publicly available information on interchange fees from the big four networks (Network | Interchange Fee Range):

- Mastercard: 1.35% + $0.00 % to 3.25% + $0.10

- Visa: 1.15% +$0.25 to 2.70% + $0.10

- Discover: 1.56% to 2.40% + $0.10

- American Express: 1.43% to 3.0% + $0.10

Perhaps unsurprisingly, American Express, the network most known for above-and-beyond cardholder benefits, carries the most substantial fees. This is one of the main reasons you do not see its acceptance offered by as many merchants.

2. Data levels

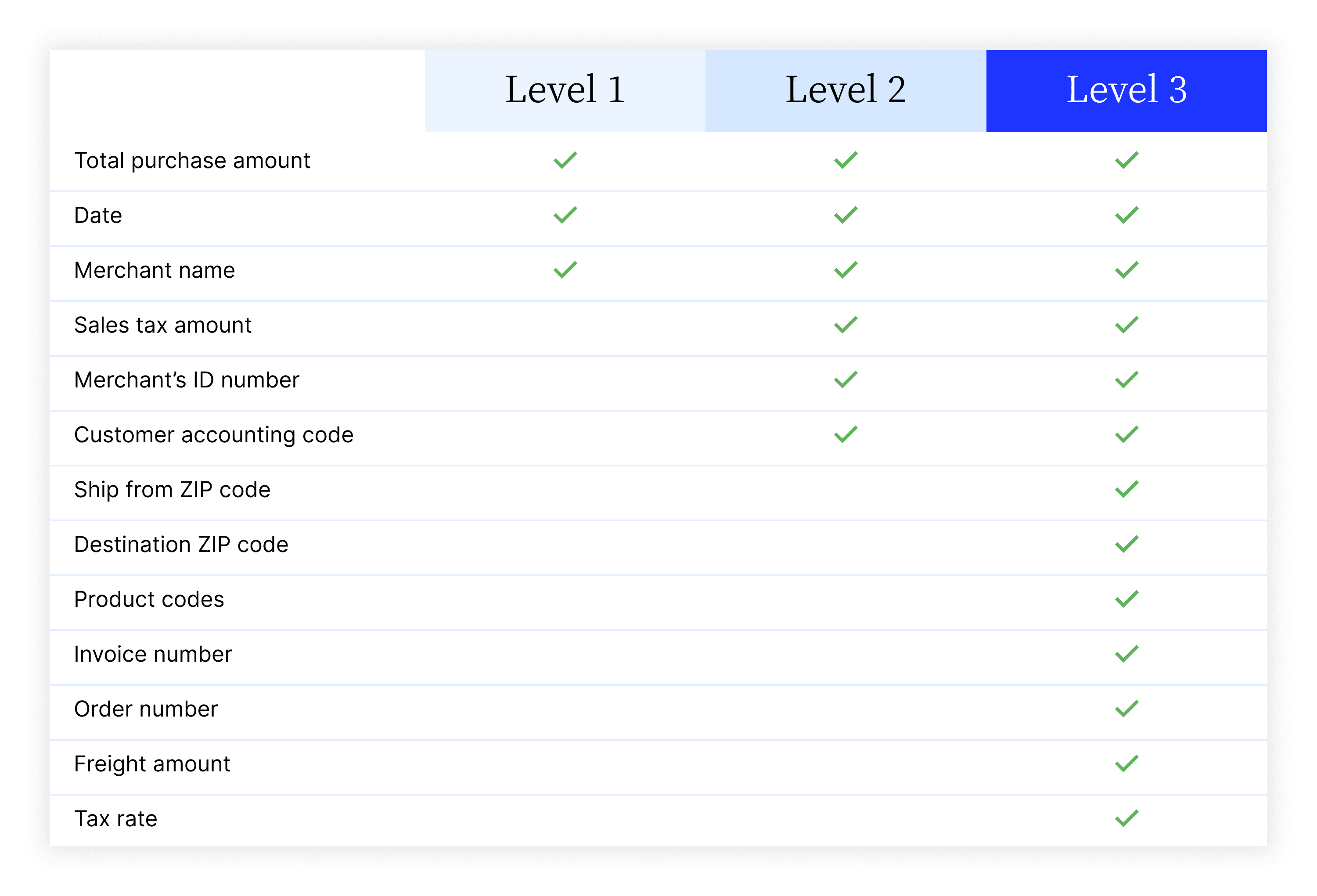

Data levels are a set of information fields required for a transaction to be completed. There are three levels: Level 1, 2, and 3 (also referred to as Level I, II, and III). Generally, the higher the level, the more information that is included. The additional information makes the transaction less risky, which is a significant reason behind why adding additional levels of data tends to lower your interchange fees.

The methods for capturing data vary by data level. Generally, you’ll need to connect with your gateway processor to enable the capture of Level 2 and 3 data.

Here’s a high-level view of what’s included at each level...

… and here’s a more detailed explanation:

Level 1

Data included in Level 1 is the most basic and is required for any transaction to be completed. It includes fields you’re almost certainly familiar with:

- Card number

- Expiry date

- CVV2 code

On top of this, plenty of processors require that you pass fields related to the card or transaction, such as the cardholder’s zip or postal code, or merchant name and transaction amount.

As Level 1 contains the lowest amount of data, it carries the highest fees. Adding additional levels of data is critical to lowering your credit card processing fees.

Level 2

At Level 2, data is applicable to corporate, government, and B2B transactions. It’s mandatory for the purchaser to use a commercial credit card to pass level 2 data. In addition to the fields required for Level 1 data, common Level 2 fields include:

- Requestor name

- Tax indicator

- Tax amount

- Tax ID

- Purchase order number

- Destination address

- Destination city

- Destination state

- Destination ZIP code

Level 3

Level 3 data also requires a commercial credit card and applies to corporate, government, and B2B transactions, but generally for larger dollar amounts. It includes all Level 1 and 2 data, as well as more detailed line-item information.

While 15-20 fields are most common, Level 3 data can include up to 100 fields. Common fields include:

- Unit price

- Item ID or SKU

- Item description

- Extended price

- Unit of measure

- Unit of cost

- Commodity code

- Quantity

- Discount amount, per line item and total

- Ship-from ZIP/postal code

- Ship-to/destination ZIP code

- VAT information

- Debit or credit indicator

3. Merchant category codes

Merchant category codes (MCC) are four-digit numbers that communicate your line of business and the goods or services you sell. They are created by credit card networks and assigned to individual merchants. While different networks generally use the same codes, they do sometimes differ.

Acquiring banks and payment service providers use these codes to determine critical details like risk levels and credit card transaction fees.

—

💡 The interchange rate factors merchants can (and can’t) control:

- Can control: Accepted card type, accepted card network, transaction type (POS vs card-not-present)

- Can’t control: Business size, industry.

3 ways to lower credit card processing fees

Just because you’re in B2B, don’t assume that you will automatically pay the highest posted rates. There are ways to decrease some B2B credit card processing fees. Here are a few of them:

- Engage in interchange optimization

- Consider a credit card surcharge

- Choose payment methods that minimize chargebacks

1. Engage in interchange optimization

When you consider that the vast majority (80%) of credit card processing fees are found in interchange fees, it’s critical to get that number as low as possible. You can do that through interchange optimization, the process of sending additional data along with a transaction in order to qualify for the lowest interchange rates possible.

Remember that interchange fees go to the issuing bank, who wants as much assurance as possible that the risk of extending credit is low. The more data you can provide about a transaction, the more secure the bank will feel.

When you can share information such as your client’s industry (some have higher rates than others), where the product is shipped to and from, the invoice number, and the invoice line-item details, you’ll likely be able to lower the interchange fee.

If you integrate your payment processing service with your Enterprise Resource Planning (ERP) platform, it’ll be even easier to practice interchange optimization. Solutions like Versapay make it simple to automatically send Level 2 and Level 3 data along with each transaction—with no extra effort from your staff. That’s because information like customer invoice numbers, number of items purchased, sales tax, and customer codes are already housed within your ERP.

When your ERP and payment processing are linked, you’ll qualify for much lower interchange rates

2. Consider a credit card surcharge

To recoup some of the costs associated with accepting credit cards, merchants have the option to charge a fee to customers who pay by credit card. Surcharging is permitted in most US states, but not all, so it’s worthwhile to check the rules of your jurisdiction.

3. Choose payment methods that minimize chargebacks

Chargebacks occur when a charge is returned to the payer of a transaction after they successfully raise an item on their account. This generally involves the customer challenging the amount, or even if they made the purchase entirely. The vast majority are due to fraud. Chargeback fees are usually substantial and can easily take a bite out of your bottom line.

Thankfully, there are a few things you can do to minimize them. First, using card readers with chip detection, as well as contactless payments, can help steer off fishy transactions. Second, you can limit card-not-present payments (e.g., taking a payment over the phone), as those transactions make it easier for someone nefarious to use a card that is not theirs.

More frequently asked questions about credit card processing fees

Can you pass on credit card processing fees to customers?

Passing on credit card fees to customers is a common way for merchants to offset the fees they incur when accepting cards. Surcharging is generally allowed; however, individual states have their own laws and regulations. Therefore, it’s recommended that you do a search to determine the rules in your state first.

What does pre-authorization mean?

A credit card pre-authorization is like other credit card charges, however, rather than debiting funds from the cardholder, the funds are simply put on a temporary "hold" for 5 days. This duration may vary based on your MCC, as different types of businesses have different risk levels.

What are the benefits of pre-authorizations?

There are many benefits to pre-authorizations. Here are two of the main ones:

- Avoid refund fees: Like the previous point, not capturing the funds immediately can prevent refund fees should the purchaser return the product.

- Avoid chargebacks: Because funds have not been captured, cardholders cannot dispute transactions, saving you hefty chargeback fees.

Is there a way to avoid credit card processing fees?

Unfortunately, you cannot avoid credit card processing fees. However, with thoughtful strategy and a focus on how you accept credit card transactions, you can lower them.

About the author

Joe Crawford

Joe Crawford is the Senior Copywriter at Versapay. While currently focused on Fintech, he’s written extensively across industries including automotive, telecom, and communications technology. Coming from a background in comedy, he welcomes any chance he can to introduce some levity to world of Accounts Receivable.