Credit Card Surcharges: Overview (and Solutions) for Merchants Accepting Credit Cards

- 21 min read

Implementing a surcharge can offset some payment processing fees when accepting credit card payments.

Learn what surcharges are and how you can implement them using certain payment processing technology.

Many business-to-business (B2B) buyers prefer paying by credit card for the convenience it affords, the opportunity to take advantage of rewards, and the cash flow benefits of delaying payment.

For B2B sellers, however, the feeling isn’t always mutual. While much cheaper than checks, credit cards are among the costlier payment methods to process, with credit card processing networks—like Visa and Mastercard—steadily increasing their fees. According to Nilson, US merchants paid slightly more than $160 billion in payment processing fees a few years ago from accepting debit, credit, and prepaid cards.

But, with online commerce only gaining in popularity—B2B ecommerce sales rose to $2.082 trillion in 2023—accepting credit cards is somewhat non-negotiable. (Plus, the benefits of accepting digital payments far outweigh the negatives.)

To avoid missing out on a substantial revenue stream by refusing credit cards altogether, sellers have a few options to reduce or significantly offset the cost of accepting credit cards. These include adding credit card surcharging fees, which is our topic du jour!

Table of contents

What is credit card surcharging?

To process credit card payments, card networks charge merchants around 1.3% to 3.5% of every transaction. This does not include the additional fees merchants will pay to their payment processor, which depends on the rate structure they have chosen—flat rate, interchange-plus, or tiered. Some businesses use a credit card surcharge fee to offset these costs.

What is a surcharge fee?

Credit card surcharging involves charging an additional fee to customers paying by credit card. The goal of surcharging is to offset processing costs. This often takes the form of an additional cost—say, around 2%—applied to the purchase. With credit card use being such a fixture of our increasingly digital marketplace, finding a way to reduce processing fees is a top priority for many merchants.

Beyond surcharging credit cards, another method sellers might use to recoup some of the costs of processing credit card transactions is introducing a convenience fee. Whereas a credit card surcharge fee is based on a percentage of a customer’s transaction, a convenience fee is a fixed rate.

As with credit card surcharging, the rules for credit card convenience fees vary by credit card network. Visa, for instance, allows merchants to charge a convenience fee for non-standard payments. This means merchants can charge a fee to accept payment methods that differ from what they typically accept—for example, a customer paying online instead of via check or in person. Other credit card networks only allow government agencies and select businesses to add a convenience fee.

Sellers are allowed to require a minimum purchase amount to accept credit card payments, as long as it doesn’t surpass $10. They can’t, however, impose a maximum purchase amount for credit card transactions. Some sellers will offer their customers discounts if they pay by debit or cash. Cash discounting is legal everywhere in the US, whereas credit card surcharging and convenience fees are not legal in every state.

Which leads us to…

Is credit card surcharging legal?

Credit card surcharging has been allowed in most states since 2013, when a class action lawsuit alleging the major card networks were charging exorbitant fees was resolved. There are, however, some surcharging laws to be aware of.

State credit card surcharge laws

As of February 15, 2024, Connecticut, Maine, Massachusetts, Oklahoma, Quebec and Puerto Rico prohibit surcharging, and Colorado, Minnesota, New Jersey and New York have requirements for surcharging.

International credit card surcharge laws

Elsewhere in the world, except for Australia, Mexico, and New Zealand, credit card surcharging is not permitted. If you do business in multiple states where surcharging laws vary, you can apply a surcharge in states where the practice is allowed. Each state has its own nuances when it comes to regulating credit card surcharges, so it’s important to be aware of state requirements at each location where you intend to implement a surcharge.

5 credit card surcharging rules

While credit card surcharging might be permitted in most US states, there are several rules around the practice that merchants need to ensure they’re following.

1. You must notify most card brands and your merchant services provider prior to implementing a credit card surcharge

If you intend on surcharging your customers, you will need to notify the credit card networks you support and your merchant services provider well in advance. For all card brands—except for American Express and Visa—you’ll need to notify them in writing at least 30 days before you plan to start surcharging.

2. You must ensure the credit card surcharge is properly disclosed and your customers are aware of it

You must disclose the presence and amount of a credit card surcharge fee to customers at the point of sale. For brick-and-mortar stores, this will mean including some form of signage at both your entrance and register. For ecommerce stores, this will mean including a statement on your checkout page.

If collecting on accounts receivable, you’ll want to communicate the presence and amount of the surcharge wherever you are directing customers to pay, such as an online payment portal. This should be clearly visible prior to customers inputting their card details. You’ll also need to indicate the surcharge as a line item on customers’ receipts and in your accounting software.

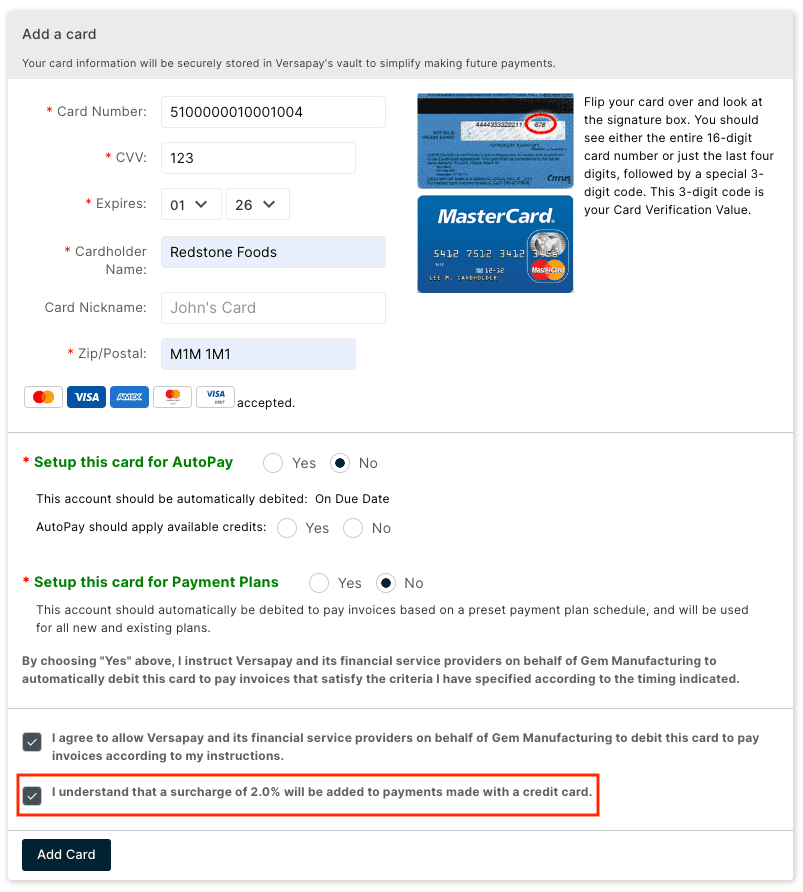

With Versapay, if you enable it, your customers can pay their invoices using credit cards. When your customers add their credit cards as a payment method—and you’ve indicated that there are surcharges associated with using credit cards—they’ll be informed. Here’s what that looks like for your customers:

3. You can’t profit from credit card surcharging

The cost of a surcharge cannot exceed 4% of the underlying transaction cost or your cost of acceptance per transaction—whichever is the lowest. This rule was put in place to ensure sellers can’t profit from a credit card surcharge fee—they can only use it to cushion their margins by reducing their processing fees.

4. You can’t add a credit card surcharge for purchases using debit cards or prepaid cards

A credit card surcharge cannot be applied to payments made with a debit card or a prepaid card. Payment processing fees for debit payments are structured differently and are typically less costly to merchants than credit card payments.

5. You must surcharge at the card brand or product level

Both Visa and Mastercard state that you can apply a credit card surcharge at the brand level or at the product level—but not both. A brand-level surcharge means you’re applying a surcharge in the same amount to all cards from that network. A product-level surcharge means you’re applying a surcharge to a particular type of card from that network—be it a traditional card, or a rewards card, etc.

The pros and cons of credit card surcharging

Credit card surcharging is especially appealing to smaller businesses, whose profits might otherwise take a hit from the high cost of accepting credit cards. The ability to lower operating costs by implementing a credit card surcharge is widely viewed as valuable.

Midsized B2B businesses can also benefit from surcharging as a means of easing their transition to digital payments. These businesses typically deal in orders of larger value and stand to lose more to processing fees as a result. Surcharging also enables these businesses to offer electronic payments to their customers in order to make exchanging documents and payments more efficient.

It is a viable mechanism for covering the cost of providing faster payment options.

Now, with credit card surcharging comes the potential for a compromised customer experience. Not all customers will be willing to pay the additional fee. A study by American Express found that 78% of cardholders believe it’s unfair to charge customers a fee based on their preferred method of payment. 86% also said that if a business they frequent often were to start surcharging, they would likely take their business elsewhere.

Conversely, as credit card surcharging becomes more commonplace, customers are becoming more used to the practice and may be less turned off by it.

Offset payment processing costs by surcharging with Versapay

With Versapay, you can implement credit card surcharging and pass a portion of payment processing fees onto your customers. Of course, you’ll still need to adhere to specific guidelines set by the card networks—and comply with state laws.

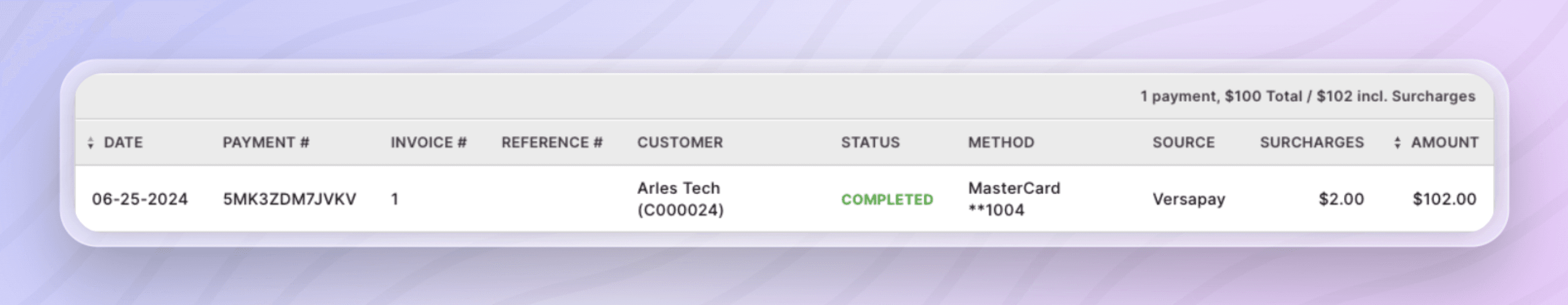

If considering surcharging, be sure to clearly communicate your policy to your customers. Consider positioning surcharges as alternatives to requiring check or cash payments, which your customers are surely keen to move away from. Take a look at the image below, to see what an applied surcharge looks like on a customer payment made through Versapay:

You’ll notice the surcharge fee is visible within the second-to-last column. And above that, a statement clearly relays the payment amount including surcharges. An added benefit to surcharging within Versapay is that having these fees immediately visible streamlines workflows and improves efficiency.

Is credit card surcharging right for your business?

Before implementing credit card surcharging, we generally suggest businesses carefully consider the following. This will help you make an informed decision on whether implementing surcharges is right:

The legalities — Make sure that surcharges are legal in your state and / or region.

Card network rules — Understand the rules put forth by credit card networks like Visa or American Express. These rules will include surcharging limits, for instance.

Customer communications — It’s important you’re transparent with your customers when implementing a surcharge.

Downstream or CX impacts — Surcharges are controversial. Buyers may opt for different payment methods or in some extreme cases, take their business elsewhere if they feel the surcharge is unfair. Balancing your financial interests alongside your buyers’ satisfaction is important.

Administrative implications — Managing surcharges might not be possible with your processing systems today. Implementing them could require changes to billing or payment processing operations.

Beyond those considerations, here are five questions to ask yourself:

1. Is your business in a highly competitive market?

If the market you play in is highly competitive and your customers have strong substituting power, it’s unwise to start surcharging. If a customer doesn’t want to pay an additional fee, they’ll have no problem taking their business elsewhere.

2. What payment methods do you primarily accept?

If credit cards only represent a small portion of your accepted payment volume, then the potential savings from a credit card surcharge fee are likely not worth the resulting impact on customer experience and loyalty.

3. Do you operate in an industry with thin margins?

Businesses in industries that have narrow profit margins—such as wholesale distributors—can greatly benefit from the opportunity to offset or reduce payment processing costs. You might also consider adding a surcharge only on select items with particularly low margins.

4. Would your customers be open to a surcharge?

If you have a strong customer base and find yourself in a market with minimal competition, then applying a credit card surcharge might not have much of an effect on customer loyalty. For some customers, the benefits of paying by credit card heavily outweighs the disadvantages of having to pay an additional fee.

For example, for some businesses, corporate cards act as their operating line of credit. And the working capital benefits these businesses gain from using credit cards could make them open to a potential surcharge. But before forging ahead with credit card surcharging, it’s a good idea to gauge your customers’ potential receptiveness to it.

5. Could it be your payment processor that’s the problem?

If credit card processing fees are hitting your business particularly hard, then it might be worth reevaluating your payment processor. If not offered by your current vendor, you would likely benefit from a processor that offers interchange optimization—the process of sending additional data with every transaction to the issuing bank in order to lower your interchange fees.

When you process payments through Versapay, because we integrate directly with your ERP, we can easily support Level 2 and Level 3 processing and save you up to 40% on your processing fees. If you choose to add a surcharge, Versapay can support this by ensuring the surcharge is recorded and applied in your accounting system automatically.

Ultimately, surcharging is a viable solution for sellers who accept credit card payments, yet are unhappy with the associated processing fees. However, it’s not the only solution. Your choice of payment processor is arguably more critical. A good payment processor enhances customer experience, enables surcharging if desired, makes accepting a variety of payment methods possible, and helps build customer trust.

Credit card surcharge FAQs

Surcharging involves adding a specific fee to a particular payment method, such as credit card—rather than check or cash—that is not otherwise charged if payment is made by other means. Sellers often consider surcharging—or adding some sort of service or convenience fee—to offset the price of accepting credit cards.

Is a surcharge the same thing as a service or convenience fee?

No, it is not. Convenience fees are fixed fees that can be applied when a particular payment method is accepted as an exception to the usual payment methods. An example would be a not-for-profit organization that only accepts cash in person. If this organization took a credit card payment over the phone as a rare exception, a convenience fee could be applied in this case because the organization would have to do something out of the ordinary workflow to accept it.

In the US and Canada, service fees are special fees that are only permitted for specific industries. Primary examples of this are tax payments, government services, court costs, schools, and nursing facilities.

How is surcharging related to cash discounts?

In general, cash discounts are legal even if surcharging is not. The distinction with cash discounts is that the standard displayed price is the credit card price; if the customer pays cash, they can receive a discount from the displayed price. The most familiar scenario with cash discounts is the price signs displayed at gas stations.

What percent can a merchant add for a surcharge?

The surcharge cannot be more than the merchant’s cost of card acceptance. Card brands additionally set a maximum surcharge in each country regardless of the cost of acceptance. In the United States, Visa lists 3% of the transaction amount for the maximum surcharge, while Mastercard sets 4%. In Canada, both Visa and Mastercard list 2.4% as the maximum. The state of Colorado limits surcharges to 2%.

Where is surcharging legal in the US and Canada?

Surcharging is largely legal in the United States and Canada. There were longstanding laws in various states and provinces prohibiting surcharging that have either been removed or rendered non-enforceable by previous court judgements.

Can you surcharge on a debit card?

Visa and Mastercard prohibit surcharges on debit transactions.

Can you add a surcharge on a debit card when it is run as “credit?”

Some debit cards are charged as “credit” when they have a Visa or Mastercard logo on them, but surcharges are still prohibited in these scenarios. It does not matter whether the customer selects the ‘debit’ or ‘credit’ button in these instances; it is still not allowed.

Do Versapay products support surcharging?

Yes, Versapay Collaborative AR supports credit card surcharging. While surcharges cannot be initiated in our embedded ERP Payments solutions, any surcharges performed via Collaborative AR can be supported in the embedded ERP solutions.

Who enforces surcharging rules?

Legally, surcharging rule enforcement largely flows through consumer protection laws. If a customer takes issue with the application of a surcharge, they would likely submit a complaint to the attorney general of their state under the umbrella of consumer protection. Besides legal suits, the card brands enforce the rules stating the % allowed and whether proper displays / disclosures are made by the merchants.

Does a seller have to register with the bank or card brands to be allowed to surcharge?

Visa has lifted its requirement to register prior to surcharging, but merchants should still inform the issuer of their merchant account. A merchant must still inform Mastercard 30 days prior to the first surcharge.

If a seller and a customer are in different states, which state laws apply for surcharging for card not present transactions?

There is not a clear answer to this question. Surcharging rules are governed by the card brands, such as Visa and Mastercard, and state / provincial consumer protection laws. Card brands generally focus on the amounts being surcharged and whether proper displays / disclosures are made by the merchant.

The card brands defer to state / provincial laws about the legality of surcharging within a particular jurisdiction. State laws do not explicitly state whether they apply to merchants or customers or both in their jurisdiction. Because of the lack of clarity in the laws, merchants, in conjunction with their legal counsel, must decide how conservative they wish to be in interpreting these laws, either by not enabling surcharging for customers in states where it is prohibited, and / or not surcharging if registered in a state where it is prohibited.

What other requirements must be met for surcharging?

Credit card surcharges must be broken out as a separate line item. They must also be displayed prior to the charge so that the customer can opt out of the purchase.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.