Direct vs Indirect Cash Flow Methods in Accounting

- 7 min read

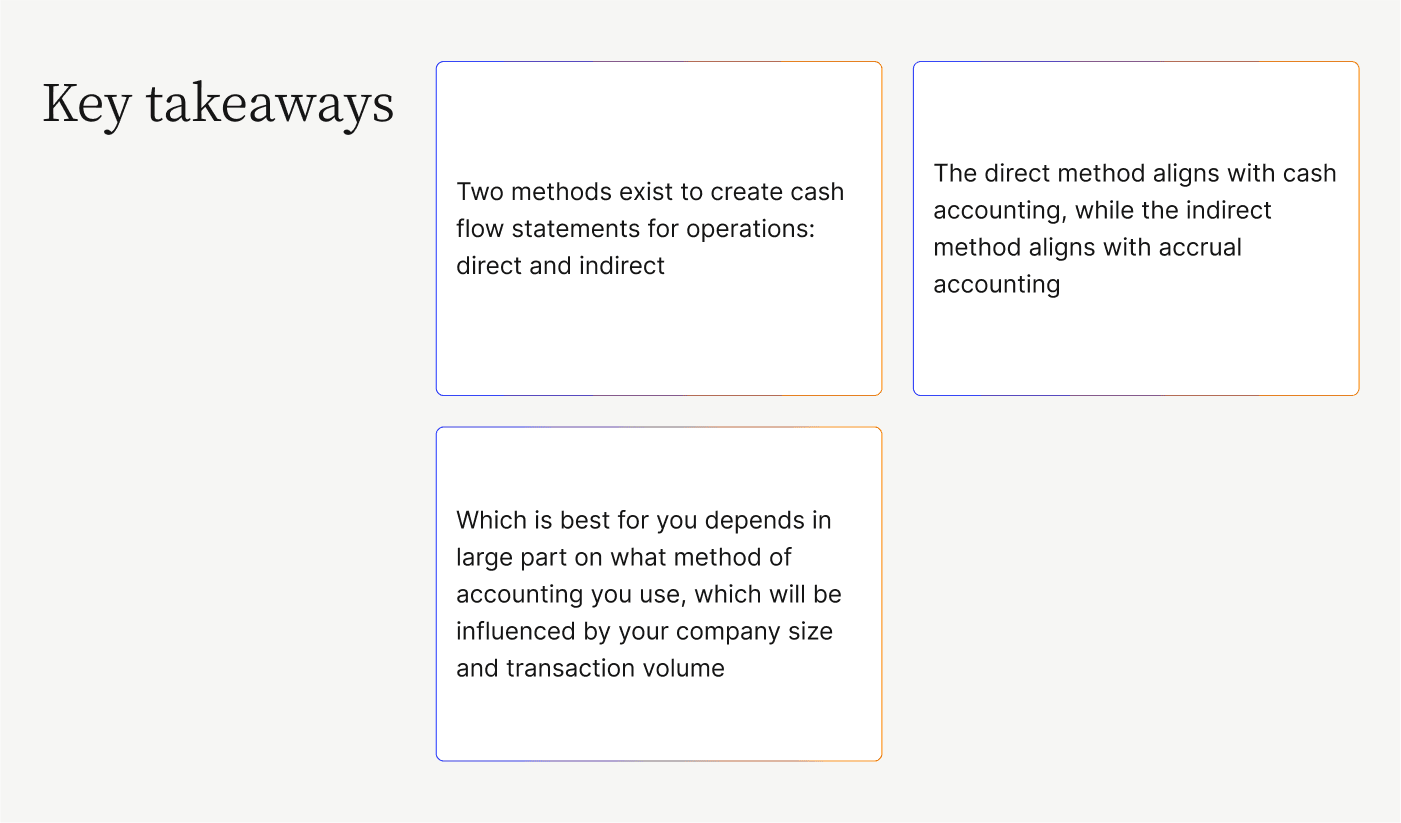

Whether you use the direct or indirect method for cash flow accounting will depend largely on your company’s accounting practices.

In this article, we define cash flow statements, the difference between the direct vs indirect cash flow methods, cover the pros and cons of each, and explore how automation can improve cash flow.

—

Cash flow management is an essential element of business operations. Cash flow is movement of money in and out of your business, and net cash flow is the difference between the money that comes into a business and the money that flows out during a given period.

Net cash flow encompasses three elements: operating cash flow, financing cash flow, and investing cash flow.

- Operating cash flow is cash from operating activities, which are the central activities of the business like selling products or providing services.

- Financing cash flow is money that a company garners from financing like loans, bonds, or selling new shares, which the company uses to finance its operations.

- Investing cash flow is money generated by a company’s investments, such as dividends from stocks or interest from bonds.

While there is a single way of accounting for financing and investing cash flows, there are two different options for operating cash flow accounting:

- Direct method, and

- Indirect method

Jump to a section of interest:

- What are cash flow statements?

- Direct vs indirect cash flow methods (an overview)

- Direct vs indirect cash flow methods (how to choose between the two)

- Pros and cons of direct and indirect cash flow methods

- How automation improves cash flow

Introduction to cash flow statements

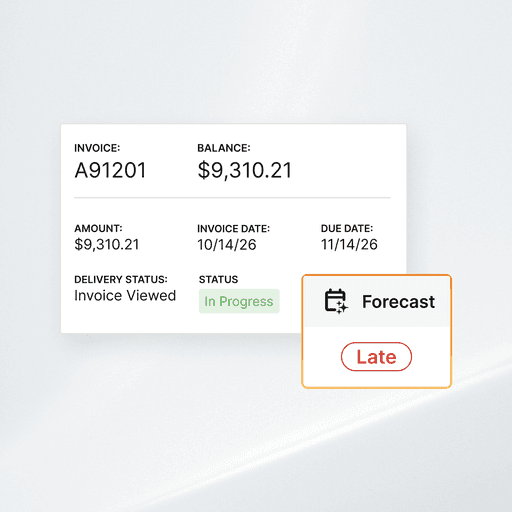

A cash flow statement depicts a company’s cash inflows and outflows during the same interval accounted for by a profit and loss statement. Also called a statement of cash flows (SCF), this statement is essential to a company’s ability to make cash flow forecasts that help in planning for sustainable and strategic growth.

Operating cash flow, financing cash flow, and investing cash flow are each detailed in separate sections in the cash flow statement. Operating cash flow is typically the first section listed in a cash flow statement.

How to calculate net cash flow

Calculating total net cash flow for your business is straightforward: Subtract the cash that goes out from the cash that comes in during the period in question. The formula looks like this:

- Total cash in – Total cash out = Net cash flow

Let’s imagine that a fictional company, Rosie’s Rivets, brought a total of $50 million in the door during the first quarter of 2023 and spent $37.5 million during that same period. Rosie’s net cash flow for that quarter was $12.5 million. Rosie’s formula looks like this:

- $50 million – $37.5 million = $12.5 million

Calculating operating cash flow is a bit more complicated, as you can do so using either the cash flow direct method or cash flow indirect method of accounting. We will explain calculations for cash flow direct and indirect methods in more detail below.

Direct vs indirect cash flow methods

The operating section of a cash flow statement can be created using either a direct or indirect accounting method. Whether to use a direct vs. indirect cash flow statement depends on which accounting method you use.

What is the direct cash flow method?

The direct cash flow statement calculates cash flow using the actual cash amounts the company received and paid in the time period—known as the cash basis. Your calculation might account for things like cash paid to the company by customers and dividends, and cash the company paid to employees and suppliers.

This direct cash flow method in accounting is based on the cash method of accounting, so companies that use cash accounting will find it simplest to use the direct cash flow method. You don’t need to make any adjustments to translate the cash basis into operating cash flows, but you will need to manually reconcile net income to the cash provided by operating activities.

The Financial Accounting Standards Board (FASB) requires those who use the direct method of cash flows to disclose this reconciliation.

Since the calculation of cash-in-cash-out is straightforward, the direct accounting method uses the same simple formula as the net cash flow calculation, but applies it to the operating cash flows.

Let’s look at a simple example. Say Rosie’s Rivets received $40 million from customers and dividends, and paid $30 million to suppliers, employees, and the bank (for interest). According to the formula, Rosie’s has $10 million in operational cash flow:

- $40 million – $30 million = $10 million

What is the indirect cash flow method?

The indirect cash flow method in accounting starts with the company’s net income, which you then adjust in various ways to convert into cash flows from operating activities.

Based on accrual accounting, this method incorporates non-operating expenses such as accounts payable and depreciation into the cash flow equation. As such, one advantage of the indirect method is that you don’t have to do an extra calculation to convert net income to the cash provided by operating activities, as you do with the direct method.

You will make some of these adjustments to net income when using the indirect method of cash flows. These might include things like:

- Adding depreciation expense

- Adding in a decrease in accounts receivable amounts

- Deducting an increase in inventory

- Deducting a decrease in accounts payable amounts

As you can tell, figuring out the indirect method of cash flow takes more than a simple formula. Your finance team or accountant will be able to put all the pieces together to create an accurate indirect cash flow statement.

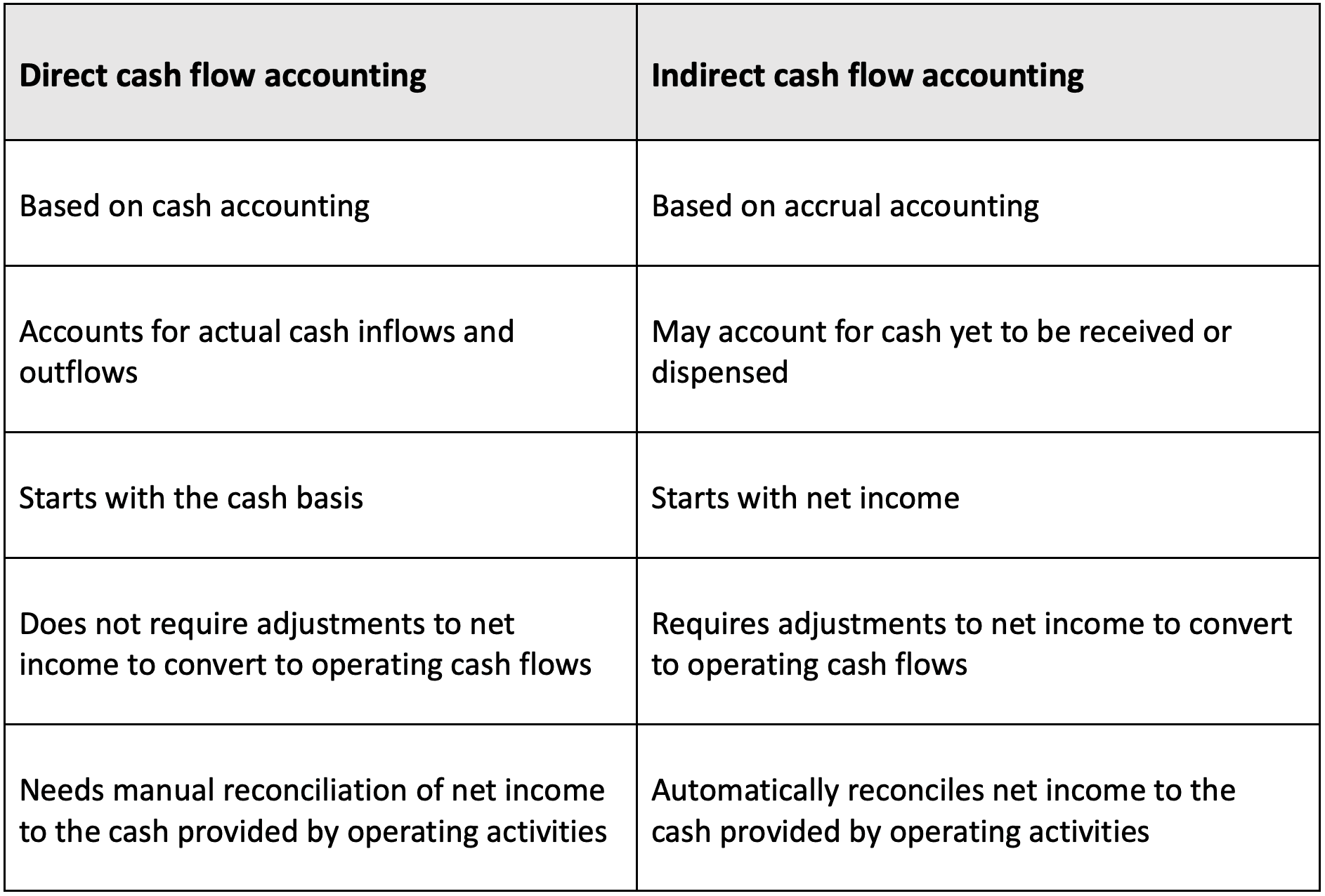

Direct vs indirect cash flow accounting: key differences

Direct vs indirect cash flow accounting: which is best for you?

Whether you should use direct vs. indirect cash flow accounting will depend largely on your company’s accounting practices. Cash accounting matches up with the direct method, while accrual accounting is a fit for the indirect method.

Since most large companies use accrual accounting, most also use the indirect method of cash flow accounting. Typically, as a company grows, it becomes increasingly difficult to use the direct method of cash flow accounting. Not only does the indirect method match the structure of larger companies’ general ledgers, it also provides a higher-level overview of cash flow to allow for more accurate cash flow forecasting and long-term planning.

By contrast, small companies may find the direct method a better fit for their needs. Those with relatively few income sources are likely to find it simpler to do cash accounting and direct cash flow accounting. The direct cash flow method offers better visibility for short-term planning as compared to the indirect method.

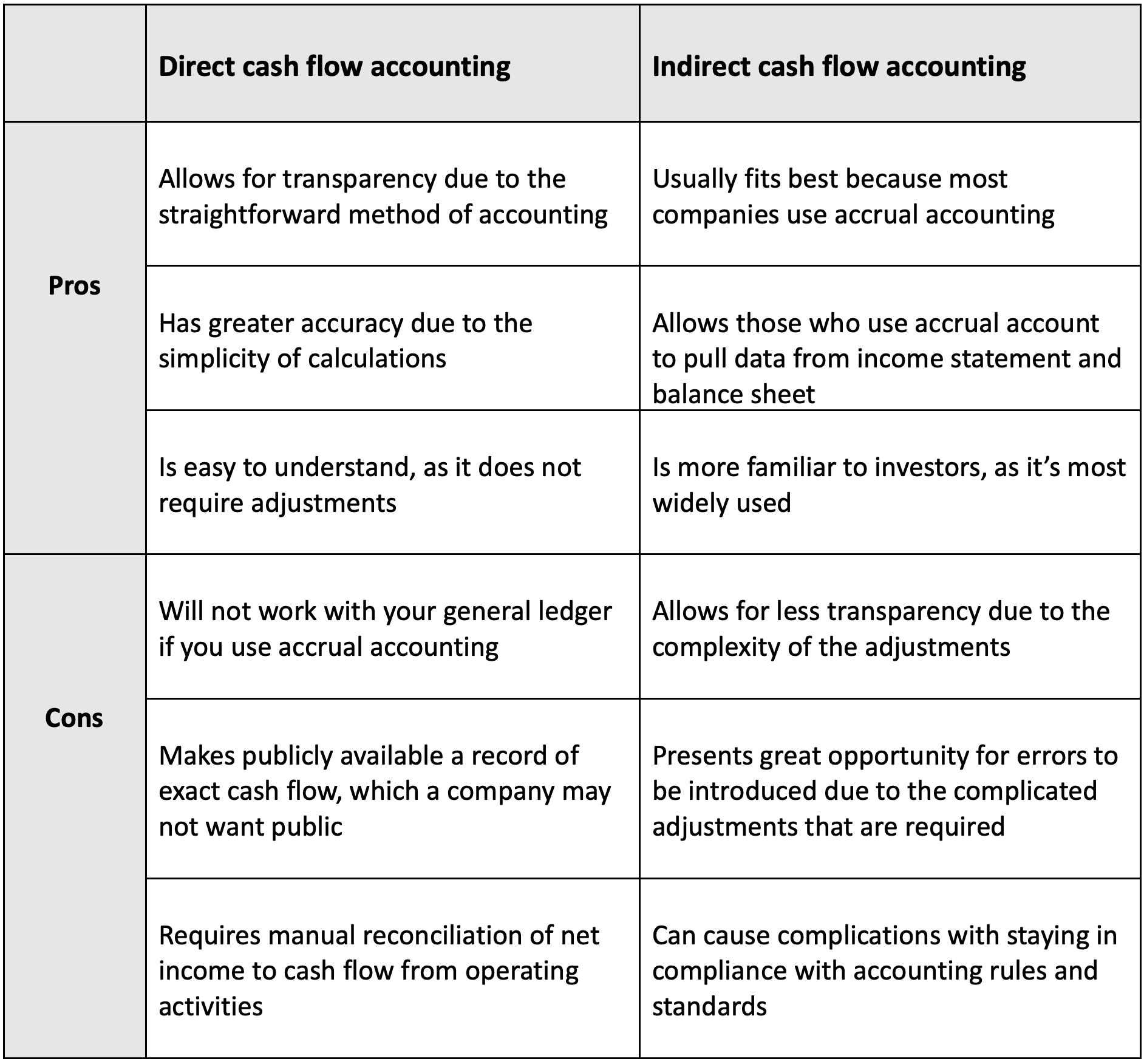

Pros and cons of direct and indirect cash flow methods

How automation can help your cash flow

To be of the most value to your company, cash flow accounting requires accurate financial information. Automating some of your processes can help you improve your accounting processes, ensure accuracy, and get more insight into cash flows.

At the same time, it can help shore up your cash flow by ensuring you’re capturing all the revenue that is owed to you. Notably, you can make your collections efforts more effective by using accounts receivable collections software that reduces nonpayment and encourages faster payment via a collaborative approach.

Check out our guide to accelerating collections to learn more about how this type of support can help your business improve your cash flow—leading to cash flow statements that you’ll be happy to see.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.