Predictable cash. Faster payments.

Automated AR helps reduces overdue invoices, accelerates payment application, and gives real-time visibility so you can plan with confidence and keep working capital moving.

GET PAID FASTER

One unified platform. Total financial control. Time to let your cash flow.

Versapay simplifies the entire invoice to cash process, so payments are never lost, delayed or misapplied. With automation, AI, collaboration, and ERP integration, we turn complexity into clarity, giving your team full control and faster cash flow.

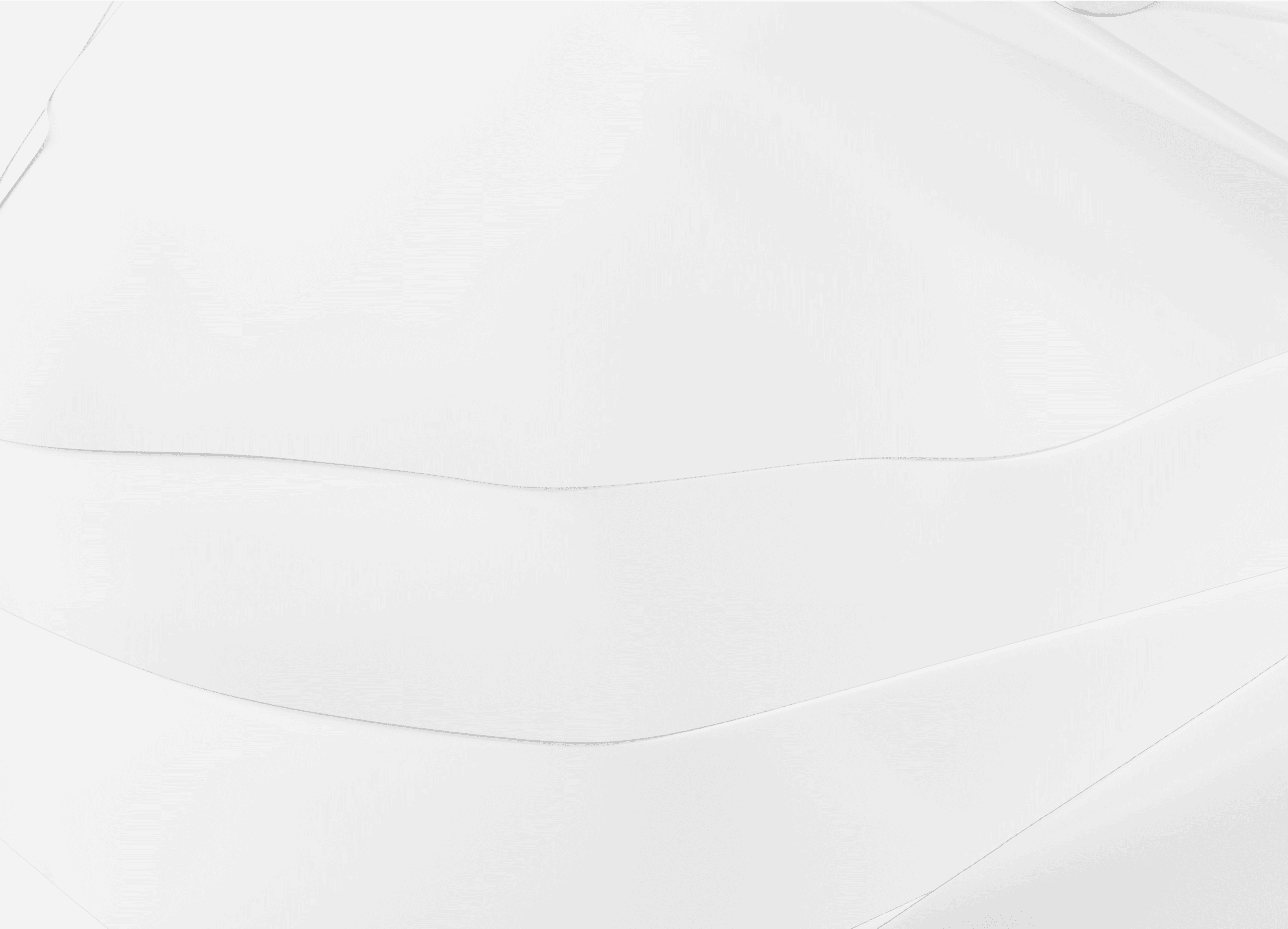

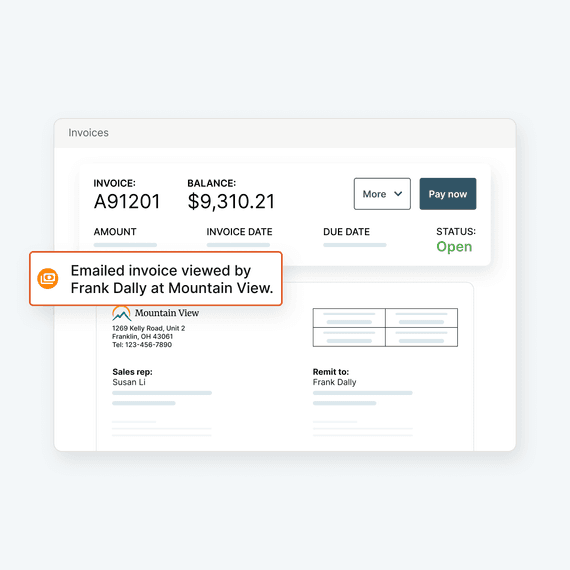

Digital invoicing & customer portal

Automate billing and get your invoices paid faster than ever

Let customers view, pay, and manage invoices freely while streamlining collections with automated invoicing.

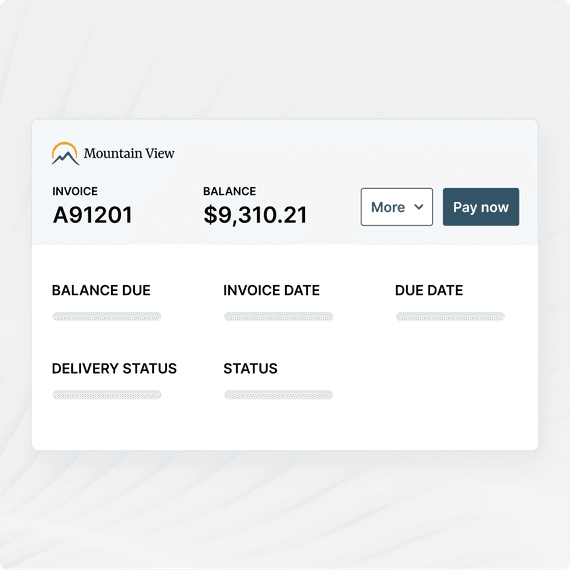

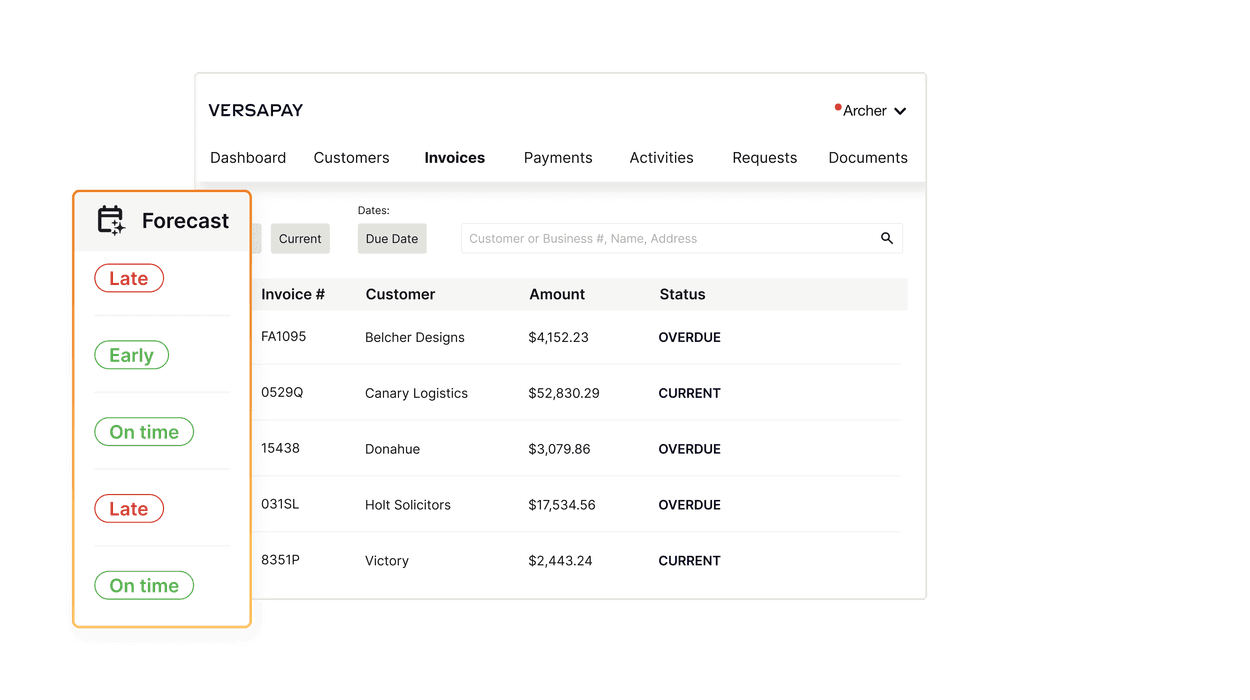

collections management

Collect with confidence and stop chasing overdue invoices manually

Automate collections, predict delinquencies, prioritize high-risk accounts, and maintain visibility.

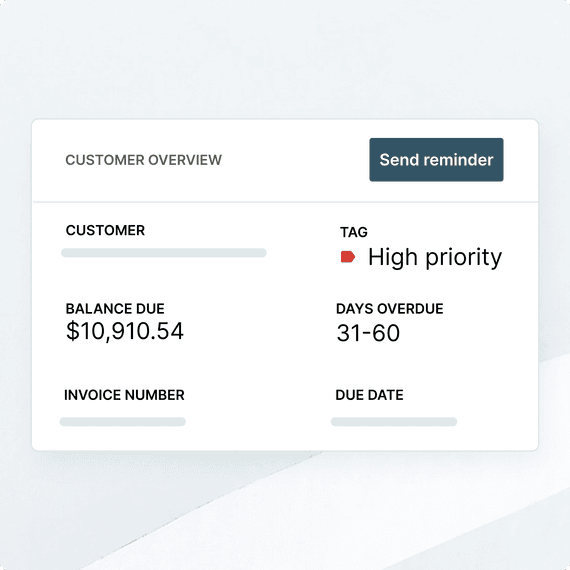

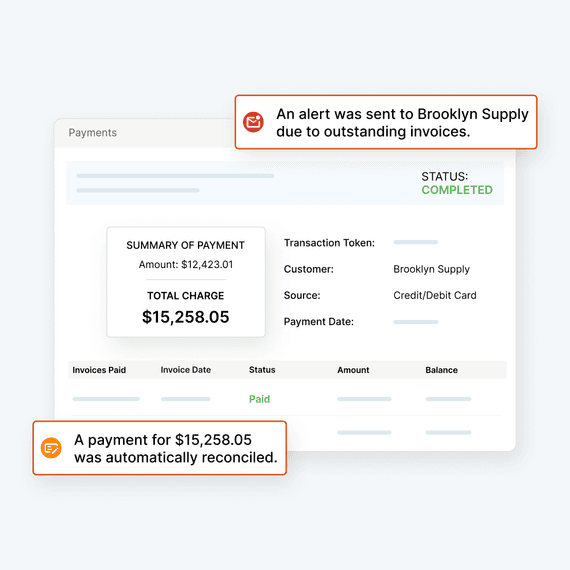

Cash application

Reconcile payments automatically, with zero guesswork

Automatically match payments to invoices, no matter how or where customers remit.

Reporting & reconciliation

Forecast cash flow and close faster

Track essential AR metrics, visualize collections trends, and act on payment risks before reconciliation begins.

TEAMS USING VERSAPAY

Thousands of finance teams like yours are turning AR complexity into cash flow

"Versapay helped us work harder and smarter, automated what took 2 full days, cut DSO by 10 days, and kept cash flowing to give us the flexibility to reinvest in growth."

Chad Feeney, Credit Manager, Mars Electric

"We've transformed our finance operations from a manual mess to a streamlined, strategic advantage; saved the cost of an FTE; and reduced DSO significantly."

Danny Ng, VP of Finance, Crystorama

Experience the future of financial flow

Cash flow shouldn’t be a challenge—it should be a catalyst. Versapay’s fully unified accounts receivable automation platform helps cash flow uninterrupted by letting finance teams collect smoothly and operate without constraints.

Automate your manual processes

Spend less time on low-impact activities and more focusing on growth with end-to-end automation. Let Versapay handle:

- Invoice delivery and presentment

- Dunning notifications

- Basic collections activities

- Cash application and reconciliation

Process and reconcile incoming payments automatically

When customers pay, Versapay captures, processes and applies payments automatically, reconciling them to invoices and posting to your ERP in real-time. No manual entry, just straight-through processing that accelerates cash flow and reduces errors.

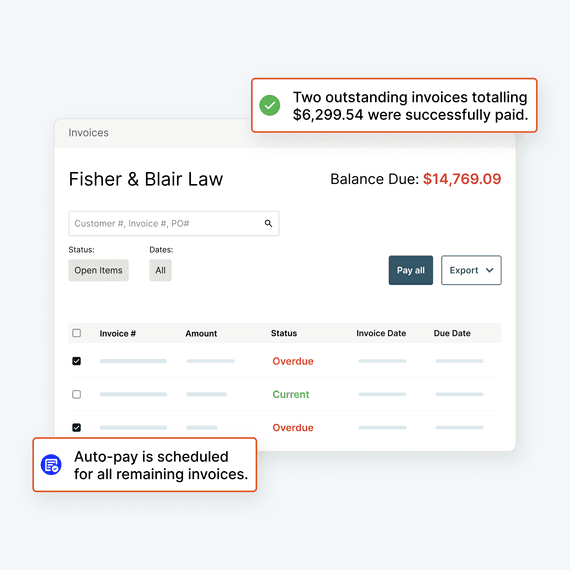

Enable self-serve payments in a cloud-based portal

A branded customer portal helps customers view invoices, make payments, and manage their accounts. Let them pay using preferred payment methods—credit card, ACH, virtual card—schedule recurring payments, and pay multiple invoices at once.

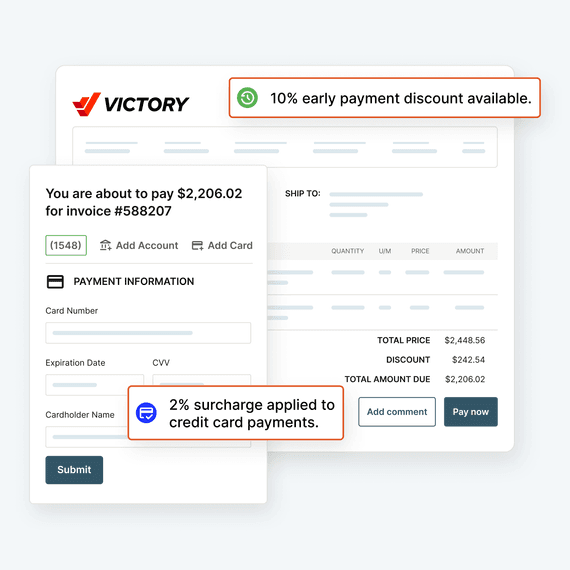

Make accepting B2B payments your competitive edge

Create flexible payment experiences, accept payments from multiple channels, access lower transaction costs with level 3 processing. Take payments from functional to foundational.

- Configurable payment acceptance rules

- Smart fraud and transaction monitoring

- Prepayment and early discount options

Make more time for your business

The teams at Versapay and American Express are here to answer any questions you may have to help you get started. Please complete the form and we will be in touch soon.

Frequently asked questions

1. What is accounts receivable automation software?

Accounts receivable automation software streamlines the entire invoice-to-cash process—automating tasks like invoice delivery, collections follow-up, cash application, and reconciliation. By eliminating manual processes and improving visibility into receivables, AR automation software helps finance teams get paid faster, reduce DSO, and improve customer experience. Solutions like Versapay unify invoicing, payments, and ERP integration in one platform.

2. How does AR automation help reduce days sales outstanding (DSO)?

Accounts receivable automation reduces DSO by accelerating the payment process from invoice delivery to reconciliation. Automated reminders, digital payment options, and real-time tracking of customer activity help ensure on-time payments. Platforms like Versapay also prioritize collections efforts by customer risk and automate cash application, giving finance teams faster access to cash and fewer overdue invoices.

3. What features should I look for in an AR management software?

Effective accounts receivable management software should offer: automated invoicing and collections workflows; a self-service customer payment portal; AI-driven cash application; real-time analytics and reporting; seamless ERP integration; customizable rules for risk and dunning. Versapay’s AR platform combines all of these in a single solution to simplify even the most complex AR processes.

4. What is the different between AR automation and traditional receivables management?

Traditional receivables management relies heavily on manual tasks—like emailing invoices, tracking payments in spreadsheets, and applying cash by hand. AR automation, on the other hand, digitizes and streamlines the process. It reduces errors, improves efficiency, and provides real-time visibility into receivables. Tools like Versapay modernize AR by connecting systems, teams, and customers in one platform.

*Offer Terms and Conditions: This offer by Solupay Consulting, LLC d/b/a Versapay (“Versapay”) is for either (a) a waiver of Versapay’s standard implementation fees, or (b) a 15% discount off Versapay’s standard monthly software subscription fees for thirty-six (36) months. To be eligible for this offer you must: (i) be located in the US or Canada; (ii) be an American Express accepting merchant referred by your American Express representative, (iii) be a new Versapay customer, and (iv) sign a 36-month contract with Versapay within 12 months of being referred by your American Express representative. The amount of the discount may vary depending on the services you choose and Versapay's assessed pricing and fees for such services. If you choose the 15% discount off the standard monthly subscription fee, your contract will automatically renew, and you will be automatically charged at a non-discounted rate starting on the 37th month of your contract. Any information you provide Versapay is subject to Versapay’s privacy policies and terms of use, available at Versapay.com. No guarantee is made regarding savings, service performance, or specific business outcomes. This offer is non-transferable and may not be combined with any other offer. Limit one offer per customer. Fulfillment of the offer is the sole responsibility of Versapay. Versapay reserves the right to modify, suspend, or revoke this offer at any time for any reason, without prior notice, to the maximum extent permitted by law. Void where prohibited.

The information contained herein is provided by Solupay Consulting, LLC d/b/a Versapay and/or its affiliates (“Versapay”) and is for informational purposes only. This document is Versapay’s property and is protected by U.S. and international intellectual property laws. Unauthorized use, reproduction, or distribution of this document, in whole or in part, is strictly prohibited. Information included in this document has been taken from sources that Versapay believes to be reliable, but its accuracy, completeness, or interpretation cannot be guaranteed. Information is current as of the date of this document only and is subject to change without notice. This document is provided “as-is” with no warranties, including any warranty of merchantability, fitness for a particular purpose, and non-infringement. Versapay expressly disclaims all liability arising from or relating to the use of any information or material included in this document for any purpose, including any actions taken or not taken based on the contents of this document. You are solely responsible for making your own independent assessment of the information in this document. For questions regarding any legal, financial, tax, or other matters referenced herein, you should consult your legal and/or financial advisors or other relevant authority.

VERSAPAY® is a registered trademark owned by VersaPay ULC in Canada and the United States of America, and Solupay Consulting, LLC d/b/a Versapay in the European Union and United Kingdom.