Accounts Receivable Turnover Ratio: What It Means and How To Calculate

- 11 min read

Accounts receivable turnover ratio measures the efficiency of your business’ collections efforts. In this blog, we discuss how to calculate it, its strengths and limitations for reporting, and tips for improving your ratio.

—

Being able to efficiently collect debts is essential for any business that offers credit terms. When customers don’t pay on time, this can quickly lead to cash flow problems with significant downstream impacts. Often a supplier can’t release inventory until payment has been received or make more sales with a customer until their credit has been replenished

Collection challenges are often a result of inefficiencies in the accounts receivable (AR) process. Accounts receivable turnover ratio is an important metric for determining the effectiveness of your collection efforts so that you can make any necessary course corrections.

In this blog, you’ll learn:

What is accounts receivable turnover ratio and why is it important?

Accounts receivable turnover ratio, also known as receivables turnover ratio or debtor’s turnover ratio, is a measure of efficiency. It refers to the number of times during a given period (e.g., a month, quarter, or year) the company collected its average accounts receivable.

Tracking accounts receivable turnover ratio shows you how quickly the company is converting its receivables into cash on an average basis. Finance teams can use AR turnover ratio when making balance sheet forecasts, as it provides a general expectation of when receivables will be paid. This allows companies to forecast how much cash they’ll have on hand so they can better plan their spending.

Some corporate lenders will also look at a businesses’ accounts receivable turnover ratio to assess their financial health. Businesses hoping to secure funding or receive credit will want to ensure their AR turnover is in a healthy place.

Accounts receivable turnover ratio also gives companies quick insight into how well their collections team is following up on overdue payments, how effective their credit policies are, and their customer base’s creditworthiness.

How to calculate accounts receivable turnover ratio

Here are three steps for learning how to calculate your accounts receivable turnover ratio:

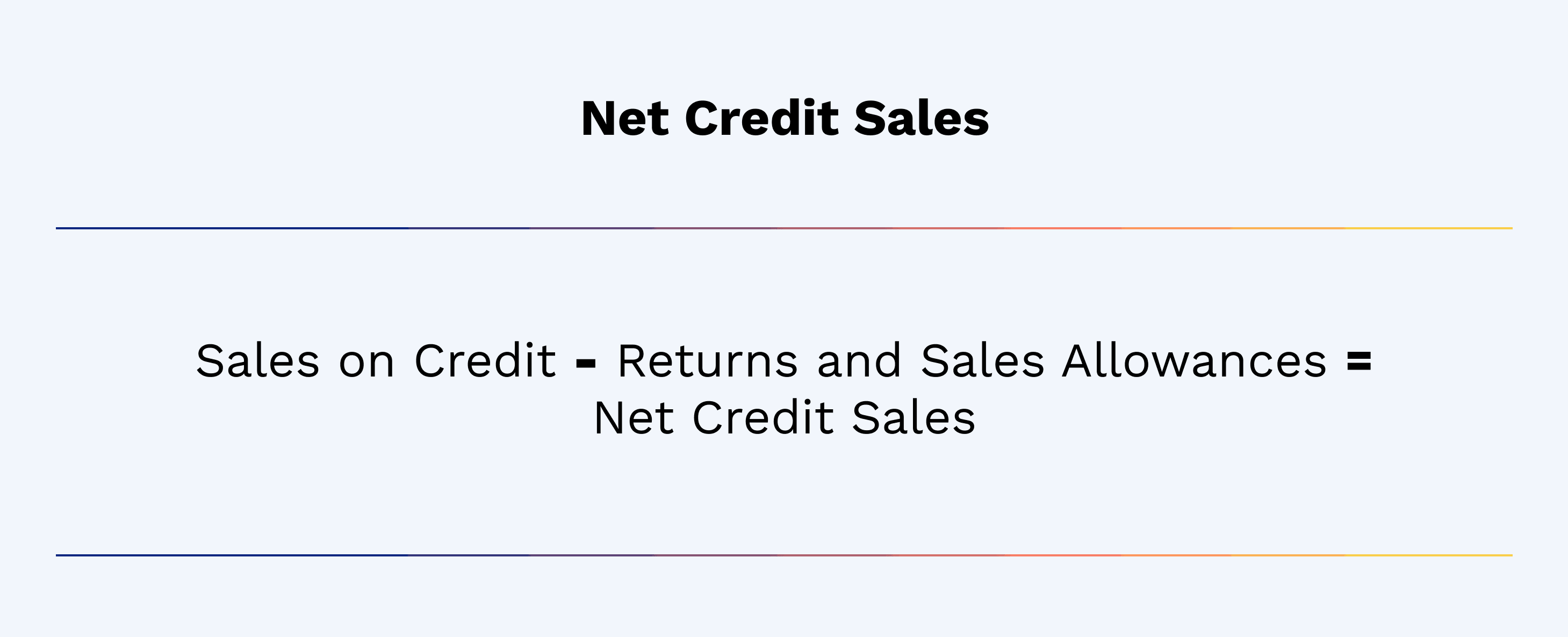

Step 1: Determine your net credit sales

First, it’s important to note that when measuring receivables turnover, we’re only interested in looking at sales made on credit. Cash sales result in an upfront payment, so these don’t create receivables.

To calculate your accounts receivable turnover, you’ll need to determine your net credit sales. To do this, use an AR turnover formula that takes your total sales made on credit and subtracts any returns and sales allowances. You should be able to find this information on your income statement or balance sheet.

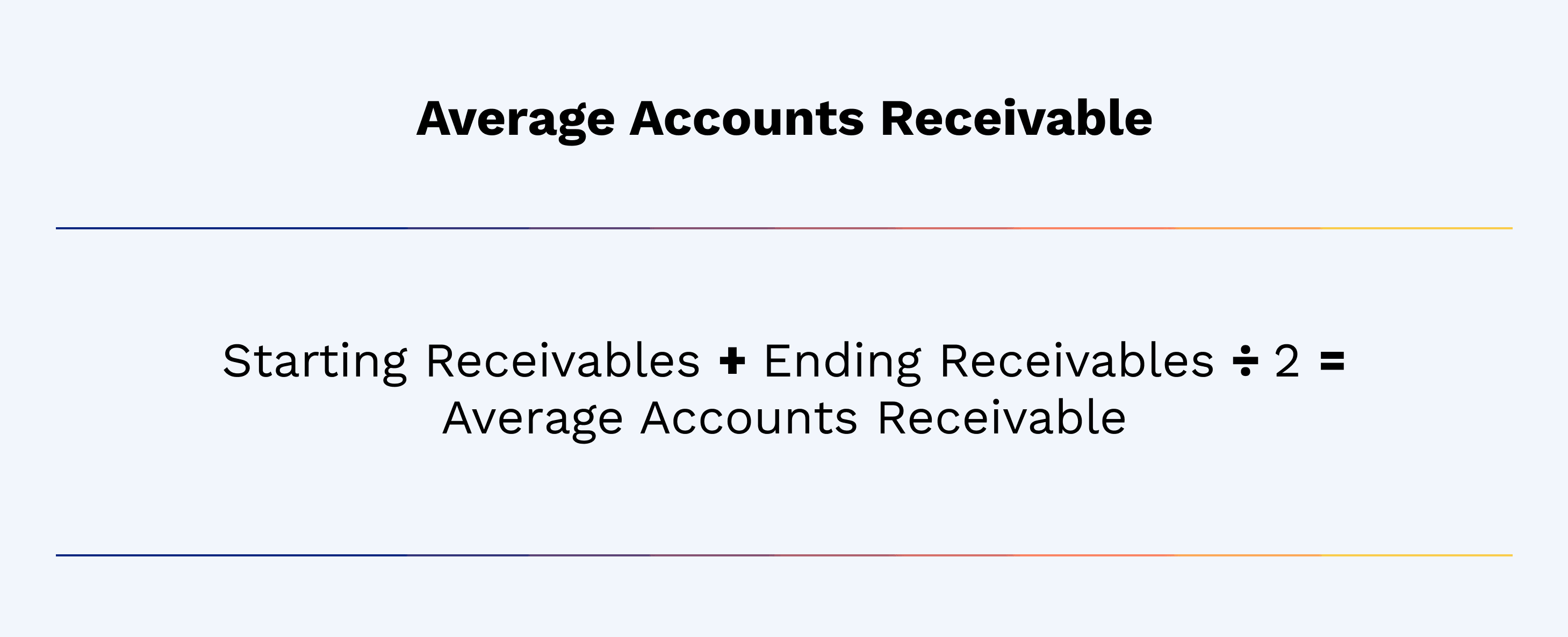

Step 2: Calculate your average accounts receivable

Next, you’ll need to calculate your average accounts receivable. This looks at the average value of outstanding invoices paid over a specific period.

To do this, use an accounts receivable turnover formula that takes the amount you had in AR at the beginning of the accounting period and add it to the amount you had in AR at the end of that period. Then, divide the sum by two to get the average.

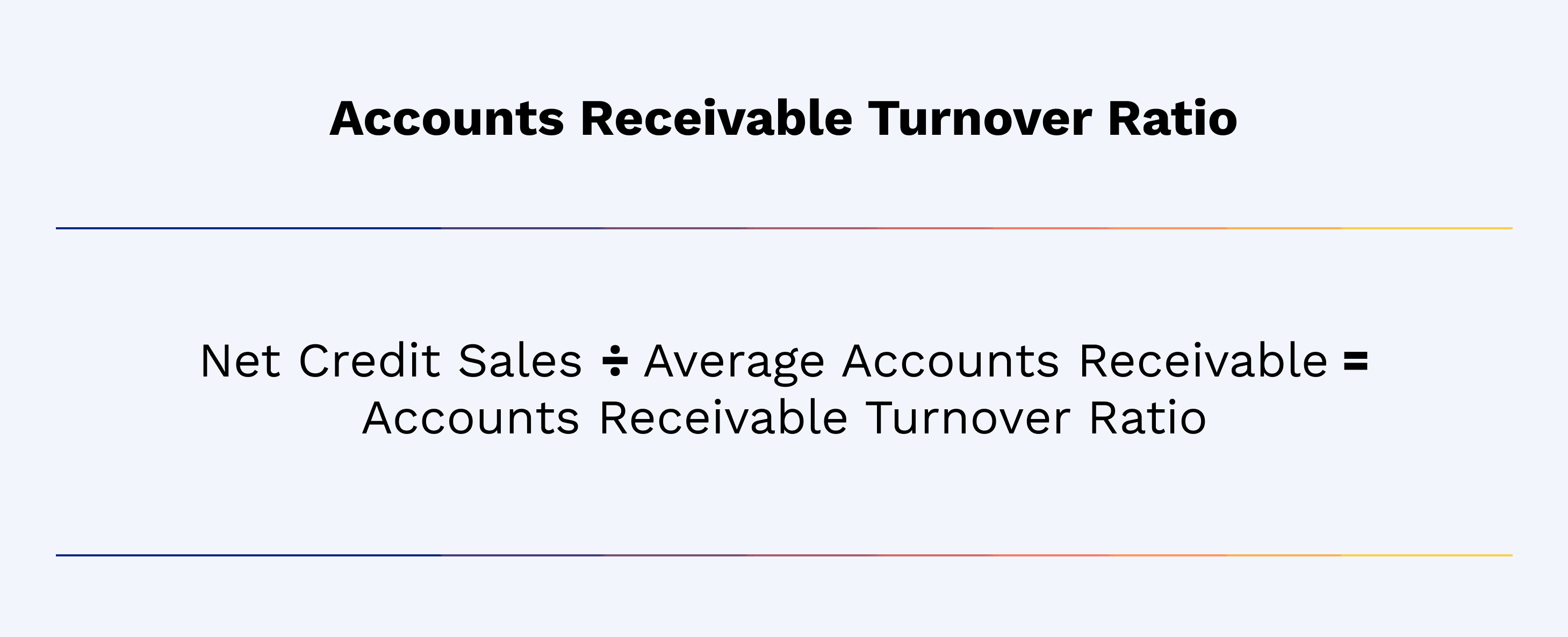

Step 3: Divide your net credit sales by average accounts receivable

Finally, you’ll divide your net credit sales by your average accounts receivable for the same period. This is how you’ll calculate your accounts receivable turnover ratio.

Here is the final accounts receivable turnover ratio formula:

Calculating receivable turnover in AR days

Once you know your accounts receivable turnover ratio, you can use it to determine how many days on average it takes customers to pay their invoices (for credit sales). This is also known as your average collection period.

Here’s how you’ll calculate it:

- Accounts receivable turnover in days = 365 ÷ Accounts receivable turnover ratio

Calculating your AR turnover days helps you see how customers’ average payment times compare with your credit terms. For instance, if your average collection period is 41 days but your payment terms are net 30 days, you can see customers generally tend to pay late.

When doing financial modelling, businesses will also use receivables turnover in days to forecast their accounts receivable balance. They’ll do this by multiplying their revenue for each period by their AR turnover days, then dividing the product by the number of days in the period.

Accounts receivable turnover ratio example

Here’s an example that illustrates how a company would calculate its accounts receivable turnover ratio.

Owl Wholesales’ annual credit sales are $90 million ($100 million – $10 million in returns). Their starting and ending receivables are $10 million and $14 million, which means their average accounts receivable balance is $12 million. This means Owl Wholesales has a receivables turnover rate of 7.5.

The math looks like this:

- $100 million sales on credit – $10 million returns = $90 million net annual credit sales

- ($10 million starting receivables + $14 million ending receivables) ÷ 2 = $12 million average accounts receivable

- $90 million ÷ $12 million = 7.5

An accounts receivable turnover ratio of 7.5 would mean that within this period (a year in this instance), Owl Wholesales collected their average receivables 7.5 times. This means that on average, it takes their customers about 48 days to pay their invoices (365 ÷ 7.5 = 48). 45 days and below is what’s considered ideal for your average collection period. But, because collections can vary significantly by business type, it’s always important to look at your AR turnover ratio in the context of your industry and how it trends over time.

What is a good accounts receivable turnover ratio?

A high accounts receivable turnover ratio is generally preferable as it means you’re collecting your debts more efficiently. There's no standard number that distinguishes a “good” AR turnover ratio from a “bad” one, as receivables turnover can vary greatly based on the kind of business you have.

There are also factors that could skew the meaning of a high or low AR turnover ratio, which we’ll cover when discussing the limitations of accounts receivable turnover ratio as a key performance indicator.

What a high accounts receivable turnover ratio means

A high AR turnover ratio generally implies that the company is collecting its debts efficiently and is in a good financial position.

It tells you that your collections team is effectively following up with customers about overdue payments. A high ratio also indicates that the company has a generally strong customer base, as customers tend to pay their invoices on time.

A high receivable turnover could also mean your company enforces strict credit policies. While this means you collect receivables faster, it could come at the expense of lost sales if customers find your payment terms to be too limiting.

If you find that your strict payment terms are starting to turn customers away, consider revising your credit policies, even if it means your AR turnover ratio goes down.

What a low accounts receivable turnover ratio means

Conversely, a low AR turnover ratio could mean the company is not very discerning with whom it extends credit to, creating a higher risk of bad debt. A low ratio could also mean that there are barriers impeding the collections process. Your AR team might be understaffed or lack the right knowledge and tools to excel at collections.

If you use paper invoicing practices, this could delay when customers receive their invoices. Relying on disjointed communication methods like phone calls and emails to communicate with customers can also prevent AR staff from making headway in collections.

By automating your collections workflows with AR automation software, you better your chances of getting paid on time, substantially improving your accounts receivable turnover.

Industry averages for accounts receivable turnover ratio

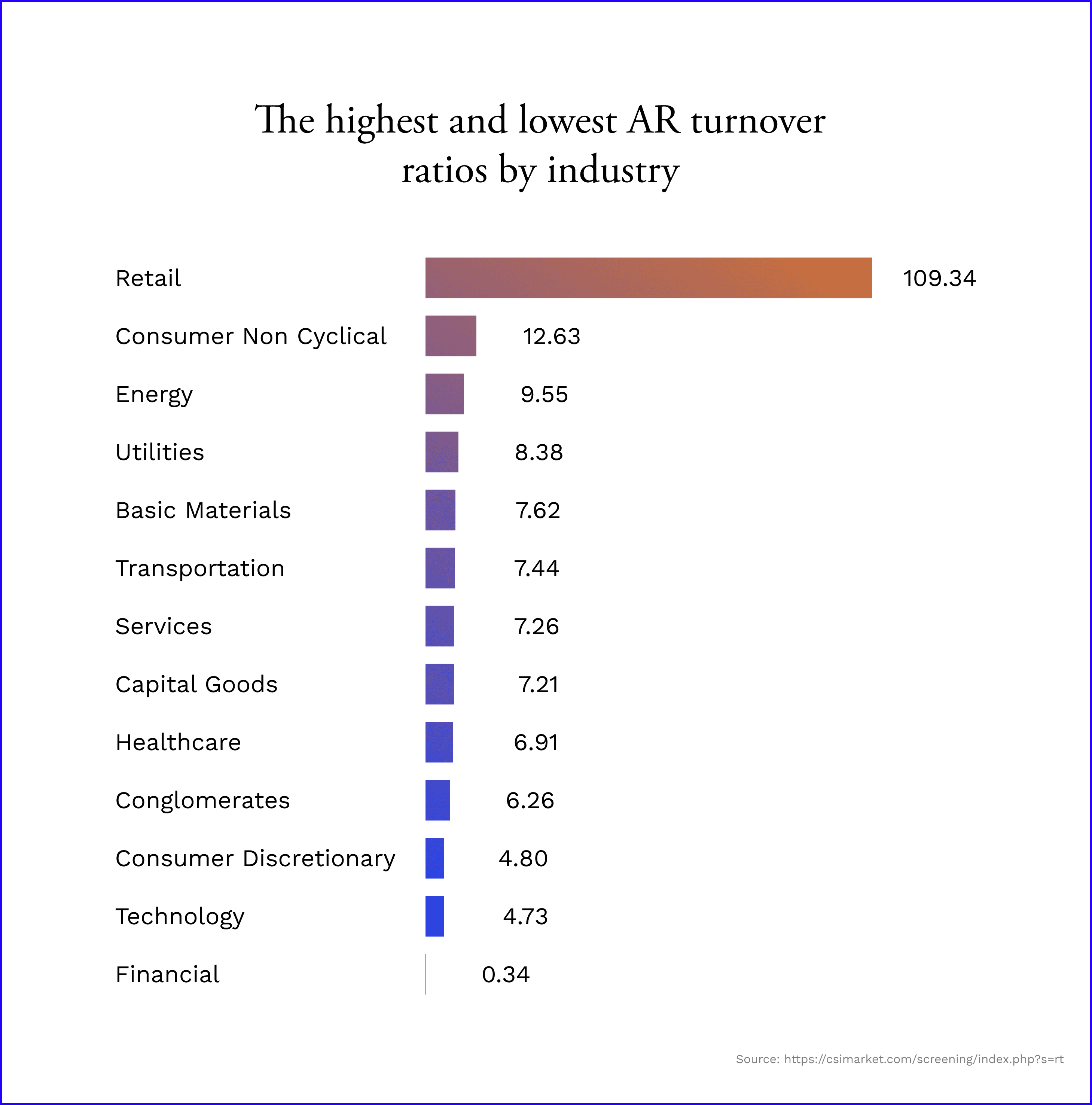

To understand what your AR turnover ratio means, you should always compare it to what’s considered normal in your industry. Economic fluctuations will also play a role. Industries like manufacturing and construction typically have longer credit cycles (e.g., 90-day terms), which makes lower AR turnover ratios normal for companies in those sectors.

In industries like retail where payment is usually required up front or on a very short collection cycle, companies will typically have high turnover ratios.

According to research conducted by CSIMarket, some of the industries with the best AR turnover ratios in Q1 of 2022 were retail (109.34), consumer non cyclical (essential consumer goods) (12.63), and energy (9.55). At the other end of the list, the industries with the lowest ratios were financial services (0.34), technology (4.73), and consumer discretionary (4.8).

Limitations of the accounts receivable turnover ratio

While accounts receivable turnover ratio provides a great way to quickly measure your collection efficiency, it has its limitations.

For one, because AR turnover ratio represents an average, any customers that either pay uncommonly early or uncommonly late can skew the result. And, because receivables turnover ratio looks at the average across your entire customer base, it doesn’t allow you to home in on specific accounts that might be at risk of default. To get this level of insight, you’ll want to create an accounts receivable aging report.

AR turnover ratio is also not especially helpful to businesses with a high degree of seasonality. In these cases, it’s more helpful to pay attention to accounts receivable aging.

3 ways AR automation software helps improve your AR turnover ratio

Because AR departments historically experience a high degree of manual work, streamlining collections processes is the easiest way to improve accounts receivable turnover.

Collaborative accounts receivable automation software can help businesses invoice faster, proactively manage (and prevent) overdue payments, and address what is often the biggest contributor to late payments—disputes.

Here are three ways AR automation can help improve your accounts receivable turnover ratio:

1. Automated invoice delivery

Slow collections could be a result of inefficient invoicing practices. The time it takes your team to prepare and send out invoices prolongs the time it will take for that invoice to get to your customer and for them to pay it.

With an AR automation solution that integrates directly with your enterprise resource planning (ERP) system, you can create invoices in your primary accounting system and deliver them to your customers automatically.

A platform like Versapay that supports omni-channel invoicing lets your customers access their billing details in whichever format suits them best—be it email, customer portal, EDI, accounts payable portal, or even paper. Delivering invoices in a more convenient format also increases customers’ likelihood of paying you faster, improving your collection efficiency.

2. Reminders sent before a bill is due

With AR automation software, you can automatically prompt customers to pay as a payment date approaches.

By proactively notifying your customers about their payment with personalized communications, you improve your chances of getting paid before receivables become overdue and speed up accounts receivable turnover. With Versapay, you can deliver custom notifications automatically and direct customers to pay online, eliminating much of your team’s need for collections calls.

3. Faster dispute resolution

Common contributors to late payments are invoicing errors and payment disputes. If customers have a difficult time getting hold of your AR team to correct billing errors prior to payment, this makes it difficult for you to capture revenue quickly.

Versapay’s AR automation solution allows your customers to raise any issues by leaving a comment directly on their invoice. This allows members of your team to address concerns in real time. Giving customers the opportunity to self-serve also reduces the number of inquiries coming into your AR department, contributing to faster collection times.

About the author

Nicole Bennett

Nicole Bennett is the Senior Content Marketing Specialist at Versapay. She is passionate about telling compelling stories that drive real-world value for businesses and is a staunch supporter of the Oxford comma. Before joining Versapay, Nicole held various marketing roles in SaaS, financial services, and higher ed.