What Is Remittance Advice? Definition, Examples, and Advice for AR Teams

- 11 min read

AR teams depend on remittance advice to complete cash application. Yet remittances arrive through multiple channels in various formats, making cash posting hard.

This article explores what remittance is, and how you can ease the ways your team processes and matches remittance advice with payments and open invoices.

Maintaining accurate records is essential for any accounting team, and remittance advice plays an important part in helping you match incoming payments to the right invoices.

The trouble is that sourcing and interpreting remittance advice is a notoriously challenging process. This is especially because there’s no standardized format that all companies use for remittances. Accounts receivable (AR) staff also typically have to do all the matching manually.

In this article, we’ll explain what remittance advice is, the challenges associated with processing remittance slips, and how the right software can help your AR team surmount those challenges.

Jump to a section:

Remittance advice overview: 6 common definitions and questions

1. What is remittance advice?

After issuing an invoice, sellers wait to receive payment from their customers. Remittance advice is the clarification a customer provides along with their payment that tells their supplier what invoice their payment is for. The term “remittance” refers to a payment made for goods and services more generally. It quite literally means to “send back.” So, providing “remittance advice” means giving additional details about the payment you’ve just made.

Remittance advice can also act as confirmation that a payment is on the way. Some companies call this a remittance slip, or even a payment voucher.

2. What are the different types of remittance advice?

All remittance advice is not the same, nor is how it’s sent. Remittance advice might be physical and delivered through the mail; or it might be digital and delivered electronically. There are several different forms of remittance advice, including:

Basic remittance advice — This remittance simply states which invoice number a payment is for, and indicates the total payment amount

Removable invoice advice — This remittance accompanies an invoice (when issued), and is removable. The recipient (the customer) fills out the remittance slip and submits it back to the seller alongside their payment.

Scannable remittance advice — As the name suggests, this remittance slip can be scanned for digital record keeping.

Alternatively, you might see remittance advice categorized as such:

Email remittance advice — This remittance is sent via email (alongside or separate payment), and often found within the email’s body or as an attachment. It’s an increasingly popular format for remittance delivery as buyers and sellers eskew paper-based processes.

Paper-based remittance advice — This remittance is often hand-written or printed, and packaged up and mailed. It contains all pertinent payment information.

EDI-based remittance advice — This remittance is usually sent through EDI machines. They’re composed of alphanumeric characters, and are ideal for businesses that process large payment volumes and who have automated portions of their AR processes.

Web-based remittance advice — This remittance is digital, and sent to sellers through web- or cloud-based accounts receivable payment portals.

3. Why do you send remittance advice?

Customers aren’t required to supply remittance advice with their payment, but it is common courtesy. This is because accounts receivable departments depend on remittance advice to complete cash application (the process of recording revenue once you’ve received a payment). By providing a remittance slip, customers help suppliers match their payment to the correct invoice(s), ensuring their open balances get settled.

Unfortunately, as most payments are made digitally these days, remittance advice is rarely issued. Previously, these information slips would accompany checks and detail their purpose. Today, advanced cash application tools and accounts receivable automation software—that leverage AI and machine learning—can automatically pay incoming payments with open invoices in lieu of remittance advice.

4. How do you create remittance slips?

Accounts payable (AP) departments will generate remittance advice slips to accompany payments to their suppliers. Methods of sending remittance advice include:

Email (in the body or as an attachment)

Paper documents (snail mail)

Excel sheet

Electronic data interchange (EDI)

On a check itself (I.e., the memo line)

Accounts payable portal

As businesses’ adoption of accounts payable software increases, you’ll likely get more customers sending remittance advice through their AP system as they can more easily integrate this into their existing workflow.

For instance, as an AR professional, you might receive an automated email marking a payment as approved by the customer’s AP department. This will often be followed by another email advising that the payment is on the way, followed by a final email confirming the invoice has been ‘paid’.

5. Is remittance advice proof of payment?

Remittance advice is not proof of payment, but simply a confirmation that payment was sent. There are things that can go wrong between a buyer sending a payment and the funds hitting your bank account (like incorrect information or insufficient funds causing an electronic transfer to fail).

For this reason, an auditor wouldn’t recognize a remittance slip as confirmation of the payment’s receipt. Auditors will rely on an actual bank statement to confirm proof of payment. For internal purposes, however, a remittance slip provides helpful documentation of the payment date and which receivable(s) to match it with.

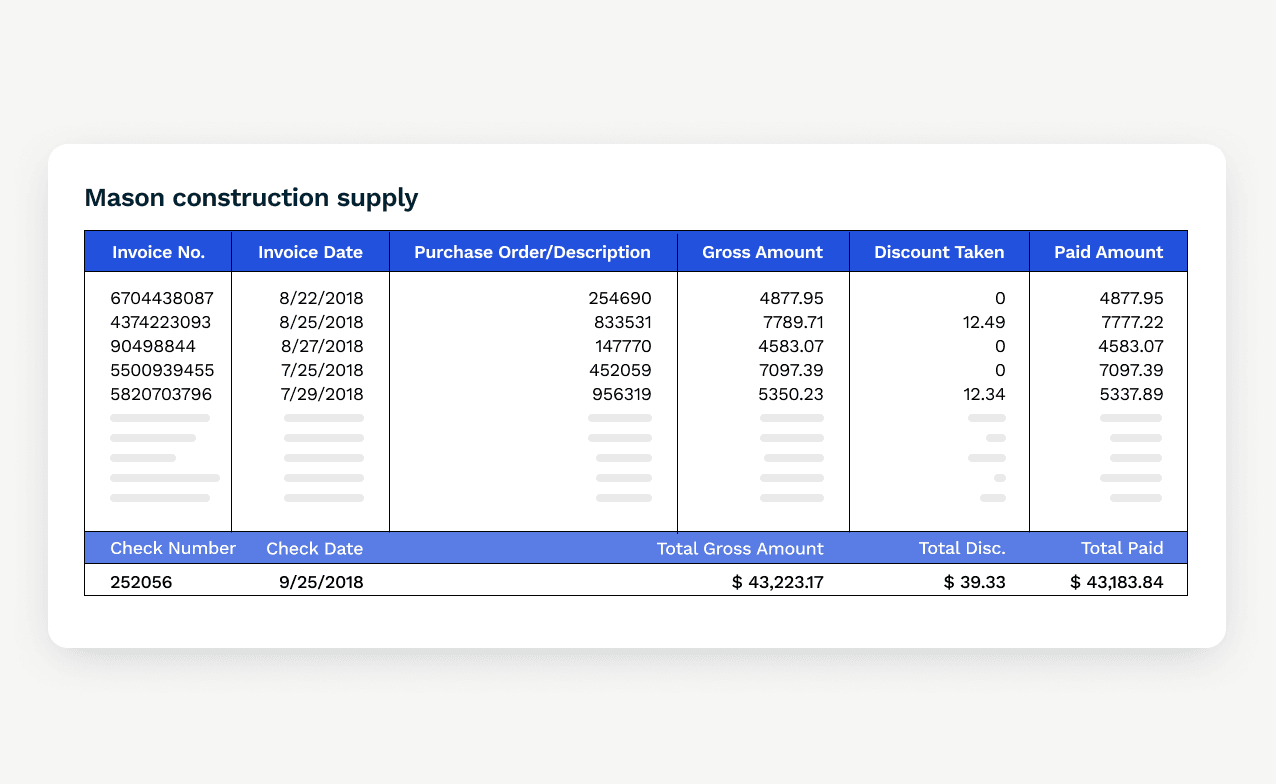

6. What information does remittance advice contain?

The type of information included in remittance advice will differ depending on what payment method was used. For example, checks are often accompanied by lengthy paper remittance advice, whereas automated clearing house (ACH) payments might exclude remittance information altogether.

That said, here is the information basic remittance advice will contain:

Payee and payer names

Contact details for both the payer and payee

An email address (for emailed remittance advice)

Invoice date

Invoice number

Related purchase order number

Payment method and currency

Description of services of products

Payment amount and date

Highly detailed remittance advice slips may also include:

Payment reference number

Paper document number

Gross and net amounts

Discount taken

Deductions

Amount withheld

You might also see the amount paid by invoice number (or payroll period), the credit amount issued with credit reference numbers, or an expected receipt date if the electronic funds transfer is not immediate.

What does remittance advice look like? (Remittance advice example)

Remittance slips typically provide information about which invoices are being paid and the amount of each payment. Occasionally, the remittance advice slip will show any adjustments made to the payment total (such as deductions or credits).

The AR department will then use the information on the remittance slip to update their records and apply the payment to the correct invoice(s). Here’s an example of what a remittance slip commonly looks like:

3 frequent challenges with managing and processing remittance advice

Accounts receivable teams often experience challenges when manually matching remittance advice with invoices. Chief among these challenges are:

Dealing with disparate sources and formats

Illegible remittance data

Complex cash application

1. Dealing with disparate sources and formats

Retrieving remittance advice from multiple customers means dealing with disparate sources and formats. There is no standardized format for remittance advice—it will differ based on the company and the payment method used.

Checks might include remittance information (the invoice number) in the memo line or in an accompanying document. Meanwhile, for ACH, wire transfers, and virtual cards, the remittance advice arrives separately in different formats (often email).

Also, because buyers are not technically required to send remittance advice, it's possible you might not receive a remittance at all. When payment arrives without remittance advice, AR staff must contact customers for clarification. This will traditionally involve a series of emails or phone calls.

When remittance advice does arrive—be it by mail, email, Excel, or AP portal—the task of retrieving it is equally time-consuming. This is especially challenging if most customers are using AP automation platforms to send remittance advice, because your staff will undoubtedly have to access multiple online portals, each with a different login. As your customer base grows, this becomes harder and harder to scale.

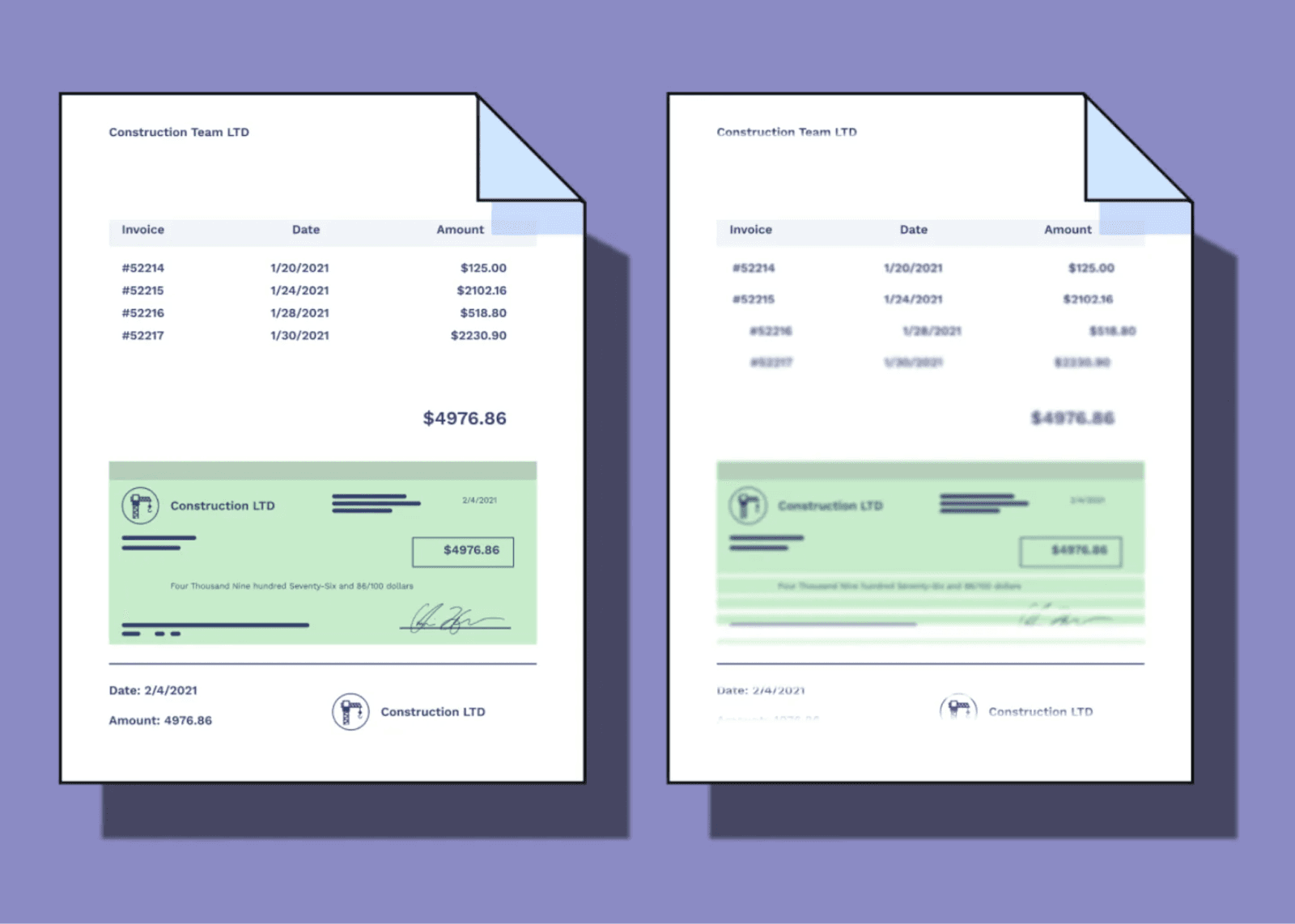

2. Illegible remittance data

Remittances can be notoriously illegible, too. Think blurred images, missing characters, and sometimes even handwriting. This can make the process of matching remittance slips with open receivables extremely difficult.

Because companies can have varying approaches to how they format remittance slips, this can make it difficult for AR staff to be sure they’re applying payments correctly.

3. Complex cash application

The actual process itself of matching remittances with open invoices is complicated. One payment could be paying 50 invoices, an invoice could be short-paid, or there could be no supporting remittance advice. In some cases, single payments might be accompanied by tens of pages of remittance advice, taking hours to apply, as was the case with one of our customers.

“The size of some of our regular customers’ invoices were tripling. A $200,000 check payment might be accompanied by 60+ pages of remittance. It simply wasn’t scalable.” — Sr. Manager of Financial Services

What’s worse, you could have a confluence of all these issues at once: a payment covering multiple invoices, with deductions applied, and without any accompanying remittance advice. Complex situations like this can create entire workdays of fact-finding, troubleshooting, and back-and-forth communications with customers for your AR staff.

How automation can streamline remittance advice processing and matching

Up until recently, companies were stuck spending countless human hours resolving individual cases during cash application. Versapay gives accounts receivable teams a much simpler way to retrieve and match remittance advice with open invoices. Our cash application solution captures and normalizes data for various types of remittance advice and matches these to open invoices using artificial intelligence.

What's more, payments made through Versapay’s account receivable automation software automatically give context about what the payment is for, eliminating the need for a separate remittance slip. For the outlying cases where your AR team does need to request clarification from a customer, they can do so seamlessly through Versapay’s cloud-based collaboration tools.

Want to see for yourself how Versapay's advanced cash application works? Watch Versapay's cash application product demo to see how we automatically extract remittance data from multiple sources—including vendor portals, bank lockboxes, emails, and PDFs—using advanced image recognition and machine learning technology:

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.