Information on Visa's Commercial Enhanced Data Program (CEDP)

Visa's interchange program is a card brand initiative to improve the quality of transaction data on business credit card purchases.

Table of contents

Overview

What is CEDP?

Visa's Commercial Enhanced Data Program (CEDP) is a card brand initiative to improve the quality of transaction data on business credit card purchases. Starting October 17, 2025, merchants must provide complete, accurate Level II/III enhanced data to maintain optimal interchange rates.

Verified versus non-verified status

Visa determines if the data provided with transactions meets their new specifications. If the data passes Visa's requirements, Visa will classify the merchant as verified. If the data does not pass, Visa will classify the merchant as non-verified. Merchants in non-verified status will not be eligible for interchange incentives until errors are resolved.

✓ Verified merchant

- Consistently submits complete and accurate Level II/III data

- Earns verified status in Visa's system

- Eligible for reduced CEDP (Product 3) interchange rates

- Minor occasional errors are tolerated

- Benefits from lower costs and better data analytics

✗ Non-verified Merchant

- Does not consistently provide required enhanced data

- Lacks verified status in Visa's system

- Not eligible for interchange incentives

- Transactions often downgraded to higher fees

- Risks removal from Level III pricing eligibility

NOTE: Visa will continually analyze merchants' data integrity and can change the verification status at any time. Verification is not controlled by Versapay.

Why verification matters

Benefits of compliance

- Lower interchange rates: Access to more competitive interchange rates by providing complete and comprehensive data. You can review Level 2 and Level 3 data requirements here.

- Avoid downgrade fees: Complete data prevents costly transaction downgrades.

- Better customer relationships: Detailed data supports customer accounting needs.

Risks of non-compliance

- Higher processing costs: Downgraded transactions carry higher interchange fees.

- Loss of eligibility: Risk removal from Level III pricing programs entirely.

- Operational disruption: Last-minute scrambling to meet requirements.

Important timelines and dates

April 2026: Legacy programs sunset

By April 18, 2026, Visa will retire the old Level II program entirely. At this point, CEDP and its stricter standards will be fully in effect for all B2B credit card transactions. Enhanced data has transitioned from a "nice-to-have" to an expected norm for earning lower rates.

January 2026: CEDP is increasing merchants' cost of acceptance (COA)

Visa now verifies the accuracy and completeness of Level 2 and Level 3 data for merchants to qualify for interchange benefits. Visa is increasing the Business Credit Level 2 interchange rates and with this change, Level 2 rates now align with the Business Credit Level 1 rates for card-not-present transactions.

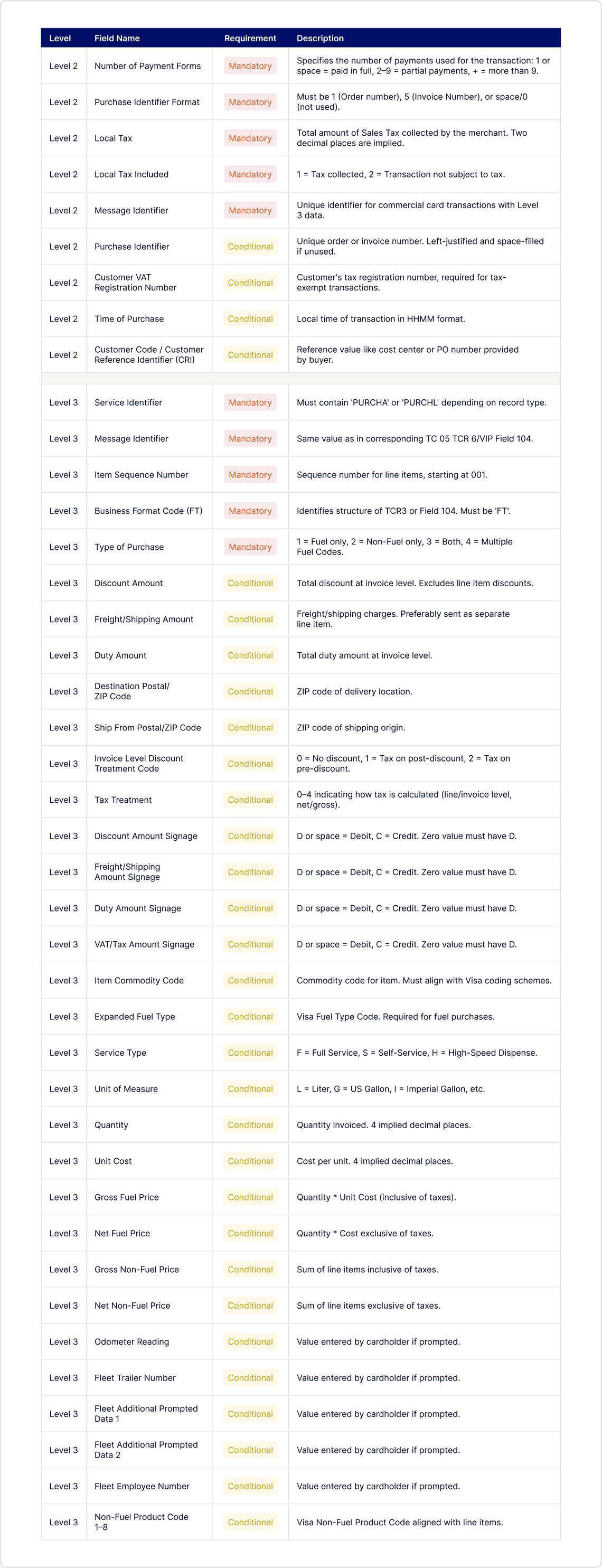

Questions on Level 2/3 definitions? You can review mandatory and conditional fields descriptions here.

October 17, 2025: Data quality enforcement

This is a critical date for merchants. As of October 17, 2025, Visa will fully enforce CEDP standards. Only transactions from verified merchants providing complete, accurate enhanced data will qualify for the best "Level III" interchange rates. Merchants with poor data quality will be flagged as non-verified, and their transactions will incur higher interchange costs.

April 2025: Program launch and fees begin

Visa launches CEDP in the U.S. Starting April 12, 2025, a new "participation" fee of 0.05% is applied to commercial card transactions that include Level II or III data. This fee is designed to incentivize merchants to comply with the program. Visa also begins initial data quality validations in this period.

Data requirements

Under CEDP, merchants must submit comprehensive Level III data including:

Product information

Detailed product descriptions

Product quantities

SKU numbers and item codes

Unit costs per item

Financial details

Extended amounts

Tax information

Freight costs

Discount amounts

Business information

Merchant tax ID

Supplier tax ID

Customer reference numbers

Purchase order numbers

Critical requirement

All data must be real, accurate, and descriptive. Visa's validation technology will identify and reject:

- Generic descriptions (e.g., "Product," "Service," "Item")

- Placeholder data or dummy values

- Artificially generated content

- Incomplete or missing required fields

NOTE: We recommend you carefully read Visa's CEDP material to verify the most up to date requirements.

Versapay's recommended immediate actions

For all merchants

- Review and confirm your existing data quality, audit current submission processes, and ensure your integration or payment gateway passes all required fields accurately.

- Ensure all data is granular and accurate.

- Review tax considerations for your customers. Even if you do not wish to charge tax, always include a value. Passing 0 tax is insufficient, and merchants must explicitly flag transactions as tax-exempt.

- If you have a custom ERP integration, ensure your API code meets Visa’s new regulations.

If you use a Versapay ERP integration

Do all the above and take these additional steps:

- Important upgrades may be required to your ERP application

- Review data your finance team enters into invoices and customer records

With Versapay's ERP integrations, interchange eligibility depends on the data sent with each transaction, and we're working to ensure our configuration pathways support the transmission of enriched data fields—like tax details, line items, and PO numbers.

Ongoing recommendations

Data requirements for “tax exempt” must be explicit: Passing 0 tax is insufficient; merchants must explicitly flag transactions as tax‑exempt. This affects tax‑exempt transactions and underscores the broader need for precise and detailed invoice‑level data (items, quantities, taxability, shipping, ship‑to, etc).

Merchant Data Quality Responsibilities: Merchants should ensure the information provided is sufficiently descriptive and complete, as Visa requires detailed data for CEDP compliance, and should review what is being passed on invoices and through systems.

Integrated Solution Benefits: Versapay’s integrated solutions are designed to capture and transmit detailed transaction data from ERPs, increasing the likelihood of meeting CEDP requirements.

Statement Comparison for Impact Assessment: Merchants are advised to compare their September 2025, November 2025, and upcoming February 2026 processing statements to understand the financial impact of CEDP changes and to identify shifts in cost of acceptance.

Data Quality and System Review: Preparation includes reviewing the quality of data captured at the point of sale, understanding the capabilities and data captured from shopping carts plug-in's and ERPs, and ensuring that all relevant transaction details are being transmitted to the processor.

How Versapay is preparing: a next generation payment platform

Versapay is building a next-generation payment platform designed to meet the evolving demands of B2B payments—including compliance with Visa’s CEDP mandate. We’re upgrading and unifying our infrastructure to support policy changes and deliver the latest in B2B payment innovation.

As we roll out new capabilities, you’ll see enhancements that improve data quality, streamline compliance, and unlock interchange savings. This is just the beginning—we’ll keep you informed as we introduce features that redefine what’s possible in B2B payments and AR automation.

Versapay's commitment

Our mission is to remove friction in payments and cash flow. We're here to support you. If you have any questions or concerns outside of the resources below, please contact [email protected].

Additional resources

CEDP L2 / L3 mandatory and conditional fields

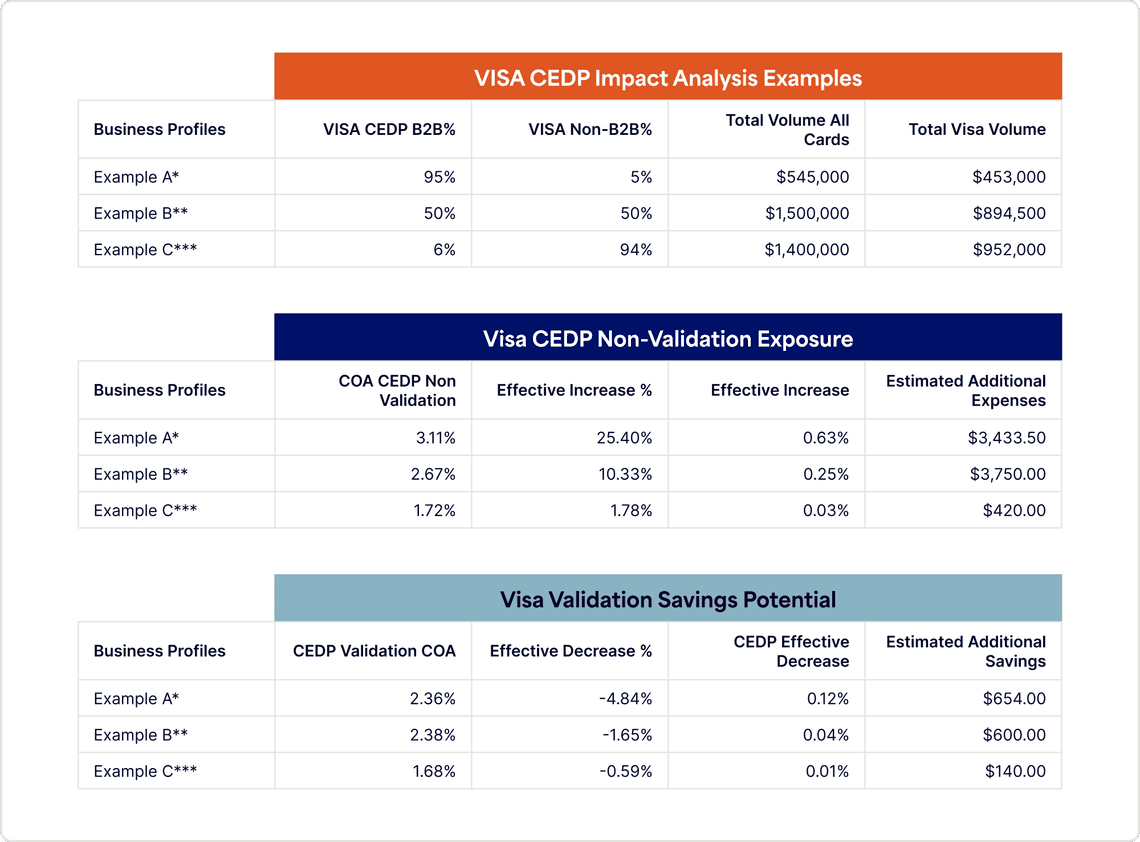

CEDP impact analysis examples

* Merchant accepting 95% of their Visa Volume in B2B Visa Categories that are impacted by changes with CEDP enforcement for select business, purchasing and corporate cards

** Merchant accepting 50% of their Visa Volume in B2B Visa Categories that are impacted by changes with CEDP enforcement for select business, purchasing and corporate cards

*** Merchant accepting 6% of their Visa Volume in B2B Visa Categories that are impacted by changes with CEDP enforcement for select business, purchasing and corporate cards

Calculations

1. COA (Cost of Acceptance) =

➝ Total Processing Fees / Total Card Volume Funded

2. Effective Increase % =

➝ Estimated Anticipated Expenses / Previous Fees Occurred

3. COA CEDP Non-Validation (New Anticipated COA With Client in Non-Validated Status and/or Failing to Send Data That Meets Visa's New Requirements With CEDP) =

➝ Total Processing Fees + Estimate Additional Expenses / Total Card Volume Funded

4. CEDP Validation COA (New Anticipated COA With Client in Validated Status Sending Data That Meets Visa's New Requirements With CEDP) =

➝ Total Processing Fees - Effective Savings / Total Card Volume Funded

5. Effective Decrease % =

➝ Effective Savings With CEDP Validation / Previous Fees Occurred