Exploring Electronic Payment Processing: 5 Burning Questions Answered

- 4 min read

We address five of merchants’ burning payment processing questions, explain why B2B payment acceptance is becoming more customer-focused, and explore payment processing services.

The markets are seeing seismic shifts in how buyers engage with merchants to pay for goods and services. The most transformative being preferred methods of payment.

Accelerated by recent events, B2B buyers are embracing electronic payments and merchants are finding that to remain competitive, they need to meet these changing expectations. Electronic payments are money transfers that don’t warrant physical cash or paper checks. Electronic payment methods consist of debit cards, credit cards, digital wallets, wire transfers, and ACH transfers.

Merchants are now simplifying how they accept payments and are partnering with payment processors that embed within their enterprise resource planning (ERP) solutions to transform their accounts receivable processes, better drive digital payment adoption, reduce processing costs, and speed up payment cycles.

But online payment processing is still relatively new for many merchants, and many of their questions have been unanswered—until now.

Jayme Moss, Executive Vice President of Payments Operations and Strategy at Versapay recently joined PYMNTS.com to discuss how going digital requires merchants to clear their payment processing blind spots. In this podcast, she addresses 5 electronic burning payment processing questions, explains why merchants are becoming more customer-focused, and explores what payment processing services are out there.

We’ve summarized her key insights for you in this blog.

Listen to the podcast or continue reading below

1. What digital payment processing challenges do merchants face?

As the workforce continues its massive transition towards remote and hybrid work arrangements—it’s estimated at least one-quarter of employees will be working remotely by the end of 2021—merchants are realizing how unsustainable their paper-based processes are.

Layer on the B2B community clamoring for a more seamless, easy-to-use billing and payment experience—one more akin to what they’re accustomed to as consumers—and merchants suddenly find themselves in a very precarious position.

And, with limited in-office resources at their disposal, it’s increasingly difficult to receive customer payments in the form of checks. Buyers’ irritations with having to pay manually—paper checks, bank-initiated transfers, etc.—and suppliers’ inability to continue accepting traditional paper-based payments are the most pressing challenges merchants are currently facing. We're witnessing first-hand a shift in purchasing power.

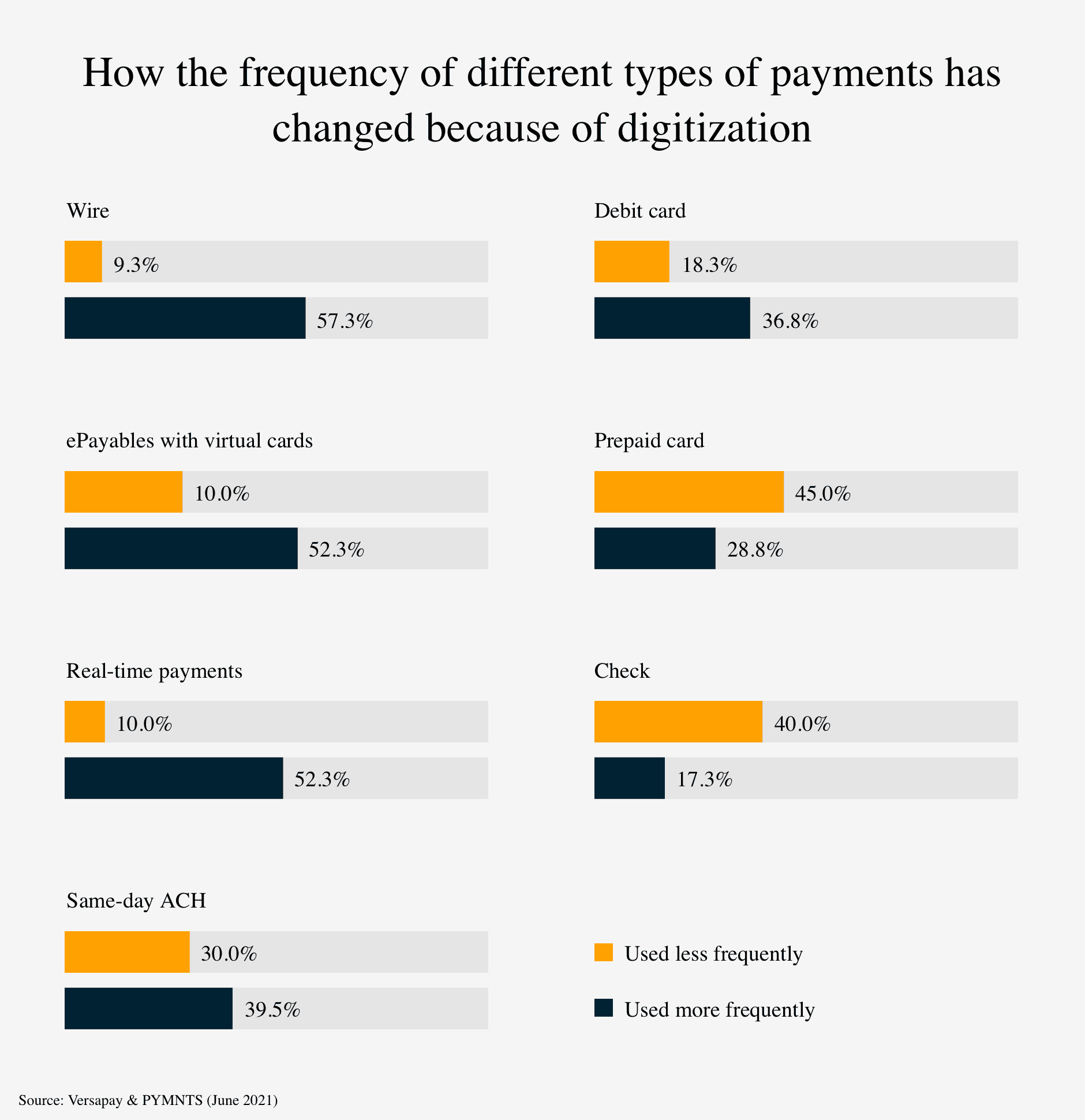

The ability to offer customers the payment options that are most convenient for them is a distinct competitive advantage in B2B. A recent survey revealed that CFOs are investing significantly in digitizing their accounts receivable functions and are increasing their use of digital payments, allowing them to reduce their reliance on paper checks.

As a business, you have the delicate task of balancing both customer satisfaction and business growth. The new digital revolution brought on by the pandemic is shining a light on how empowering customers to self-serve and choose their payment method is a significant factor in determining how fast you collect payment, and in turn how fast that cash becomes available as working capital.

2. Why empower customers to pay how they want?

Take a moment and think back to a positive experience you recently had when paying for something. We’re willing to bet you instinctively remember purchasing something as a consumer: shopping for apparel at your favorite online retailer, ordering dinner from an online delivery service, or securing a ride using a ride-sharing application.

What each of these experiences has in common is how simple it was to pay for these goods or services. In a matter of clicks, you were able to locate the item you wished to purchase, select your payment method, input your card and billing information, and complete the transaction.

The B2B buying experience has been slow to place value on convenience and payment flexibility—something the B2C buying experience excels at. The B2B post-sale experience is changing, however, and what some payment processors are now focusing on is replicating those desirable B2C payment experiences, and bringing them into the B2B realm. There are three key benefits to doing this:

Driving accounts receivable efficiency

The top motivation CFOs cite for digitizing their accounting operations (with 96% of them reporting so) is to benefit their customers and vendors. That said, in bringing digital technologies into your payment acceptance and accounts receivable (AR) processes, there are also the obvious benefits of reductions in manual labor, leading to major efficiency improvements.

Accelerating cash flow

These efficiency gains can lead to significant improvements in cash flow acceleration, thanks to businesses no longer having to wait around for customers’ checks to come in the mail. You can also incentivize customers’ use of certain digital payment methods (for instance offering discounts for customers paying with autopay or credit card), helping you get paid even faster.

Humanizing the experience

The average online shopping cart abandonment rate—the rate at which a customer decides not to make a purchase once reaching checkout—is just shy of 70%. While many factors contribute to this percentage, much can be attributed to merchants not offering diverse payment methods—63% of consumers are more likely to make a purchase if digital payments are accepted. In meeting their customers' payment expectations, merchants are more likely to drive incremental sales and enjoy higher levels of customer satisfaction and retention.

3. How can payment processors help merchants lower their processing fees?

When it comes to accepting payments, every penny counts, and much like their traditional counterpart—the check—there’s a price associated with accepting digital payments. The most sophisticated payment processors, however, possess mechanisms that help businesses save significantly on processing fees—in some cases, up to 40%.

Not all payment processors are created equally, and while many are effective at processing digital payments, not all processors can provide the same levels of savings. What many payment processors lack are deep integrations with your ERP that allow for sending additional customer information with every transaction, helping reduce payment card industry (PCI) scope and lower interchange fees as a result—this is what's known as interchange optimization.

80% of payment processing fees are tied up in interchange, which are fixed fees that banks collect on each transaction. On a per-transaction basis, the fees a merchant incurs are marginal and rarely worth fretting over. As the volume of transactions increases, however, and the per-transaction dollar value increases (with big-ticket purchases being common in B2B), merchants will want to ensure the payment processor they’ve partnered with is proactively taking steps to minimize their costs.

By embedding payment processing within your ERP, select payment processors can pass along higher levels of data with each transaction. When level 2 and level 3 data—product codes, invoice numbers, order numbers, freight amounts, etc.—are provided, banks recognize the transaction as more secure, resulting in lower interchange costs.

Other ways payment processors can help merchants lower their processing fees include reauthorizing stale transactions, partial authorizations (when products are only partially shipped and what’s outstanding ships later), and authorization reversals on unused authorizations.

4. Why should payment processing companies have proprietary payment gateways?

Many merchants rely on third-party vendors to assist with their digital payment processing needs. Commonly outsourced components include shopping cart plugins, customer portals, and payment gateways—some payment service providers even outsource the process of tokenizing transactions to ensure PCI DSS compliance.

The problem with this lies in its impact on the overall customer experience. Customers are—rightfully—at the heart of accounts receivable digitization endeavors, and payment processors are feeling pressure to create more seamless transaction flows.

When payment information is passed between multiple vendors—many of whom are not privy to the merchant’s business needs or have not built relationships with the merchant—the transaction flow feels fractured and lackluster. The merchant loses a significant amount of control, and the payment processor is unable to oversee the entire customer experience.

Unfortunately, the number of payment processors that provide a holistic suite of merchant services—proprietary payment gateway included—are few and far between. Those that do ultimately perform payment facilitation in-house can ensure a more seamless payment experience for customers and greater back-office efficiencies for merchants.

Payment processors that operate as gateways as well can control the entire transaction flow without experiencing downtime by having to depend on customer service, onboarding, or any other myriad third parties. Outsourcing degrades the customer experience, and therein lies the value of developing and controlling every facet of a transaction.

5. What are the benefits of an ERP-embedded payment flow?

For thousands of accounting and finance teams, their ERP systems are synonymous with business operations. Financial tracking, inventory and supply chain management, procurement, and ecommerce website hosting—to name a few—often all live within ERPs, making them highly critical partners in supporting businesses’ day-to-day activities and growth.

According to PYMNTS, fragmented systems and processes are the primary cause of strain on accounting teams managing the B2B commerce cycle. When merchants perform accounts receivable—and accounts payable—processes in separate systems, they often struggle to send and receive payments and maintain positive cash flow.

Understanding that merchants perform many mission-critical tasks within their ERPs, it’s important that payment processors create streamlined processes that do not interfere or distract their users from the job at hand. It's for this reason, that some payment processors offer solutions that are truly embedded within an ERP—ones that blend seamlessly, as would a puzzle piece. The highest quality integrations ensure merchants are unable to tell where their ERP stops, and the payment processor begins.

We mentioned earlier how businesses are seeing an increase in the use of digital payments. This is important because as B2B businesses begin modernizing their payment processes, they’ll naturally look for ways they can reduce their reliance on manual activities—and will look to migrate AR and AP processes to electronic channels.

In integrating payment processing capabilities with ERP systems, merchants gain the ability to automatically email their invoices, process customer payments, offer diverse payment methods, lower their processing fees, automate manual processes, enhance security, and increase revenue. The benefits of an ERP-embedded payment flow are nearly limitless.

—

Interested in learning more about electronic payment processing and how the right credit card processing technology can speed up and automate payments? Download The Ultimate Guide to Credit Card Processing and learn how to choose the best payment processor for your business

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.