Streamline Your Revenue: A Guide to the Order to Cash Process

- 11 min read

When evaluating order to cash strategies, teams should ensure the solutions are flexible enough to accommodate customer needs for receiving invoices and making payments.

AR automation streamlines the O2C process by reducing invoicing errors and expediting order fulfillment, while self-service customer portals drive electronic payment adoption and dispute reduction.

Order to cash (O2C) is a part of the transaction process where two parties—the customer who purchased a product (the buyer) and the company who sold the product (the seller)—are in a waiting period. The customer is waiting for their item and the business is awaiting payment for said item.

An efficient order to cash process leads to faster order fulfillment and payment. A good ol’ win-win situation for everyone involved. So, how can teams achieve optimal O2C procedures?

Streamlining O2C procedures is attainable with order to cash solutions that address the challenges introduced between order and payment. It’s important to first understand O2C in detail, including the stages of the O2C cycle, and best practices for optimizing these efforts.

Jump to a section of interest:

What is order to cash?

Order to cash refers to the stage between when a buyer places an order and the seller awaits payment for that order. In other words, it is the process for converting an order to cash. O2C is also known across industries as quote to cash, bill to cash, and other similar terms.

What is the order to cash cycle?

Stages of the order to cash process

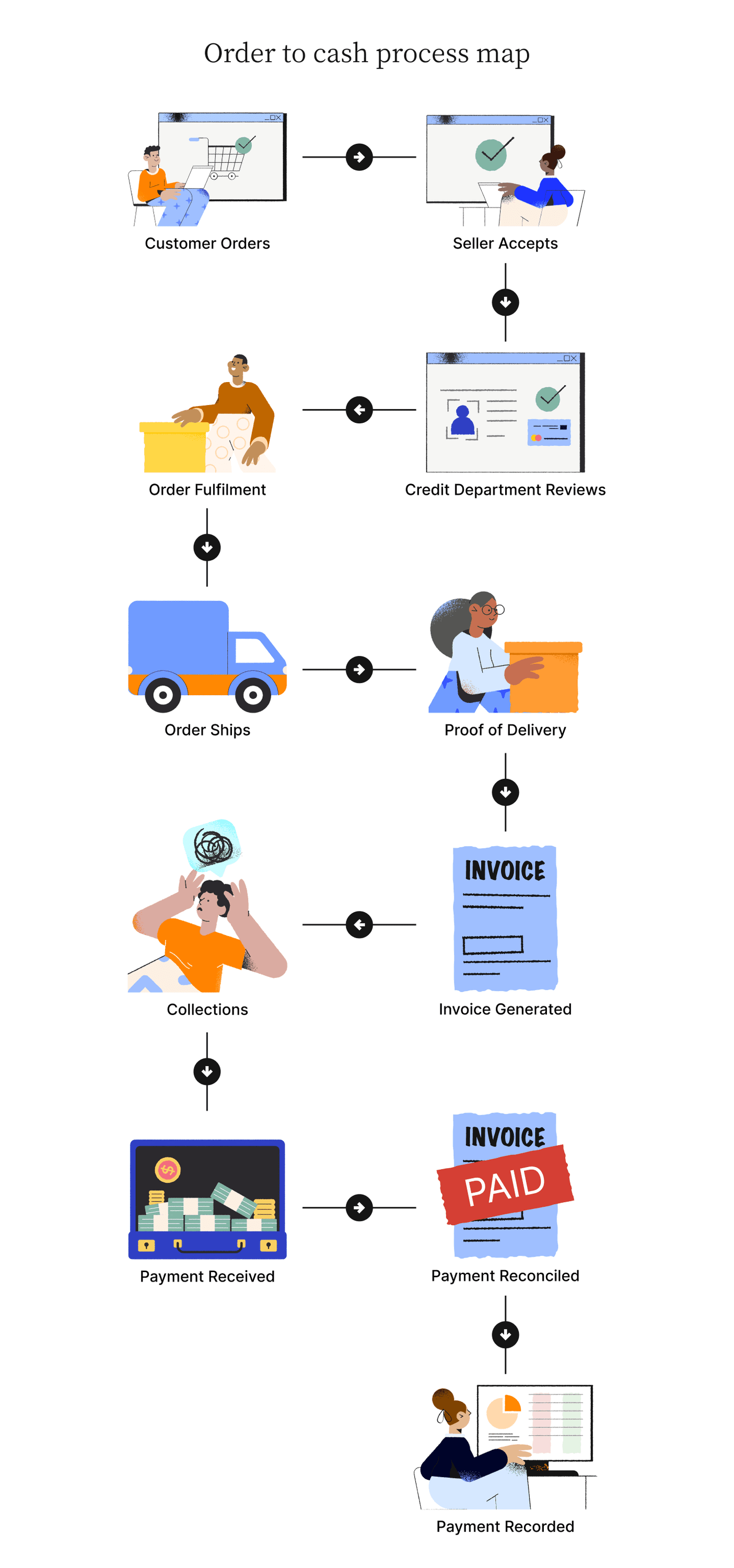

The order to cash cycle has seven defined stages:

- Order placement and management: The customer places an order and the seller accepts the order.

- Credit management: The seller’s credit department reviews the customer’s credit portfolio and evaluates the credit risk according to the supplier’s credit policy.

- Order fulfillment: The seller prepares the order for fulfillment and updates inventory accordingly.

- Order shipping: The order is prepared for shipment and handed off to carrier services for delivery. After delivery, the O2C team should collect proof of delivery and a bill of lading from the carrier.

- Customer billing or invoicing: An invoice or bill is generated and delivered to the customer.

- Payment collections: Dedicated collections teams recover outstanding invoices.

- Cash reconciliation and lender management: After payment is received, it is matched with the open invoice to reconcile cash. Then the payment is recorded in the general ledger.

4 common order to cash challenges

1. Data accuracy

Even if a business handles the majority of transactions directly on their website, it’s common for large orders to be submitted on paper or via phone. This often requires manual data entry, which can slow the order to cash process, especially if the data is entered incorrectly. Similarly, manual invoicing can cause errors in customer delivery. Using automated invoice delivery can solve related issues by delivering customer invoices based on their preference.

When order to cash operations are siloed from the rest of the accounts receivable process, teams lack the ability to make holistic, data-driven decisions. When a collector, for example, lacks visibility into payment posting status, they might reach out to a customer that has already paid.

2. Lack of automation

There are numerous parts of the order to cash cycle that still rely on manual efforts. Collections teams manually prioritize the customers they reach out to and make dunning strategy decisions without real-time data about customer credit risk and payment posting status. This causes teams to overlook high-risk customers and focus on customers that would have paid on time without intervention.

By severely hindering the ability to prioritize collections efforts, lacking automation can cause companies to spend far too much time and resources tracking down payments. One such business, a cybersecurity company, was spending over 50 hours a month on collections before implementing AR automation software.

Deduction management teams manually organize documents related to claims, proof of delivery, and bills of lading before conducting deductions research and attempting to resolve the dispute. Without automation, this process is extremely time-consuming.

3. Payment lead time

The longer a business has to wait for revenue, the greater the risk of late or non-payment. Long payment lead times can cause cash flow uncertainty, increased risk of bad debt, higher financing costs, and a negative customer experience.

4. Security

Because the order to cash process involves exchanging sensitive information like customer data, financial details, and payment information for customers, suppliers, and banks, security is a persistent challenge.

Specific security concerns during the O2C phases include payment fraud, data breaches, phishing attacks, and insecure communication channels.

4 best practices for optimizing order to cash

1. Optimize invoice delivery

Intelligent invoice design and Electronic Invoice Presentment and Payment (EIPP) more optimally deliver customer invoices and increase the chance of getting paid on time.

For customers to pay on time, they must understand how to use the electronic payment system. Integrated payment acceptance solutions streamline the order to cash process with features for electronic invoice delivery and customer payment.

2. Automate invoicing, payments, cash application, and collections

The order to cash cycle covers so many areas of the accounts receivable process that automation opportunities are abundant. These include:

- Automating invoicing

- Automating payments

- Automating cash application

- Automating collections

Automating invoicing helps teams pull data from ERPs, OM, and sales systems while complying with customer invoicing needs. Dynamically listing PO numbers or regions on invoices based on customer preference, for example, makes the invoicing process more efficient.

Cash application issues can compromise sales by slowing down the overall order to cash process because this task traditionally relies on manually matching payments to invoices. With an AI-powered cash-application tool like Versapay, AR teams can increase cash application efficiency by 75%.

Machine learning and AI can have a significant impact across the accounts receivable process and order to cash tasks like cash application, predicting the probability of a customer paying on time, and estimating the likelihood of customer disputes.

Setting up automated collection reminders is another suggestion for removing the tedious and time-consuming work associated with chasing payments during the collection period. Optimizing this step also prevents future late payments and reduces the O2C cycle length. Developing effective collections email templates is another low-effort initiative AR teams can implement in lieu of more transformative AR digitization projects.

3. Streamline dispute communication

Traditional dispute resolution methods don’t encourage interactions between customers and accounts receivable teams. When AR teams can collaborate with other departments and customers, they can transform accounts receivable to become customer-centric and strategic.

Through a digitized, automated, and collaborative dispute management process, teams can store AR data in one place and initiate direct communication channels with customers to build better relationships.

Streamlining dispute communication improves the order to cash process by increasing customer trust and resolving nonpayments faster. Automating parts of this process like notifications and escalations saves teams time and money, and allows better visibility into the root causes of disputes to prevent them in the future.

4. Deliver better customer experiences

When there is a communication disconnect between AR departments and customers—AP teams—all involved parties suffer. Cloud applications can connect buyers and suppliers, making accounts receivable more efficient, accelerating cash flow, and delivering better customer experiences.

Focusing on the customer at each stage of the order to cash process creates a better payment experience, transparency into account statuses, and enhanced communication between accounts receivable and accounts payable.

Through Versapay’s advanced collaborative accounts receivable solution, customers can access complete account information, access real-time communication channels to resolve issues 24/7, and enjoy flexible payment options through a secure self-service portal.

5 benefits of order to cash optimization

An optimized order to cash process provides businesses with benefits like:

- Faster order fulfillment

- Accelerated cash flow

- Reduced manual labor

- Better customer experiences

- Measurable cost savings

1. Faster order fulfillment

With increased order accuracy of an optimized, automated accounts receivable and order to cash process, businesses see increased order accuracy, improved inventory management, and enhanced communication, both internally and between the customer and accounts receivable team.

2. Accelerated cash flow

An optimized O2C process also accelerates cash flow. This optimization enables faster invoice delivery, streamlines payment processing, improves credit management, automates manual tasks, and more accurately forecasts cash flow.

3. Reduced manual labor

Automating manual order fulfillment tasks like order entry and processing, invoicing, and payment collection optimizes the order to cash process. Streamlined order processing leads to more efficient order management without any manual intervention. Encouraging customers to use self-service collaborative payment portals reduces manual communications and provides a better experience.

4. Better customer experiences

Self-service portals are just one way optimized order to cash initiatives enable better customer experiences. Collaborating with customers conveniently over the cloud helps teams quickly answer questions and more efficiently resolve disputes.

5. Measurable cost savings

O2C optimization can generate significant cost savings by reducing labor costs, enabling faster order processing, minimizing errors and disputes, and improving cash flow and inventory management. With real-time visibility into cash flow, teams can prevent late payments, bad debt, and other issues that lead to costly borrowing and financing.

Order to cash with Versapay

When evaluating order to cash strategies and solutions, teams should ensure the solutions are flexible enough to accommodate customer needs for receiving invoices and making payments. They should address the critical final step of cash application and drive electronic payment adoption.

Implementing accounts receivable automation using Versapay’s solutions reduces errors, enables faster payments, and provides a single cloud solution for customer collaboration.

Teams can deliver complete, shared invoice and account information through a secure, self-service customer portal. With efficient dispute resolution and short-pays with built-in commenting, teams can solve customer problems more quickly.

Versapay enables teams to provide customers with multiple payment options, make the invoicing process easier, and stay in control of the payment experience.

About the author

Ben Snedeker