How Prepayments Can Control Credit Risk and Drive Revenue

- 9 min read

This article explores what credit risk in accounts receivable is and the pros and cons of using prepayments for poor-credit customers.

The majority of cash flow problems mid-market businesses encounter stem from their customers paying them late or not at all. While there are a number of valid reasons for such problems, a portion of late and non-payments is attributable to a problematic cause: working with customers with poor credit.

While it may seem like working with such customers is a no-win proposition, there are good reasons to work with poor-credit customers. And there is one particular approach to doing so that can reduce your risk to a negligible level: prepayments.

A look at this under-appreciated topic can help you assess whether opening your business to lower-credit B2B customers could be an effective strategic step.

Table of contents:

- What is credit risk in accounts receivable?

- Why you shouldn't dismiss customers with poor credit

- How to work with customers with bad credit

- 4 benefits of using prepayments for poor-credit customers

- Risks of using prepayments

- Customer spotlight: how NAI used prepayments to generate millions in revenue

What is credit risk in accounts receivable?

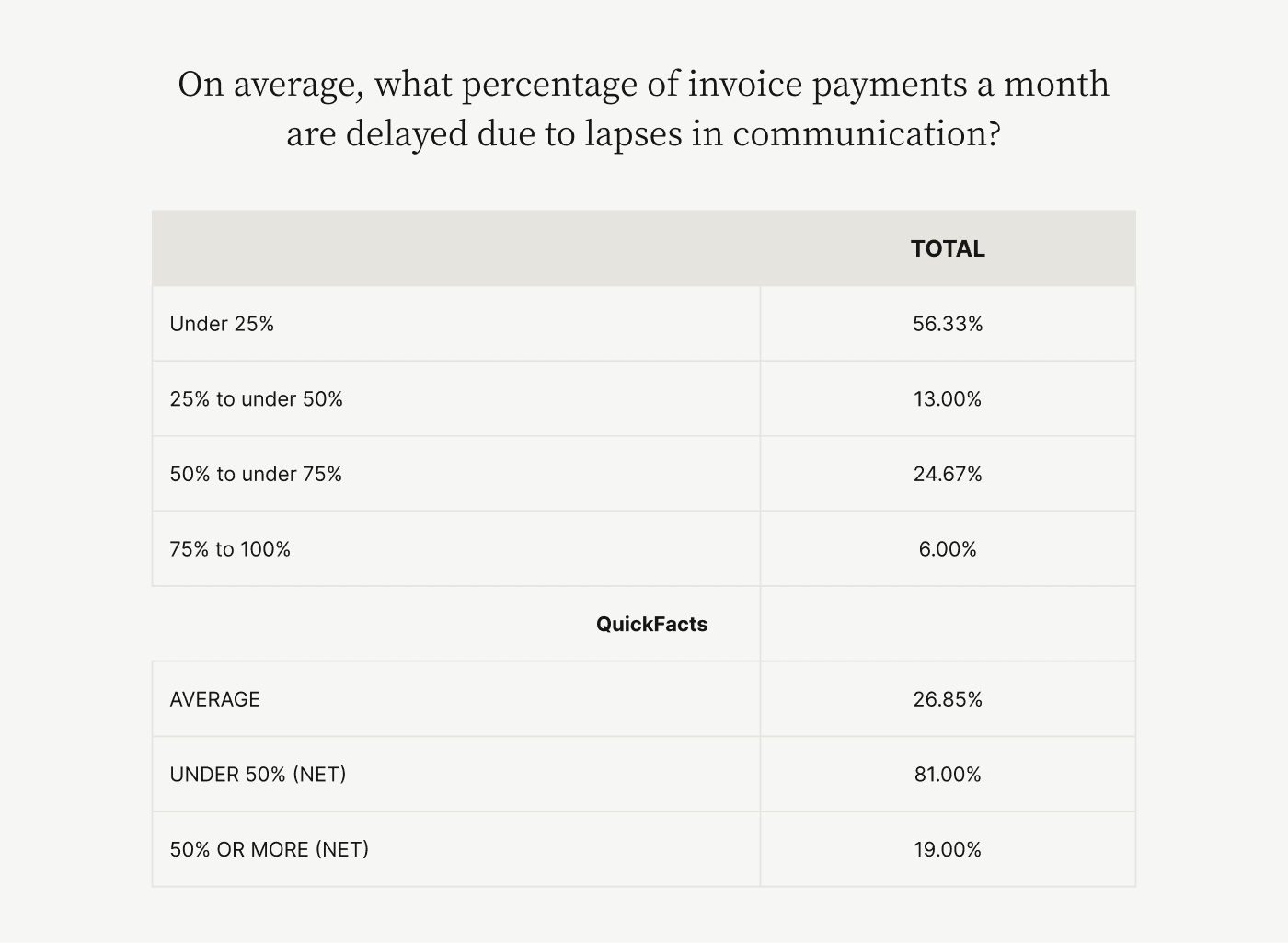

Many late and non-payments occur for valid reasons, such as slow payment methods like checks and miscommunication in the payment process. For example, an average of 27% of invoice payments are delayed due to lapses in communication, according to research from Versapay and Wakefield.

Valid late payments are a risk to accounts receivable (AR) and cash flow, but aren’t a risk in regards to extending credit (or deciding to extend credit) in unwise ways. That issue is reserved for poor-credit customers with whom you agree to do business.

Customers whose credit score reflects a low level of creditworthiness are more likely to have problems paying their bills than customers with higher scores. And improving how you communicate with these customers will do little to ease your concerns around late or non-payments. That’s because working with such customers introduces credit risk in your accounts receivable system.

The more low-credit customers you sell to, the higher the risk in your AR, which translates into risk to your cash flow and bottom line.

Why you shouldn’t dismiss customers with poor credit

While working with customers with poor credit does present a hazard to your business, the benefits of engaging with this large, under-tapped market may make the risk worthwhile.

One reason to work with these customers is that those with poor credit are likely to have fewer avenues to get the goods and services they need, which increases their potential to be loyal to those who do business with them.

Additionally, many customers with poor credit are working toward becoming consumers with good credit. You can reap the rewards of working with these strivers if you set up long-term, trustworthy relationships with them.

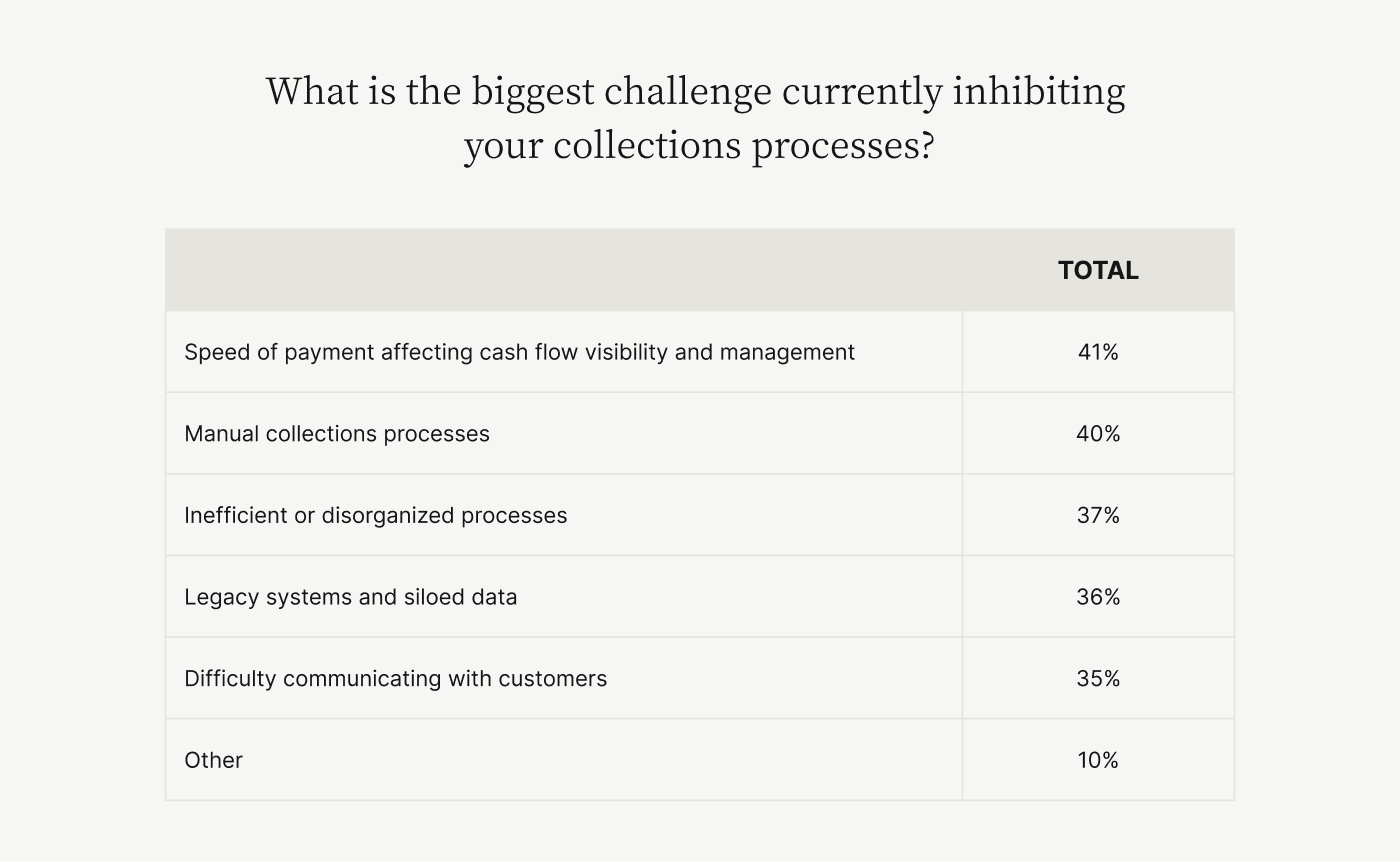

According to our research, finance leaders indicate that their biggest collection problem is speed of payment affecting cash flow visibility. Prepayments can ameliorate this problem since they ensure that the full amount owed is paid and accounted for at the beginning of a transaction.

How to work with customers with bad credit

Throwing in your lot with risky buyers may seem ill-advisable. But fortunately, there is a way to engage this large market that substantially reduces your exposure: prepayments.

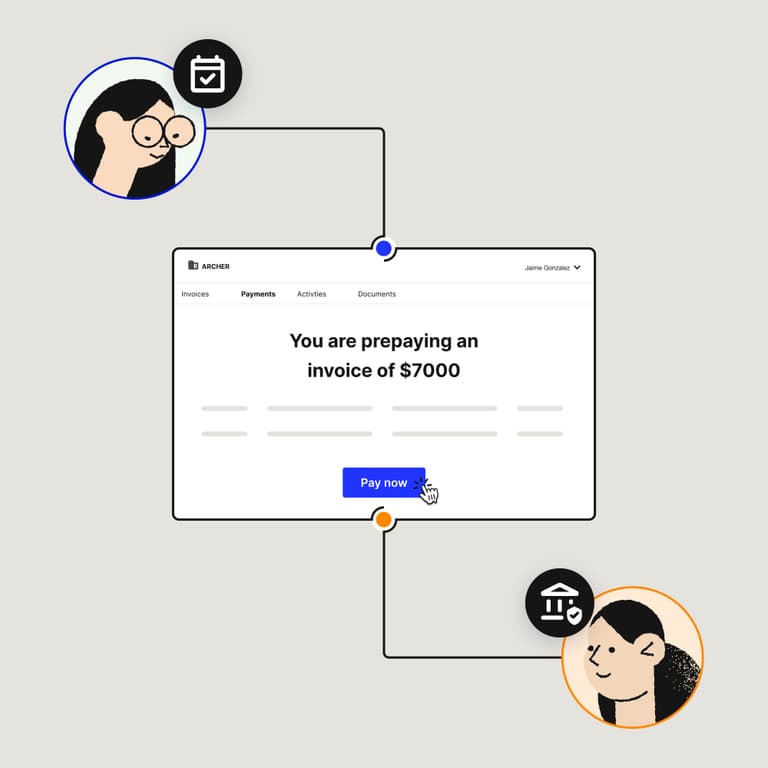

A prepayment is a payment that a customer makes before receiving the purchased goods or service. For example, a poor-credit customer may want to enroll in a subscription service for 18 months but does not qualify based on the seller’s terms. If the customer pays for the entire contract up front, the seller can sell them the service without any risk at all.

Having poor-credit customers prepay for goods and services allows you to boost cash flow and revenue by increasing your customer base, all while continuing to meet all financial obligations by avoiding late and non-payments.

The partial-payment option

One problem with prepayments is that they can be too restrictive for customers with poor creditworthiness. Such customers are more likely than others to have precarious financials and lack access to large lump sums with which to pay ahead of time.

One way to handle this problem is to establish an agreement in which the customer pays a portion of the prepayment up front, like a down payment, with the remainder of the prepayment extended as credit and due in the future. This arrangement carries more risk than a full prepayment, but still reduces the risk of working with poor-credit customers in accordance with the amount of the down payment.

4 benefits of using prepayments for poor-credit customers

While the risks are low in using prepayment with poor-credit customers, the benefits can be large. Here are the three biggest benefits of using prepayment for these customers:

Opening up a new market with little or no risk — Prepayments let you safely access a large under- or untapped market made up of customers who are eager to develop a relationship with your business. Engaging with this new clientele has potential to increase cash flow and revenue as you grow your customer base.

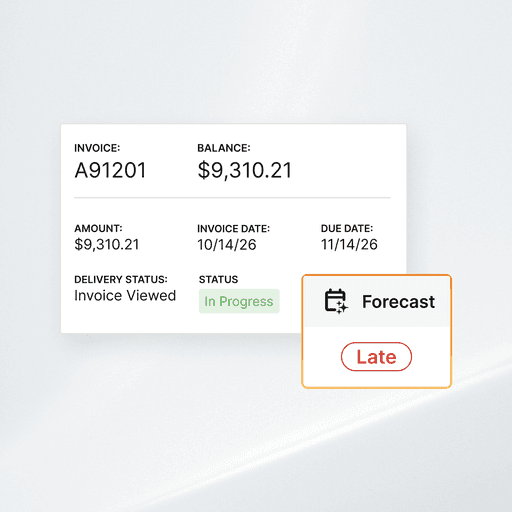

Enabling better budgeting and cash flow forecasting — Prepayments simplify accounting, as they allow you to record the entire price of a given service at one time, which facilitates effective budgeting and allows you to more accurately forecast cash flow. Prepayments in-hand can help you hedge against the risk inherent in extending credit to other customers.

Building creditworthy customers — Offering a prepayment option lays the foundation to eventually offer credit to poor-credit customers who stay with you while working to prove that they are suitable to receive credit. Over time, you can build your own cohort of creditworthy customers with whom you can cultivate strong, sustainable relationships.

Improving visibility into receivables — Prepayments help finance leaders feel more confident in their collections process, since payments made up-front address their most commonly cited issue: lack of visibility into cash flow. Prepayments eliminate the uncertainty about payments timing within the AR system.

Risks of using prepayments

There are relatively few risks to using prepayments to engage poor-credit customers. One risk is the potential for losing those customers to competitors who are willing to offer them more lenient terms, especially as you build these people up over time into more attractive customers with better credit.

You can forestall this by offering partial-prepayment options to those who present relatively less risk, and let customers progress to providing smaller and smaller down payments to secure credit as their creditworthiness improves.

However, the risk inherent in accepting partial prepayments is that you will never receive the remainder of the payment that you have extended on credit. This eventuality is the reason to carefully structure any program through which customers gain your trust and increase their credit usage over time.

Case study: How North Atlantic International Logistics used prepayments to generate millions in new revenue

Prepayments have been very valuable to North Atlantic International Logistics (NAI), a leader in the transportation industry that facilitates all aspects of freight warehousing and movement. Working with rail, trucking, and ocean freight, NAI was managing multiple different delivery timelines and billing cycles. The company wanted an online payment solution that would allow for prepayment before delivery of freight to enable taking on logistics jobs for companies with poor or no credit.

NAI adopted Versapay to be able to handle this level of complexity and tap into a lucrative segment of potential customers. After starting to accept prepayments, NAI earned about $2.5 million in new revenue in a year and is on track to collect $10 million in new revenues over the following two years.

“[With prepayments] we're allowed to open up our view of who we can give business to,” says NAI Director and CEO Anthony Mestroni. “We’ve been able to open our doors to a lot, especially to transport companies.”

Accepting prepayments from poor-credit customers can be a good strategic move

Accepting prepayments from customers with poor credit can be an excellent strategic move for B2B companies, especially those who offer subscription services that customers are expected to pay for over time. Those who can reliably accept prepayment can gain more financial resilience, cultivate customer relationships, and grow faster by tapping into new markets.

Automated accounts receivable solutions like Versapay can facilitate prepayments, further minimizing risk by ensuring that this alternative form of payment is correctly received and accounted for.

Talk to an expert to see how Versapay can enable prepayments.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.