Short Paid Invoices: How to Handle Short Payments

- 8 min read

In this blog, you'll learn everything you need to know about short payments, including:

- What a short paid invoice is,

- The business impact of short pays,

- How you can prevent unexpected short paid invoices

- How to ensure your invoices are paid in full

- And more!

Submitting a short paid invoice is a convenient way for customers to make payments while they dispute certain elements of their bill. In fact, with today’s business-to-business (B2B) buyers expecting to pay using a range of payment options, short payments are quickly becoming options they look for and even expect.

However, short paid invoices must be managed properly. They are unavoidable, and most often occur because of invoice discrepancies or miscommunications in the invoice-to-cash cycle. Often, a short payment received indicates your customer believes the work or goods they’ve been promised has been insufficiently fulfilled.

And ineffective collections processes that fail to consider short payments can further negatively impact cash flow, and burden your accounts receivable team.

In this blog, we’ll discuss:

- What short paid invoices are

- Why businesses short pay invoices

- The business impact of short pays

- How to engage in dispute and deduction management

- How to resolve short pays, and

- Best practices for preventing unexpected short paid invoices (and ensuring your invoices are paid in full)

Short payment meaning: what is a short paid invoice?

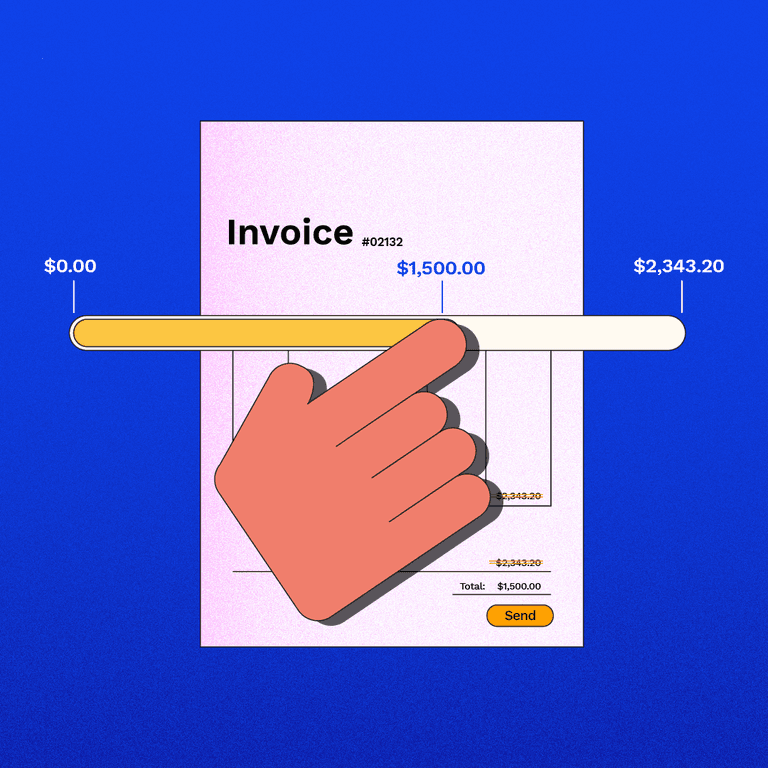

A short payment is a payment that is less than the invoiced amount. A short paid invoice is an invoice that hasn’t been fully satisfied by the payment that was submitted.

A short paid invoice is usually indicative of a customer disputing some portion of what you’ve billed them for. That dispute may be valid or invalid, but either way, it’s something that your accounts receivable (AR) team must deal with quickly and professionally.

Leaving a short paid invoice unaddressed for any period of time effectively provides your customer a no-interest loan at the expense of your company’s bottom line. This also increases the chances that the outstanding balance will remain unaddressed and end up permanently unpaid.

Why do businesses short pay invoices?

There are many good reasons why a customer might partially pay an invoice, and there are also less respectable motivations. Let’s call these reasons “valid” and “invalid.”

Valid reasons to short pay invoices

Valid reasons to short pay an invoice usually relate to questions or disputes about items on the invoice, however, there are other genuine reasons.

- A customer might short pay because they disagree with an element of the bill and would like to resolve the discrepancy before paying for the full amount. For example, a shipment might arrive with missing or broken items.

- Another good reason to make a short payment is to correct an error on an invoice. Perhaps an invoice lists the same item twice, but the customer only ordered one. The customer could pay the invoiced amount minus the extra item—resulting in a short paid invoice—satisfying what they believe is their obligation for the transaction.

- One common error that AR teams make is charging sales tax to customers who are tax-exempt, whether it’s because they live in a state with no sales tax or they have tax-exempt status. In that case, the tax-exempt organization may short pay by excluding the tax from their payment.

- Another valid reason why customers might short pay is when they make an honest mistake. Customers that aren’t using electronic payment management may simply write or key in the wrong amount, resulting in a short paid invoice.

Invalid reasons to short pay invoices

Invalid reasons to short pay an invoice usually involve customers intentionally avoiding payment. A customer may make a short payment because they don’t have enough cash on hand to satisfy the full payment. Or they might do it because they simply want to pay less than required and hope you won’t notice or won’t follow up on the short paid invoice.

The impact short paid invoices have on businesses

The most obvious business impact of short payments is the reduction in revenue these underpayments result in. This is especially problematic for invalid short pays, as those underpayments represent income that your business can legitimately claim.

But beyond the revenue impacts, short pays also present challenges when reconciling payments with open receivables. Without cash application automation software, for example, the complexities of handling short paid invoices are a major source of headaches for accounting teams.

A lot of manual effort would be required to follow up with customers to figure out why a short payment was made and track the follow-up process.

This heavily manual process was cumbersome and would take accounts receivable professionals away from other important tasks. But with new tools that streamline and automate the handling of short paid invoices, this process is now much easier to manage.

What is dispute and deduction management?

A dispute occurs whenever a customer doesn’t pay the entire amount they’ve been invoiced for, whether that means they neglect the entire invoice or short pay a portion of it. In both cases, there could be legitimate reasons for the lack of payment, and it’s the accounts receivable department’s job to get to the bottom of it.

For instance, it’s possible that a customer did not receive a particular item or received it damaged. Perhaps a customer was quoted a discounted price but is being invoiced for the full amount. Perhaps the customer was mistakenly charged for an item they did not order, or they are being charged with a late fee they feel is unjustified.

The process of resolving these issues is called dispute or deduction management. AR teams must investigate an issue and resolve it with the fairest outcome for both the supplier and the customer. Resolving disputes quickly is essential because the longer a resolution takes, the longer the business goes without receiving the revenue in question.

How to resolve short pays and short paid invoices

Resolving short paid invoices can be a tricky and time-consuming process. Traditionally, it involves a lot of back-and-forth with the client over mail, email, and phone. When these efforts are unsuccessful, AR teams may need to opt for more formal dispute resolution strategies.

They say an ounce of prevention is worth a pound of cure, and that is certainly the case with short payments. Automating as many aspects of your accounts receivable process as possible will help reduce the number of errors and discrepancies that so often result in invoice disputes.

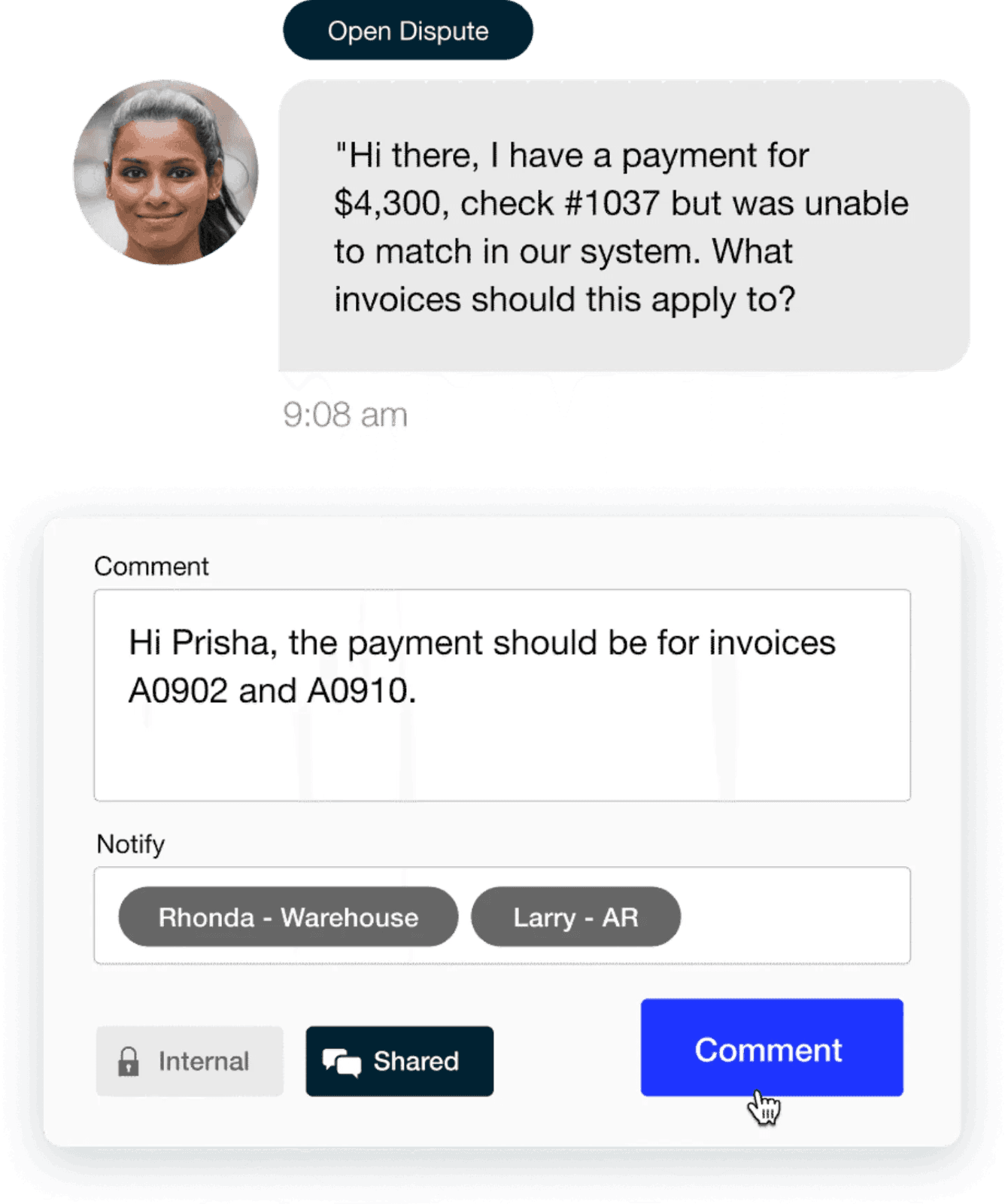

Communicating with clients through a collaborative payment portal also helps streamline the process of inquiring about short pays and resolving disputes.

💡 Quick tip for resolving short payments

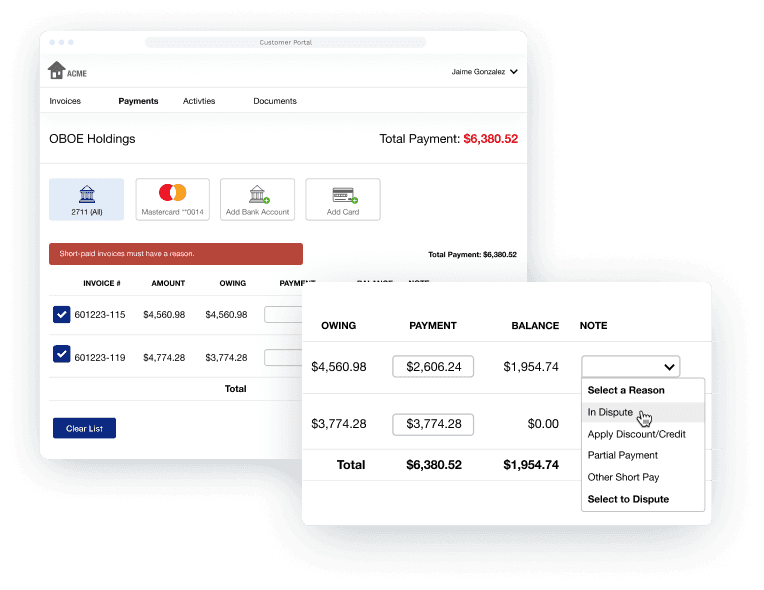

Make sure that your invoicing solution or accounting software includes customizable deduction codes. This will require your customers to indicate the reason for a short payment via an approved list of options, which will help you reconcile short short paid invoices without the guesswork. Versapay’s Collaborative AR automation software provides exactly that capability, helping you streamline the dispute and deduction management process.

When your customers pay through the Versapay platform, they can elect to pay multiple invoices or make a short payment. When making a short payment, customers are required to give a reason and can leave a note—directly on the invoice—providing additional context.

A fully paid invoice: best practices for reducing short payments

Regardless of the tools you have in place, there are always tactical adjustments your AR team can make to reduce the volume of short payments they receive.

While Collaborative AR automation software will go the farthest toward reducing short pays, following these best practices will help reduce their frequency, no matter how you manage your receivables:

- Use a consistent and reliable invoicing method, including a set follow-up procedure—collections email templates work great!

- Have a process in place to check invoices for errors

- Have a process for tracking valid reductions such as early payment discounts, working closely with your sales team, and

- Work with a reliable sales tax calculation engine to ensure you’re calculating correct sales tax figures.

All of these best practices are easy to follow when you use a Collaborative AR platform like Versapay. When paying through Versapay, your customers can pay multiple invoices at once, schedule and automate recurring payments, leverage credits, and pay with their method of choice.

Learn how Versapay helps your accounts receivable team spend less time handling short payments and more time focusing on strategic work.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.