Accounts receivable automation for manufacturers

Manufacturers managing high-ticket orders, legacy ERPs, and extended credit terms can now take full control over their order-to-cash processes.

Traditional collections tools weren’t designed to solve manufacturers’ challenges

Managing overdue invoices demands precision and a proactive approach. But unique challenges make controlling cash flow, accessing working capital, and competing agilely near impossible.

Complex invoicing

Multiple SKUs, services, change orders, deposits, and shipments complicate tracking and reconciliation

High DSO

Invoice disputes, returns, and approval-chain delays are common, dragging out days sales outstanding

Highly reactive

Collections teams lack real-time visibility into which customers to call, how often, and when

Late payments

Extended credit terms and large orders increase risk of late payments and cash flow bottlenecks

Disconnected data

AR data lives across spreadsheets, ERPs, and email threads, creating errors, duplicates, and reconciliation delays

Invoice disputes

Discrepancies between POs, receipts, and invoices lead to disputes that hurt cash flow and customer relationships

Global complexity

International customers, currency fluctuations, and regulatory requirements add uncertainty to payments

Seasonal sales

Seasonality and inconsistent payment timing make it hard to forecast and plan for working capital needs

Connect your customers, invoices, and payments in one platform, so your cash flow never gets stuck in production

less time managing receivables

faster payments

fewer past-due invoices

Automation built for how manufacturers sell

You operate on thin margins and complex payment terms. When receivables are tied up across systems, cash flow stalls, and so does production. You need a platform built for high-volume orders, complex billing, and multi-tiered distributors.

Automate and simplify the invoice to cash process, from invoicing to reconciliation

Fully unified AR automation software helps manufacturers remove friction, accelerate cash flow, and take control, so cash flow moves as efficiently as your production lines.

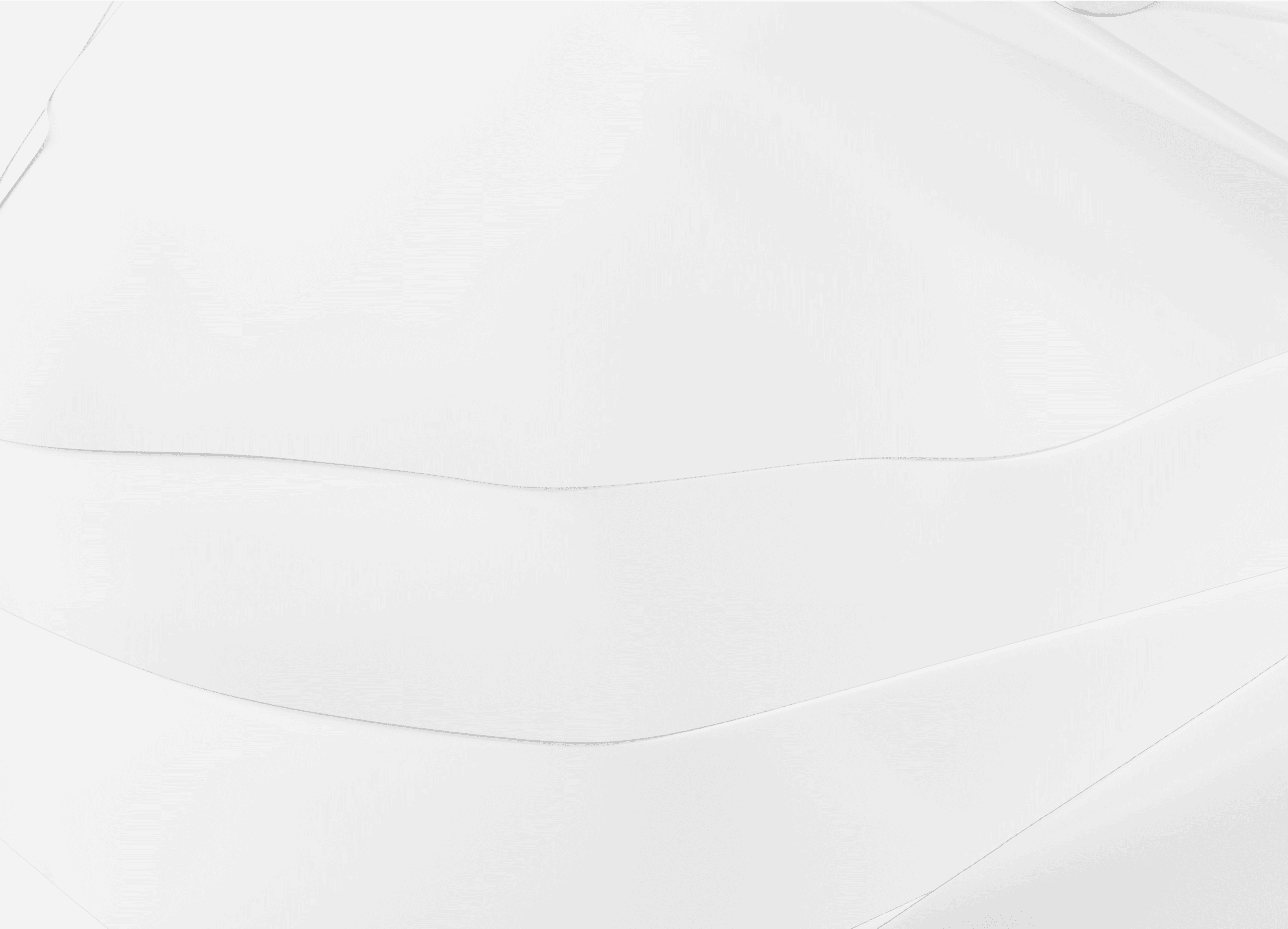

Automate billing and get your invoices paid faster than ever

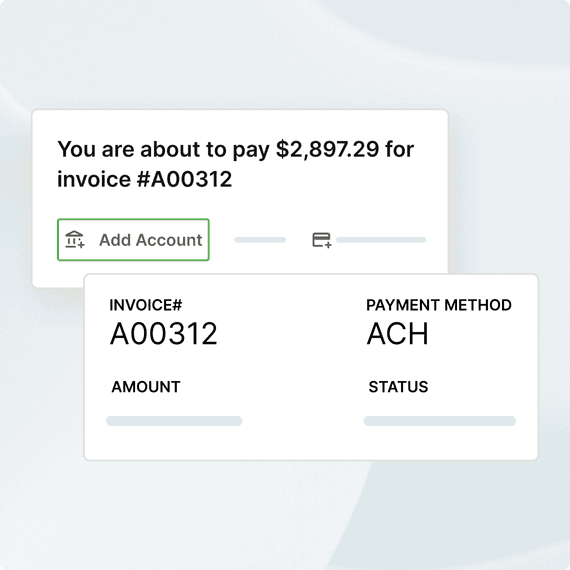

Let customers view, pay, and manage invoices freely while streamlining collections with automated invoicing.

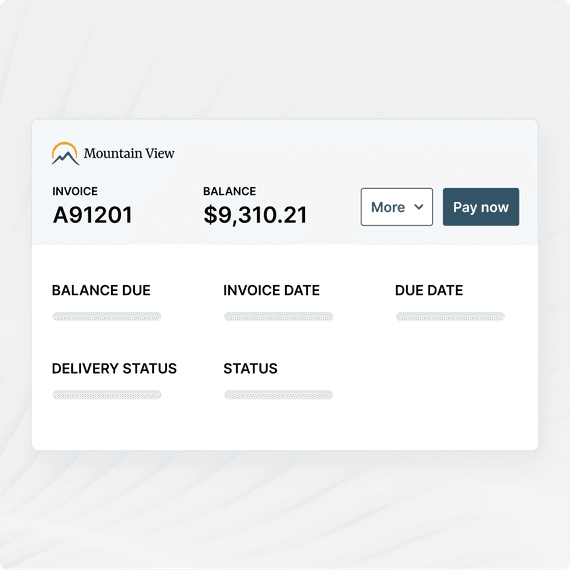

Collect with confidence and stop chasing overdue invoices manually

Automate collections, predict delinquencies, prioritize high-risk accounts, and maintain visibility.

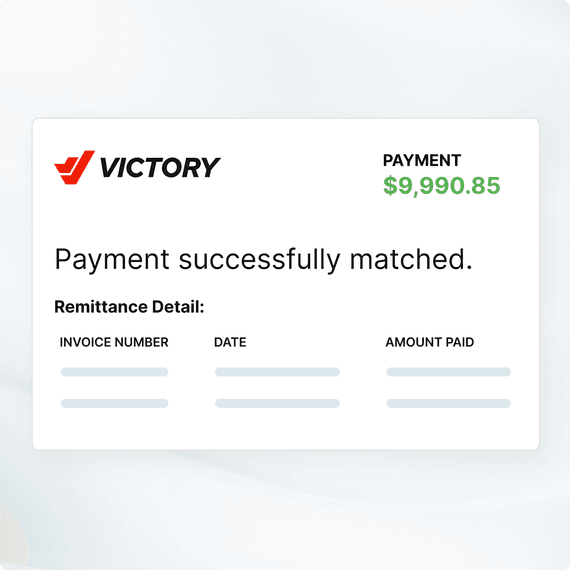

Reconcile payments automatically, with zero guesswork

Automatically match payments to invoices, no matter how or where customers remit.

Accept and process digital payments without disruption

Accept ACH, credit cards, and wire payments in an integrated payments platform.

Experience the future of financial flow

Cash flow shouldn’t be a challenge—it should be a catalyst. Versapay’s fully unified accounts receivable automation platform helps cash flow uninterrupted by letting finance teams collect smoothly and operate without constraints.

The tools manufacturers need to stay competitive and resilient

Tight margins and supply chain complexities aren’t going away. Every day your cash is tied up in receivables, you’re leaving capital on the factory floor. Digitize accounts receivable to improve cash flow and customer experiences.

Eliminate manual invoice delivery and reconciliation

Automatically match payments with open invoices

Built for complex B2B transactions

Effortlessly manage multiple billing terms and payment types

ERP-native integrations

Real-time, accurate data syncing without added IT burden

Built-in customer collaboration

Resolve disputes and capture payments faster through a shared portal

Automation that scales with you

Handle growing transaction volumes without more headcount

Meet the manufacturers whose complexities we turn into cash flow

Trusted by 10K+ customers and 5M+ companies, Versapay helps manufacturers process millions of transactions and hundreds of millions in payments annually.

Laticrete improves an inefficient collections process, boosting cash receipts by $6 million

“Our goal is to prevent having to get more employees. Versapay does the work of three employees right now.”

— Andrew Ceccorulli, Manager, Credit & Collections, Laticrete

Johnny’s Selected Seeds uses predictive insights to prioritize customer follow up

“Customers let us know through our online portal that they’re facing challenges that will cause payment delays, saving us doing outreach.”

— Samantha De La Croix, Accounts Supervisor, JSS

Save time and effort, improve cash flow, and fuel growth