The CFO's Guide to Accelerating Collections

Collections is primed for digitization. Discover the power of an automated, collaborative collections process.

Less Resistance, More Collaboration. The CFO’s Guide to Accelerating Collections

EXCLUSIVE EBOOK

April 26th, 2022

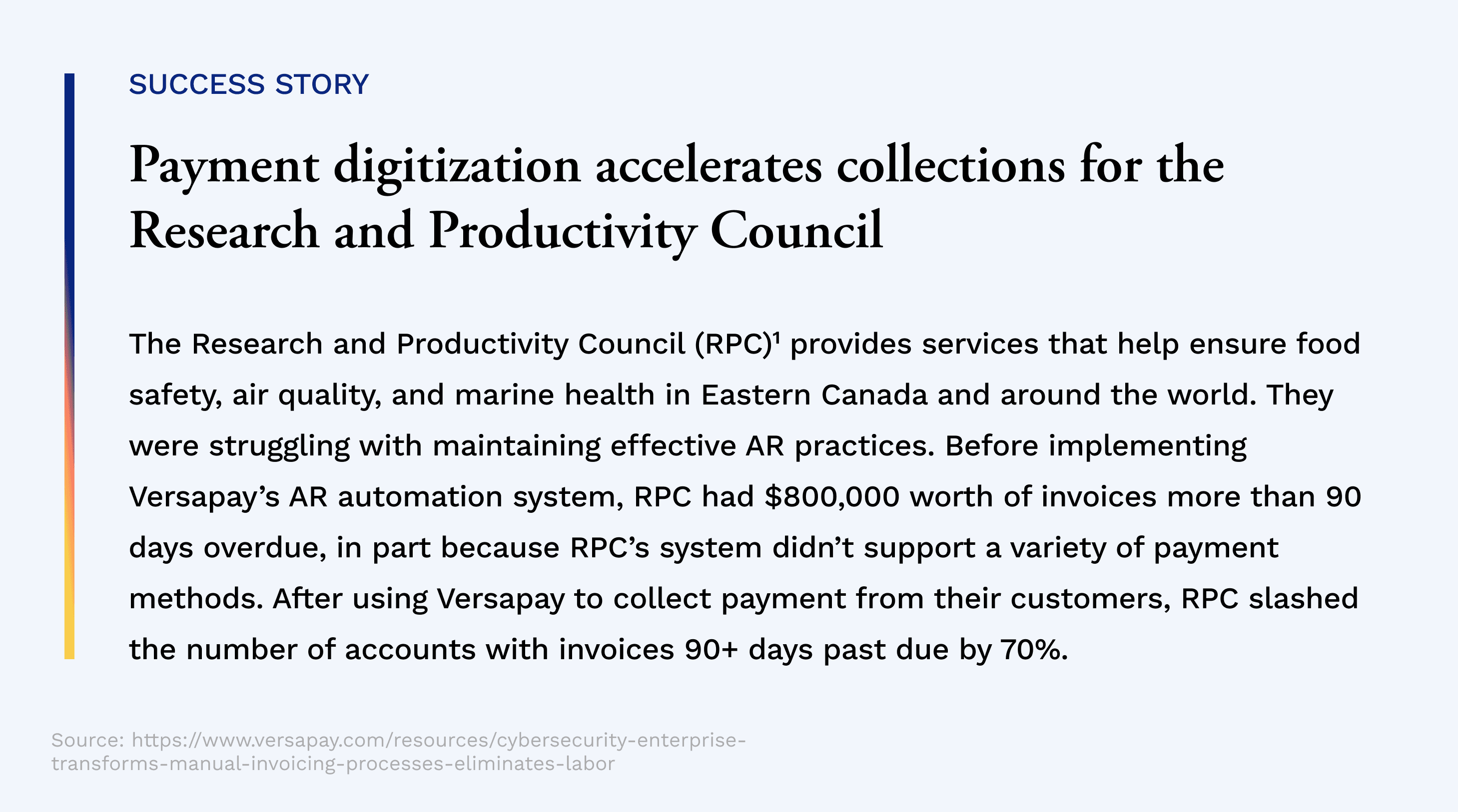

Collections is an area that's primed for digitization—and perhaps more importantly, transformation.

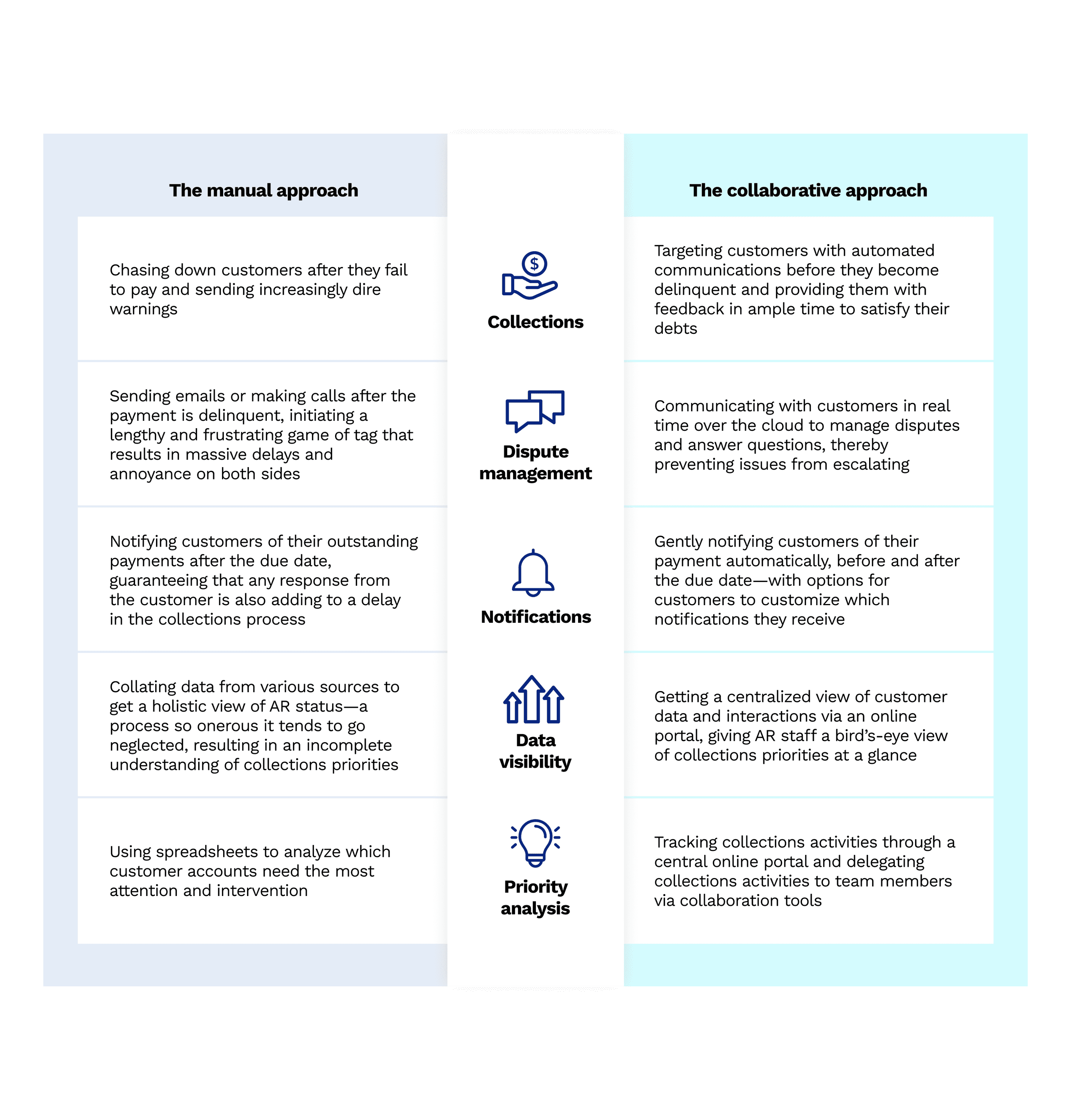

This ebook explores why the most important change businesses can make right now to increase their collections’ effectiveness is to adopt a more collaborative approach.

What to expect from the guide

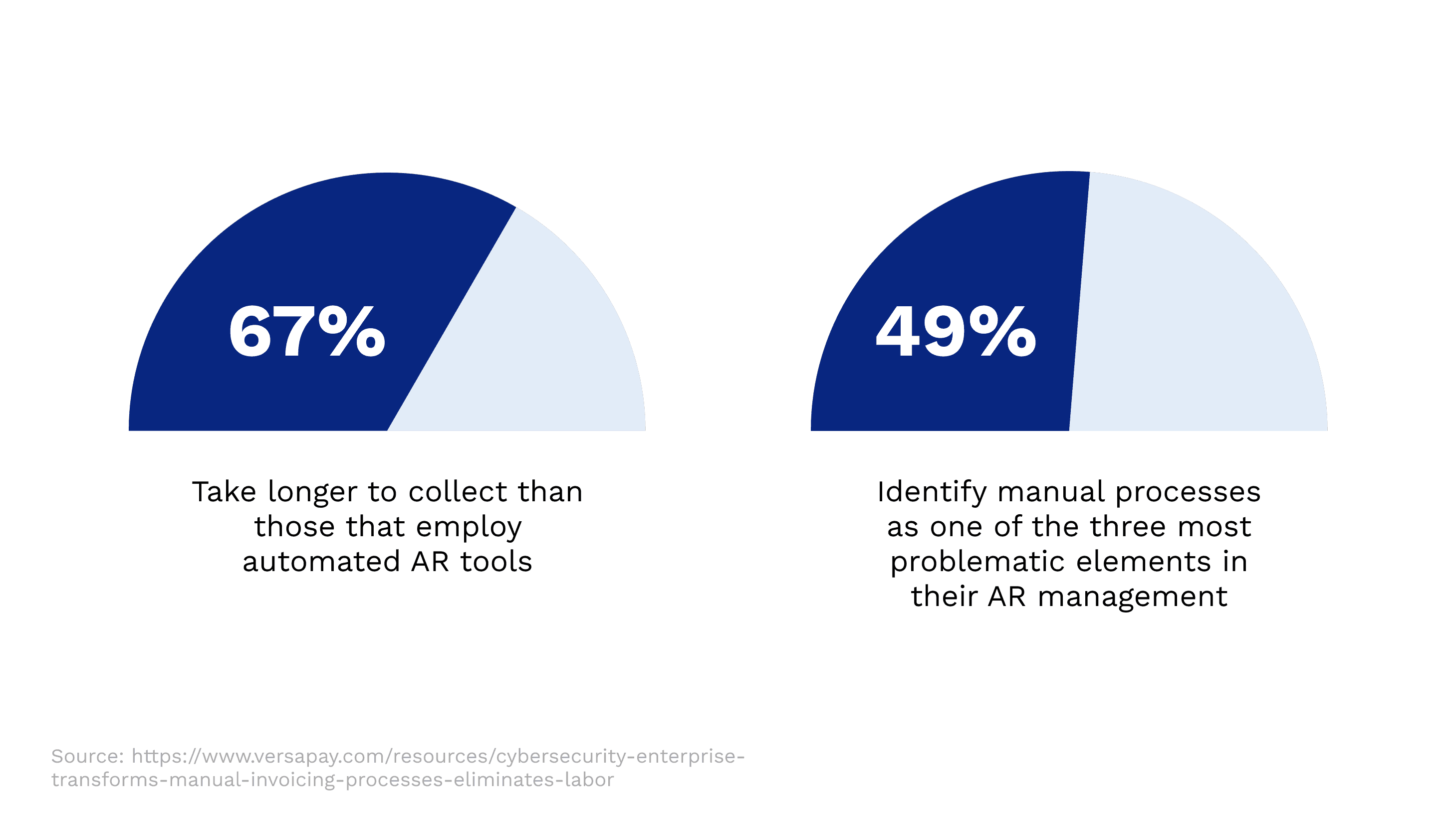

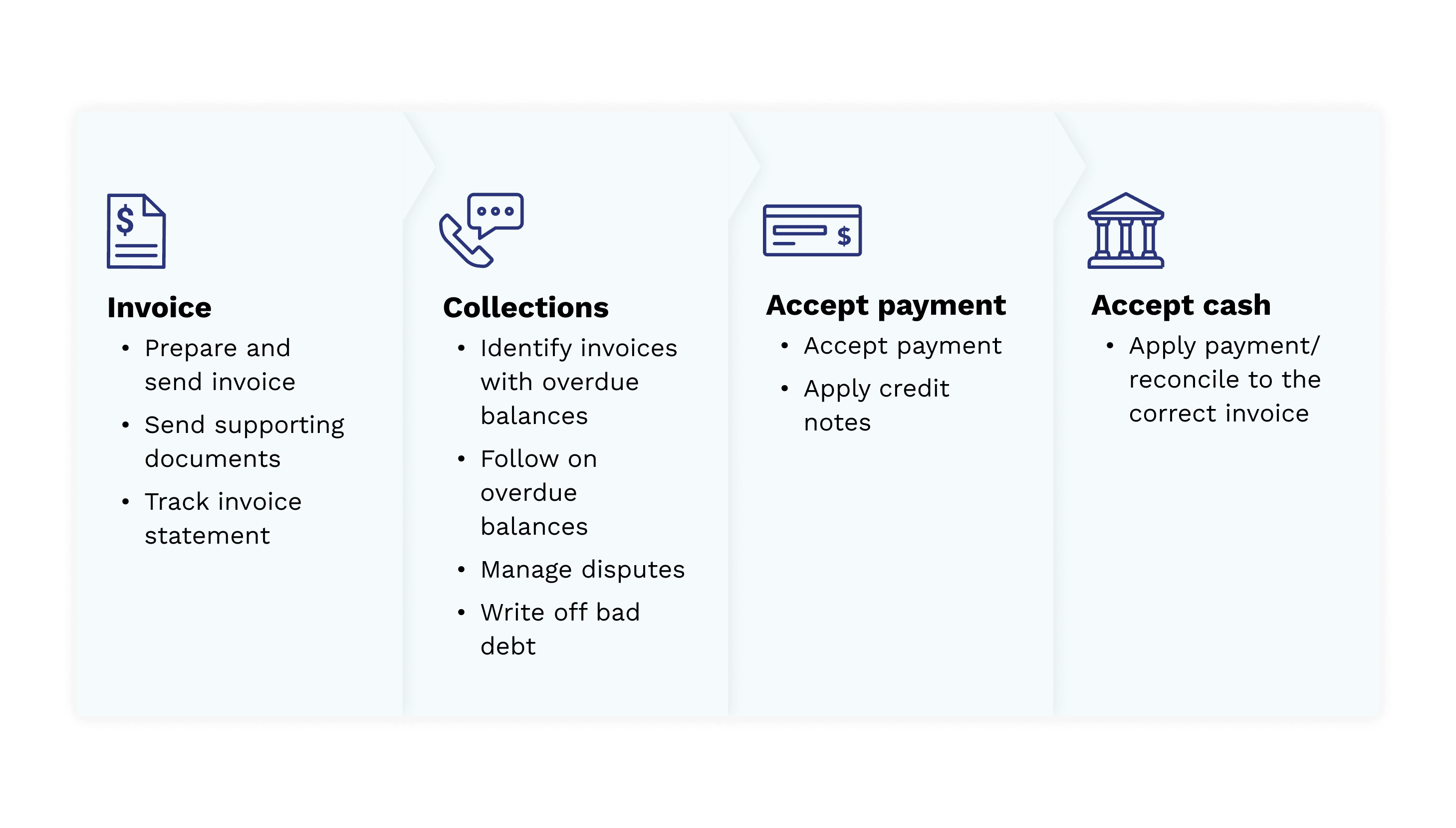

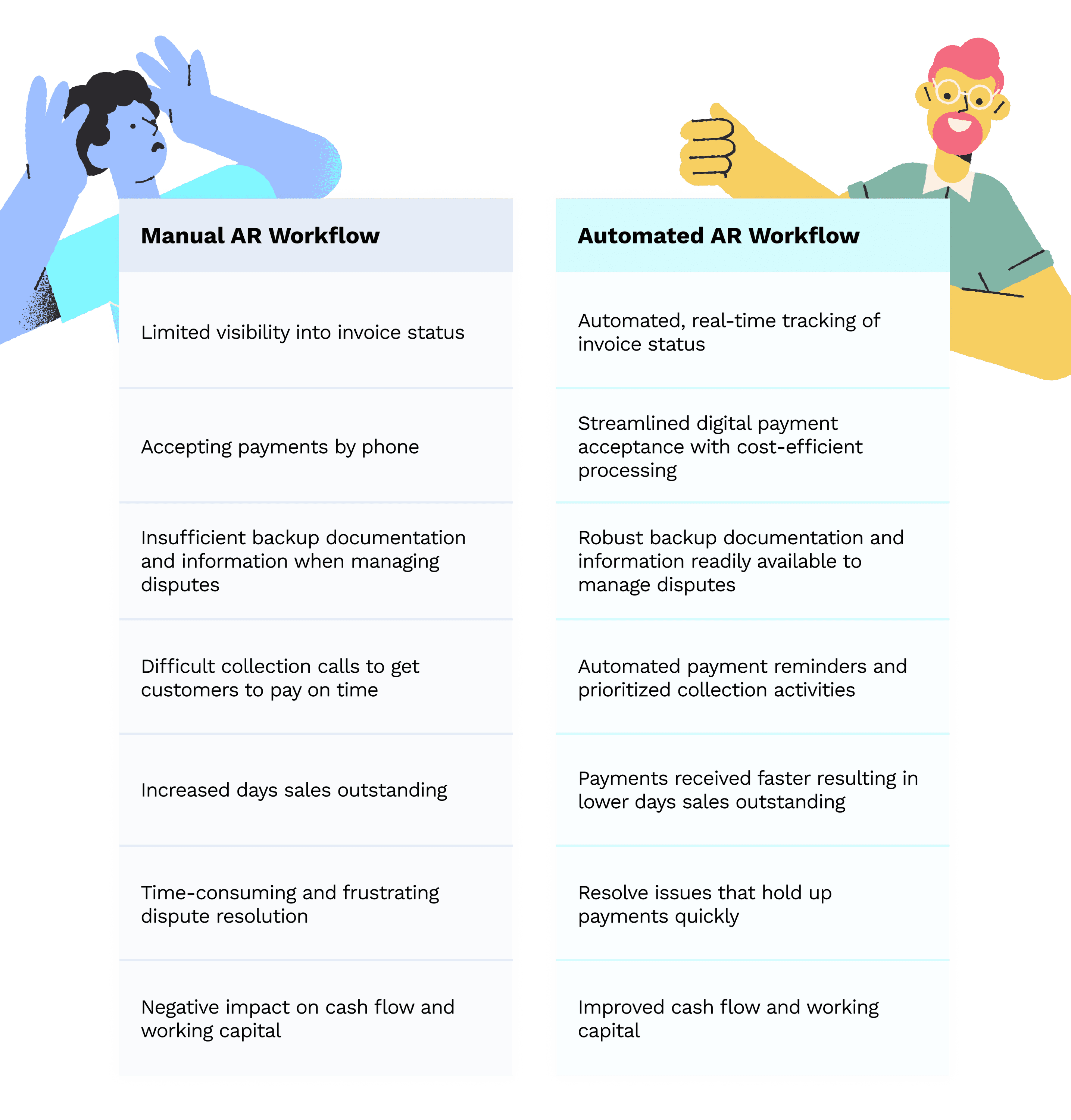

Companies are increasingly adopting automated solutions that help them track AR processes, reduce errors, conduct robust analysis, and—crucially—engage customers throughout the entire invoice to payment lifecycle.

The most important change businesses can make right now to increase their collections’ effectiveness is to adopt a more collaborative approach. Continue reading to discover what that means, and the power an automated, collaborative collections process can have.