How To Use Credit Risk Analysis in Accounts Receivable

- 10 min read

This article covers what credit risk analysis is, how it reduces bad debt, and how to improve and use credit risk analysis in accounts receivable.

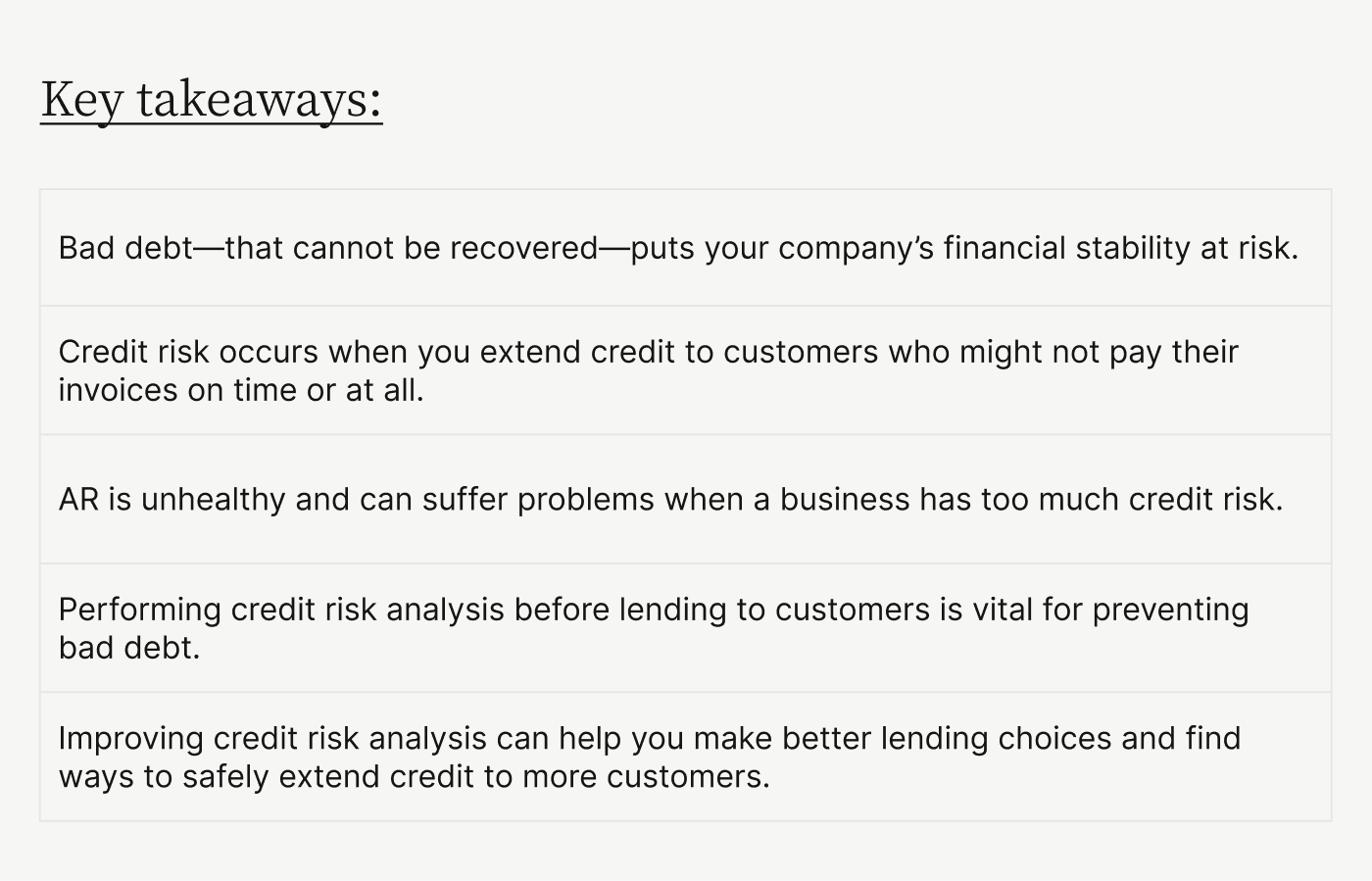

Business sustainability and success depend on financial stability. Anything that slows or interrupts steady cash flow puts your company’s wellbeing at risk. One of the main culprits in this regard is bad debt—that is, debt that cannot be recovered—which slows cash flow by reducing the amount of income your business brings in.

The most prominent reason that companies end up with bad debt is by extending credit to unreliable borrowers. Accordingly, reducing the amount of bad debt on your books depends on ensuring that your customers can be trusted to pay.

Credit risk analysis is a key method for doing so. Let’s look at how you can use this approach to head off bad debt and keep your accounts receivable function healthy.

Table of contents:

- What credit risk analysis is →

- How credit risk relates to accounts receivable →

- How credit risk analysis minimizes bad debt →

- How to do credit risk analysis for accounts receivable →

- How to improve credit risk analysis →

What is credit risk analysis?

Credit risk is the likelihood that a borrower will not pay back the credit a lender has extended to them. There are a variety of reasons a borrower—in this context, a B2B customer—may not pay their debt:

Customers may have financial problems due to mismanagement or market shifts, which can keep them from paying their debts promptly, especially if they have gone into bankruptcy.

Customers who are dissatisfied with your product or service may opt not to pay, changing a viable invoice into a bad debt.

Poor communication between your accounts receivable team and your customers can cause payment delays or prevent collection altogether.

Credit risk analysis can help you keep bad debt off your books by assessing how likely it is that a customer will default on an invoice. The information from this analysis makes it more likely for your team to make good choices about who can be trusted with credit.

Accounts receivable’s core job is to collect on customers’ debts. A healthy receivables function requires low credit risk, meaning that most or all customers are able and willing to pay their invoices. An unhealthy receivables function is one with too much credit risk.

Accounts receivable credit risk results in sluggish cash flow as debts remain uncollected. AR teams must do resource-intensive legwork to try to recover overdue payments that may become bad debts.

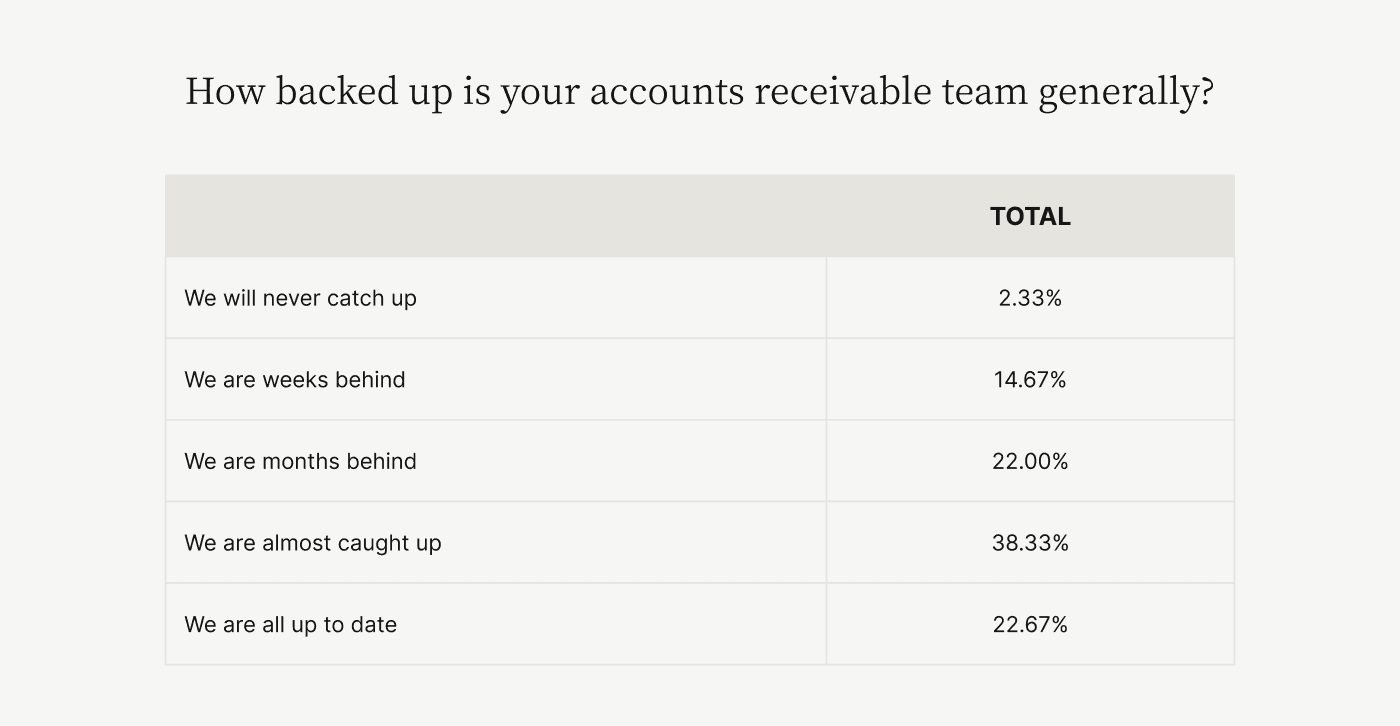

The need to run down unpaid bills can quickly bog down AR teams; research shows that 77% of CFOs say their teams are (often hopelessly) behind on processing invoices. As bad debts languish on your books, they reduce income, damage cash flow, and put your company’s financial stability at risk.

How credit risk analysis minimizes bad debt and accelerates cash flow

Credit risk analysis is the best tool in your arsenal for keeping bad debt off your books. There are a number of reasons this is such a useful strategy. Credit risk analysis:

Ensures you only extend credit to reliable customers and avoid credit risk

Helps you prioritize and quickly onboard low-risk customers

Reduces the operational costs associated with soliciting late payments

Improves cash flow forecasting, which can assist with strategic planning

Enables tailoring of terms to customers’ needs, which sets them up for smooth payment

Strengthens customer relationships by increasing the likelihood of positive interactions

Improves customer satisfaction by setting up productive buyer-seller relationships

How to do credit risk analysis for accounts receivable

Credit risk analysis for accounts receivable requires a detailed assessment of where your credit risk lies. It involves the following steps:

Calculate your DSO

Create an AR aging report

Assess patterns in unpaid invoices

Identify risks to cash flow

Up-skill your receivables team

1. Calculate days sales outstanding

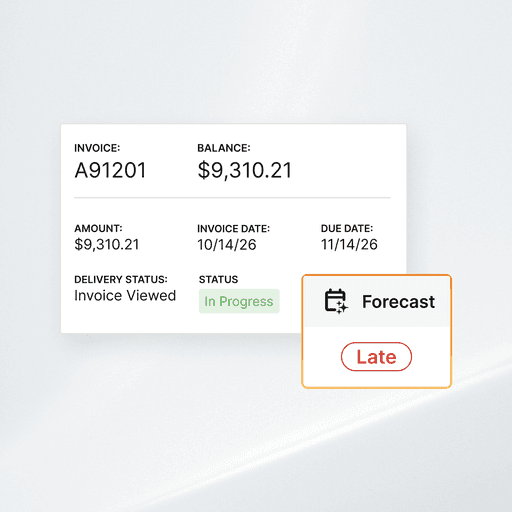

Days sales outstanding (DSO) is the average number of days that pass between invoicing and payment. This metric is a reliable indicator of the efficiency and health of your accounts receivable function. A high average DSO suggests a likelihood of too much credit risk in your AR.

2. Create an AR aging report

An accounts receivable aging report shows all unpaid invoices alongside their due dates, revealing how much each customer owes and how late their payments are.

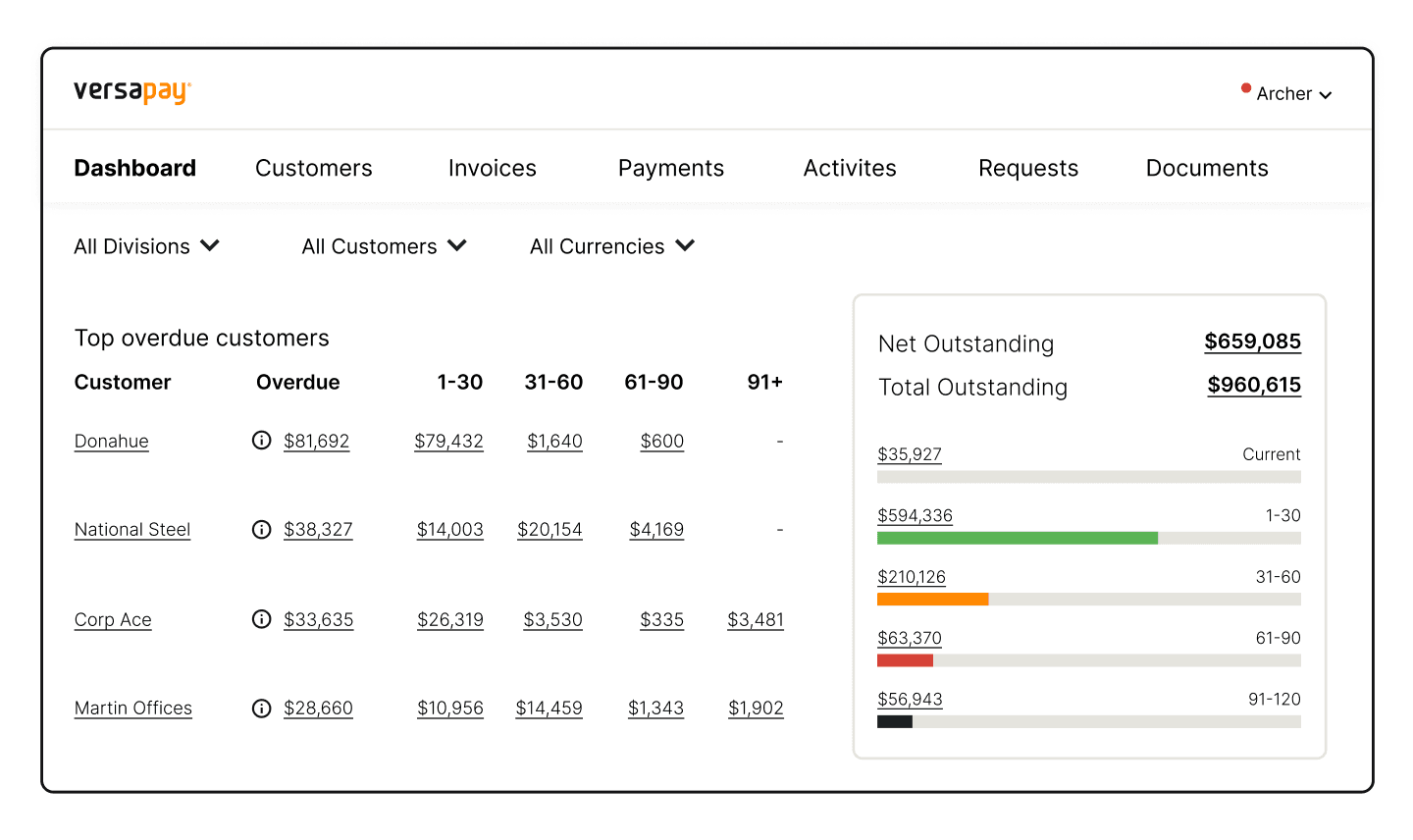

These reports can help give you detail and context for your DSO findings. Technology can streamline the creation of these reports, automating the process and presenting the information in an intuitive and interactive way. Here’s an example of an aging report:

3. Assess patterns in unpaid invoices

Group your customers based on characteristics that may help you identify patterns in your credit risk. Such groupings could be defined by customer location, industry, or size; product category; their share of receivables; or many other metrics.

Looking at all your bad debt and how it relates to the customer groups you’ve created can help you identify patterns and take defensive action in how you extend credit in the future.

4. Identify risks to cash flow

As you uncover patterns in your customers’ payment activity, you’ll be able to see which parts of your accounts receivable process hold the most risk.

Perhaps you are extending credit to risky customers in certain industries or regions. Maybe your use of manual payment processes is causing delays or making it difficult for you to accept digital payments, with a resulting increase in DSO. Perhaps your payment terms are harming customers’ ability to pay in some way that wasn’t evident before.

5. Up-skill your accounts receivable team

Ensure that your AR team has a good understanding of credit risk and how to reduce it. This is especially important given the widespread shortage of finance staff, which means receivables teams can scarce afford to get backlogged with the work of chasing down late payments from risky customers.

Technology that allows for better transparency into credit risk and AR health can help your finance staff become adept at incorporating credit risk awareness into every aspect of their collections work.

How to improve credit risk analysis

Improving credit risk analysis can help you make better lending choices and find ways to safely extend credit to more customers. Here are three ways how you can do that:

Refine your segmentation techniques

Incorporate trend analysis

Strategically leverage technology

1. Refine your segmentation techniques

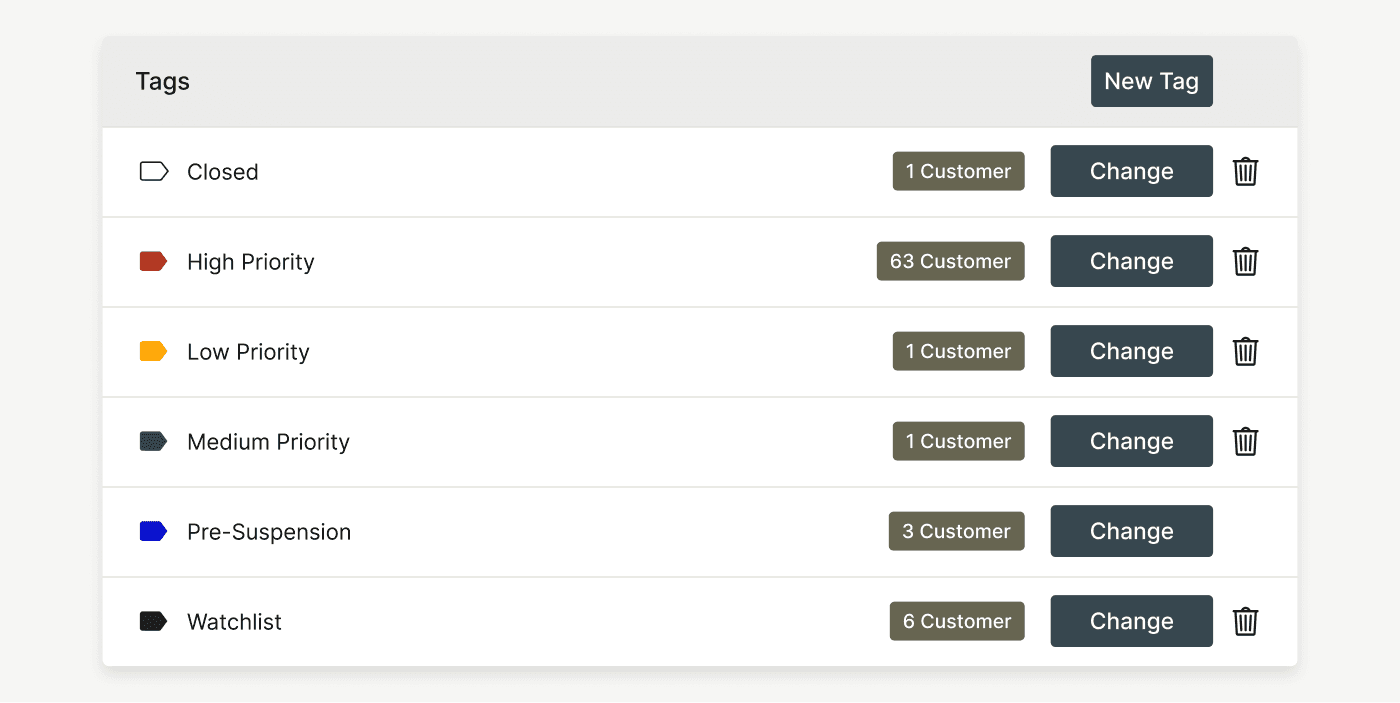

Identifying problem areas or concerning patterns in your AR function is the core objective of credit risk analysis. The more granular, specific, and targeted your segmentation process is, the more insight you’ll gain. You can divide and group your customers in a wide range of ways. Doing so manually can be a laborious and error-prone process, but technology enables you to accomplish this quickly and with infinite flexibility in how you group data.

Within Versapay, for example, you can apply customizable tags that allow you to group your customers by any number of criteria. This can help your accounts receivable team create the most pertinent groupings and make it easier to see patterns that can bear upon credit decisions.

2. Incorporate trend analysis

The goal of credit risk analysis is not necessarily to blacklist every customer that has ever submitted a payment late or left an invoice unpaid. There are many reasons a certain customer or set of customers may have trouble paying at a given juncture even though they may be creditworthy as a rule.

You can better understand the risk level of each customer by looking at trends in their payment activity and credit information, as well as national, regional, and industry-specific trends that affect them and their business.

3. Strategically leverage technology

Technology can allow for more insight within your AR and offer new options for reducing credit risk. Machine learning and artificial intelligence, for example, can improve your credit risk modeling and automatically detect potential risks based on your data or larger industry-related datasets.

Accounts receivable automation software like Versapay can enable prepayments, which companies can use to mitigate the risks of dealing with poor-credit customers.

Keep your accounts receivable healthy

Credit risk analysis plays an important role in ensuring your receivables function remains healthy by allowing you to identify problem patterns and anticipate risks. Low-risk AR operations ensure that your company maintains robust cash flow and sustainable financial health.

Automating your accounts function is the first step in improving your credit risk mitigation approach. Check out our CFO’s Guide to Accelerating Collections to learn more.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.