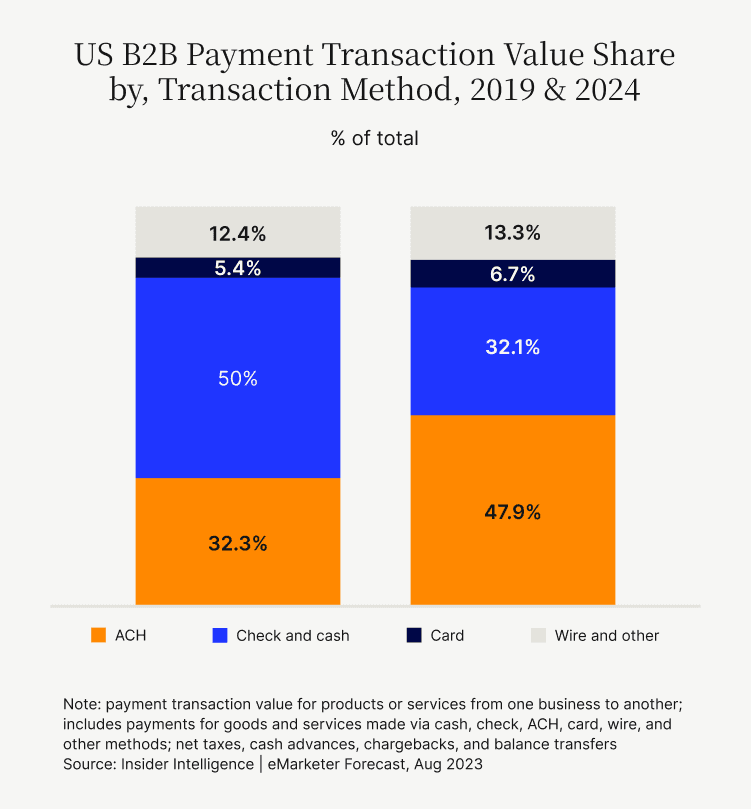

Digital Payments: The Bedrock of Modern Business

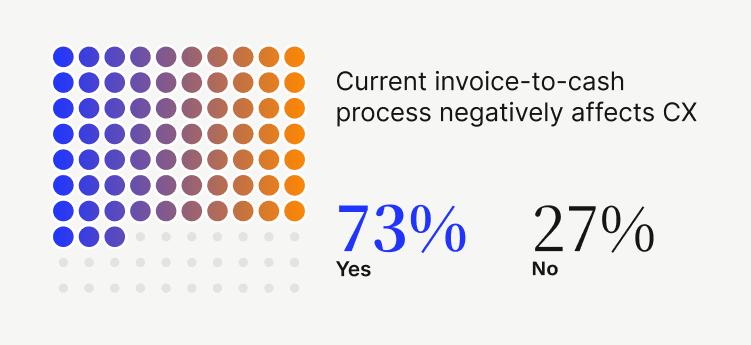

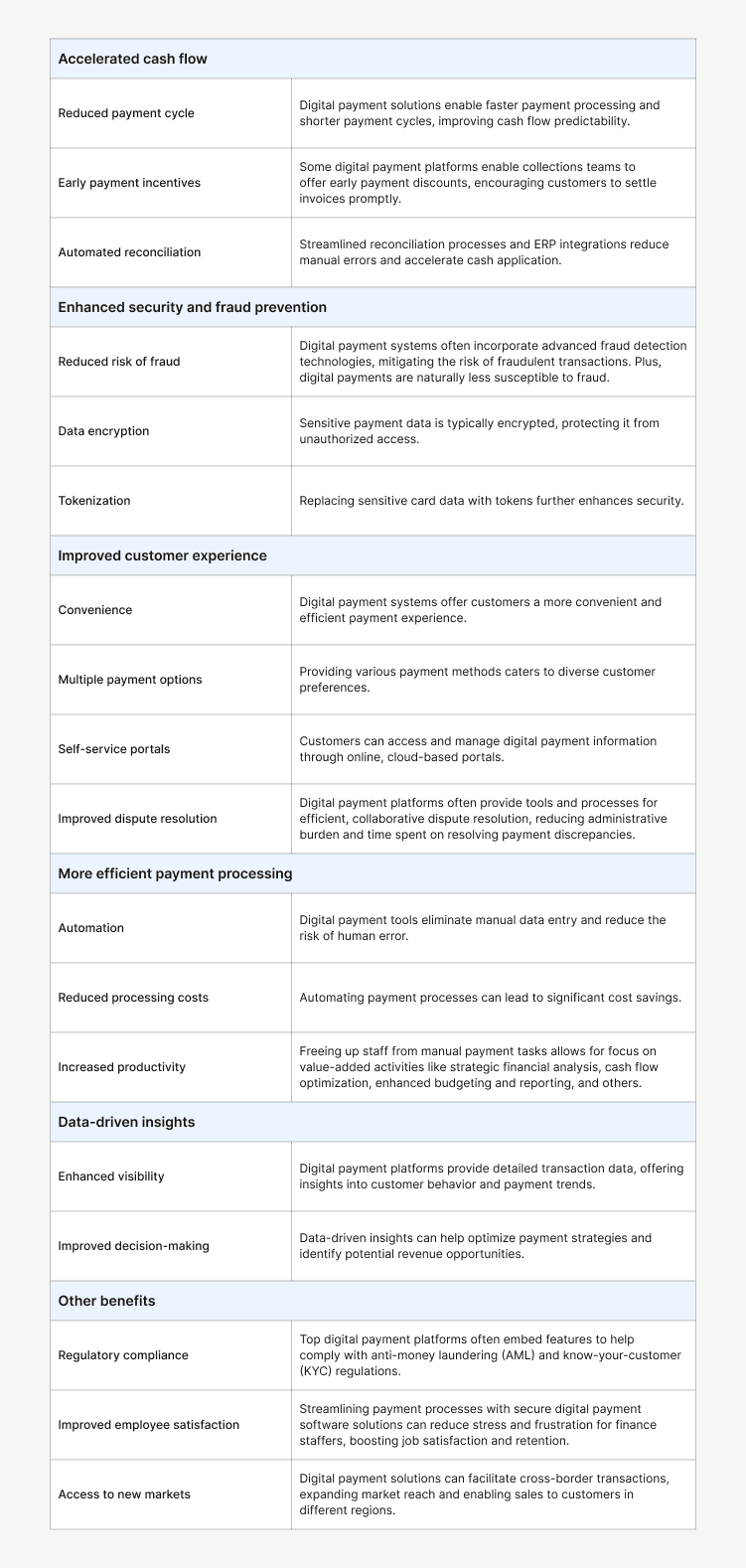

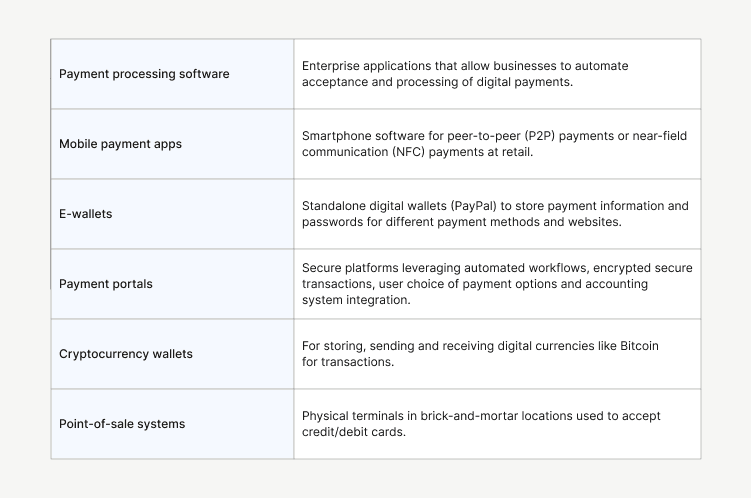

Secure digital payment solutions are becoming an essential element of the invoice-to-cash cycle in modern commerce, especially in B2B.

Digital Payments Are Ready For The Spotlight

We surveyed 100 finance tech leaders to find out how check and digital payments use compare at their organizations and what their priorities are for the year.

All digital payments resources

Getting paid online means you'll get paid faster. Find answers to questions on topics like virtual cards, what payment methods are used in B2B transactions, and much more.

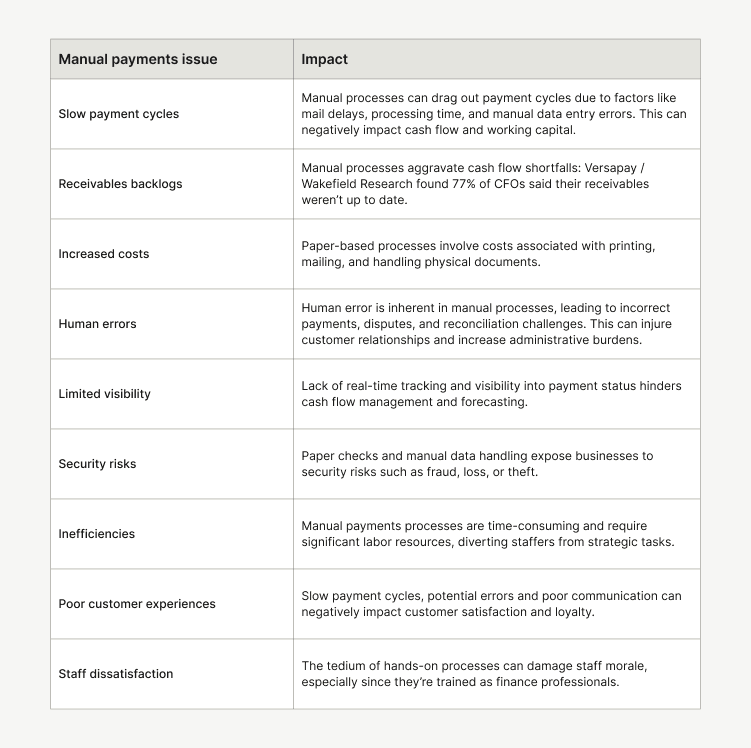

How to Choose Accounts Receivable Automation Software

Learn what value there is in automating your accounts receivable and how to choose accounts receivable automation software

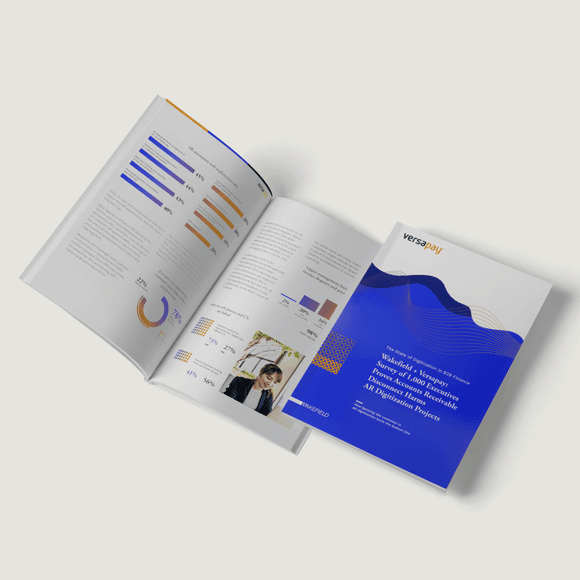

The State of Digitization in B2B Finance

In collaboration with Wakefield Research, Versapay surveyed 1,000 C-level executives at companies with a minimum annual revenue of $100m USD on their AR digital transformation efforts.

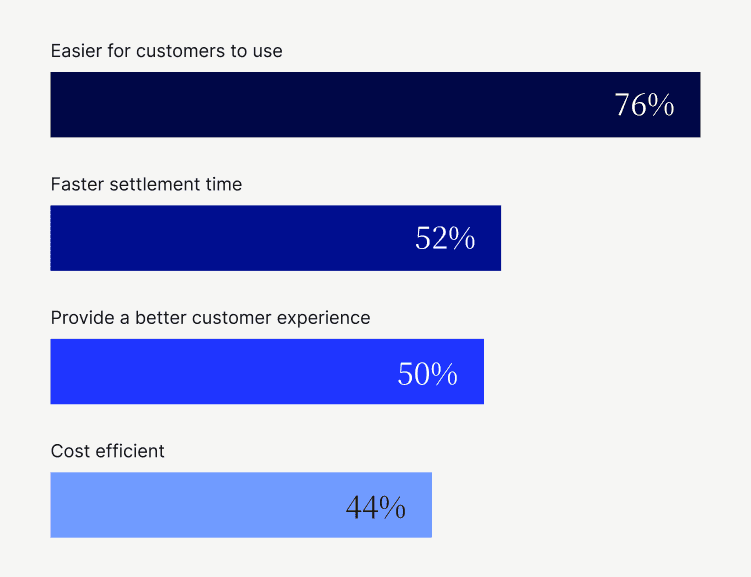

Digital Payments Are Ready For The Spotlight

Versapay surveyed 100 finance tech leaders to find out how check and digital payments use compare at their organizations and what their priorities are for the year