Controlling Collections: Why Some CFOs Win While Others React

- 7 min read

Learn to improve forecast reliability and reduce receivables risk with accounts receivable collections software that tracks payment behavior and turns data into predictive insights.

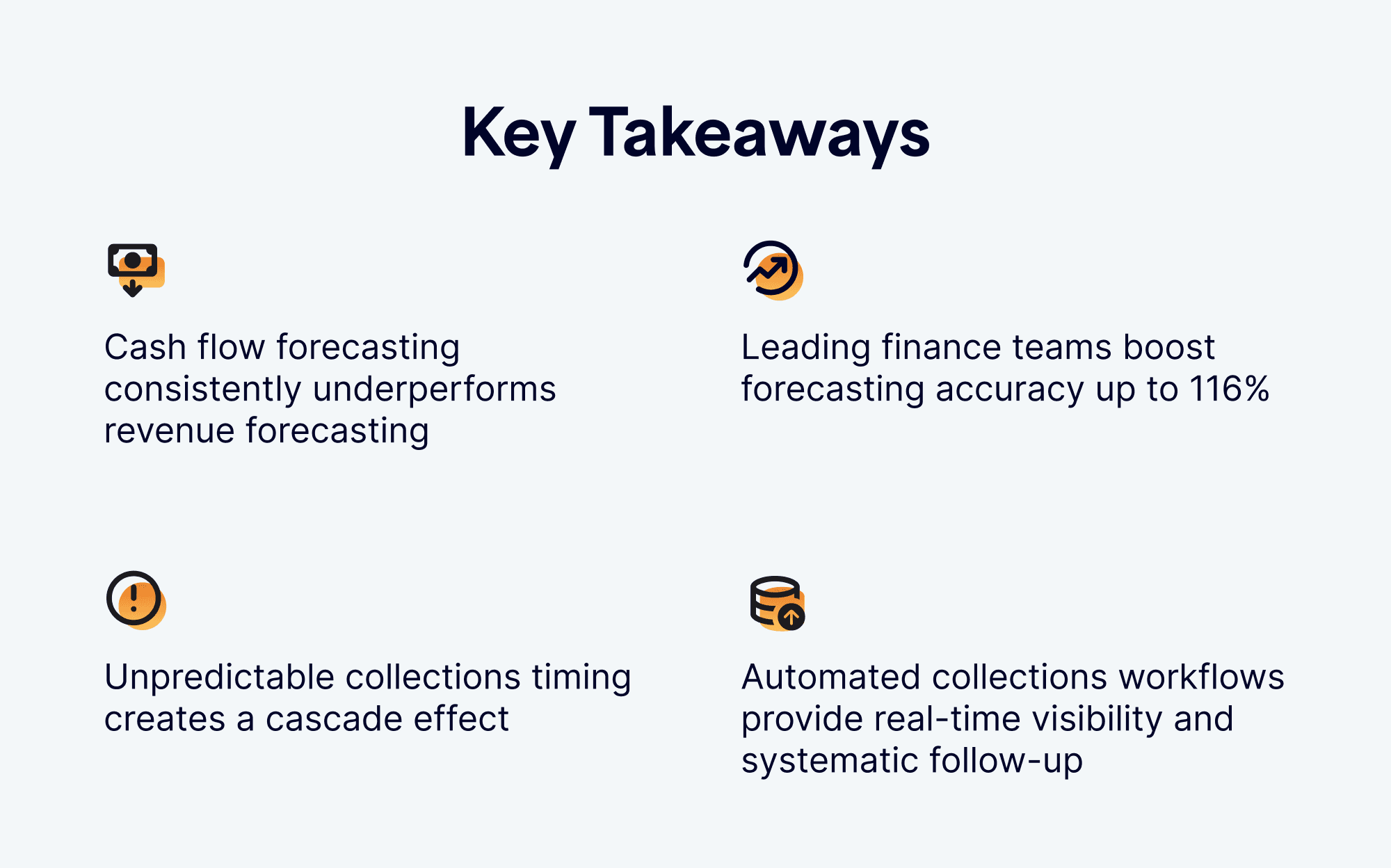

- Cash flow forecasting consistently underperforms revenue forecasting at most companies, creating uncertainty that forces CFOs to stockpile cash while competitors with predictable cash flow capture strategic opportunities.

- Unpredictable collections timing creates a cascade effect that undermines budgeting, investment decisions, and market responsiveness—leaving agile competitors to dominate emerging opportunities.

- Leading finance teams are pulling ahead by making collections timing predictable rather than just faster, with the best achieving up to 116% quarterly forecasting accuracy.

- Automated collections workflows provide real-time visibility and systematic follow-up needed to eliminate forecasting blind spots and maintain competitive positioning in volatile markets.

—

Companies are flying blind when it comes to their most critical financial metric. A recent EY-Parthenon analysis of 2,400 global organizations exposed a dangerous disconnect. While these companies confidently nail their revenue forecasts, they're systematically failing at predicting the cash flow that actually keeps their doors open.

And they’re missing the mark by significant margins that could mean the difference between thriving and scraping by.

In highly volatile economic environments, much like the ones that have become the new normal, failure to forecast cash flow is unacceptable.

The missing piece isn't revenue recognition or expense management—it's collections efficiency, and the consequences ripple through every aspect of financial decision-making. When collections variability makes financial planning unreliable, even sophisticated forecasting models become educated guesses rather than strategic tools.

The question is: how can you increase collections efficiency without increasing costs?

The hidden costs of unpredictable collections

Most CFOs focus on the direct costs of collections delays such as the obvious hits to quarterly cash targets or emergency borrowing expenses. But the damage runs much deeper, creating opportunity costs that compound over time and undermine decision-making confidence.

Consider the productivity loss on your finance team. When collections become unpredictable, forecasting goes from strategic analysis to constant damage control. Your analysts spend their time explaining variances instead of identifying opportunities. Meanwhile, competitors with predictable cash flow are making decisive moves.

Monthly planning meetings become exercises in adjusting expectations rather than setting ambitious targets. The intellectual capital that should be driving growth gets redirected to managing uncertainty.

The strategic planning process suffers even more. When your cash flow assumptions shift monthly, long-term projections become academic exercises:

- Capital allocation decisions get postponed because you can't confidently model future liquidity.

- Market opportunities slip by while you wait for "better visibility".

The opportunity cost of defensive cash management is the most expensive. That excess cash sitting in low-yield accounts is unrealized returns in reality—from strategic acquisitions, technology investments, or higher-yielding instruments.

EY's research shows companies maintain these expensive buffers because forecasting variance forces them to do so. You're essentially paying a premium to insure against operational inefficiencies.

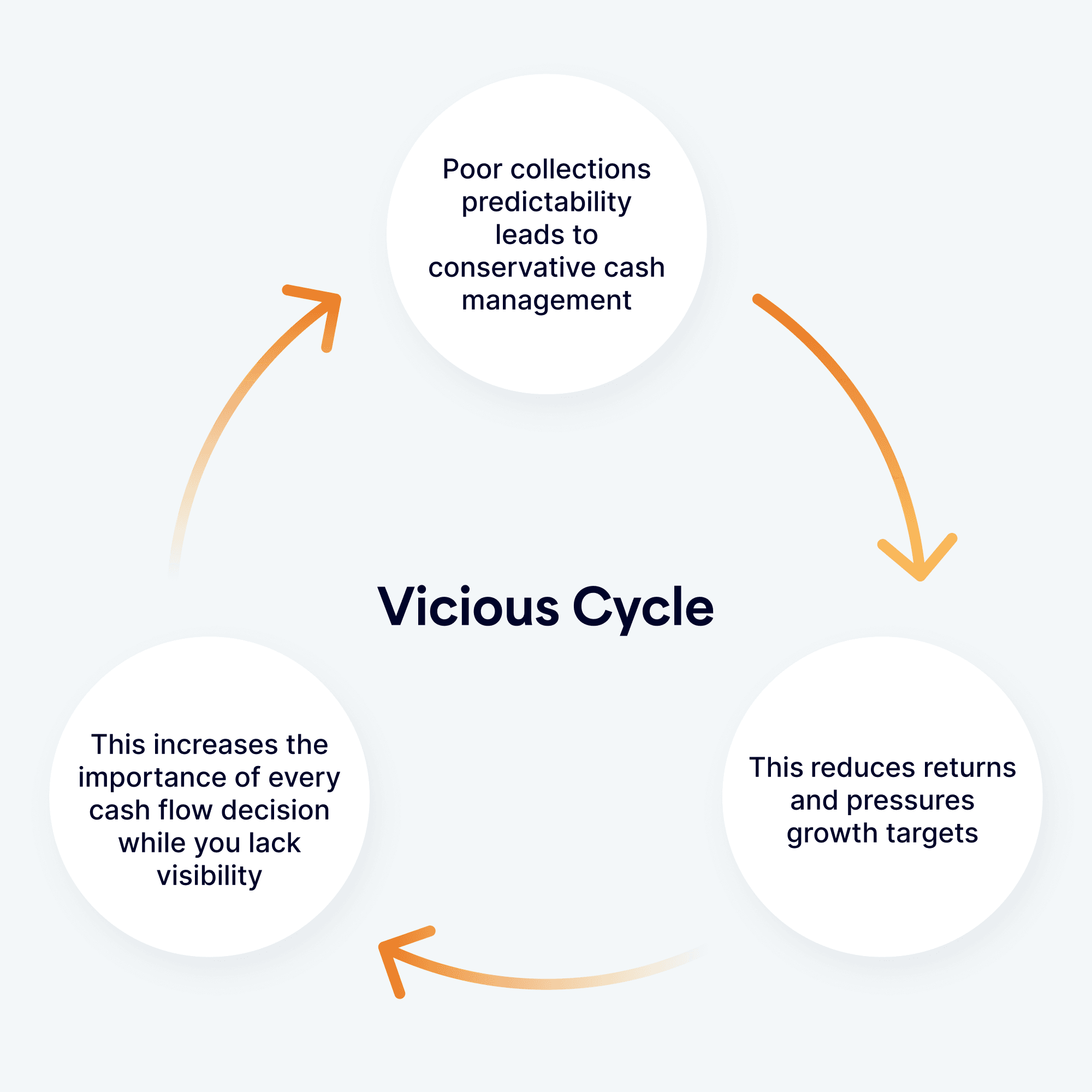

Meanwhile, investors value cash flow predictability. This uncertainty erodes enterprise value and creates a vicious cycle:

What separates high-performing finance teams from the rest

Leading companies, according to EY data, are discovering they can achieve up to 90% quarterly forecasting accuracy by making collections timing predictable rather than just faster. Instead of treating collections as a back-office function that occasionally updates finance, these organizations integrate collections processes directly with their forecasting models.

This integration creates visibility into payment patterns that most finance teams lack. Rather than tracking when invoices are sent, they monitor customer payment behaviors, seasonal patterns, and early warning signals that indicate potential delays.

For example, a customer requesting multiple invoice copies might signal a 10-day payment delay. Retail customers might consistently slow payments by two weeks in Q4. These patterns become forecasting inputs, not just collections notes.

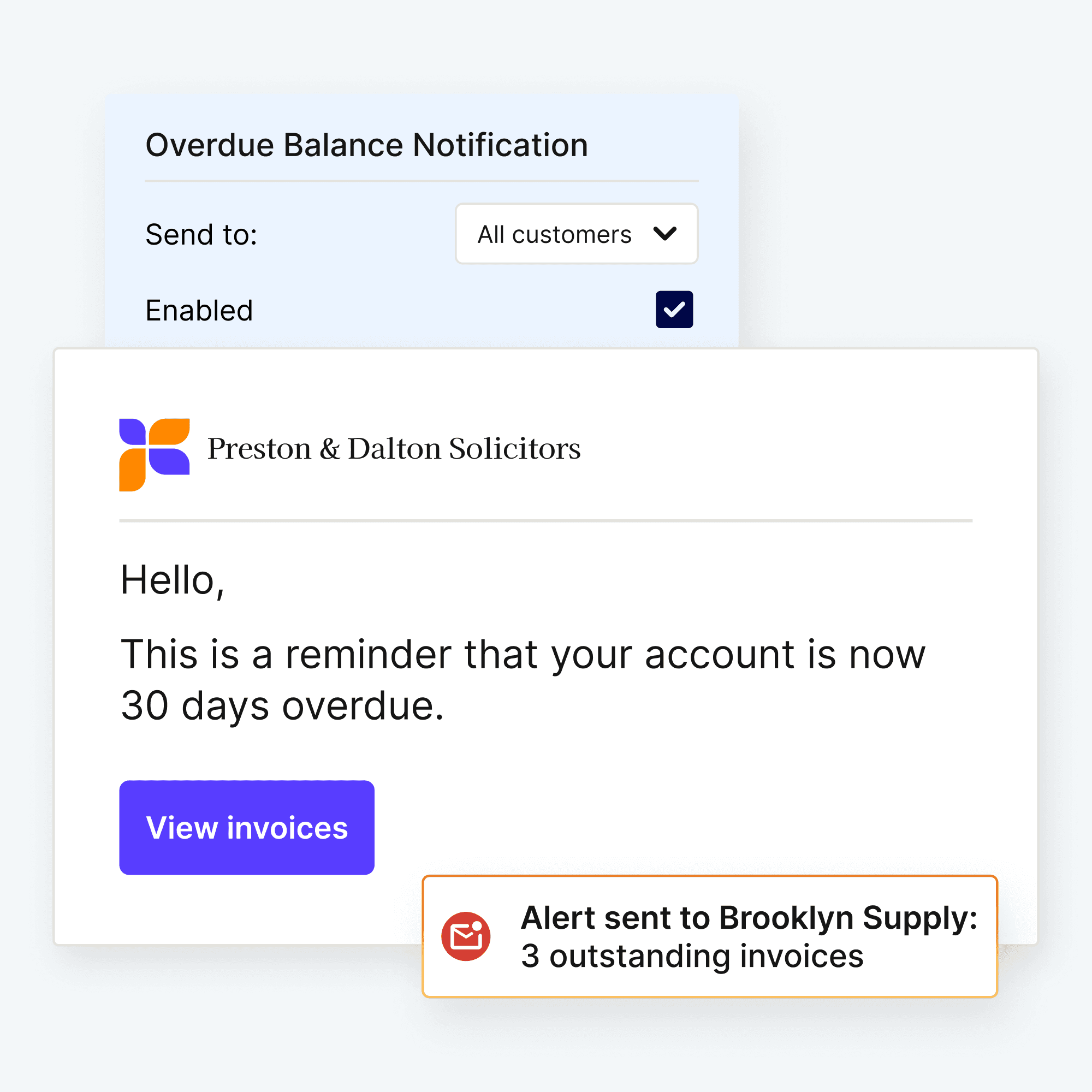

The breakthrough comes from moving beyond reactive collection calls to proactive workflows that feed real-time data into forecasting systems. Automation can create systematic touch-points at predetermined intervals, generating reliable payment timing data that improves forecast accuracy over time.

Technology can enable companies to automate data flows between collections activities and forecasting models, creating feedback loops that continuously improve accuracy.

The result is finance teams that can confidently model liquidity 90 days out, setting dynamic minimum cash levels based on actual payment patterns rather than historical averages or worst-case scenarios.

Building the collections-to-forecasting bridge

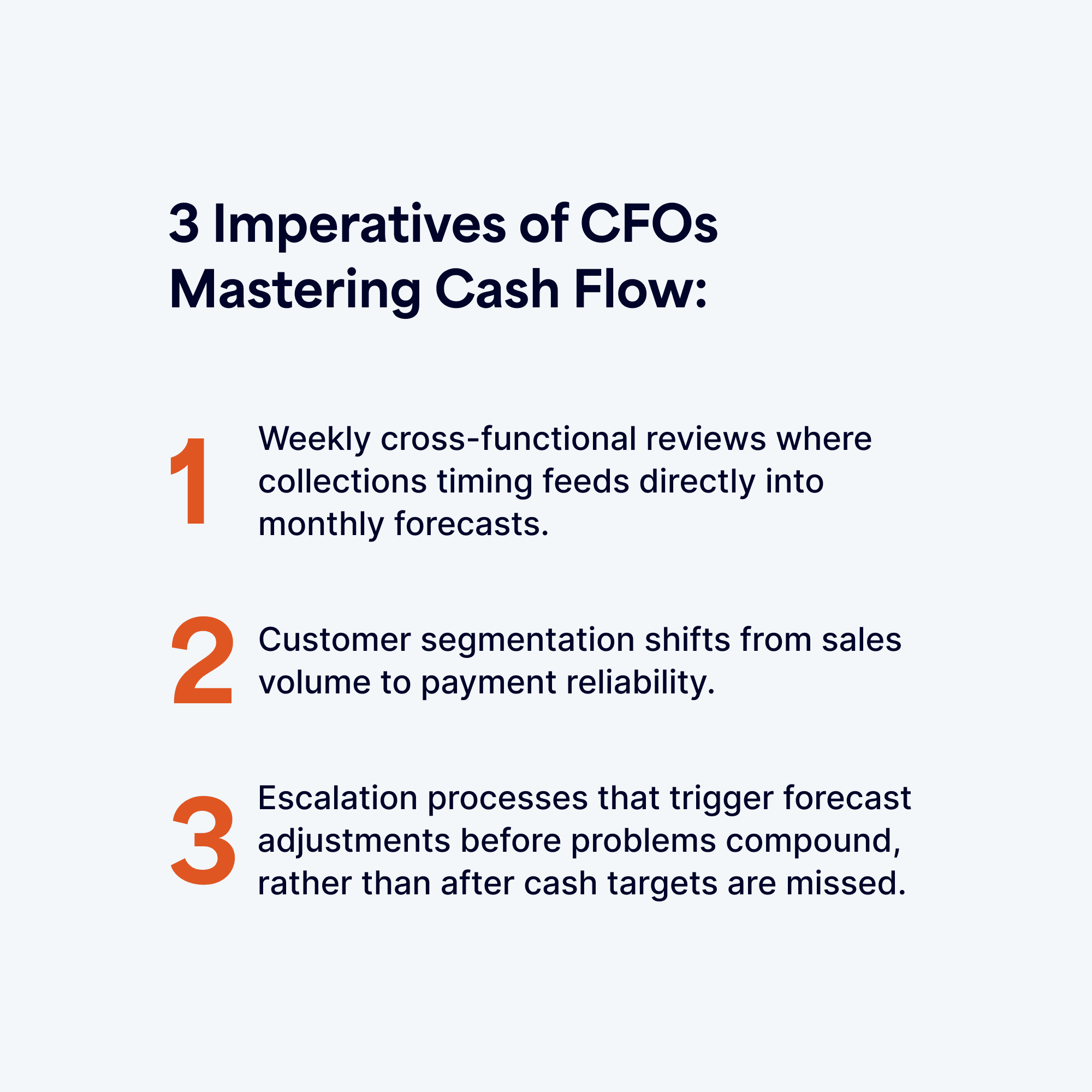

The gap between collections activity and forecasting accuracy is organizational. Stop treating collections and forecasting as separate functions. They're interconnected systems that demand integrated workflows.

Establish regular communication and shift collections updates from status reports to impact analyses. Replace "Invoice X is 30 days overdue" with "Customer Y's delay cuts this month's cash target by $Z, jeopardizing our Q3 marketing spend."

Create customer payment reliability scores by analyzing historical timing, seasonal patterns, and behavioral data. Start by aggregating past payment data at the customer level to surface trends like average days to pay, quarter-end delays, or behaviors such as partial payments or disputes. Assign weighted values to these factors to generate a score that predicts payment risk and helps AR teams focus their attention where it matters most.

For example, a customer with a consistent 45-day payment cycle should be scored differently than one who usually pays in 15 days but occasionally spikes to 60. Feeding these scores into your forecasting models sharpens accuracy and flags accounts worth deeper investigation.

Track collection timing variance alongside traditional days sales outstanding (DSO) metrics. This gives finance teams the data needed to improve forecast accuracy while providing collections teams forecasting context for their activities.

Some practical first steps you must take include:

- Launching weekly collections-to-cash meetings where timing analysis drives monthly projections

- Setting escalation triggers when delays threaten monthly targets

- Installing early warning systems that catch small timing issues before they become forecasting disasters

Systematic automation can scale these improvements dramatically. Technology becomes the enabler that transforms manual coordination into integrated workflows, positioning automated processes as extensions of strategic thinking rather than replacements for it.

How modern collections automation enables forecasting control

To bridge collections timing and forecasting accuracy, you need systematic visibility into payment patterns that manual workflows simply cannot provide. This is where collections automation transforms from a back-office efficiency tool into a strategic forecast engine.

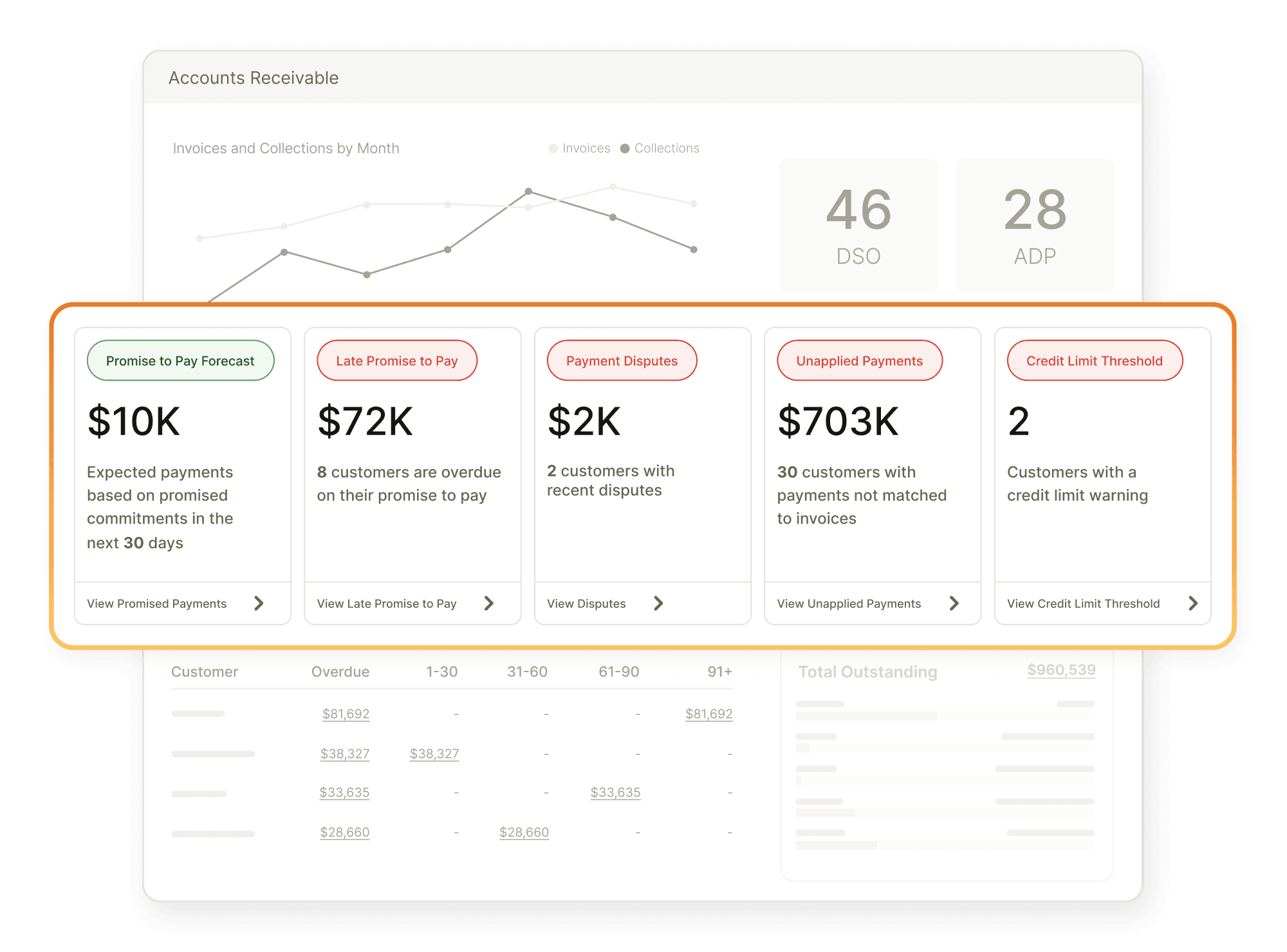

Versapay's collections automation software transforms collections data into predictive intelligence. Every customer interaction, payment behavior, and timing pattern becomes a data point that feeds forecasting accuracy.

Instead of reacting to payment delays, finance teams gain the visibility to predict them and adjust forecasts accordingly.

AI-powered payment predictions turn historical patterns into forward-looking intelligence, giving you weeks of advance notice instead of after-the-fact surprises. Real-time customer behavior tracking means you spot payment hesitation before it becomes delinquency.

Automated monitoring of payment commitments ensures promises translate into performance. Most critically, you identify delinquency patterns while there's still time to course-correct, transforming potential cash shortfalls into manageable forecast adjustments.

When collections workflows automatically capture timing data and feed it into forecasting models, finance teams can redirect their intellectual capital from explaining variances to identifying opportunities.

The results speak for themselves:

- 50% reduction in time managing receivables

- 30% fewer past-due invoices

- 25% faster payment speeds

These aren't just collections improvements. They're forecasting control mechanisms that restore confidence to strategic planning.

Stop bleeding cash through broken collections processes. Discover how Versapay's collections automation captures every outstanding invoice, eliminates missed follow-ups, and accelerates collections.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.