The Ultimate Guide to Credit Card Processing

Learn how credit card processing technology can speed up and automate payments, reduce manual processes, accelerate cash flow, and more!

Gotta run? Download the designed PDF (for free!) instead

The Ultimate Guide to Credit Card Processing

April 19th, 2023

This guide will help you understand how credit card processing technology can:

✓ Speed up and automate payments

✓ Reduce manual processes

✓ Accelerate cash flow

✓ Drive more revenue, and

✓ Empower crucial staff to perform more strategic activities

This guide explores:

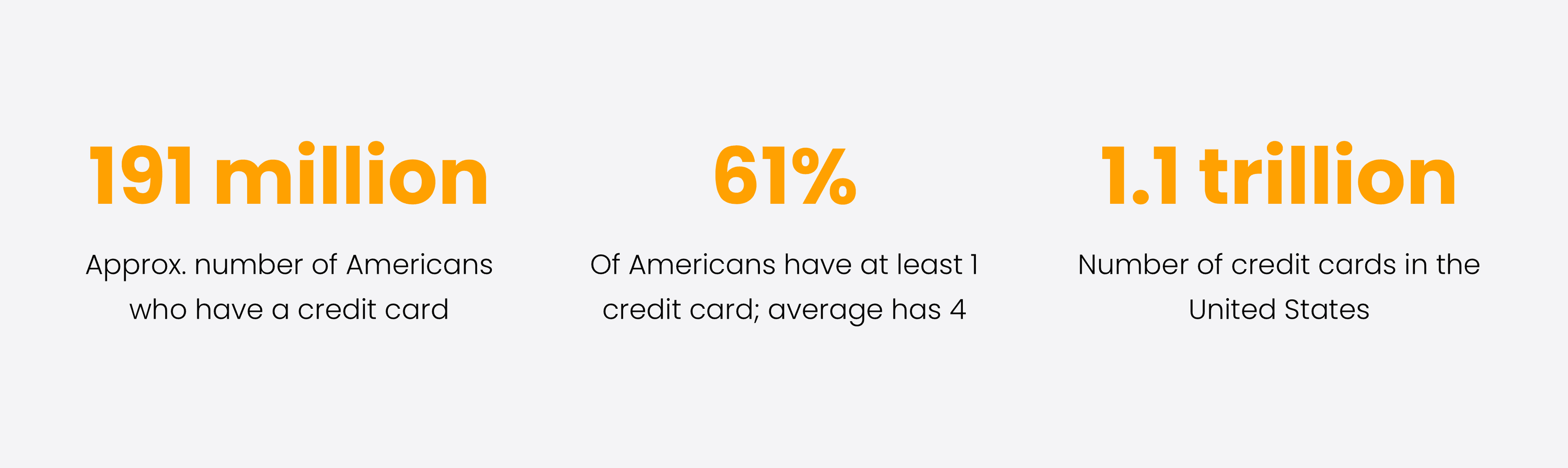

- The rise of credit card use

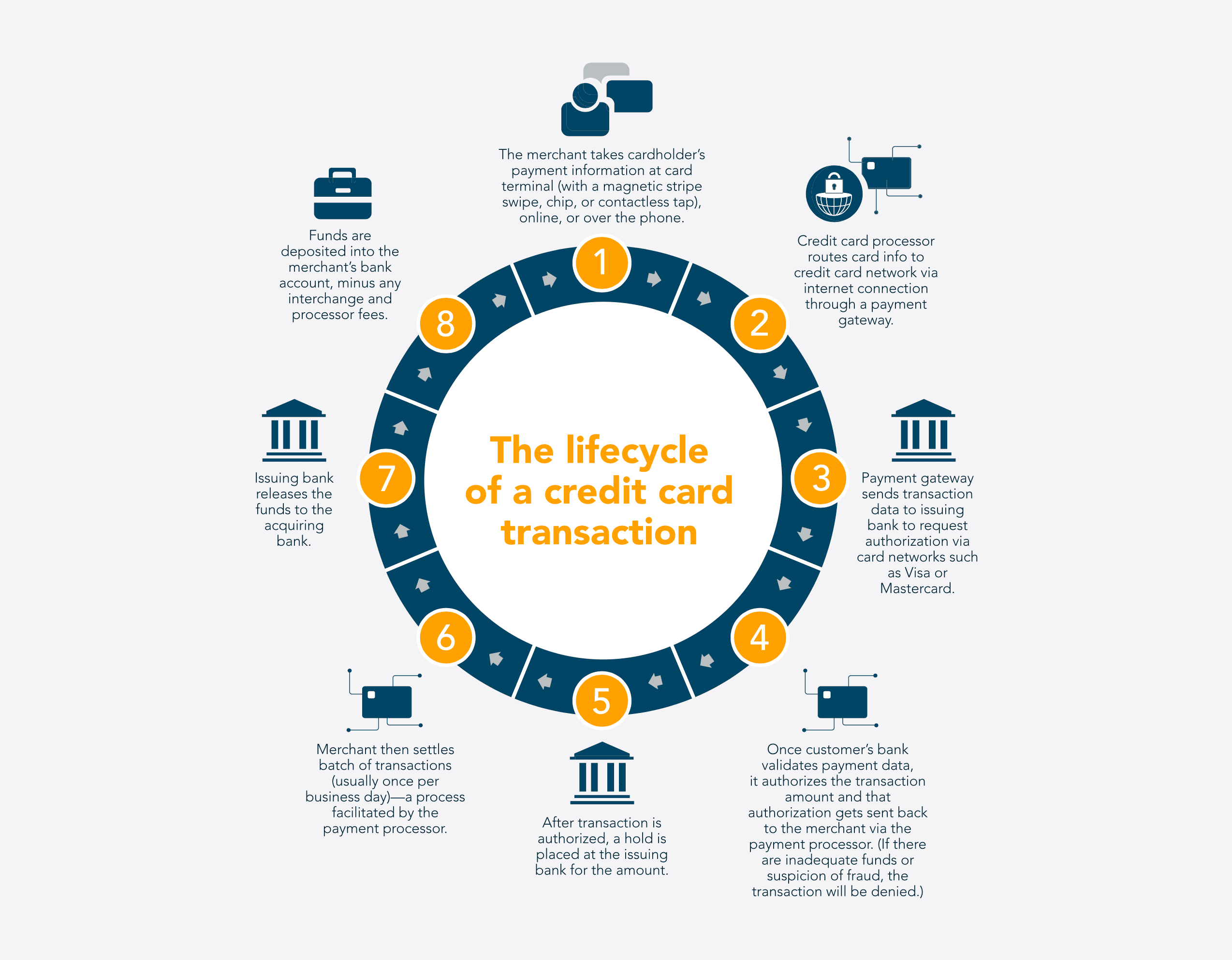

- The entities involved in the credit card processing ecosystem

- The different processing fees and pricing models

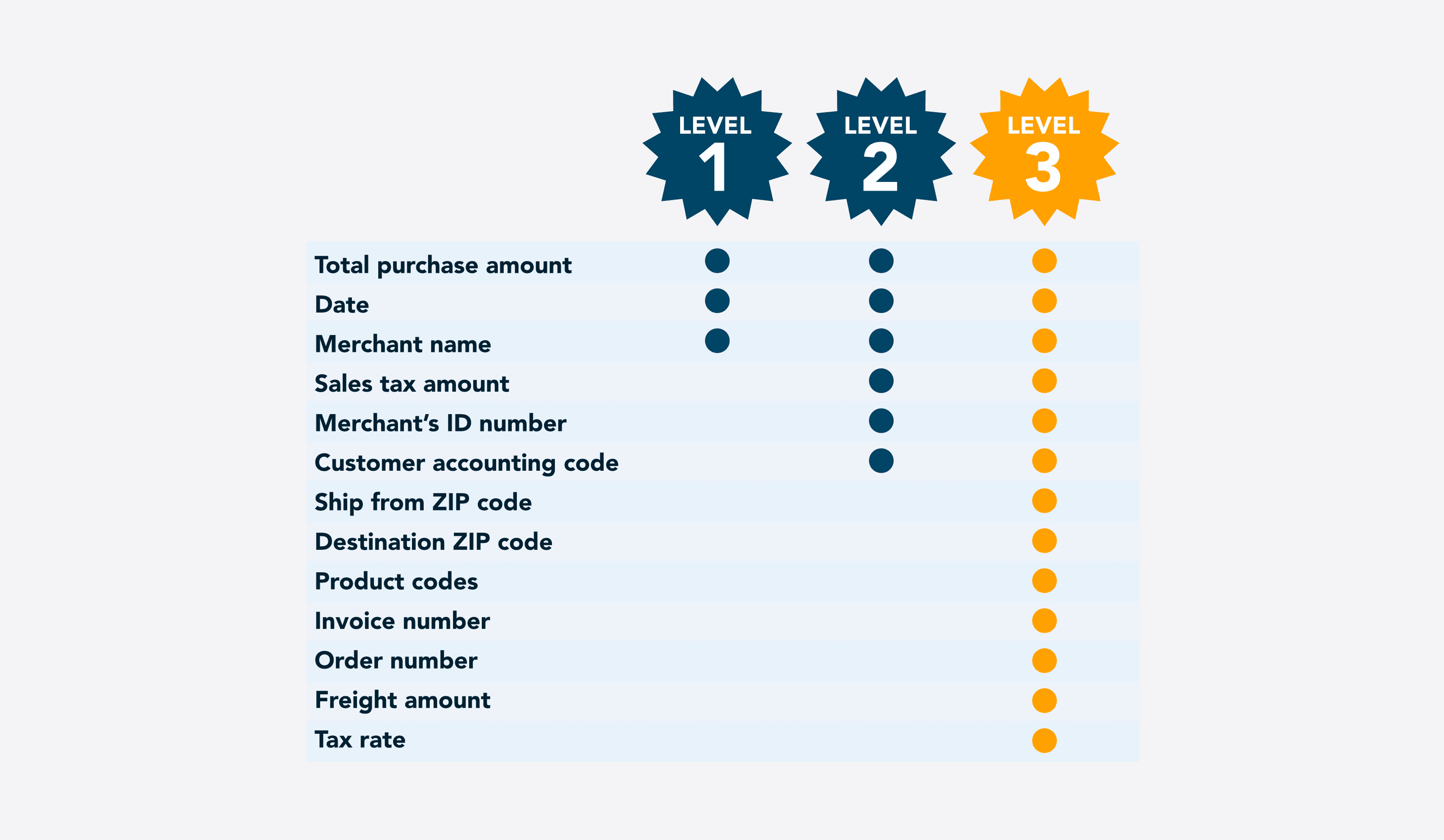

- How you can save money through interchange optimization

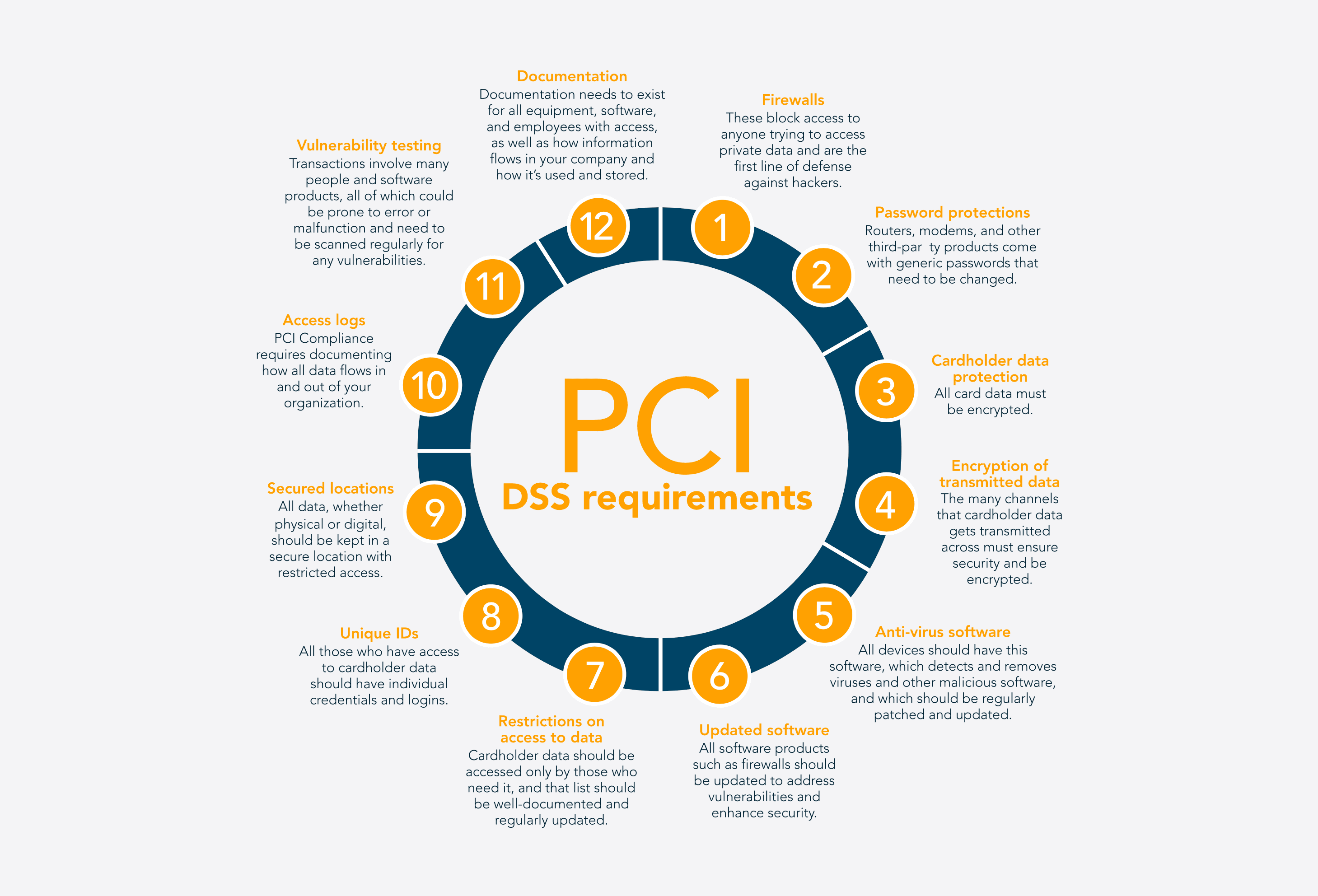

- How to prevent security breaches and data theft

- How to ultimately choose the right credit card processor for your unique business