How Boston Properties Achieved 99% Collection Rates Across 2000+ Tenants

- 8 min read

Learn how Boston Properties transformed and automated their invoice-to-cash process, through collections, payments, and cash application with a focus on connecting their AR department with their customers over the cloud.

—

Boston Properties’ accounts receivable processes were outdated, and they were spending too much time dealing with tenant calls and questions about invoices and payment statements.

The rapidly growing REIT signed approximately 592,000 square feet of leases in the first quarter of 2021—some of their largest tenants by square feet include the U.S. Government, Google, and Bank of America—however, their collections process was unilateral and time-consuming, the cost of mailing invoices was too high, and payments were too frequently delayed.

In this case study, you’ll learn how Boston Properties digitally transformed their legacy accounts receivable processes to engage and empower collections staff, eliminate paper-based tasks, achieve rent revenue certainty, and keep aged receivables under 30 days across their wide portfolio of tenants.

Paper-based invoicing was costly and inefficient

Prior to Versapay:

- $0.55: Cost per paper mailing to 2200 tenants

- 2: Number of collectors manually chasing payments

- 4-5: Number of months for operating escalations to be reconciled

Between 2017 and 2018, Boston Properties began a search for an accounts receivable automation solution capable of shifting a greater volume of rent payments from cash and paper check to predictable and scalable digital payments.

Ultimately, Boston Properties wanted to automate the tedious and manual processes associated with sending and receiving paper invoices. This approach was costing the business 55 cents per mailing to tenants, along with countless staff trips to and from the bank.

Prior to implementing Versapay, the company’s frontline collections were difficult, time-consuming, and manual. The finance team spent the bulk of their time on cash application and reconciliation. With cash coming in that didn’t neatly reconcile, the AR team frequently became bogged down in manual back-and-forths to chase payments.

In simple terms, Boston Properties relied on phone calls or emails, often finding that tenants hadn’t received their invoices or rent payment statements. In some instances, tenants were taking advantage of this flawed system to delay making rent payments.

"The catalyst for looking for a new solution was threefold. How do we scale our business? How do we better meet customer expectations? How do we change the dynamic to decrease the time spent chasing small dollars?" Jim Whalen, SVP, Chief Information and Technology Officer, Boston Properties

Boston Properties wanted an AR automation solution to help them scale their business, support their long-held reputation for superb tenant relations and decrease the time their finance team spent chasing ‘small dollars’. They chose Versapay as their AR automation solution.

Radically new receivables process underpins management fee revenue

In July 2019, Boston Properties implemented Versapay’s cloud-based accounts receivable solution to transform and automate the full invoice-to-cash process, through collections, payments, and cash application with a focus on connecting their AR department with their customers over the cloud.

Since Implementing Versapay:

- $0.00: Cost per paper mailing to 2200 tenants

- 98%: Adoption by rental tenants

- 99%: Percentage of rent collected in 2020

- 1-3: Number of months for operating escalations to be reconciled

Cash rent payments are generally due on the first day of that month, although tenants have varying grace periods. Dealing with cash was always a big concern for Boston Properties, with the use of lockboxes and ACH also adding delays and inconveniences to the AR process, and ultimately slowing down the flow of cash for the business.

A key strategic initiative was to get high adoption rates for digital payments and for Versapay’s customer portal to facilitate real time collaboration between the AR department and their tenants.

"Versapay's support with implementation was unbelievable, especially when we had issues retrieving tenants' banking information. Onboarding them the right way with Versapay's support was terrific." Jeff Phaneuf, VP of Finance and Planning at Boston Properties

Here’s how Boston Properties transformed their accounts receivables processes and accelerated cash flow by implementing Versapay:

1. Letting customers view and pay invoices in real-time with self-serve

Since implementing Versapay, Boston Properties has changed the dynamics of their AR processes to be more collaborative and further excel in tenant relations. With Versapay’s online cloud portal, the company’s tenants can self-serve to view their open balances and make payments. As well, when tenants have questions or problems, Boston Properties can now communicate with them as effortlessly as if they were in the same room together.

With this shift to self-service, Boston Properties has decreased the time spent chasing small dollars, allowing them to better meet the expectations of their diverse and growing tenant portfolio across five major cities. By digitizing their traditional manual and paper-based tasks, Boston Properties’ AR department is now 100 percent paperless.

"We have collected over 99 percent of office rents billed throughout the pandemic." Boston Properties 2020 Annual Report

2. Automatically keeping receivables under 30 days

According to Deloitte’s 2021 CRE Outlook, many CRE companies are beginning to feel the impact of the turbulent business environment brought on by the pandemic. Average rent collections remained around 90% for industrial and office REITs between April—July 2020, however, US shopping center REITs dropped to 50% in April.

Despite this shaky economic outlook—and despite 66% of North American REITs expecting a decline in rent collection between 10 and 40%—Boston Properties has achieved a near-perfect record of rent collection for office rents billed throughout 2020. Much of this is due to their new approach to AR and their partnership with Versapay.

"We have million-dollar tenants. Before, if that million-dollar tenant was two days behind, we were spending a lot of time and effort trying to understand the reasons why. Now, Versapay is allowing us to ping these customers directly and start a conversation over the cloud." Jeff Phaneuf, VP of Finance and Planning at Boston Properties

Versapay has enabled Boston Properties to automate their standard process of contacting every tenant within 30 days if they fall late with rental payments. This allows the finance team to escalate key matters with leasing representatives or property managers if needed.

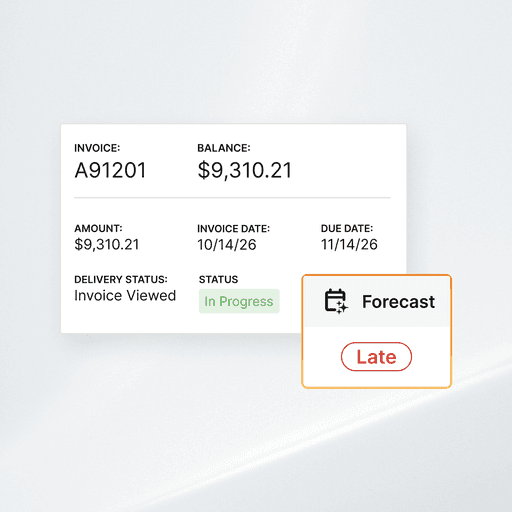

3. Forecasting late-payment risks

"We like the depth of real estate understanding that Versapay is delivering. So many products cover only financial planning, AR and AP, without understanding that real estate is unique." Jeff Phaneuf, VP of Finance and Planning at Boston Properties

As a rapidly growing REIT, Boston Properties also needs to forecast and report on any risks to the business. With Versapay, for example, if a tenant pays rent of $5000 a month and becomes three months behind—leading to an open balance of $15,000—the software is capable of flagging potential risk and alerting the finance team that action or intervention is required.

"When you have tenants paying through Versapay, it's impossible to have any discrepancies. They click on their invoices and pay. It's great. It's huge. It's a home run. We lock it up and go." Jeff Phaneuf, VP of Finance and Planning at Boston Properties

4. Streamlining rent abatement amid the pandemic

At the onset of the pandemic in March 2020, Boston Properties worked with tenants to abate rent where needed. Some tenants were provided with a rent abatement of up to three months.

"Before, many tenants were out of sight, out of mind. If they weren't being called by us, they might not be worrying about what was due. Now, through automation, they're being contacted by Boston Properties in a timely fashion and are then reaching back out to us." Jeff Phaneuf, VP of Finance and Planning at Boston Properties

Versapay’s automation of the company’s accounts receivable meant it could keep track of abatements and ensure tenants were contacted once abatement periods were up.

"Versapay is bringing our AR team to another level that didn't exist before." Jeff Phaneuf, VP of Finance and Planning at Boston Properties

Automated accounts receivable to scale REIT revenues

Boston Properties once labored needlessly with manual accounts receivable processes, which bogged team members down in less-strategic manual work. The legacy system was paper-based, costly, and unfit for an REIT with a culture of outstanding tenant relations.

Since their implementation of Versapay in mid-2019, Boston Properties has transformed rent collection, without adding headcount or hindering their relationships with anchor tenants.

By eliminating those previously manual AR processes, the company achieved a remarkable 99 percent rate of collections for office rents billed throughout 2020.

—

Learn more about Versapay’s accounts receivable automation platform, and how you can join Boston Properties in increasing AR productivity and accelerating cash flow as your business grows, here.

Company snapshot

Boston Properties is a self-administered and self-managed real estate investment trust (REIT). The company is the largest publicly traded owner, manager and developer of properties in the United States, with a large presence in Boston, Los Angeles, New York, San Francisco, and Washington DC.

About the author

Nicole Bennett

Nicole Bennett is the Senior Content Marketing Specialist at Versapay. She is passionate about telling compelling stories that drive real-world value for businesses and is a staunch supporter of the Oxford comma. Before joining Versapay, Nicole held various marketing roles in SaaS, financial services, and higher ed.