Accounts Receivable Aging Report: Definition, Examples, How to Use

- 13 min read

Accounts receivable aging reports help companies identify slow-paying customers. They are periodic reports that group and categorize your AR depending on how long an invoice has been outstanding.

Maximizing collections efforts is a delicate dance. For many accounts receivable (AR) teams, prioritizing which accounts to engage with is one of the more difficult decisions they make daily. For example, is there more value in prioritizing the most overdue or delinquent accounts, or in prioritizing those accounts with the highest outstanding dollar values?

While your approach to collections may vary, it’s no secret that overdue invoices are pervasive and, for many businesses, unavoidable. In fact, a surprising 22 out of 228 industry segments surveyed by Dun & Bradstreet reported that more than 10% of their AR aging dollars are more than 90 days overdue.

A piling of outstanding invoices is not desirable. Neither is compromising on your collections efforts or having to take a phrased approach to collections to capture revenue in full. That’s why accounts receivable aging reports are one of the most powerful tools in your AR team’s toolkit. AR aging reports are highly valuable because they help you stay on top of money owed and ensure the right collection actions are taken at the right times.

Jump to a section of interest:

- What is an accounts receivable aging report?

- Why are accounts receivable aging reports important?

- How to prepare an AR aging report?

- Accounts receivable aging report in Excel example

- How to automate AR aging reports using Versapay

What is an accounts receivable aging report?

Accounts receivable aging reports help companies identify slow-paying customers. They are periodic reports that group and categorize your AR depending on how long an invoice has been outstanding. These AR reports often list and sort outstanding balances into columns based on date-ranges like:

- Current

- 1 to 30 days past due

- 31 to 60 days past due

- 61 to 90 days past due

- 91+ days past due

AR aging reports show which accounts are late, for which invoices, and for how long they've been overdue. Every unpaid invoice, alongside complete customer and account details, should be listed in aging reports, illustrating how healthy—or unhealthy—your receivables and cash flow are.

AR aging reports are valuable because they let you know who is behind on paying you. They indicate the financial strength and reliability of your customers. They also encourage action by showing you which loyal customers might need adjusted payment terms and which receivables might be in danger of becoming doubtful debts.

💡 In general, if your AR aging shows your receivables are being collected slower than usual, business is either slowing or you’re taking on greater credit risk.

What is the AR aging schedule?

The accounts receivable aging schedule is a table showing the dynamic between unpaid invoices and their respective due dates. Essentially, it shows the amount of debt owed by each customer alongside how overdue it is. The term schedule comes from the receivables being segmented by their aging categories.

An AR aging schedule will aggregate the outstanding receivables per date-range, indicating the total receivables based on the number of days invoices are past due.

In maintaining an accounts receivable aging schedule, you get a list of potential defaulters and customers still in the process of paying off debt. Collections teams can then ensure they’re communicating with customers in the most appropriate ways and enforcing suitable payment policies.

With AR aging reports, you acquire the ability to make more confident decisions more frequently and compromise less often.

—

Accounts receivable aging report? Check. Next up? Even more AR metrics you should be measuring, how to measure them, and what you can do to make the soar—all in this on-demand webinar.

Accounts receivable aging analysis: 5 reasons why accounts receivable aging reports are important

AR aging reports matter because they simplify and streamline the process of identifying late-paying customers. While the benefits of AR aging reports are plenty, there are two primary reasons for using them:

- To keep track of delinquent or overdue accounts to ensure you’re able to pursue owed debts

- To determine from which accounts you can expect not to collect payment from

In short, these AR reports offer a snapshot of the status of your outstanding invoices and present actionable insights for accelerating cash flow and improving accounts receivable workflows. Without accounts receivable aging reports, maintaining healthy cash flows is difficult, and identifying credit risks is challenging. Beyond that, AR aging reports are helpful because they:

- Highlight and identify cash flow problems

- Inform credit policies

- Help calculate allowance for doubtful debt

- Help calculate average collection period

- Improve collections processes

1. AR aging reports highlight and identify cash flow problems

Late payments are troublesome, primarily because they hamper your cash flow. Without healthy cash flows, investing in your business is near impossible. An abundance of late payments makes cash flow forecasting difficult, too.

Accounts receivable aging reports allow you to quickly identify who is not paying their invoices on time. They also allow you to easily determine how much any given customer owes. If you’re having trouble capturing owed revenue, the aging report can surface problem customers and in turn, you can direct your attention and staff’s efforts where necessary.

In short, AR aging reports help you stay on top of your receivables and keep a record of who owes you money—and who might be a credit risk—to preserve the health of your cash flow.

💡 PS—accounts receivable automation software is great at accelerating cash flow. According to a study by PYMNTs and American Express, businesses using manual processes to collect on overdue payments take 67% to collect than those that employ automated AR tools.

2. AR aging reports inform credit policies

Running an accounts receivable aging report helps your staff analyze customers’ late payment behaviors and determine which customers they need to prioritize contacting regarding unpaid invoices. The decision to prioritize outreach initiatives—typically based on dollar amounts or number of days overdue—is made easier with AR aging reports as the data needed is at your fingertips.

Regular accounts receivable aging analysis also helps AR managers manage the effectiveness of their credit policies, empowering them to adjust processes accordingly to maximize their collections efforts. If your AR aging report surfaces that customers are repeatedly not paying their bills, you’ll certainly want to consider tightening the leash and not giving them additional credit.

AR aging reports can also be helpful in determining the need to change policies—such as offering discounts for early payment or charging fees for excessively late ones.

3. AR aging reports help calculate allowance for doubtful debt

Doubtful debts are late payments that you’re unlikely to ever recover, primarily because the older the receivable is, the less likely collection is. In other words, the longer an invoice remains unpaid, the lower its chances of being paid.

Accounts receivable aging reports are especially well-suited for determining which receivables—if any—need writing off or turning over to an outside collection agency. In fact, the approximate amount of receivables that may not be collected is used as the ending balance of your allowance for doubtful accounts.

An AR aging report can then help you make your adjusting entries to record bad debt expense.

4. AR aging reports help calculate average collection period

In analyzing your customers’ payment behaviors and trends, an accounts receivable aging report can help you determine—and ultimately reduce—your average collection period. This calculation provides the number of days it takes on average to receive payment for goods or services.

While an AR aging report may provide a more-than-reasonable estimate or high-level takeaway of the status of your outstanding invoices, its inputs will let you calculate your average collection period, and more accurately determine short-term liquidity, which is how able your business is to pay its liabilities.

5. AR aging reports improve collections processes

Lastly—and perhaps most importantly—accounts receivable aging reports can help you improve your AR team’s collections efforts. For example, an AR aging report that reveals a significant chunk of outstanding payments more than 60 to 90 days past due might indicate your collections workflow is flawed and requires fixing.

Note that the collections workflow is complex, and an AR aging report will not pinpoint exact problems. It will, however, reveal whether a problem exists.

💡 For tactics on how to increase the effectiveness of your efforts, check out our CFO’s Guide to Accelerating Collections

How to prepare an AR aging report

To prepare an accounts receivable aging report you require three inputs:

- Your customers’ names

- The outstanding balances for each account

- Aging schedules

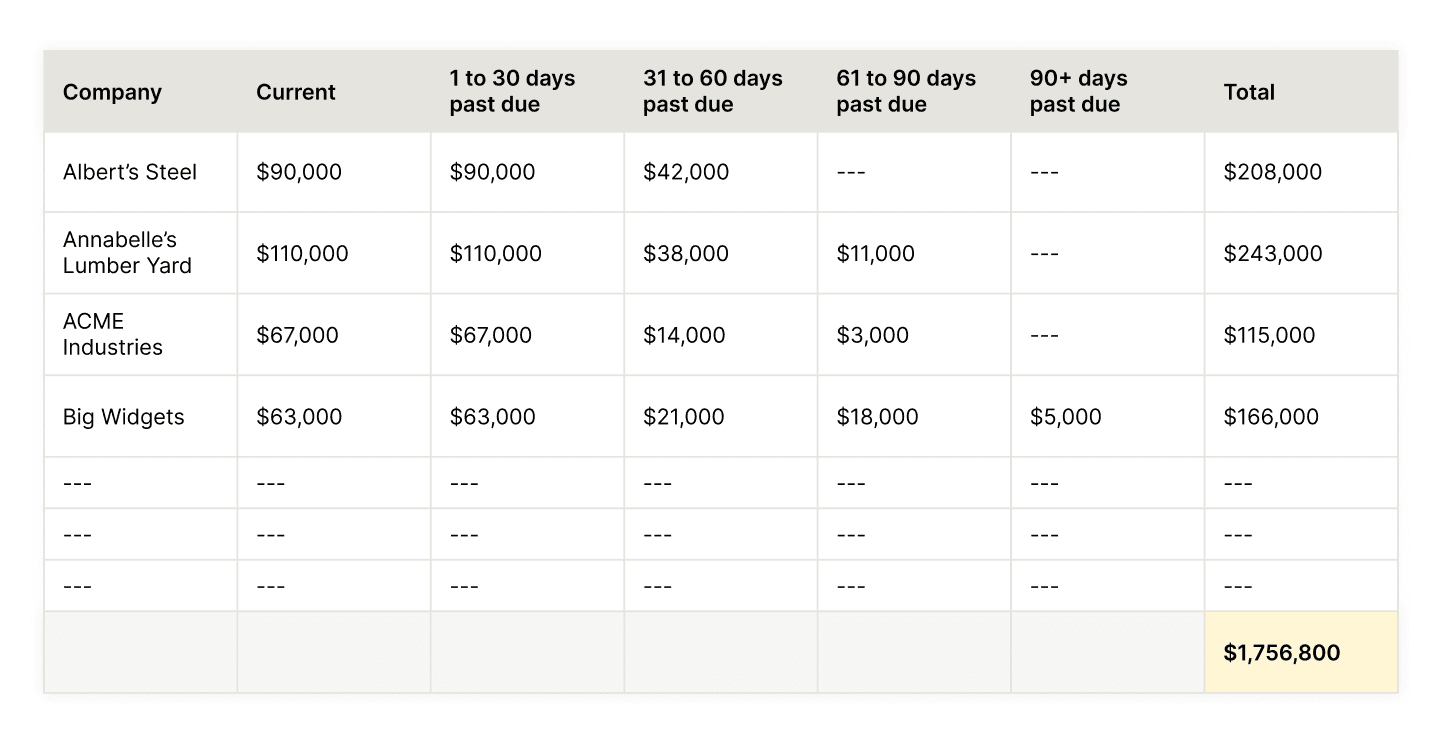

To recap: The AR aging schedule reveals the dynamic between outstanding invoices and accounts, and their respective due dates. To then prepare your AR aging report, you need to segment your receivables by age categories—as defined above or per your preference—and indicate against your customer accounts the total outstanding payments per age category.

- Step 1) — Make a list of all outstanding invoices broken down by customer in a spreadsheet.

- Step 2) — Add columns for invoice date, invoice number, original dollar amount, and the unpaid balance.

- Step 3) — Fill out each of the columns for each invoice that is unpaid, as of the current date.

- Step 4) — Then add different aging columns, such as current, 1 to 30 days past due, 31 to 60 days past due, 61 to 90 days past due, and 91+ days past due. You can make as many aging columns as you need to.

- Step 5) — The outstanding amount for each invoice then needs to be copied into one of those columns depending on their age. You can work out step 5 manually, but you’ll save time by setting up an AR aging formula in Excel to do this for you.

- Step 6) — Add subtotals for each customer and a grand total at the bottom

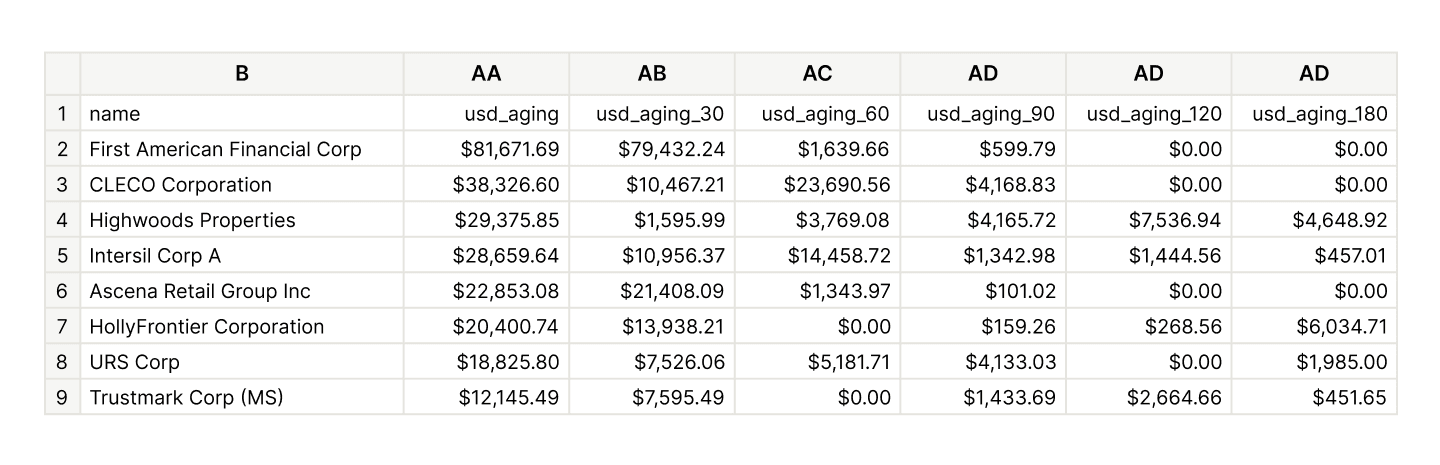

Accounts receivable aging report in Excel example

You can learn how to calculate aging in Excel, although this may take you a while (we’ve got a better solution a bit further down). Here’s what an AR aging report in Excel might look like after being manually created:

How to automate AR aging reports (using Versapay)

While creating an AR aging report in Excel isn't terribly difficult, its upkeep and scalability leaves much to be desired. In fact, it can be one of the most onerous and tedious parts of traditional collections. There are better options today for reporting on AR aging, such as via Collaborative AR Automation solutions with intelligent collection capabilities.

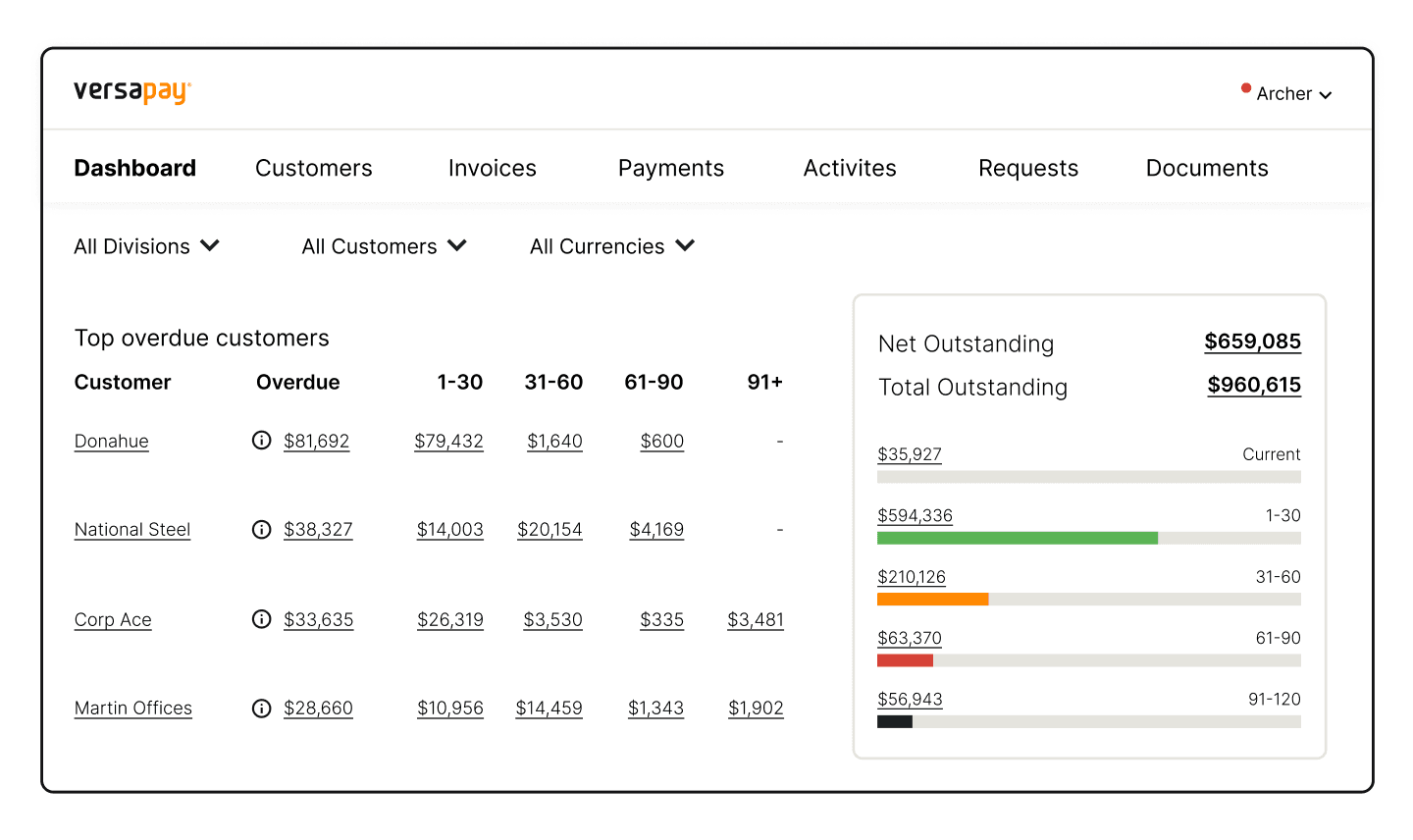

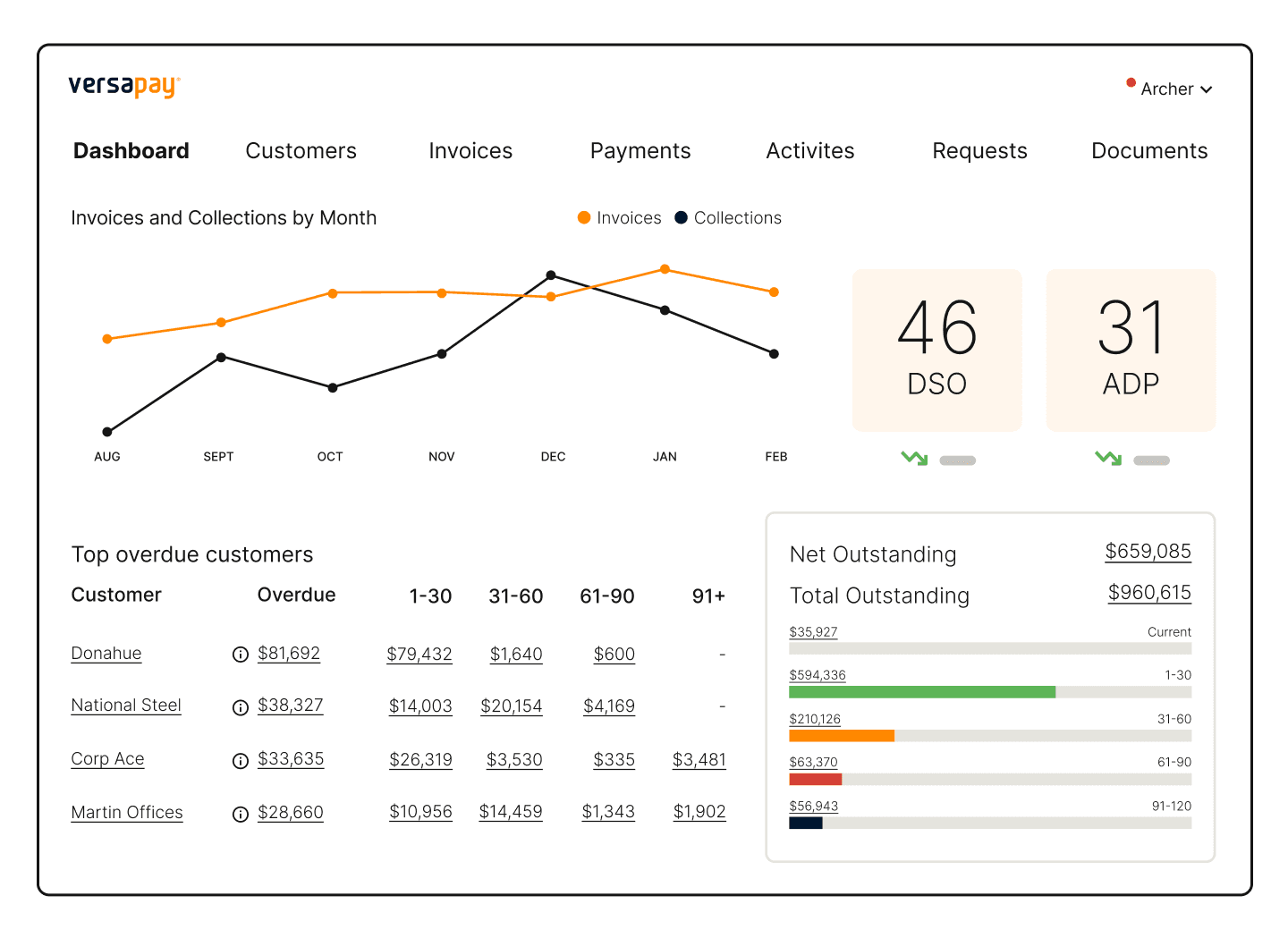

With Versapay, you get a real-time, interactive dashboard of all your receivables by aging period, as well as your days sales outstanding (DSO); through this dashboard, your team can easily—and at-a-glance—determine the status of their receivables.

With Versapay, you can also automate collections and dunning reminders, and collaborate directly with your customers over the cloud to clear up any issues holding up payment.

AR managers and collections teams can modernize their AR aging analysis and reporting with:

- Real-time communications and dispute management with late-paying customers

- Central visibility of customer interactions, tracked over time and displayed as current

- Timely prompts to help collections teams stay on task and focus on priority accounts.

Versapay’s intelligent collections software provides AR teams with a variety of ways to surface pertinent information and quickly identify accounts that require more attention. Using real-time data, these teams can surface overdue accounts—for example—send timely email reminders and segment high-risk customers. This helps them prioritize collection activities so they can focus on more strategic tasks

Without accounts receivable aging reports to inform your collections efforts, payment terms, and debt management, you leave cash flow to chance. But that doesn’t mean you have to stick with traditional, manual methods of aging report preparation and aging analysis. Digitization and automation can vastly speed up this process, leaving you with more time for higher priority work.

Learn more about how you can streamline your AR processes with Collaborative AR Automation software.

Additional AR aging report FAQs

What's the difference between AR aging and DSO?

Days Sales Outstanding (DSO) is the average number of days it takes for your company to receive payment after a sale is made. A low DSO means your company is quick to collect payment while a high DSO may signal inefficiencies in your collections process. A long collection cycle can add to your costs and even reduce your margins.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.