How to Identify and Decrease Delinquent Accounts

- 15 min read

For accounts receivable teams to thrive, they need to effectively manage their delinquent accounts.

That's why in this blog, you'll learn:

- 3 useful methods for identifying delinquent accounts

- 7 steps for decreasing them

Plus, you'll hear from various accounts receivable professionals (including Versapay's CFO) on what accounts receivable performance means to them.

Managing delinquent accounts is a critical component of a thriving accounts receivable (AR) department. Like stubborn weeds overtaking a garden, delinquent accounts can spread financial strain and siphon crucial resources required for businesses to function.

Delinquent account management should be handled methodically, which will help businesses:

Optimize cash flow to meet financial obligations

Ensure business liquidity and enable growth initiatives

Preserve positive relationships with customers with prompt service and open communication

Reduce bad debt and protect profitability

Maintain reliable records and make strategic decisions based on accurate financial information

Correctly identifying delinquent accounts and the right tools and strategies can significantly reduce the volume of delinquent accounts and help a business thrive. This article will explore methods to spot delinquent accounts and suggest tactics that fit with a range of resources and needs.

Jump to an area of interest:

When does an account become delinquent?

Delinquent accounts in accounts receivable are customer accounts with unpaid invoices or balances with past due dates. Specifically when an account becomes delinquent depends on the terms of the credit agreement in place. Generally, collections teams group delinquent accounts into buckets ranging from 30 days to 120+ days past due.

How to identify delinquent accounts

The first and most basic step to identify delinquent customer accounts in AR is to standardize what a delinquent account means for your teams. This is dictated by the payment terms you set with your customers.

Some industries have their own norms your business may decide to adapt for, and others may have certain regulations. However your terms differ by customer, make sure your credit policies are clearly documented and each potential case is understood by the entirety of your team.

Here are 3 useful methods for identifying delinquent accounts:

Monitor and reconcile accounts regularly

Harness accounts receivable aging reports

Track payment history and credit hold requests

1. Monitor and reconcile accounts regularly

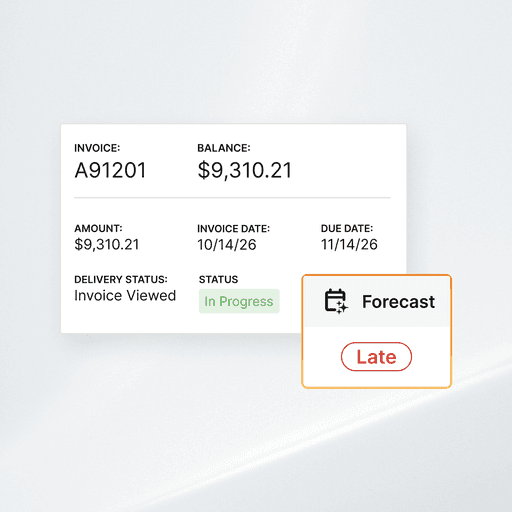

Regular monitoring enables teams to quickly identify overdue accounts. This leads to prompt action to head off delinquencies. Collections automation software can significantly streamline this process by digitizing processes and setting up real-time alerts or notifications for overdue accounts. Automation also reduces manual effort and the potential for human errors.

There are also important metrics to track to assess the overall health of accounts receivable, which rests heavily on reducing account delinquency. Key metrics include:

Day sales outstanding: the average number of days within a certain time period it takes for a company to get paid after making a sale on credit

Calculate your DSO:

Average collection period: the number of days it takes your business on average to get paid after making after making a sale or delivering a service

Calculate your average collection period:

Collection effectiveness index; the percentage of receivables a company collects during a given period

Calculate your collection effectiveness index:

Average days delinquent: the average number of days your invoices are delinquent

Regularly reconciling accounts to identify discrepancies and resolve payment errors also helps avoid payment discrepancies and issues where customers may be incorrectly marked as delinquent.

An automated AR tool can also help streamline reconciliation tasks. For example, integrating your automation solution with your ERP system can automate the cash application process and eliminate manual data entry.

💡Looking for a way to reduce your organization’s past-due invoices? Here’s how Engineering Sales Associates reduced their past-due invoices by 73% in 3 months.

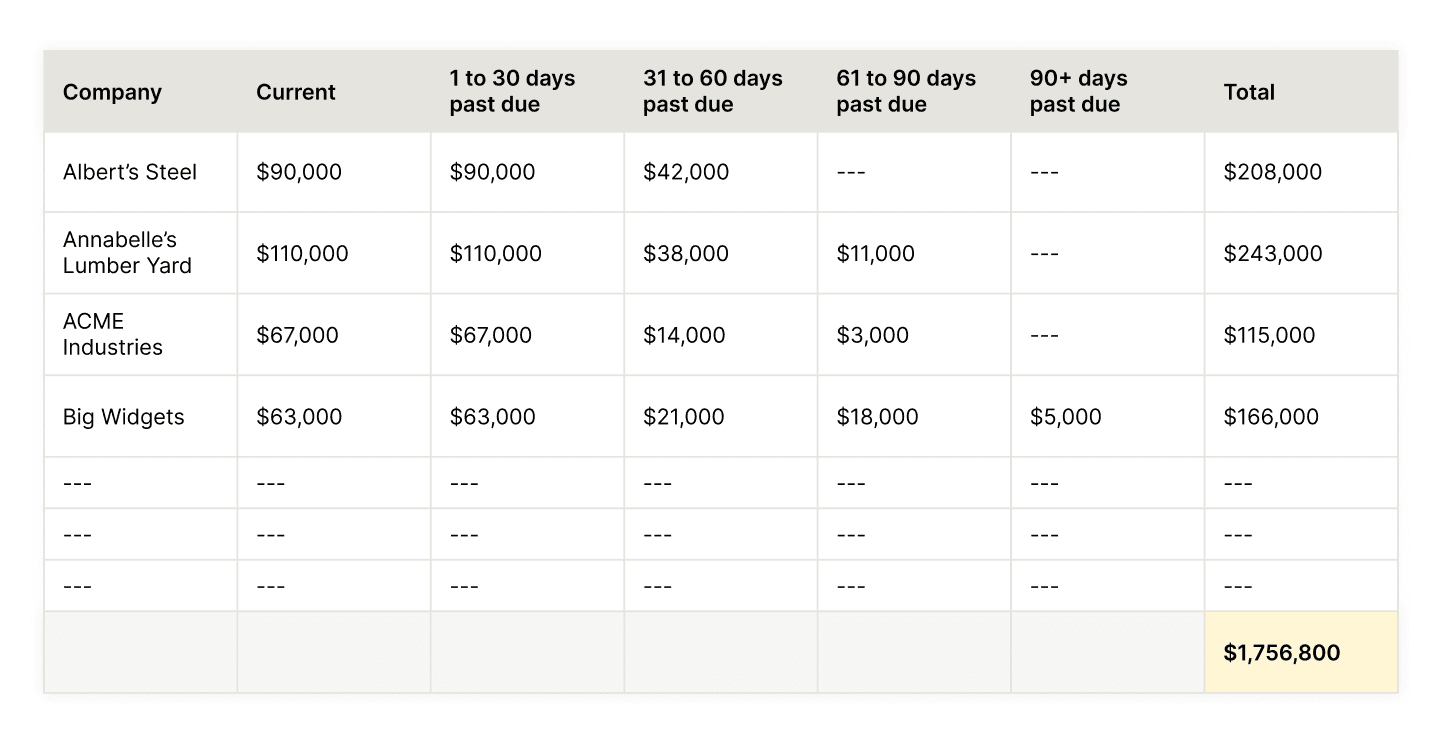

2. Harness accounts receivable aging reports

Aging reports help teams identify slow-paying customers. These periodic reports group and categorize your AR based on how long an invoice has been outstanding. The reports will often list and sort outstanding balances based on date ranges.

An accounts receivable aging report provides a snapshot status of your outstanding invoices and indicates which accounts have overdue or delinquent payments. It also calculates your average collection period and helps you reduce it. An aging report can also indicate where customers might need adjusted payment terms.

Using aging reports can help your teams:

Prioritize collections efforts by prioritizing the most delinquent accounts

Promptly follow up with customers that have outstanding invoices

Tailor collections strategies based on how overdue accounts are (more about some email templates to do this below)

Align with credit and sales teams to collaborate on strategies to prevent future delinquencies

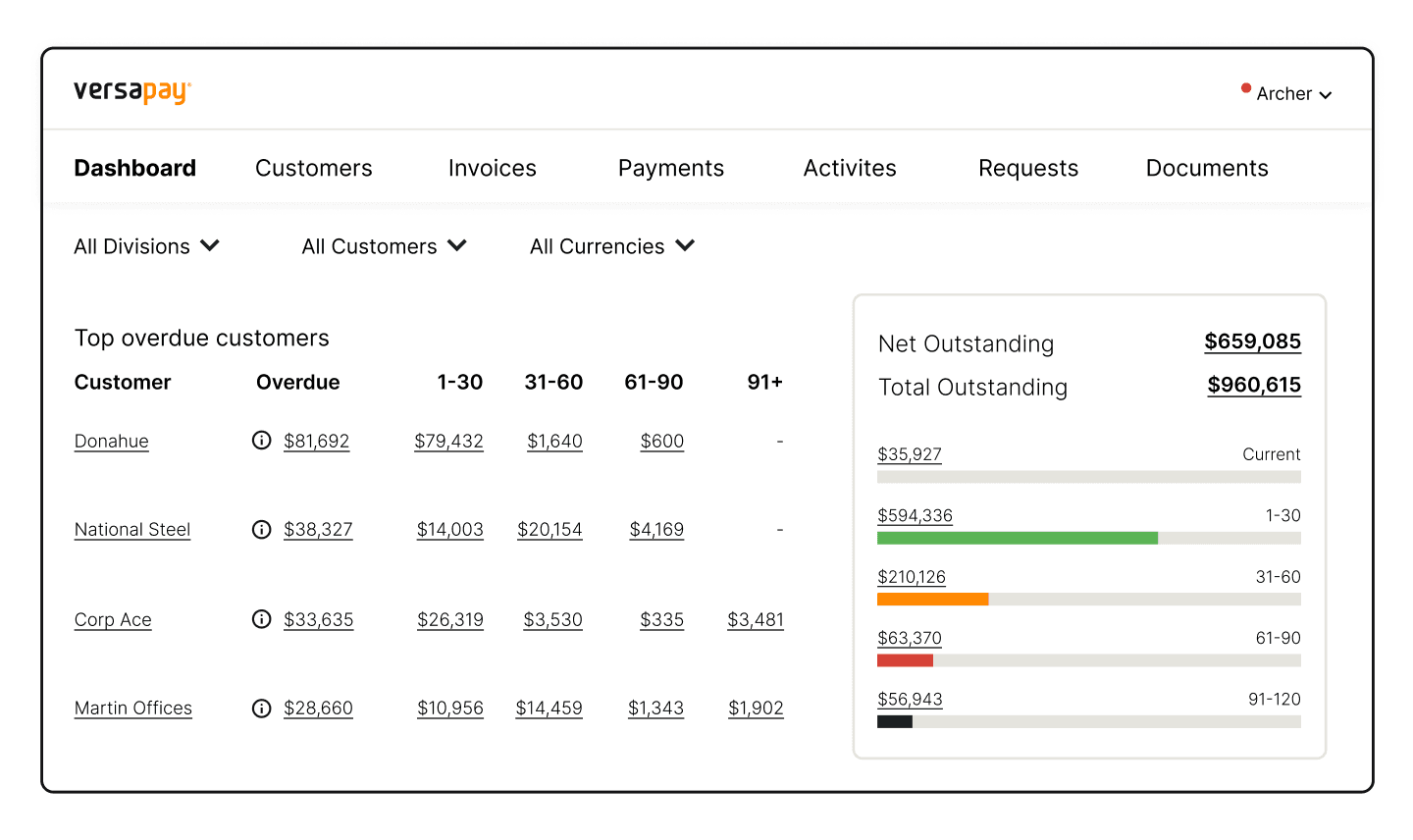

While manually creating aging reports isn’t overly difficult, it is a tedious, manual process that doesn’t scale well. Versapay provides a real-time, interactive dashboard of all receivables by aging period as well as day sales outstanding. The dashboard allows your team to determine the status of your receivables at a glance and easily navigate through company, division, invoice, and line-item data—no futzing with Excel.

3. Track payment history and credit hold requests

AR teams that monitor and analyze customer payment patterns can identify client accounts with a history of late or delinquent payments. A review of a client’s payment history can indicate patterns of frequent late payments or delays. (This is where aging accounts come in especially handy, as you can identify and flag [which some automation software allows] accounts that consistently fall into delinquent categories.)

Teams can also track instances where customers request credit holds or refuse to pay until certain issues are resolved. Tracking these occurrences helps uncover potential payment challenges and indicate accounts that may become delinquent.

Document each time a customer requests a credit hold due to disputes, quality issues, or other reasons. Note the duration of credit holds and whether the customer makes a payment during the holding period. Further document situations when a customer refuses to make a payment until specific concerns or issues are addressed, then identify whether the payment remains outstanding despite resolving the issue.

Tracking and documenting history of payments and hold requests can help your AR team take proactive measures to address payment challenges. Let’s take a look at how to reduce and prevent delinquent payments now.

How to decrease delinquent accounts

An AR automation solution delivers the most outsized impacts to minimizing delinquent customer accounts. However, there are plenty of tactics that will help you deliver small, quick wins that enhance proactive communication among AR teams and customers and prevent delinquent customer accounts.

Here are 7 you can consider today:

Optimize your invoicing process

Create collections email templates

Automate your dunning strategies

Segment your customers and develop custom collections strategies

Offer payment plans and accept multiple payment options

Focus communications on customer experience

Streamline your invoice to cash cycle with collaborative automation

1. Optimize your invoicing process

So you still create all your invoices manually? Let’s make sure they’re the best they can be. There are five key elements of an invoice:

Vendor and customer information

Purchase order number

Invoice number

Product description and pricing

Invoice payment terms

The most important aspect of an invoice is to ensure there is no confusion as to what the customer owes and when. Use larger fonts and/or bolder typeface to highlight amounts and due dates.

Next, ensure the customer can easily tell who the invoice is from. If your information is not on the invoice, their accounts payable teams will spend more time confirming who the invoice is from, delaying payment further. The invoice should also make clear all the different ways the customer can pay.

One of the biggest drawbacks to manually creating invoices is that mix-ups are easy to make and mistakes are bound to happen. But ensuring you send the correct invoice for the correct amount to the correct customer—as quickly as possible—is of paramount importance. Any kind of mix-up just causes payment delays, which can push a past-due invoice into delinquent territory.

🎥 Hear from Maddie Yates, Senior Accounts Payable Manager, Versapay, on what accounts receivable performance means to her:

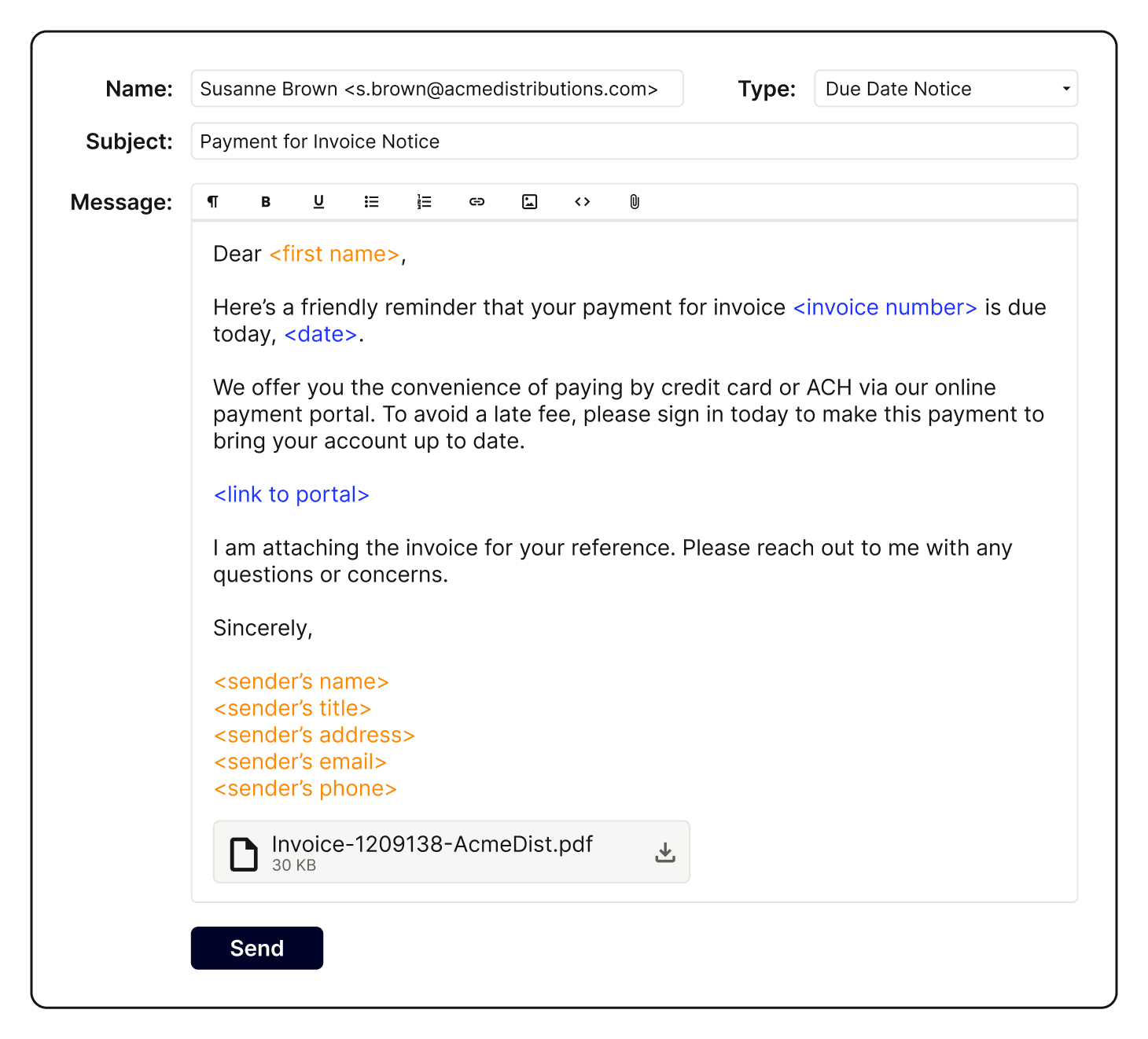

2. Create collections email templates

An AR collections email template makes it easy for teams to populate applicable recipient information for a variety of situations. Such situations can include initial payment reminders, a follow-up reminder the day before, of, or after a payment is due, and escalating past due notices.

Even if all your email processes are still manual, templates will save your teams a lot of time and effort. Such templates can also improve the customer experience by reducing errors, increasing speed, and enabling clearer communication.

A Wakefield-Versapay study surveyed 1,000 C-level executives at companies with a minimum annual revenue of $100m USD and showed that communication is a major factor in a successful AR department. It found that 78% of executives agree that customer communication in AR is a problem, while 85% agree that poor communication has led to nonpayment. Doing better in these areas leads to better processes, better experience, reduced risk, and accelerated cash flow.

💡Want five starter collections email templates now without worrying over tone and wording? Check them out here.

3. Automate your dunning strategies

Next, automate all those emails. Automating your dunning emails can significantly reduce AR team workload.

Dunning letters are cornerstones of the collection process for delinquent accounts, but they have a few drawbacks: They’re a formal, impersonal touchpoint on a one-way communication street. More importantly, they also put AR in a reactive position and reach the customer only after there is a problem.

There are ways to mitigate that and reduce a potentially reactionary stance. It’s easy to set up automated email communications to send well in advance of any issues. You can even automate emails that notify a customer when they need to update their credit card/payment method well in advance to avoid last-minute phone- or email-tag.

These are excellent steps to take toward building a collaborative AR process that emphasizes proactive communication between your AR team and your customers’ AP teams.

🎥 Hear from Nico Ahyoon, Intermediate Accountant, Versapay, on what accounts receivable performance means to him:

4. Segment your customers and develop custom collections strategies

Once you’ve established a smoother, more automated process, the next step to reducing delinquent accounts is to start segmenting your customers and tailoring collections strategies. You might create general customer groups like:

Always pay on time

Need a gentle reminder

Frequently past due

Pattern of delinquency

Then each group receives its own automated cadence of communications with tailored language (and their own set of email templates!). You could also group clients by credit reports and past payment histories.

These groupings might also help your teams identify potential beneficial payment terms adjustments. For example, you might want to change your policy so customers that are frequently past due or with a pattern of delinquency must pay for goods or services up front.

💡 Versapay believes that transforming your accounts receivable started with customer collaboration. That’s why its software allows you to easily segment and personalize communications so you know your communications are proactive, helpful, and fruitful.

5. Offer payment plans and accept multiple payment options

Offering payment plans to certain customers can help them avoid defaulting on their payments and improve your relationship with them (while also ensuring you are getting paid).

It’s also ideal to offer (and accept!) multiple forms of payment. This makes it easier for customers to pay, increasing the likelihood they will pay promptly. When customers can pay without manual intervention from your teams, your collections will be more consistent and timely—and less delinquent. Remember: Most of your customers want to pay you, but they also want it to be easy to pay you.

This will require payment processing technology—and Versapay’s processing platform integrates seamlessly into your ERP and even automatically updates expiring credit cards.

⭐ Better understand how credit card processing technology can speed up and automate payments, reduce manual processes, accelerate cash flow, and more with our Ultimate Guide to Credit Card Processing

6. Focus communications on customer experience

Miscommunication loses your company revenue. If a customer elects not to pay for whatever reason and becomes delinquent, your company loses revenue. As we mentioned above, 85% of executives agree that poor communication between AR and customers has led to non-payment.

It’s time to change that.

A poor invoice to cash process that neglects or deprioritizes AR-AP collaboration produces bad customer experiences (CX). The Wakefield-Versapay study showed that 73% of executives agree that their current invoice to cash process negatively affects CX. When the invoice to cash process is collaborative, AR can nip issues in the bud and decrease or prevent delinquent accounts.

Uniting around collaboration tools can help teams close the communication gap between AR and customers. These tools can be as simple as phone calls and emails and be as advanced as collaborative accounts receivable payment portals. With tools that offer insight into payment statuses, AR teams can resolve disputes and avoid issues escalating to legal departments and executives.

7. Streamline your invoice to cash cycle with collaborative AR automation software

Most automation efforts focus on adding efficiencies by automating manual processes. That might include automating payment acceptance or sending electronic invoices directly to customer AP systems.

Those are great. But to specifically decrease delinquent accounts, your focus should be on automation that strengthens communications between AR teams and customers. Collaborative AR provides customers with one place to view invoices and related documents, leave comments, ask questions, upload documentation, and make payments in real-time. This enables the AR team to answer questions quickly in a location visible to everyone, eliminating confusing email threads. Plus, it’s a scalable process that enables you to service customers faster and get your payment sooner.

Let’s review these ways to decrease delinquent accounts:

- Optimize your invoices so they’re actionable and easy to read

- Create collections email templates to reduce manual work and better reach customers

- Automate your dunning strategies to be more effective and proactive

- Segment your customer collections strategies for tailored interactions

- Offer payment plans and accept multiple payment types to provide customers with easy, flexible payment processes

- Leverage collaborative AR automation software to streamline your invoice to cash cycle and improve communication

🎥 Hear from Russell Lester, CFO, Versapay, on what accounts receivable performance means to him:

Find and reduce delinquent accounts with Versapay

Versapay is the first AR automation tool that gives your team and customers full visibility into open receivables status so they can prevent and resolve disputes quickly. The central dashboard provides direct feedback to the AR team, mitigating the need to go through sales or customer service to figure out what’s happening.

Versapay provides central visibility of customer interactions tracked over time. And because it integrates directly with your ERP system, teams company-wide will benefit from real-time visibility. (Not to mention the significant boost in efficiency that comes from payments automatically posting back to your ERP.) Versapay clients can see up to 30% fewer past-due invoices and 25% faster payments. That’s real money in your company’s pocket, faster.

To learn more about why the best way to handle collections is to adopt a more effective, collaborative approach (thereby decreasing delinquent accounts), get our CFO’s Guide to Accelerating Collections now.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.