How to Improve Order to Cash and Procure to Pay with Automation

- 8 min read

In this article, we explore what order to cash and procure to pay are, how they differ and work together, and the ways automation technology bolsters both O2C and P2P.

Businesses that rely on inefficient processes risk putting themselves at a competitive disadvantage. Sluggish, complex, or error-prone business processes can lead to delays in payment processing and collections, which can impact cash flow and revenue. Of course it should be a top priority to avoid such outcomes. But how?

Two important business processes that must run smoothly are Order to Cash (O2C) and Procure to Pay (P2P). These operations focus on managing customer orders, including ensuring payment is received for these orders, and managing the business’ procurement of goods and services, including making sure payment is remitted. Since both of these processes are concerned with accuracy and promptness, organization and efficiency are essential.

Read on to learn more about O2C and P2P, including steps and examples for each, and how AR automation can enable efficiencies in these essential business operations.

Jump to a section of interest

What is order to cash?

O2C is the process of receiving and fulfilling customer orders, and collecting the cash these orders generate for the business. When customers are in the O2C process, they are each waiting for the transaction to be completed: The customer waits to receive the thing they ordered and the business waits for the payment for that purchase.

This process is a lynchpin in supporting customer relationships, ensuring healthy cash flow, and driving business growth. A more efficient O2C process results in speedier fulfillment and payment, which accelerates cash flow and makes for happy customers.

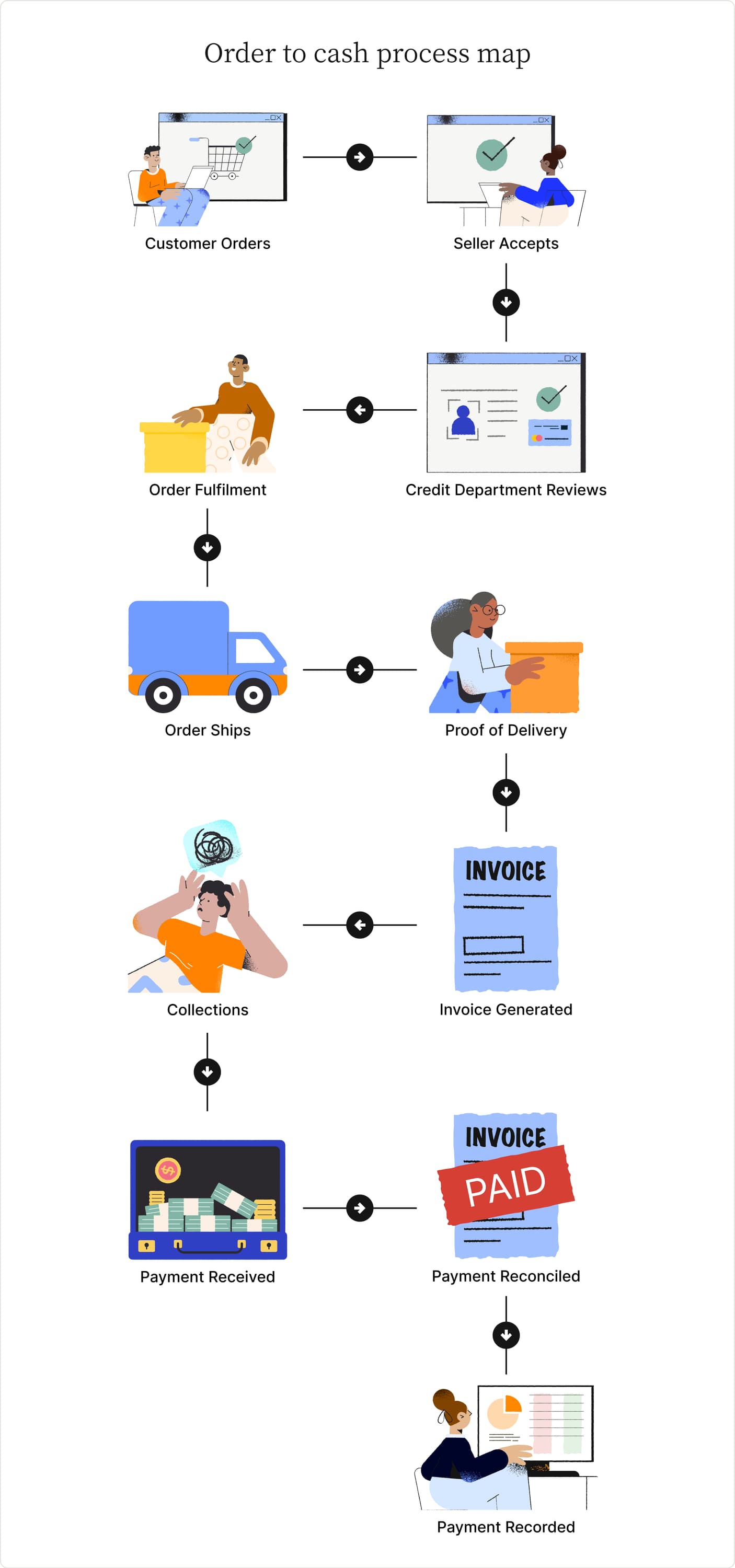

The 7 steps of the O2C cycle

The order—The customer places their order, and the seller accepts it.

Credit management—The seller assesses whether the customer’s credit profile presents an acceptable risk and decides whether the sale can proceed.

Fulfillment—The seller prepares to ship the item to the buyer and updates inventory to reflect the sale.

Shipping—The seller sends the item with a carrier service for delivery, then later gets proof of delivery and a bill of lading from the carrier.

Invoicing—The seller creates an invoice and sends it to the customer.

Collections—The seller’s collections team receives payment for the invoice or pursues payment if the customer doesn’t pay by the deadline.

Cash reconciliation—The collections team matches the incoming payment with the open invoice to reconcile cash, then records the payment in the general ledger.

An example of order to cash

Let’s look at a real-life instance of how the O2C process can impact a business.

The staff of a cybersecurity company was overburdened by managing the collections process manually. They had two problems: They accepted few credit card payments, which reduced their ability to process payments quickly, and their process for following up on payments was so cumbersome that they could only chase down invoices of $100,000 or more.

In short, their O2C process was extremely inefficient; in fact, it was failing completely.

The AR team automated the AR process, which slashed the time they spent on collections by 50 hours a month. The automation allowed them to accept far more credit card payments and streamlined the process of following up on outstanding payments. This vastly improved the O2C process so that the company began receiving payments in a timely and orderly manner.

What is procure to pay?

P2P is the process of sourcing, purchasing, and paying for goods and services that a business needs to operate. An efficient P2P process lowers the effort, cost, and potential problems and penalties associated with disorganized payment processing.

Managing this process efficiently is important for a business because its successful execution ensures that the company has the goods and services it needs to operate on a daily basis.

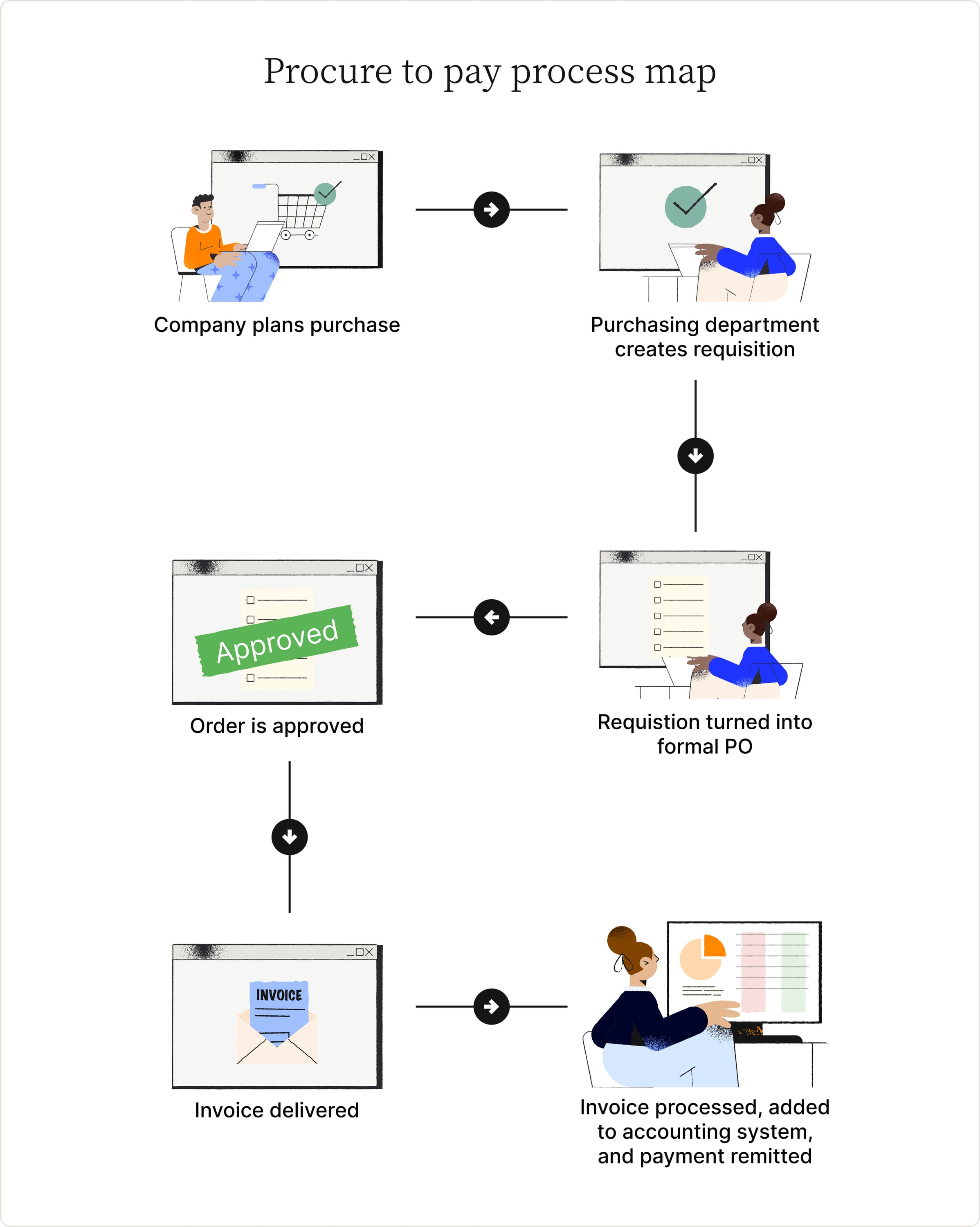

The 5 steps of the P2P cycle

Purchase planning—The first step is to plan what the company needs to order so as to create accurate purchase orders, choose the right vendors, and estimate costs.

Requisition—The purchasing department creates a purchase requisition, which is approved internally and turned into a formal purchase order (PO). The PO goes to the vendor as the official request to purchase.

Order approval—The buyer and seller communicate to ensure the specifications in the PO are accurate and that the vendor can fulfill the order correctly.

Invoice processing—The vendor sends the company an invoice for the purchase.

Payment—The company’s finance team puts the invoice into the company’s accounting system and remits payment to the vendor.

An example of procure to pay

Let’s look at an example of how a business can improve its P2P process.

Imagine a fictitious provider of safety equipment to the construction industry was struggling with a manual procurement process that relied on email to coordinate orders between departments, leaving the accounting team to decipher purchasing details from these communications. The accounting team managed the procurement process manually, putting payments into their system by hand. The slow process was leading to long lead times for securing important supplies.

The company could cut the turnaround time for its supplies substantially by automating its accounts payable process. By creating a standardized, centralized process for handling purchase orders—and integrating the accounting platform with the system to provide ready access to all data in one place—payments and receipt of supplies would be sped up, meaning the company could serve more people more effectively.

Order to cash vs. procure to pay

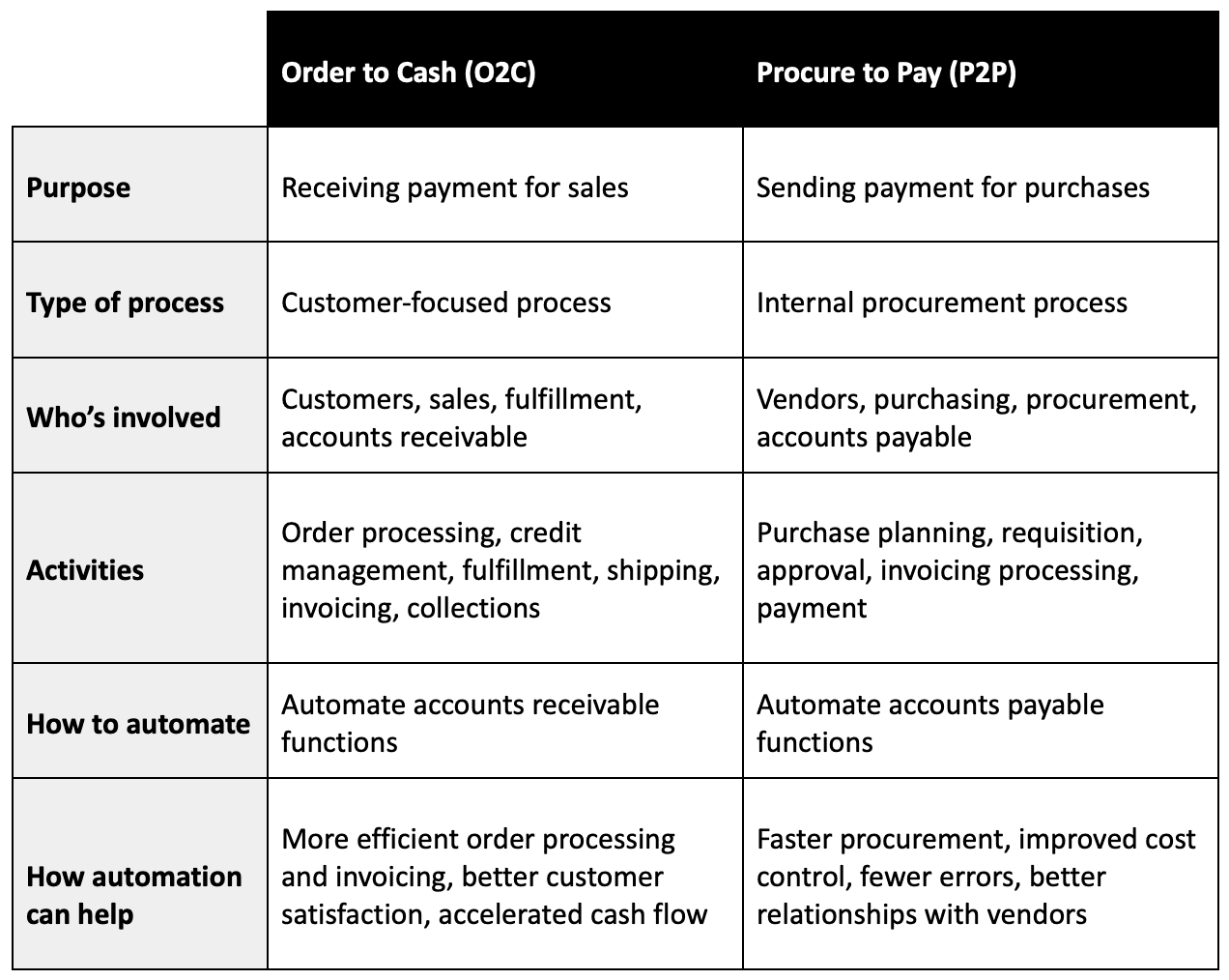

O2C deals with bringing money in the door, while P2P is about sending money out. Both are essential for ensuring that the business remains in good stead with the customers and vendors on which it depends. These two processes differ in a number of ways, including their purpose, type, stakeholders, steps or activities, and how automation can help in each case.

The differences between O2C and P2P

How automation can improve O2C and P2P

One difference between O2C and P2P is the benefits automation can bring to each process. In the case of O2C, automation makes for more efficient order processing and invoicing, better customer satisfaction, and accelerated cash flow. In the case of P2P, automation results in faster procurement, improved cost control, fewer errors, and better relationships with vendors.

How do you automate O2C and P2P? A more automated O2C process relies on automation of a company’s accounts receivable functions, while a more automated P2P process requires the automation of a company’s accounts payable functions.

How to improve order to cash with Versapay

Versapay focuses on payments and accounts receivable, so our AR automation solution is extremely well-suited to helping companies improve their O2C process. AR automation improves the O2C process by preventing errors in invoicing, accelerating order fulfillment, enabling electronic payments, and reducing disputes.

Versapay allows AR teams to deliver invoices and account information through a secure, self-service customer portal, which facilitates transparency, communication, and fast payment. The system also promotes efficient dispute resolution and provides a centralized, organized repository of documentation and data.

Versapay helps teams address specific needs that pertain to the O2C process by offering:

Electronic invoicing: E-invoices help AR teams motivate customers to pay faster and facilitates follow-up and record-keeping related to those invoices.

Cash application: Automated cash application helps AR teams close the loop on the O2C cycle by instantly applying incoming payments to open invoices.

Payment processing: Enabling customers to pay in a few clicks with digital methods means faster remittance and simpler payment processing.

Collaboration with customers: Facilitating collaboration and easy communication with customers via an AR customer payment portal helps AR teams create a robust, successful O2C process that keeps staff and customers alike happy.

Read our Essential Guide to Accounts Receivable Automation to learn more about how Versapay can help you automate your AR function and improve you O2C.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.