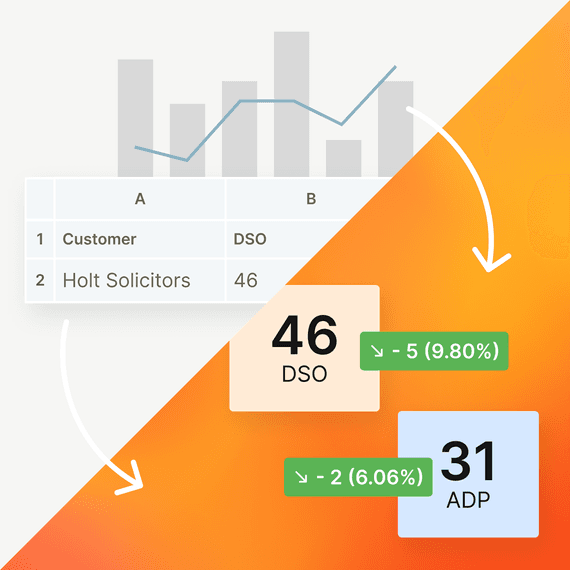

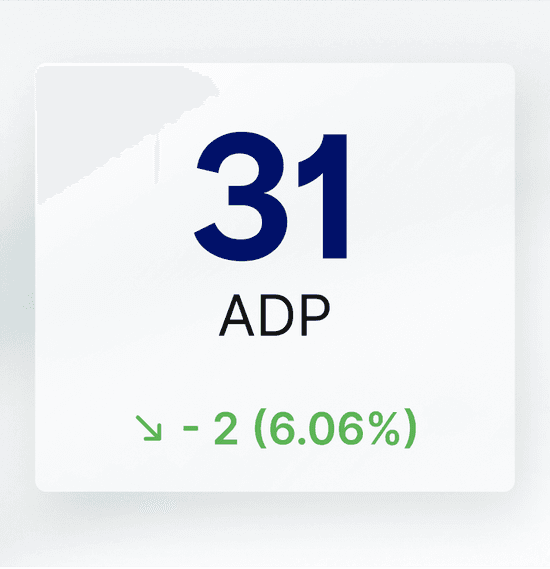

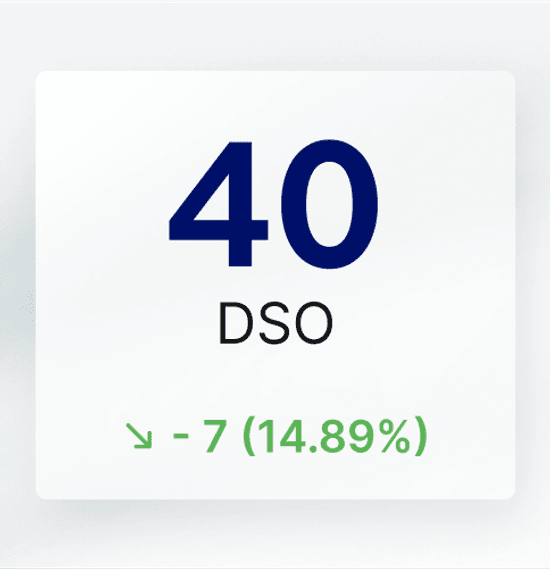

The best AR dashboard software combines real-time metrics like DSO, ADP, and cash forecasting with actionable insights into payment risk, disputes, and credit limits. Versapay’s AR dashboards eliminate manual filtering and exporting, helping finance teams take faster action and accelerate collections.

Forecast cash flow and close faster

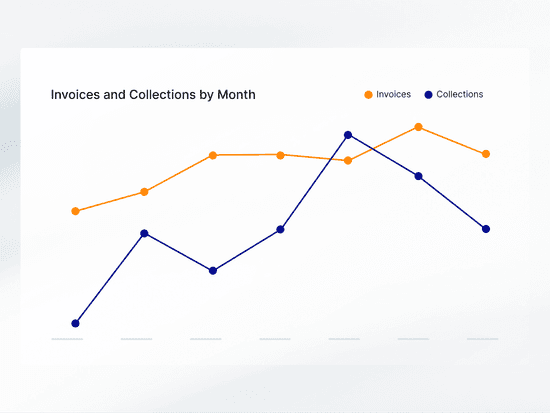

Control your cash flow with accounts receivable reporting software. Track essential metrics like DSO and ADP, visualize collections trends, and act on payment risks before reconciliation begins.

See what’s coming from miles away. Track collections performance in real-time.

less time managing AR

faster payments

fewer past-due invoices

customer satisfaction rate

Reporting should guide your next move, not slow it down

Spreadsheets and static reports delay action, complicating month-end close. We replace manual workflows with real-time dashboards, giving you visibility into DSO, ADP, and accounts receivable performance metrics.

Real-time collections insights

Improve cash flow forecasting and spotlight your top collection priorities

Know how long customers take to pay, who’s at risk of delay, and how it all impacts cash flow. Versapay’s accounts receivable KPI dashboards help you sharpen your forecasts and speed up collections, all without manual analysis.

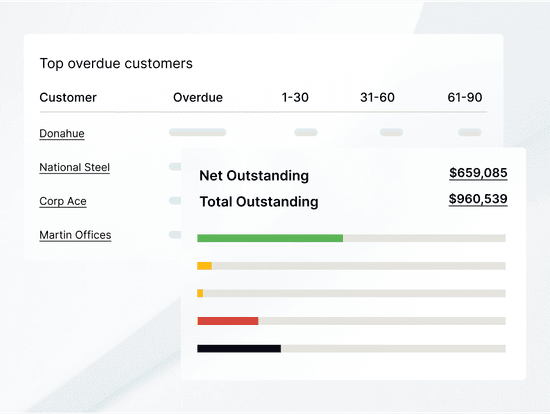

Zero in on payment risks without digging through the data

See how long customers take to pay and who’s slowing you down

Track how efficiently your team turns invoices into revenue

performance toolkit

Learn which KPIs to track to improve collections

You can’t fix what you can’t measure. Grab a copy of our performance toolkit and see how you can improve your accounts receivable performance.

“Versapay improves our bottom line, and lets us focus on productive business. Instead of fighting nickel and dime with our customers, we’re building constructive relationships.”

Anthony Mestroni, CEO, North Atlantic International Logistics

Real-time AR metrics that make a difference in your day-to-day collections strategy

Versapay's accounts receivable reporting software contains a wealth of data. Dynamic insights let you instantly see which customers need attention, eliminating the need for time-consuming filtering, exporting, and manual analysis.

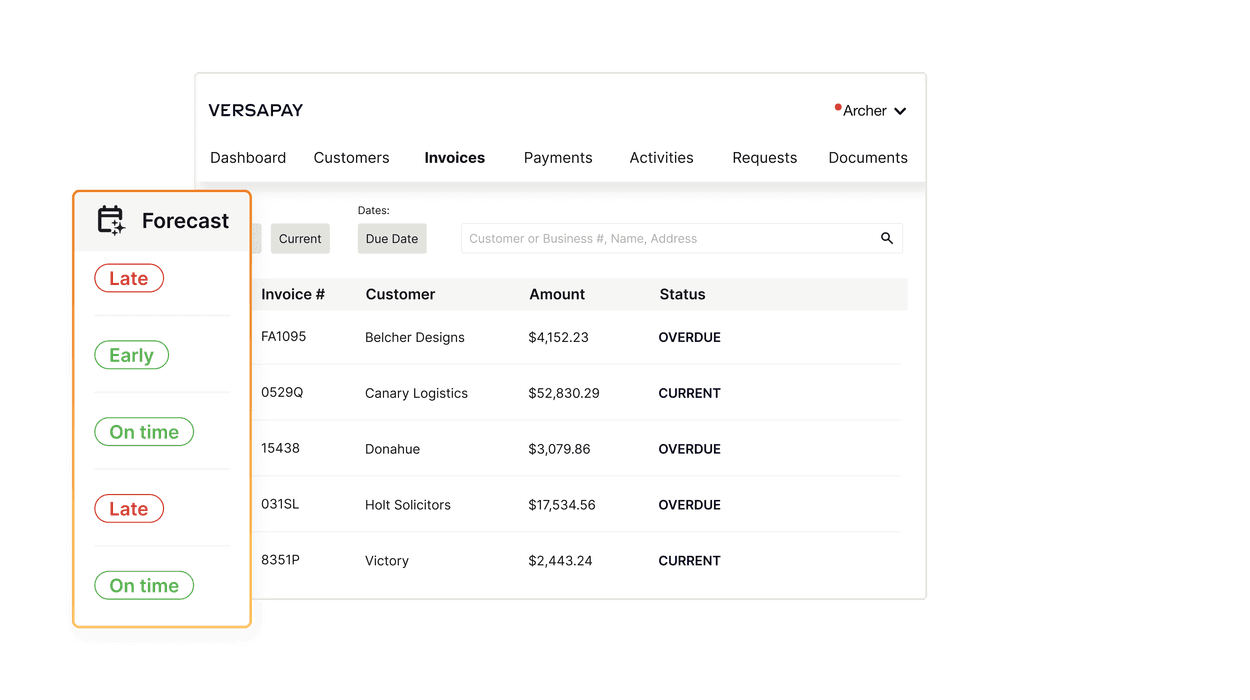

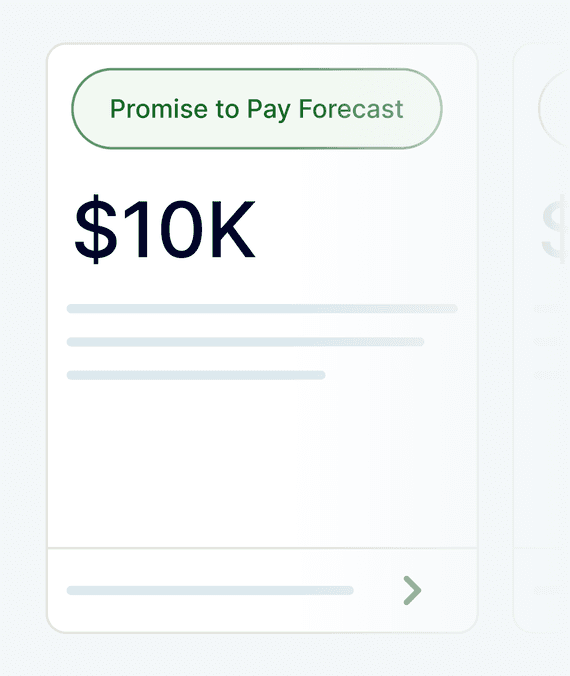

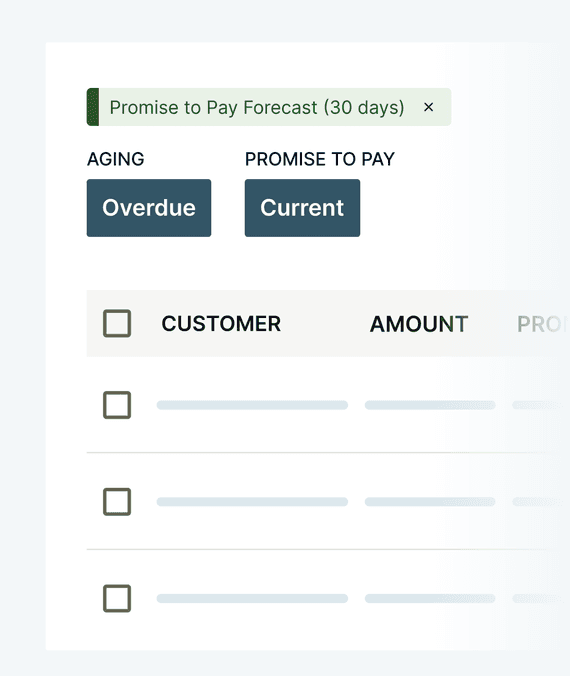

Forecast promised payments

Quickly see total expected payments based on customer promises within the next 30 days.

These insights help you:

• Predict short-term cash inflows

• Focus collections on at-risk gaps

• Proactively share insights internally

Identify overdue promised payments

Late promised payments? See how many, the total dollar value, and the customers falling behind.

These insights help you:

• Flag missed commitments early

• See risk to forecasted cash

• Prioritize targeted follow-up

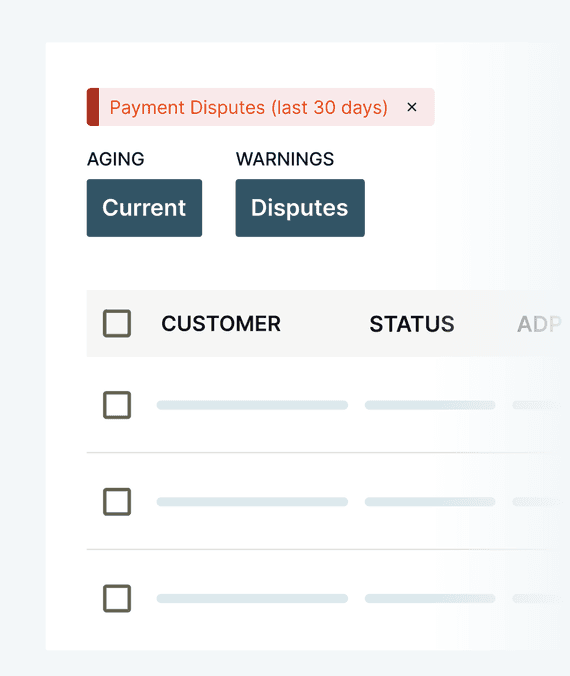

View invoice balances under dispute

Resolve disputes faster by seeing disputes recently opened and affected customers at a glance.

These insights help you:

• Spot dispute trends immediately

• Protect your expected cash flow

• Align accounts receivable and sales

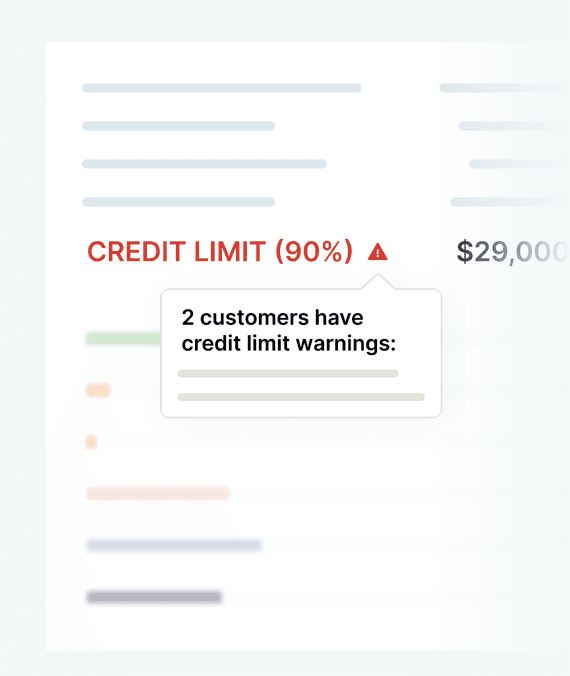

See which customers exceed credit limits

Monitor customers nearing or exceeding credit limits to cut risk and guide escalation decisions.

These insights help you:

• Limit exposure to credit risk

• Strengthen credit control processes

• Prioritize account reviews

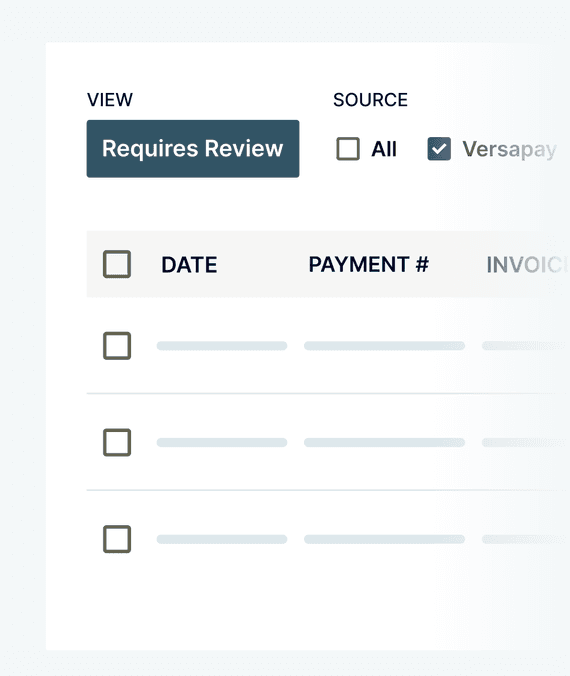

Get the total value of unapplied payments

Track payments not yet matched to invoices to speed up reconciliation and improve accuracy.

These insights help you:

• Accelerate cash application

• Improve AR aging accuracy

• Reduce reconciliation delays

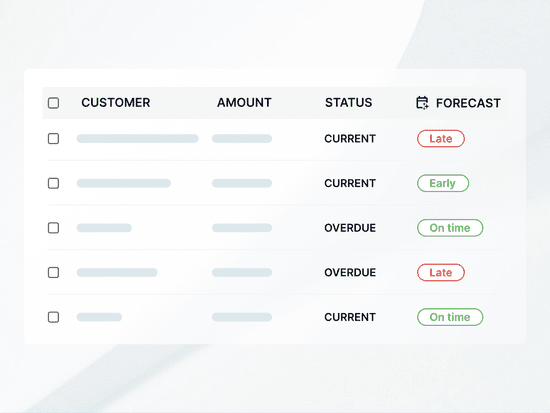

Predict delinquencies earlier.

Stay ahead of aging receivables.

Traditional AR reports show you what’s already happened. We show you what’s happening now, and what’s likely to happen next. Act faster, reduce risk, and collect confidently with intelligent aging views and predictive insights.

Customize AR aging reports to focus on what matters most

Prioritize collections activities and forecast cash

Save time and effort, improve cash flow, and fuel growth

Resources for better reporting

Sharpen your reporting strategy and get the insights and visibility today’s finance teams need to accelerate cash flow, reduce risk, and drive smarter decisions.

Toolkit

The accounts receivable performance toolkit

BLOG

Guide to allowance for doubtful accounts: definition, examples, calculation methods

BLOG

Accounts receivable aging report: definitions, examples, how to use

blog

Accounts receivable turnover ratio: what it means and how to calculate

BLOG

What is days sales outstanding (DSO)? The lifeline of accounts receivable

BLOG

Lower your days deduction outstanding and improve your cash flow

Still have questions? We've got answers!

Accurate AR forecasting depends on more than historical reports. Versapay uses AI to analyze customer payment behavior and generate predictive insights—like who’s likely to pay late and when—so you can prioritize follow-ups and forecast cash flow with greater confidence.

Key AR performance metrics include days sales outstanding (DSO), average days to pay (ADP), aging buckets, promise-to-pay forecasts, and unapplied payments. Versapay’s AR KPI dashboard centralizes these metrics so you can monitor trends, manage risk, and streamline collections.

AR reconciliation software automates the process of matching payments to invoices, tracking unapplied payments, and resolving disputes. Versapay integrates real-time dashboards and predictive insights that reduce manual work and make month-end close faster, easier, and more accurate.

With Versapay, you can monitor late payments through ADP and promise-to-pay metrics, while credit limit warnings and delinquency predictions highlight at-risk customers. These tools help finance teams reduce credit exposure and follow up faster.