Basic vs. Collaborative Payment Portals: Why Accounts Receivable Teams Should Know the Difference

Learn the important differences between these two types of payment portals and why they matter for your AR team

Accounts receivable payment portals let buyers easily review and pay invoices online, accelerating the seller’s cash flow and improving the customer experience.

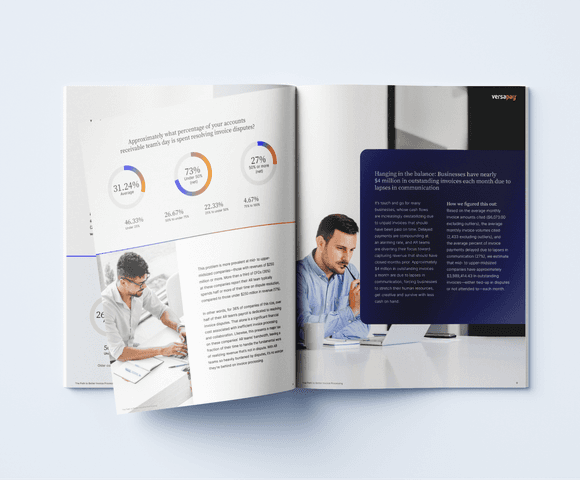

In collaboration with Wakefield Research, we surveyed 300 CFOs to learn about their most mission-critical function—invoice processing.

Download The Path to Better Invoice Processing to learn why accounts receivable payment portals are the best solution for fixing your invoicing woes

Accounts receivable payment portals provide a place for your customers to pay conveniently and securely online. Learn more about these technologies:

Invoice processing is a mission-critical function for businesses, yet it remains a formidable—and often consequential—challenge for most.

Get the free report to see why collaborative accounts receivable payment portals are the best solution for fixing your invoicing woes.