How to Create Effective Cash Flow Forecasts [Examples Included]

- 13 min read

Predicting future cash flow is called cash flow forecasting.

Learn to prepare and create effective forecasts (with examples to guide you), and explore how accounts receivable automation can improve your projections.

The cash flowing into and out of a business—its cash flow—is like its breath: It comes and goes cyclically, keeping the enterprise alive. That’s why every business needs a good sense of the amount of cash it has on hand, as well as how much cash it’s likely to have in upcoming months.

Predicting that future cash flow is called cash flow forecasting.

Crucially, a cash flow forecast can tell a company about its free cash flow. Free cash flow is how much cash a company has left in a given period after paying for operating and capital expenditures in that same period. Cash flow forecasting to learn this number can help a business plan for sustainable and strategic growth.

Planning for growth is only one of the reasons for cash flow forecasting. There are numerous other benefits to doing cash flow projections, all of which help companies run with more insight and foresight. Keep reading to learn the ins and outs of cash flow forecasting and how to use it in your business.

Table of contents:

What is a cash flow projection?

A cash flow projection breaks down the money that’s expected to come in—and out—of your business. It involves calculating your income and expenses, so that you gain a clearer picture of what’s left after a predefined period of time. Your cash flow projection may indicate you have a surplus of cash, and are well-positioned to invest; or it may indicate you have a deficit, with lower than expected earnings.

To create effective cash flow forecasts, you must deeply understand your accounts receivable and accounts payable, as the projection is more or less the difference between these. It’ll inform what cash you have today—and in the future—and highlight when excess liquidity exists or funding needs arise:

Accounts receivable — the money you expect to collect (customer payments, deposits, government grants, rebates, bank loans, etc.)

Accounts payable — the expenses you expect to pay (payroll, supplier and vendor payments, overhead, recurring payments like rent, taxes, etc.)

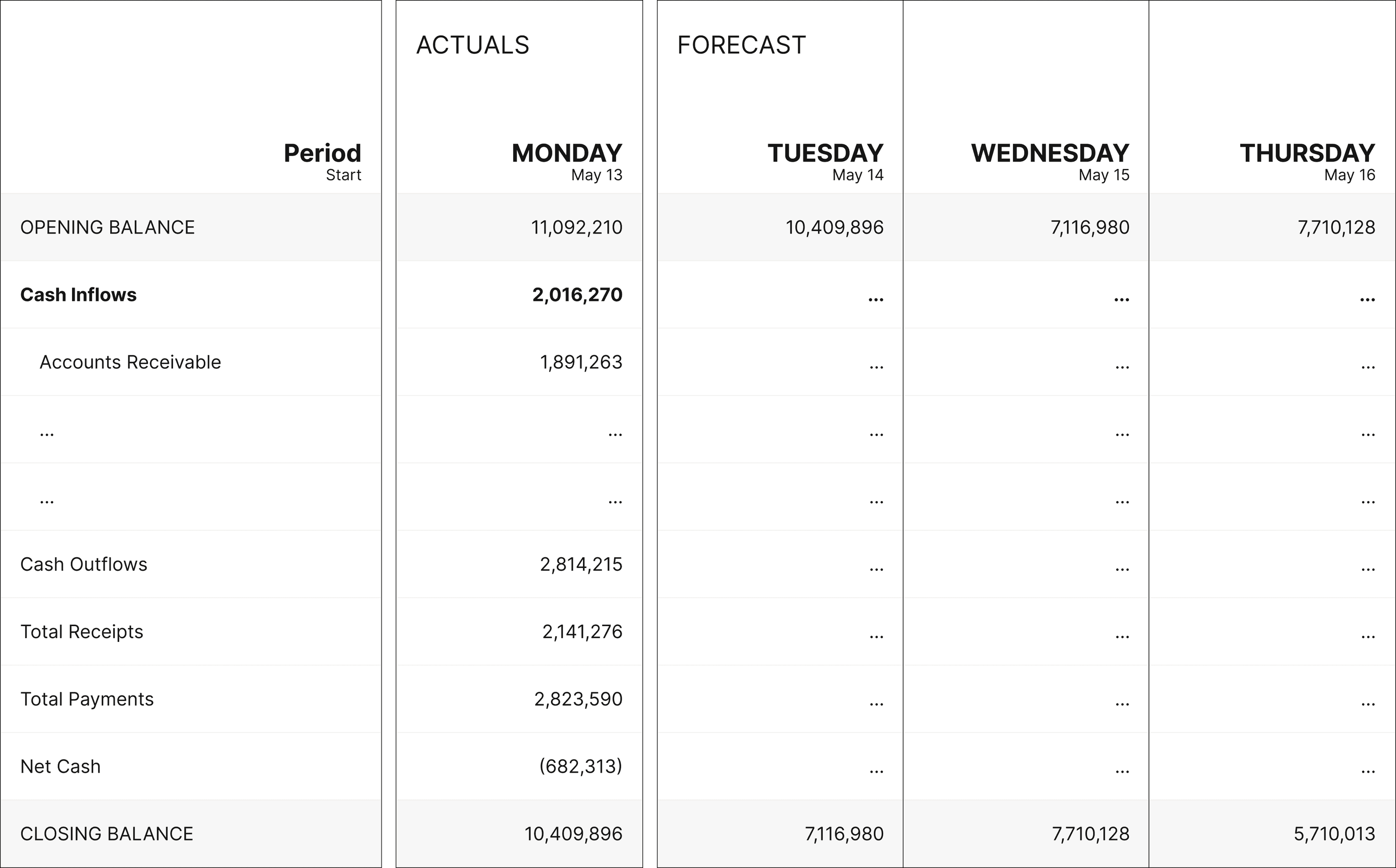

The components of a cash flow forecast

A cash flow forecast comprises some—or all of—the following elements:

Opening balance (for the predetermined period of time)

Receipts (grouped by cash flow item or classification)

Total receipts

Payments (grouped by cash flow item or classification)

Total payments

Net movement (grouped by cash flow item or totaled)

Closing balance (for the predetermined period of time)

Note that cash flow items (comprising receipts and payments) are unique to each business and its cash flow forecasting needs. How granular you go will vary. (For example, some businesses are content to forecast against aggregate accounts receivable or payable cash flows; others might choose to forecast against individual supplier payments or incoming customer deposits.)

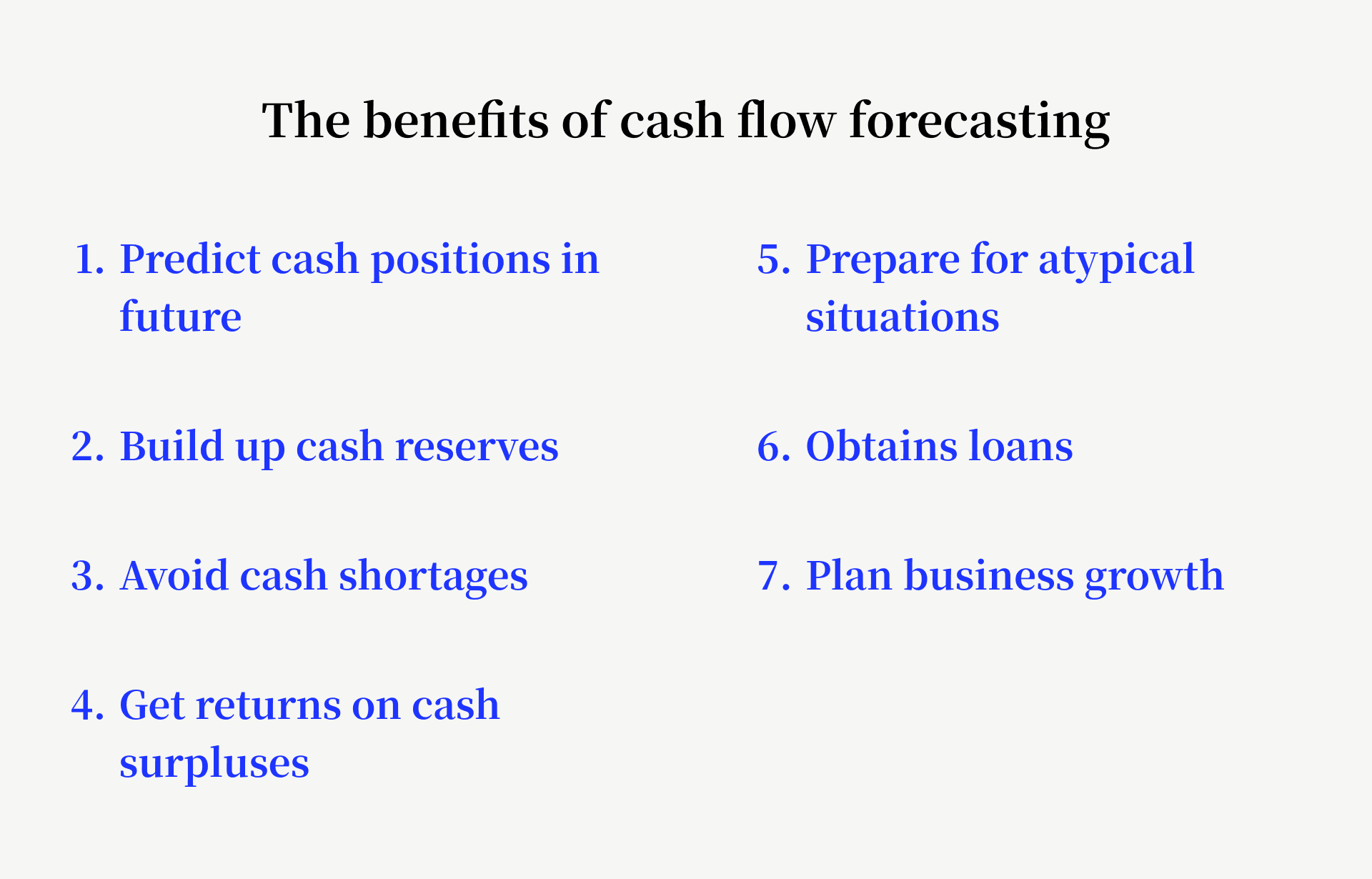

7 benefits of cash flow forecasting for businesses

There are many benefits to—and reasons for—forecasting cash flow, from ensuring your cash reserves are sufficient to enabling business growth. These include:

Predict cash positions in future — Knowing how much cash you’re likely to have in the coming months is essential for planning how you will deploy your resources to improve and grow your business. This is particularly true if most of your sales are made on credit, as you will need to be confident you will have the cash on hand to pay back your debts.

Build up cash reserves — If you know how much cash you are likely to bring in the door in future months, you can calibrate your spending to increase your free cash flow, thereby building up cash reserves that you can use strategically in the future.

Avoid cash shortages — Even if you’re not in a position to build up cash reserves, cash flow forecasting can help you avoid coming up short of cash to pay your bills. Cash flow projections can help you align your spending with your revenue and can tell you when you need credit to help get through a slow period.

Get returns on cash surpluses — Extra cash can be invested and leveraged for returns, but it’s only possible to pursue such strategies if you’re confident you won’t need the cash you’re investing to pay bills in the short term. Projecting cash flow can help you feel confident in putting your surplus to other uses.

Prepare for atypical situations — Business isn’t always the same month after month, and your finances need to be able to keep up with the changes. For example, you need cash on hand to pay your workers in months with three paydays, extra funds to buy special inventory in particular seasons, or a cash cushion to cope with inflation or even a recession. Cash flow forecasting helps make sure such occurrences don’t take you by surprise.

Obtain loans — Lenders may require cash flow forecast reports as part of loan applications, as they like to make sure you’ll be able to service the debt. Doing a cash flow projection before applying for credit is a good idea even if the lender doesn’t require it, as you should only take on debt if you know you can pay it back on time.

Plan business growth — Knowing how much free cash flow you have and can expect over time is essential for figuring out what investments you can afford to make in your business. Cash flow forecasting can also help you figure out how much credit you can safely use to enable your growth.

How to prepare a cash flow forecast

You must make two important decisions before creating a cash flow forecast: 1) what time frame you’ll be looking at, and 2) whether you want to do a direct or indirect cash flow projection. Then you’ll need to source the data (3) for your cash flow forecast.

1. Choose your timeframe

Short-term forecasting — Short-term forecasts are the shortest cash flow projections, looking just a month or less (days or weeks) into the future. These cash flow forecasts are best for short-term liquidity planning. Short-term forecasts tend to benefit small businesses, as cash inflows and outflows are shown as they occur. This helps small businesses plan better and manage payments, as they often have less credit to draw on, compared to larger businesses.

Medium-term forecasting — Medium-term forecasting has you look anywhere from two to six months into the future. This type of cash flow projection can help you see how to reduce interest and debt and manage your risk.

Long-term forecasting — Long-term cash flow forecasts usually look six to 12 months into the future, forming the basis for your annual budgeting process. These projections can help you assess your positioning in relation to growth strategy and capital projects. Long-term forecasts aren’t relied upon as heavily, as cash flow data isn’t updated monthly. However, these cash flow forecasts are helpful for big-picture planning.

Mixed-period forecasting — Mixed-period forecasts combine multiple time periods. For example, they might contain daily cash flows covering a handful of weeks, and weekly cash flow forecasts covering a month or more. Mixed-period forecasts are useful for detailing cash flow visibility where it matters most, at any given time.

The longer the term of the cash flow forecast, the more complicated it is to create and the less accurate it is likely to be. This is because cash flow projections require making assumptions about what will happen in the future, and our certainty diminishes the further out we look.

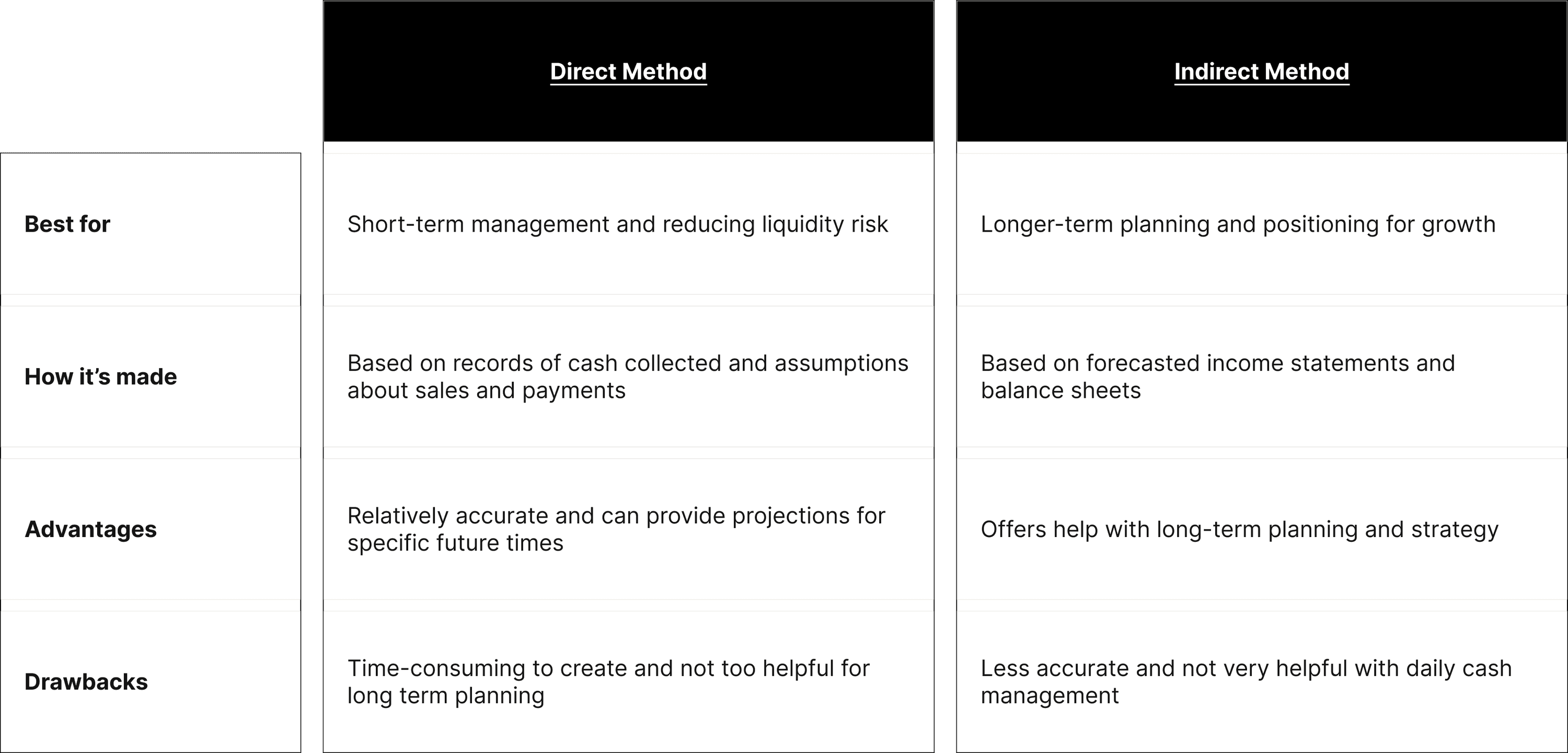

2. Choose your cash flow forecasting method: direct or indirect

There are two common cash flow forecasting methods: the direct method and the indirect method. The direct method is suited for daily cash management while the indirect method provides a better basis for strategic planning.

The direct method — This method of creating a cash flow forecast takes a bottom-up approach, building the forecast based on actual cash collected and spent in a given timeframe, and making assumptions based on the customers’ payment habits and sales projections. This method is best suited for short- to medium-term projections.

Indirect method — The indirect method is based on forecasted income statements in conjunction with balance sheets. This method for forecasting cash flow is aligned with financial plans and budgeting. It's typically used for longer-term strategic planning.

3. Source the data needed for your cash flow forecast

Now you’ll need to gather the information needed to calculate your cash flow projection. At a minimum, here’s the information you’ll need:

Financial statements — income statements, balance sheets, cash flow statements

Taxes — sales tax reports

Payroll — wage and tax reports, payroll benefits and deductions reports

Opening balance — your balance at the start of the examined period

Closing balance — your balance at the end of the examined period

Receivables — anticipated sales (such as on invoices expected to be paid) for the next period

Payables — anticipated expenses (such as rent, utilities, marketing, etc.) for the next period

Then, you’ll need to calculate your cash flow (using this formula: estimated cash in – estimated cash out), and add it to your opening balance. Let’s now take a look at a cash flow forecast example.

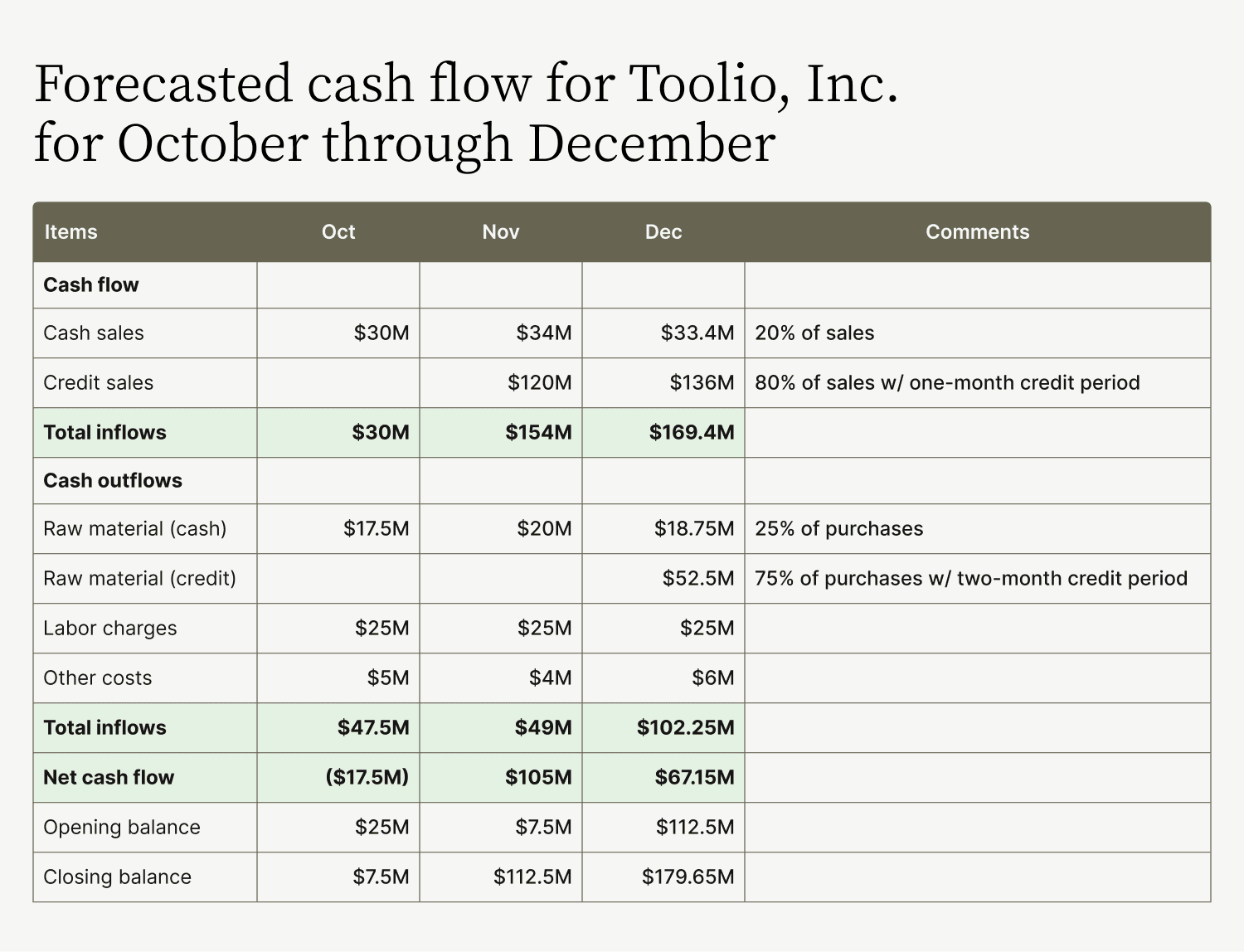

Cash flow forecast example

To get a sense of how a cash flow forecast works in action, let’s look at a sample three-month cash flow projection for Toolio Inc., a fictional enterprise tools manufacturer. Here are the data points for this cash balance forecast:

Opening balance of the cash position is $25 million

Revenue during three months (20% of sales in cash and 80% in credit; credit period is one month). Oct: $150 million, Nov: $170 million, Dec: $167 million

Raw material purchase (25% of the purchase is paid in cash and 75% in credit; credit period of 2 months). Oct: $70 million, Nov: $80 million, Dec: $75 million

Labor charges are paid in cash. Oct: $25 million, Nov: $25 million, Dec: $25 million

Other costs are paid in cash. Oct: $5 million, Nov: $4 million, Dec: $6 million

As this chart illustrates, Toolio Inc. can expect to increase its cash balance by more than 7x in three months. This allows the company to see how it can weather upcoming changes or challenges, and provides an idea that it confidently makes investments in the short term to enable more growth

5 common cash flow forecasting challenges

Cash flow forecasting comes with a number of challenges. Here are five issues that are common causes for complaint in the cash flow projection process.

The direct method of cash flow forecasting may be accurate, but it is tedious and time-consuming, taking finance staff away from other tasks for too long.

The indirect method has a relatively high chance of inaccuracy and is subject to errors in the projected income statements and balance sheets on which it is based.

A cash flow forecast’s results can be skewed if finance has an inaccurate understanding of days payable outstanding (DPO; how long the company takes to pay bills on average) and/or days sales outstanding (DSO; how long the company takes to collect payment from customers on average).

A forecast may be inaccurate if finance has a faulty understanding of customer payment terms, which can frequently change.

A forecast can be made quickly irrelevant or inaccurate by unexpected market changes that affect sales projections.

How accounts receivable automation helps cash flow forecasts

Cash flow forecasting comes with a lot of inherent uncertainty, as none of us know what the future will bring. But there’s a key way to make your cash flow forecasting easier and more accurate: accelerate your cash flow.

Accounts receivable automation tools help do just that, as they make it easier for buyers to transact, such as by paying online with their preferred payment methods. Automated invoice presentment helps invoices reach customers faster, too, and once paid, statuses update automatically. Generally, faster, more frequent cash flows help increase the ease and accuracy of a cash flow forecast.

The streamlined and accurate cash application process we have been able to achieve as a result of Versapay has drastically improved our ability to perform the critical financial functions of cash flow forecasting and budgeting, which are especially important at year-end

Accounts receivable automation tools can also offer greater insight into how your buyers' tend to pay, which can help you gain greater transparency about when and how payments will arrive. These tools can help you identify delinquent accounts and take action to recover payment quickly, allowing you to determine when payment might come in.

And this kind of software can provide accounts receivable metrics related to cash flow forecasts that can help with decision-making, such as built-in AR aging tables that give a sense of how cash is flowing.

How to improve cash flow forecasts

A cash flow forecast is only as good as the information it is based on, which is why the best-in-class tools companies use to improve their cash flow projections are all about gaining visibility into payment processes. One example is increasing the effectiveness of your collections efforts by using software that unlocks efficiencies, so you can do more with less.

Check out our CFO’s guide to accelerating collections to learn more about how this type of support can help your business improve your cash flow forecasts.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.