4 Payment Reminder Tips that Boost Cash Flow and Accelerate Collections (with Templates)

- 16 min read

Payment reminders, while tedious, offer you a unique opportunity. A well-crafted, friendly reminder helps you collect cash efficiently and prevent any delayed payments in the future.

In this article, you’ll learn how to create and distribute payment reminders that streamline the collections process and accelerate cash flow.

—

Accounts receivable (AR) teams have little love for collections processes, and crafting payment reminders often reminds AR teams of how time-consuming—and occasionally irritating, for both them and their customers—getting paid on time can be.

Payment reminders, while tedious, offer you a unique opportunity. A well-crafted reminder helps you collect cash efficiently and prevent any delayed payments in the future.

While your language and tone certainly plays a role in creating an effective, friendly payment reminder, your processes have a bigger impact. This article explores four process-based payment reminder tips that accelerate collections.

What’s in this article

Tip #1. Be proactive

“Prevention is better than a cure” is a fundamental healthcare principle that also applies to collections. You won’t have to worry about non-paying clients if you eliminate the issues that create them. Here’s how you can proactively minimize the number of payment reminders you send:

Offer multiple payment options

Evaluate credit effectively

Consider early payment discounts

Collaborate early and often

Offer multiple payment options

Customers have different payment preferences, and allowing them to pay using their preferred methods minimizes the chances of a delinquent account, thereby accelerating cash flow. Here are the B2B payment methods you must offer your customers, at a minimum:

ACH payments

Wire transfers

Commercial credit cards

Electronic checks (or eChecks)

Paper checks

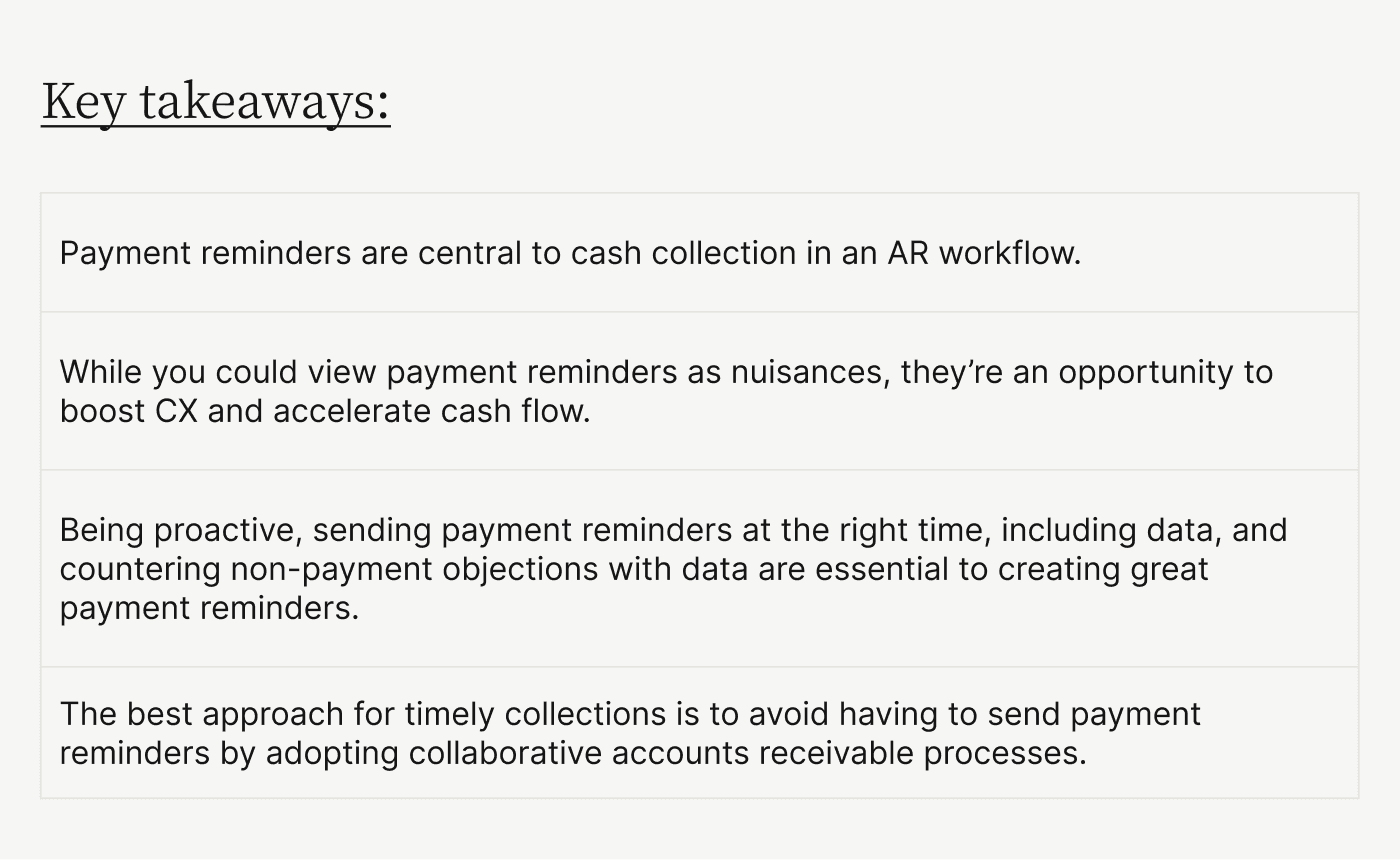

If your customers solely prefer offline payments (like checks and card-present payments, like those made over the phone) and aren’t quite ready to embrace digital payments, be sure you proactively integrate your offline payment acceptance methods with an ERP that helps you track and centralize payment information.

Evaluate credit effectively

Granting customers credit strengthens long-term business relationships which then often results in quicker payments. However, evaluating creditworthiness is challenging. Check your customers’ trade references and periodically modify your credit policy to match business needs.

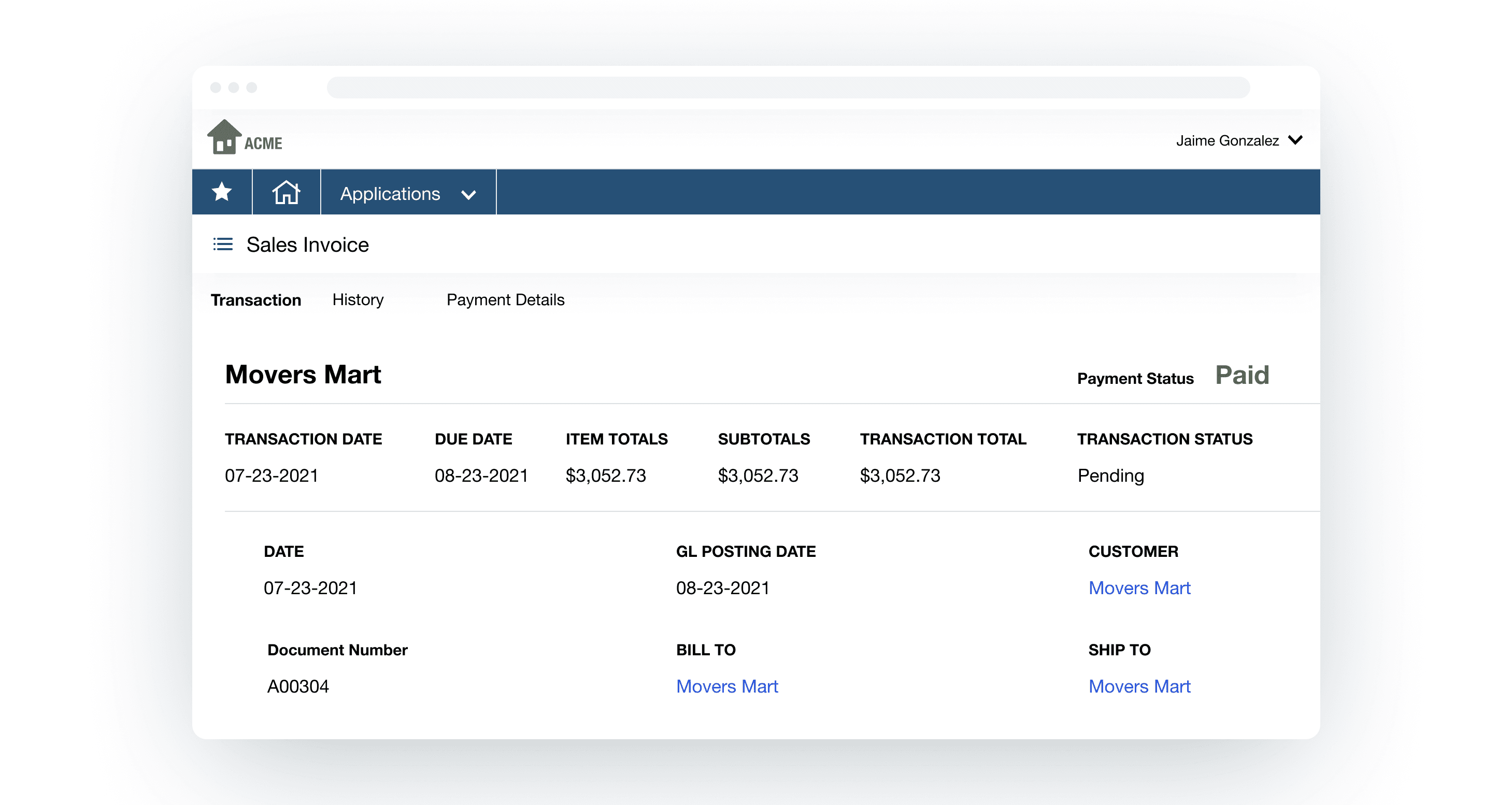

For instance, you could consider granting credit based on your AR aging data, irrespective of your customer’s creditworthiness. This approach helps you build customer relationships while taking care of your cash flow needs.

Consider early payment discounts

You can incentivize early payments by offering customers a discount. Note that early payment discounts can act as a double-edged sword. While they accelerate collections, they strain your margins. Review your cash flow and financial data before implementing these discounts. Alternatively, you can trial them with cost-sensitive customers while adjusting pricing to achieve a happy middle ground.

Collaborate early and often

Communicate often with customers and prevent issues that might lead to non-payment. For instance, reach out to customers shortly after delivery to inquire about product issues, helping you nip them in the bud and prevent delayed payments.

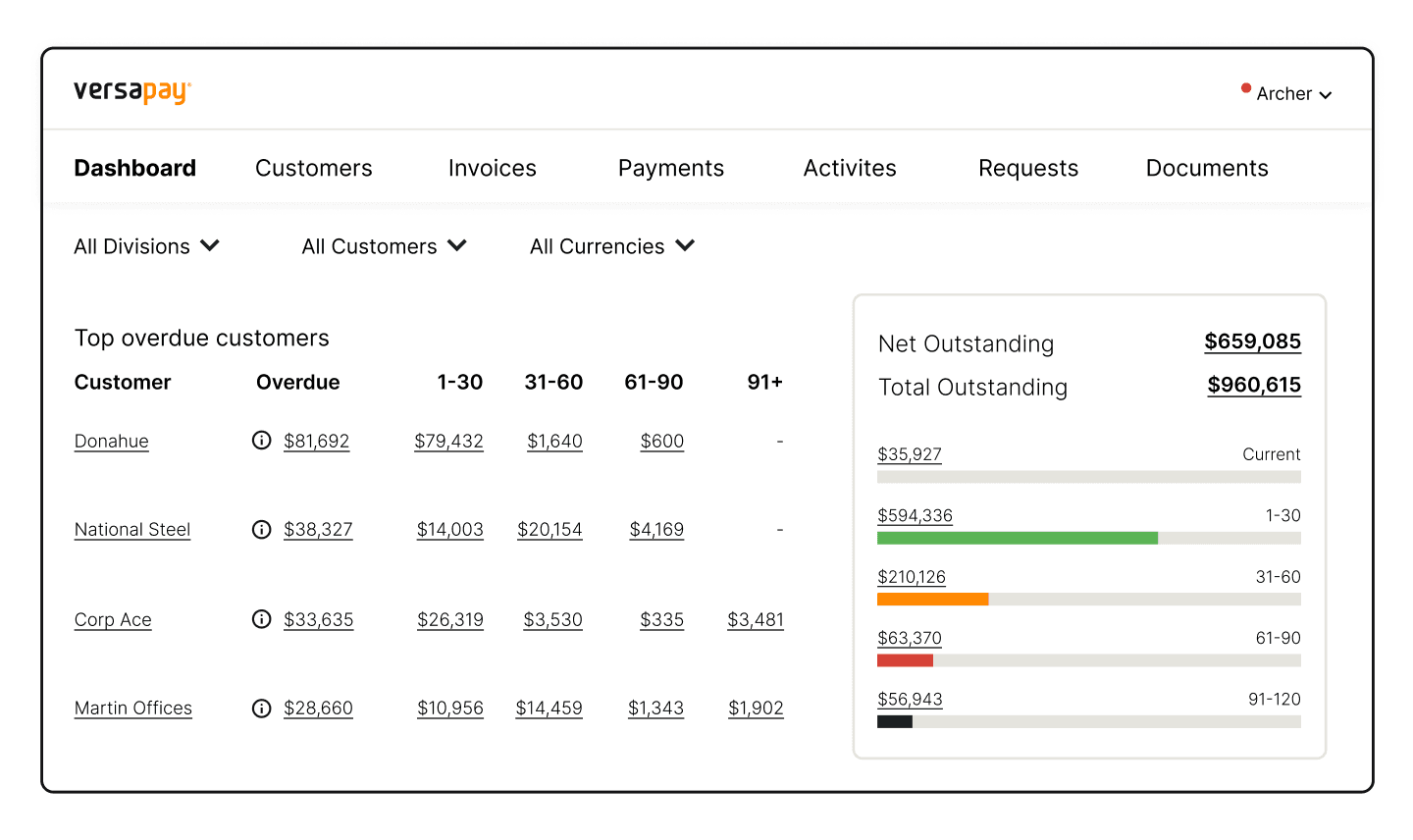

Also consider explicitly informing customers of your collections policies during onboarding to avoid misunderstandings. These types of conversations—among the many other collections communications—are made easier through powerful technologies like collaborative accounts receivable payment portals. These tools are designed to help your teams communicate directly with customers, over the cloud via chat-like functionality, instead of relying on payment reminder emails that can be ignored or lost.

Collaboration frees you to automate more of your AR workflow, boosting overall efficiency. It streamlines and reimagines the payment reminder process, ensuring past-dues are firmly of the past. It’s also how RPT Realty, an NYSE-listed REIT, saves $64,200 annually on cash application and invoicing.

Tip #2. Send payment reminders at the right time

Your payment reminders must occupy your customers’ minds without becoming annoying. Here’s how you can time your reminders to achieve this goal.

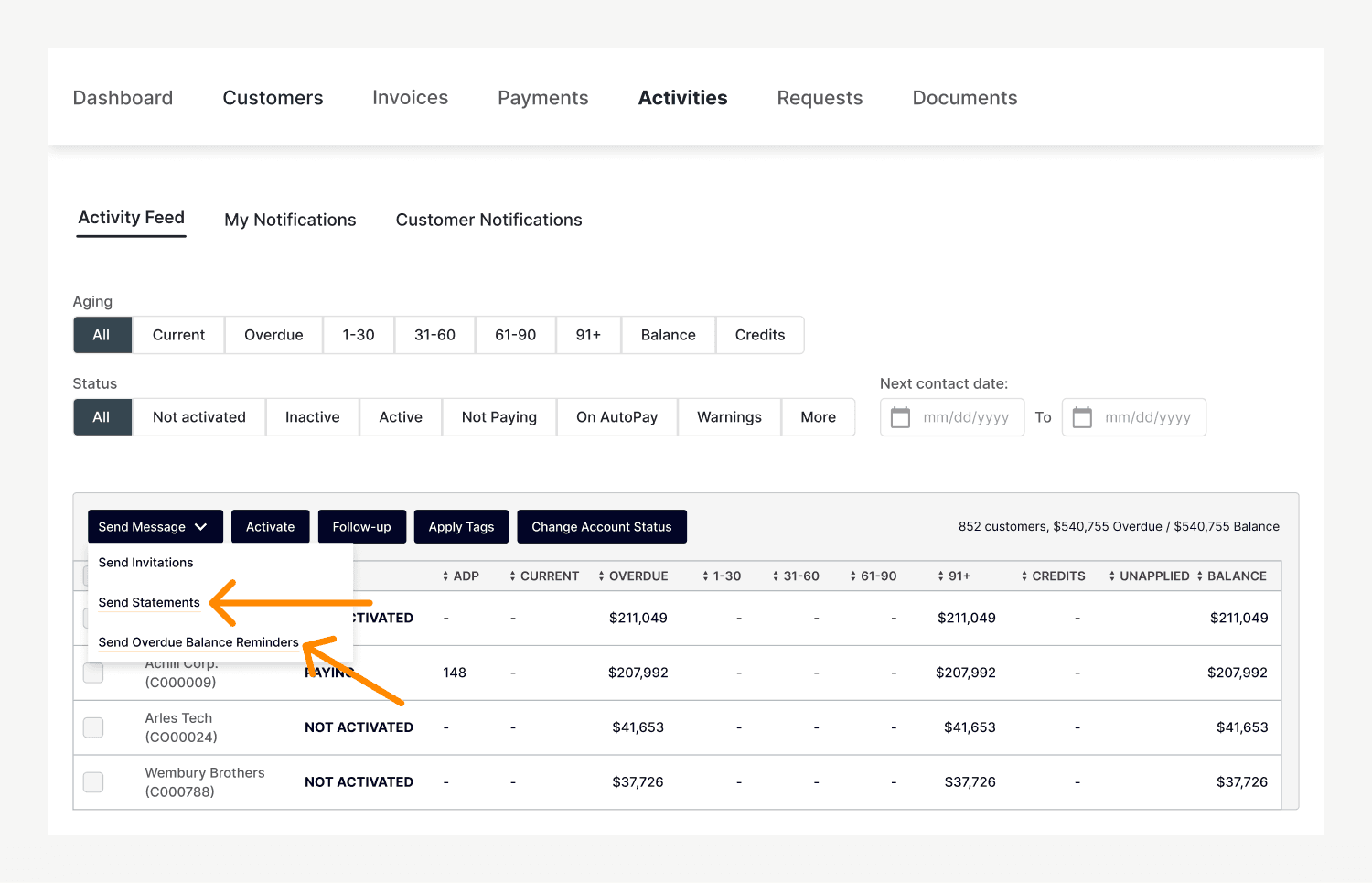

Automate payment reminders at preset intervals

Send account statements

Use payment reminder templates

Automate payment reminders at preset intervals

Sending payment reminders to customers at one, 15, 30, 45, 60, and 90 days past due is a good way to remind delinquent accounts of the money they owe you. If your AR team handles several hundreds of invoices a month—the average mid-market business issues 2,433 invoices monthly—manually sending reminder notices will become a full-time job.

Instead, automate these payment reminders and set up triggers in your AR software. For example, you can take a page out of your favorite marketers’ playbook by specifying notification frequencies and creating triggers that stop them if a customer replies to a notification or clears a payment.

Send account statements

Sending your customers their statements will give them a better view of their account status. Statements can bring additional context to payment reminders and increase the odds of a payment.

For instance, sending a single account statement highlighting a large outstanding amount is more effective than sending individual payment reminders for each overdue invoice. Automate sending account statements from your AR software to avoid increasing your AR team’s workload.

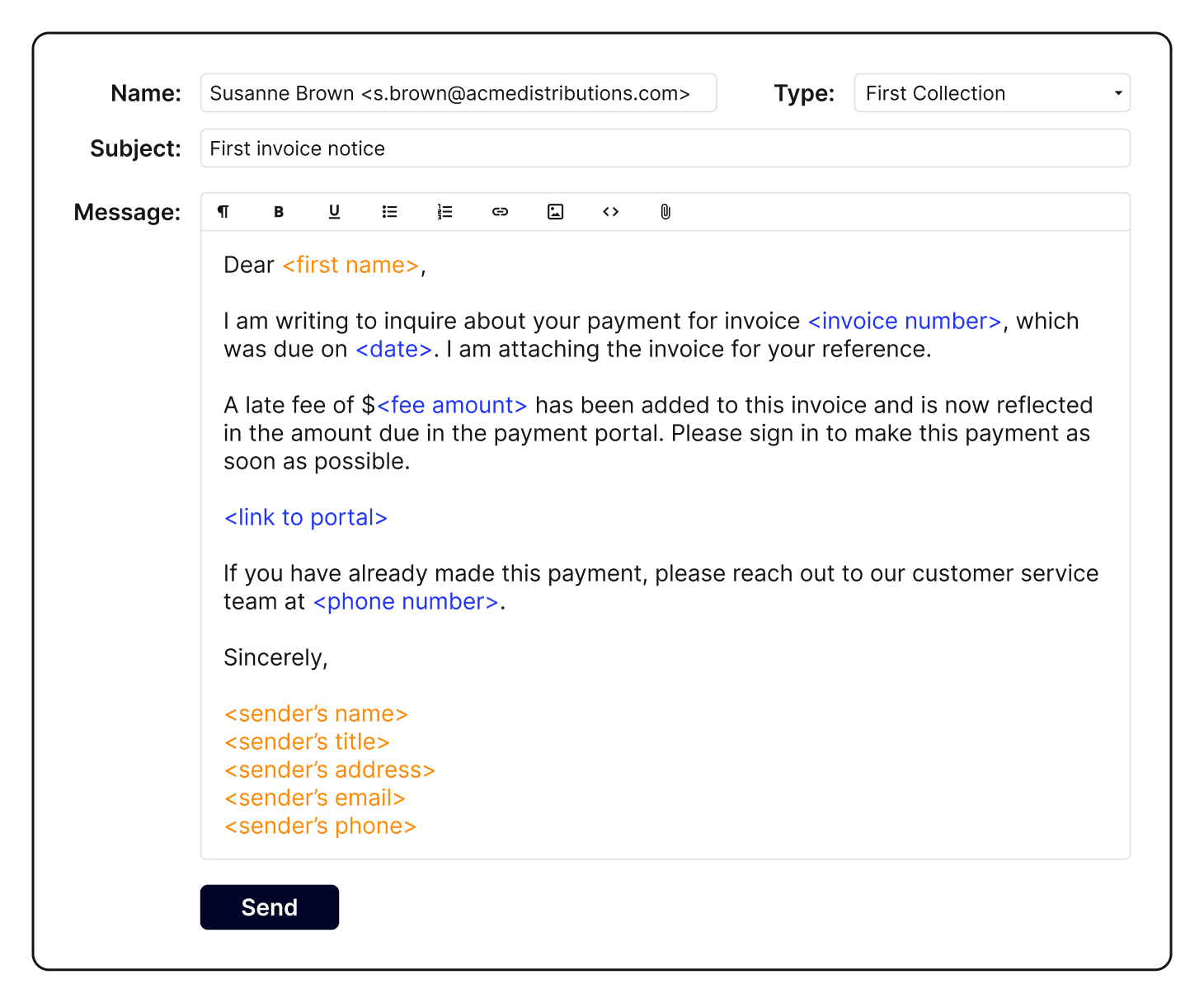

Use payment reminder templates

Payment reminder templates reduce the time your AR team spends following up with customers. Even if your AR process isn’t digitized, these templates will make collections more efficient.

Payment reminder template for an overdue invoice

Subject:

<Your company’s name> — <<Invoice number>> overdue by <<days>>

Body:

Hello <<name>>,

We hope you’re doing well! This is a gentle reminder that <<invoice number>> was due on <<invoice due date>>.

Could you please let us know when we can expect your payment? We’ve attached a copy of the invoice to this email.

You can pay by clicking on the link below.

Thank you,

<<sender’s name and title>>

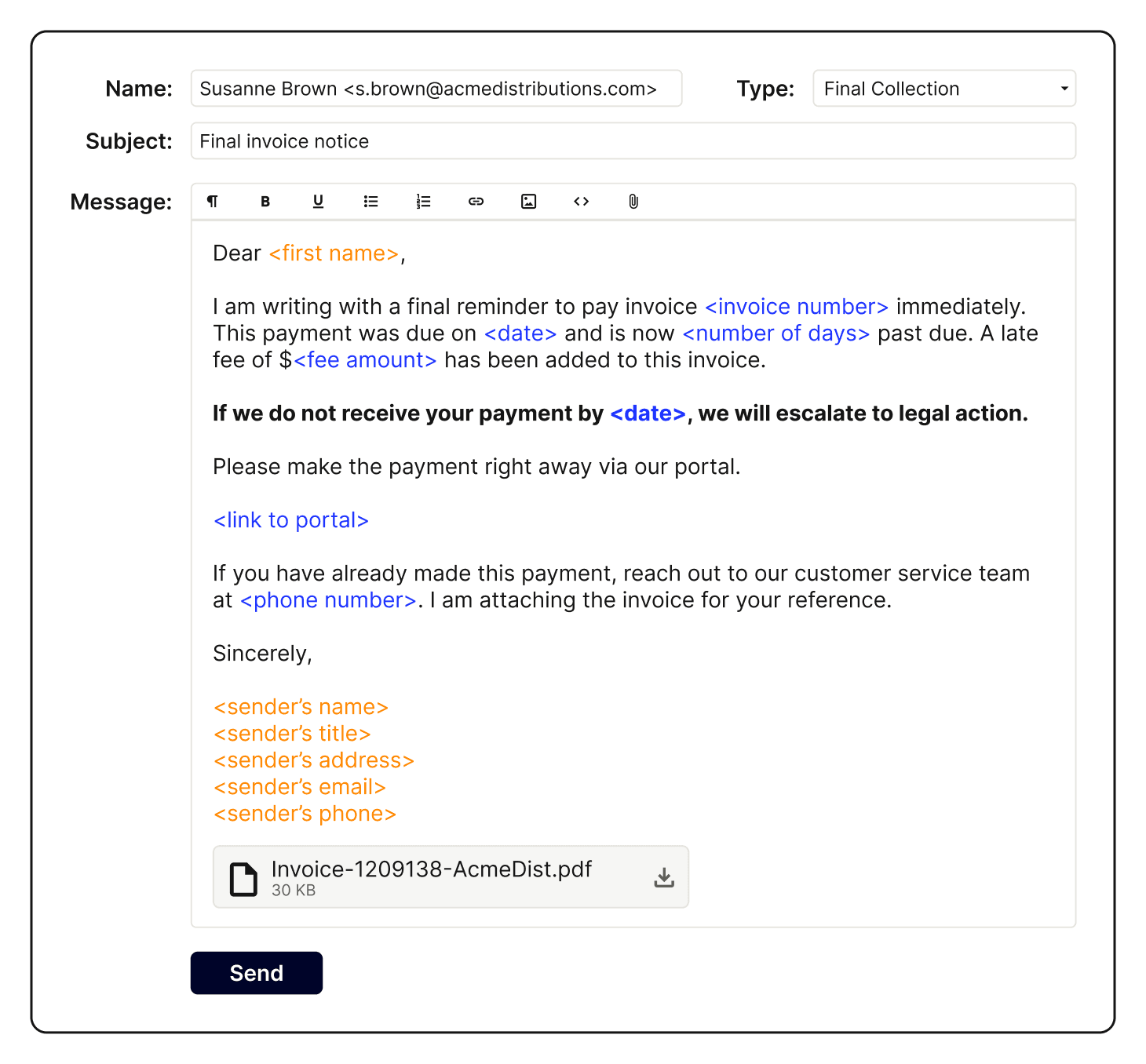

Payment reminder template for final notice of overdue invoice

Subject:

<Your company’s name> <<Invoice number>> overdue by <<days>>. Please pay ASAP.

Body:

Hello <<name>>,

This is our last reminder for <<invoice number>> due on <<invoice due date>>. We will begin applying late fees of <<late fee>> per our payment policy.

We’ve attached a copy of the invoice to this email. Please confirm receipt and submit your payment as soon as possible.

You can pay by clicking on the link below.

Thank you,

<<sender’s name and title>>

👆 Back to the list of all tips →

Tip #3. Include important data in payment reminders

Payment reminders can miss the mark without relevant supporting data. Here are two ways you can easily bring more context to your payment reminder messages, making them more impactful and likely to accomplish their purpose.

Include important payment reminder data

Always include the following information at a minimum, on your payment reminders:

Invoice number

Number of days overdue

Sender’s name and designation

Your company’s name

Any late payment fees

Copy of the original invoice

Payment links

Including the right data in your payment reminders ensures your customers have all relevant information on hand. At the very least, including important payment data prevents further back and forth that could delay collections.

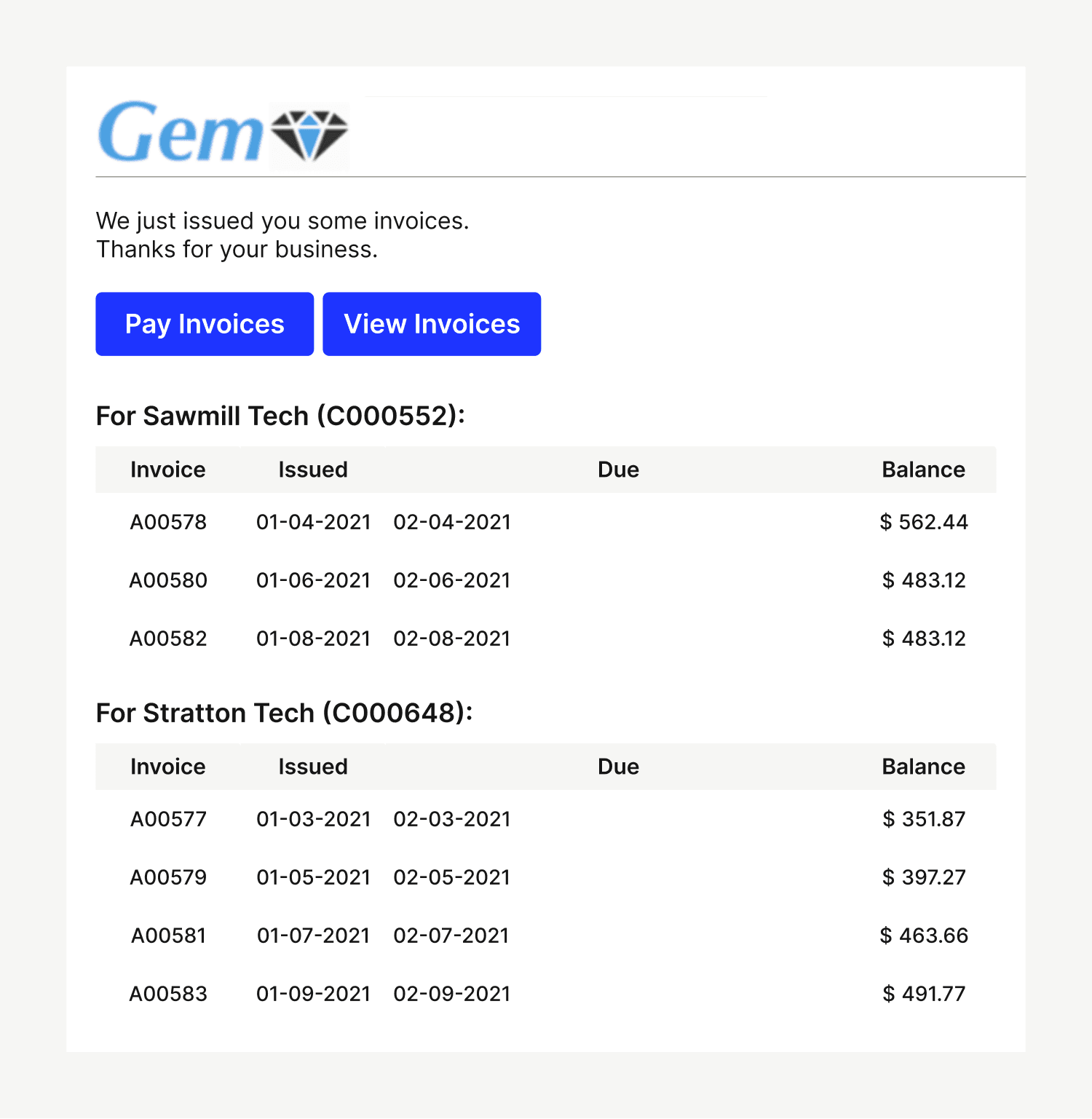

Group entity data correctly

When dealing with different entities of a single customer, make sure you send payment reminders and group invoice data to the right contact. Often, one department handles multiple entity payments, and sending individual payment reminders delays collections.

Grouping entity data offers better CX and increases the likelihood of a quick payment. Use electronic AR payment portals that group and retrieve entity-level data quickly.

👆 Back to the list of all tips →

Tip #4. Counter objections with payment data

Customers will usually counter with objections—for a variety of reasons—to your payment reminders. Here's how you can use data to counter some of the more commonly encountered objections.

“We never received your invoice”

“We’ve mailed your check”

“Your invoice is inaccurate”

“Our payment terms are <<something else>>”

Objection 1: “We never received your invoice”

Always include a delivery or read receipt when sending invoices and payment reminder emails. Send paper invoices through registered mail for proof. A collaborative AR portal automatically creates an audit trail, aside from sending invoices on time automatically, giving you all the data you need.

Objection 2: “We’ve mailed your check”

While you might not be able to counter this common objection with payment data, if your customers claim to have sent their check, you can certainly ask for proof by requesting a copy or the mailing receipt.

Objection 3: “Your invoice is inaccurate”

Prevent this objection from ever occurring by leveraging a collaborative accounts receivable portal. A collaborative portal aligns your sales and AR team around customer issues, minimizing the chances of an elementary error like incorrect pricing. And, even if an error occurs, your customer can still pay the correct amount using this technology. For instance, if you overstate the invoice amount, your customer can short-pay it, transferring the correct amount to you.

For when this objection does rear its head—or when relying on a more manual or semi-electronic AR process—have sales, inventory, and delivery data on hand before sending the payment reminder.

Objection 4: “Our payment terms are <<something else>>”

Clarify payment policies during the onboarding and contracting stage. If a customer claims to have changed their process after agreeing to your terms, counter with legally binding signed contracts and credit terms to remind them of their obligations.

👆 Back to the list of all tips →

Why collaborative accounts receivable is the key to faster collection times

Payment reminders are a good way to chase overdue cash and reduce delinquent accounts. However, the trick to reducing your DSO is to prevent late payments. Collaborative accounts receivable decreases collection times, captures AR aging data, and simplifies cash flow tracking because:

Collaborative AR increases automation’s scope

Collaborative AR boosts CX

Collaborative AR introduces greater efficiency

Collaborative AR increases automation’s scope

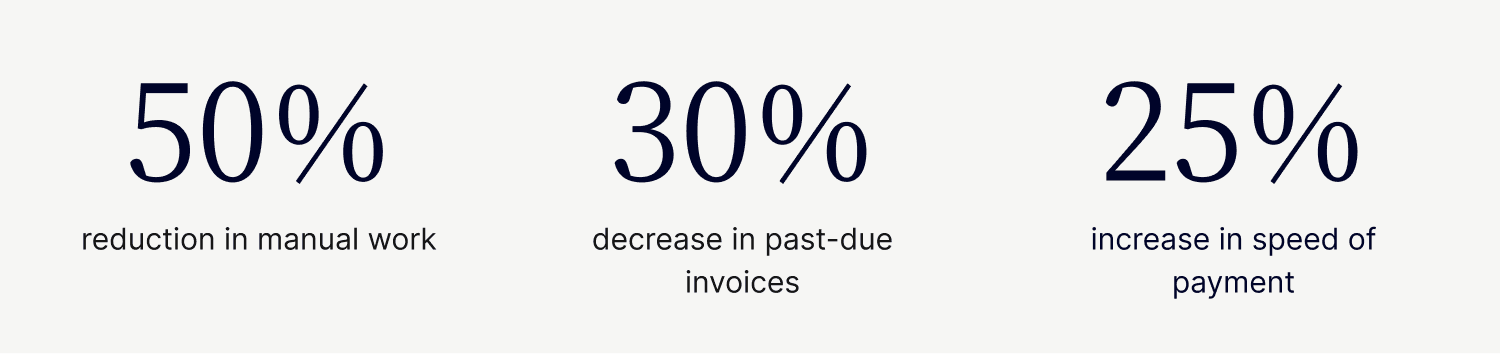

Our research shows collaborative AR processes lead to a faster collections process. In fact, you could expect the following phenomenal effects in ditching manual AR processes:

Collaborative AR centralizes payment data, making it easier for customers to self-serve. Your teams can standardize processes and automate them, saving time and reducing invoice processing costs.

🚨 Collaborative AR is central to Sharp saving hours of manual collections work and reducing PCI compliance scope thanks to automating payment data collection every month.

Collaborative AR boosts CX

Accounts receivable is no longer a back office function and is instead a CX driver, something our research confirms. Ninety-five percent of respondents to our survey reported CX is an important part of the AR experience, with more than half seeing it as very important.

Collaborative AR eases customer communication, centralizes AR data, and gives customers visibility into invoice statuses. All these factors delight customers and contribute to faster collections. After all, happy customers are less likely to delay payments.

Collaborative AR introduces greater efficiency

Collaborative AR portals eliminate time sinks. For instance, with all data centralized, your team doesn’t have to go back and forth with customers and sales confirming terms and or determining the accuracy of invoice data. You also don't have to worry about lost documents or missing proof. With easy access to sales contracts and credit terms—and a direct line of contact between you and your customers—AR will avoid invoice errors, reducing the number of disputes and accelerating cash flow—without needing to rely on payment reminders.

—

Payment reminders are a critical part of your collections policy. While crafting good reminders is important, taking steps to prevent sending one is far more effective. Collaborative AR helps you leverage automation to get your AR team focused on high-value activities that accelerate collections. Learn how collaboration and Versapay’s automated AR solutions can get you paid faster while increasing efficiency.

More frequently asked questions about payment reminders

What is the meaning of a payment reminder?

A payment reminder is either a verbal or written communication that notifies customers of their outstanding invoices. Payment reminders are commonly used by accounts receivable teams to minimize late payments and maintain good customer relationships. Sending friendly payment reminders also increases the chances of receiving early customer payments, improving the overall cash collection process.

What is the best way to structure a payment reminder message?

Payment reminder messages should start with a clear subject line that specifies the reminder, the invoice number, and the payment due date. Each payment reminder message should also be personalized with the customer’s name.

It’s essential for the message to maintain a polite, yet professional tone, avoiding any hostile language. The body of the message will include a reminder that the invoice is due with concise details such as the full amount owed, the invoice number, the payment due date, an attachment of the original invoice, available payment methods, information about where to make the payment, and contact information for customer support.

How often should payment reminders be sent?

The number of payment reminders a company sends will depend on their relationship with their customers and any outlined payment terms. Typically, the first payment reminder should be sent early, about three to five days before the invoice payment is due. Another reminder should be sent on the due date. If the payment hasn’t been collected on the due date, an additional reminder should be sent after a few business days have passed.

What are the most effective channels for sending payment reminders in?

The most effective channel to send payment reminders in will vary depending on your customer base. We recommend using an accounts receivable payment portal to automate your payment reminders and collect payments, however, more common channels include email, text message, phone call, or by mail.

How does automation for payment reminders help improve collections rates?

Automation solutions for payment reminders improve collections rates by sending timely, detailed reminders to customers on a regular cadence. This reduces manual work for accounts receivable teams and allows them to follow up with customers quicker. Automation also helps ensure that payment reminders are personalized, accurate, and include all the necessary information. This leads to more efficient customer communication and fewer past-due invoice payments.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.