How to Choose the Best Cash Application Automation Software for Your Business

- 10 min read

This guide explores how to strategically evaluate and select the best cash application automation software for your business needs.

—

Manual cash application processes are a bane of accounts receivable (AR) teams. They delay cash flow and produce revenue-draining errors. But automating cash application is easier said than done. You have plenty of automation solutions to pick from. How do you know which one is right for you?

In this guide, we look at critical components an automated cash application software should have and how you can choose the right one for your needs.

Jump to a section of interest:

3 cash application activities you should seriously consider automating

Most available software platforms automate different parts of the cash application workflow. Making sense of all those automation combinations can be confusing, so rather than diving into features and capabilities from the outset, we recommend focusing on components (or groups that features might naturally fall into) that require automating, first. Here are the 3 cash application components you must automate at a minimum:

Component #1: Linking remittance and payment data

Component #2: Linking payment data to invoices

Component #3: Coding deductions and posting to ERP

Component #1: Linking remittance and payment data

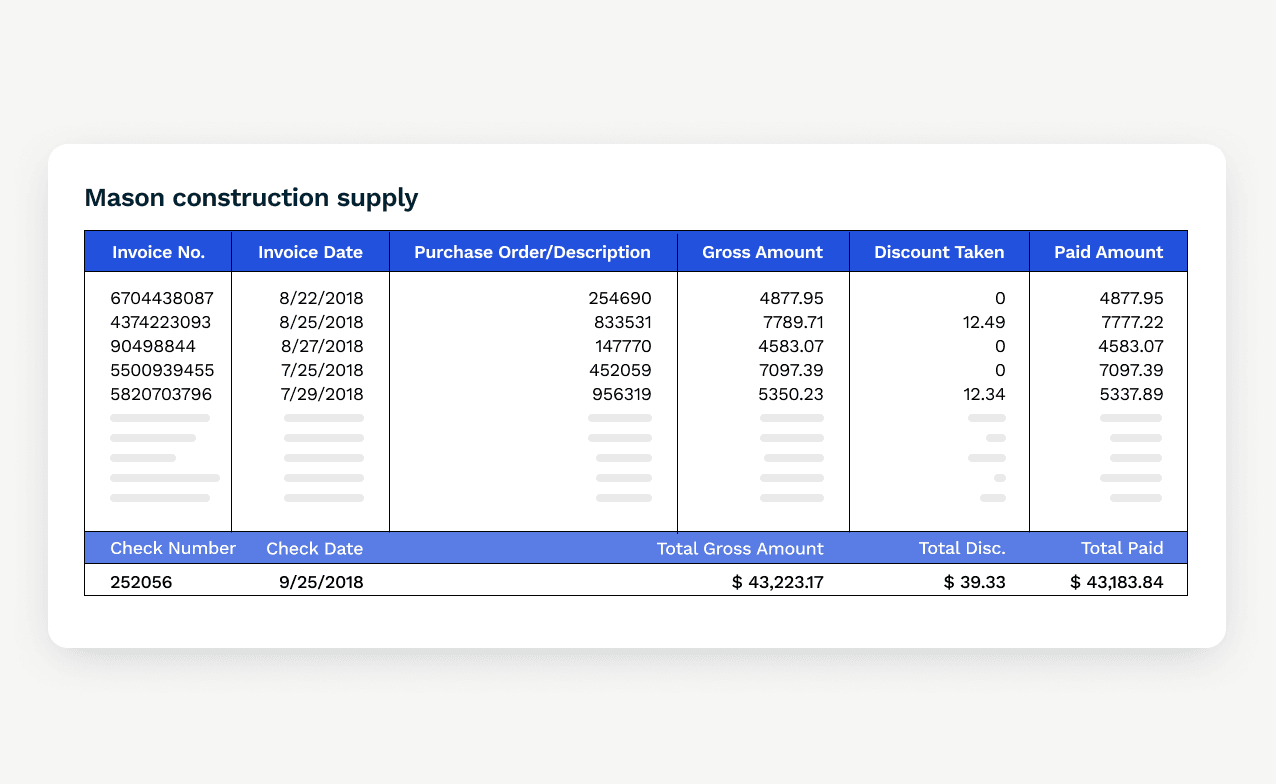

It's no secret that B2B payments are complex. Our customer, a healthcare service provider, stands as a good example of this complexity, often receiving single check payments accompanied by over 60 pages of remittance data.

Checks aren't the only payment method that suffer from remittance data complexity. Several payment channels like ACH, lockbox payments, and even echecks suffer from a 'remittance lag' where data arrives separately from the payment (if at all).

Automating this tedious task makes sense given how central remittance data reconciliation is to cash application. Look for cash application automation software that can automatically link payments to remittance information, regardless of source.

Component #2: Linking payment data to invoices

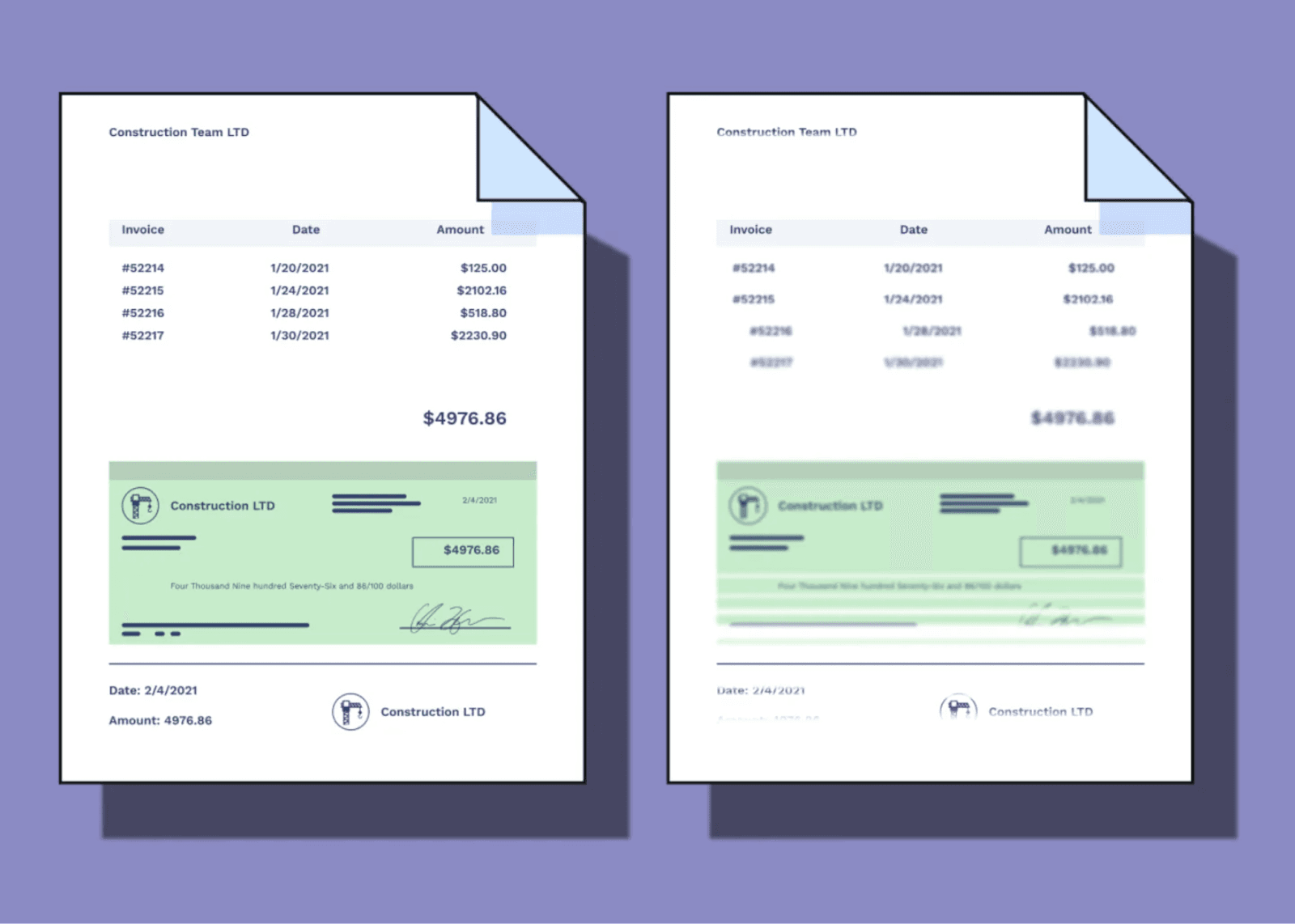

Linking remittance data to payments is just one half of the cash application equation. You still have to match payments to open invoices (and ultimately, customer accounts). Manually executing this task is a time sink for your AR team.

Let's look at check payments as an example. Some checks lack remittance information. Some checks arrive damaged or have illegible data. Handwritten checks might get lost in the mail, and even when they arrive, scrutinizing them can be tough.

Advanced optical character recognition (OCR) technology cannot repair damaged checks, but it can save your AR team's eyes (and sanity!). You can match handwritten checks to outstanding invoices thanks to OCR, matching client information to outstanding invoice amounts.

OCR is just one example of cash application automation. Look for processes like this that save you time by automating the payment matching process. It's what reduced Würth Canada's time spent processing payments by 75%.

Even if you receive legible payment data, manually matching payments to invoices and customer accounts is tedious. At high volumes, it leads to fatigue and easily-avoided errors. Choosing solutions with straight-through processing (STP)—software that automatically applies payments to invoices without human intervention—is a great way of avoiding these issues.

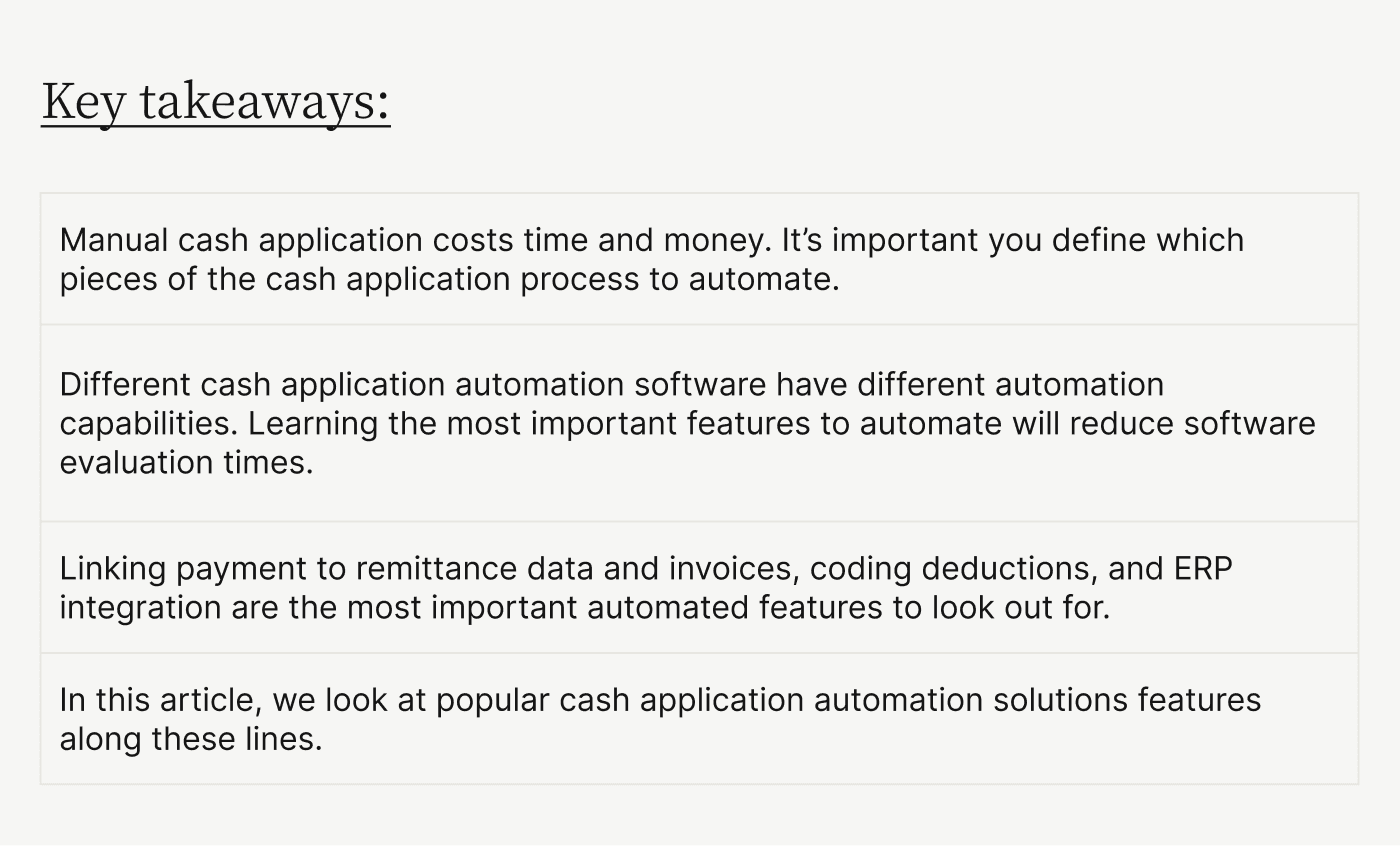

Component #3: Coding deductions and posting to ERP

Your cash application software's automation abilities must solve complexity as much as possible. Look for software that simplifies two common sources of B2B payment complexity—partial payments and dispute workflows.

Here's an example: Your customer pays a few lines in an invoice but raises disputes on others. Can your cash application automation software record the right payment data from remittance information, tag the invoice with the correct status, and apply cash automatically? Furthermore, can it integrate with your ERP platform to apply cash to your books correctly and without your involvement?

Look for these features when evaluating cash application software. The best solutions identify the right payment conditions, deductions, and other data to record the right amounts of cash on your books.

When used as part of a broader accounts receivable automation platform, some cash application automation solutions even allow your customers to communicate with you over the cloud, in real-time, to clear up common questions arising from short payments or payments covering multiple invoices.

While you’ll still need manual intervention when remittances are highly unstructured or illegible, automating other cash application situations will give your AR team more time to handle these exceptions successfully.

The buyer’s checklist for automated cash application software

Now that you know what to look for in software at a minimum, here is a checklist of features you can use to track different software functionality.

4 popular cash application automation software platforms

You'll likely encounter a few vendors when searching for popular cash application automation software. Here are those platforms alongside brief reviews of their functionality:

HighRadius

Billtrust

Quadient AR by YayPay

Versapay

HighRadius

HighRadius is a popular accounts receivable management platform that offers cash application automation functionality. It features a customer portal that enables self-service, reducing the time your AR team spends manually matching and managing invoices.

The platform also features credit management tools and integrates with your customers' accounts payable portals. This means the process of issuing invoices and applying cash to your books is automated, with manual intervention required only as needed. HighRadius also offers deduction management functionality along with automated collections.

On the downside, the platform cannot manage disputes down to the invoice level. HighRadius' onboarding is also tedious, which increases ramp-up times for your accounts receivable team. And while the platform offers global support, the turnaround for requests is slower with offshore teams potentially increasing response times.

Lastly, HighRadius is not a payment facilitator, meaning you'll have to integrate a third party payment processing system with it to automate capturing payment information and applying it to invoices.

Billtrust

Billtrust is a popular accounts receivable automation platform. They claim to have industry-leading matching rates thanks to AI-powered cash application. In addition, Billtrust’s solution features intelligent collections, with useful features like automated payment reminders that save your team valuable time.

Billtrust also offers credit management capabilities through its accounts receivable payment portal. In contrast to HighRadius, Billtrust is a payment facilitator, which makes capturing electronic payment information seamless. When added to its ability to integrate with customer AP portals, Billtrust's cash application module is fairly powerful.

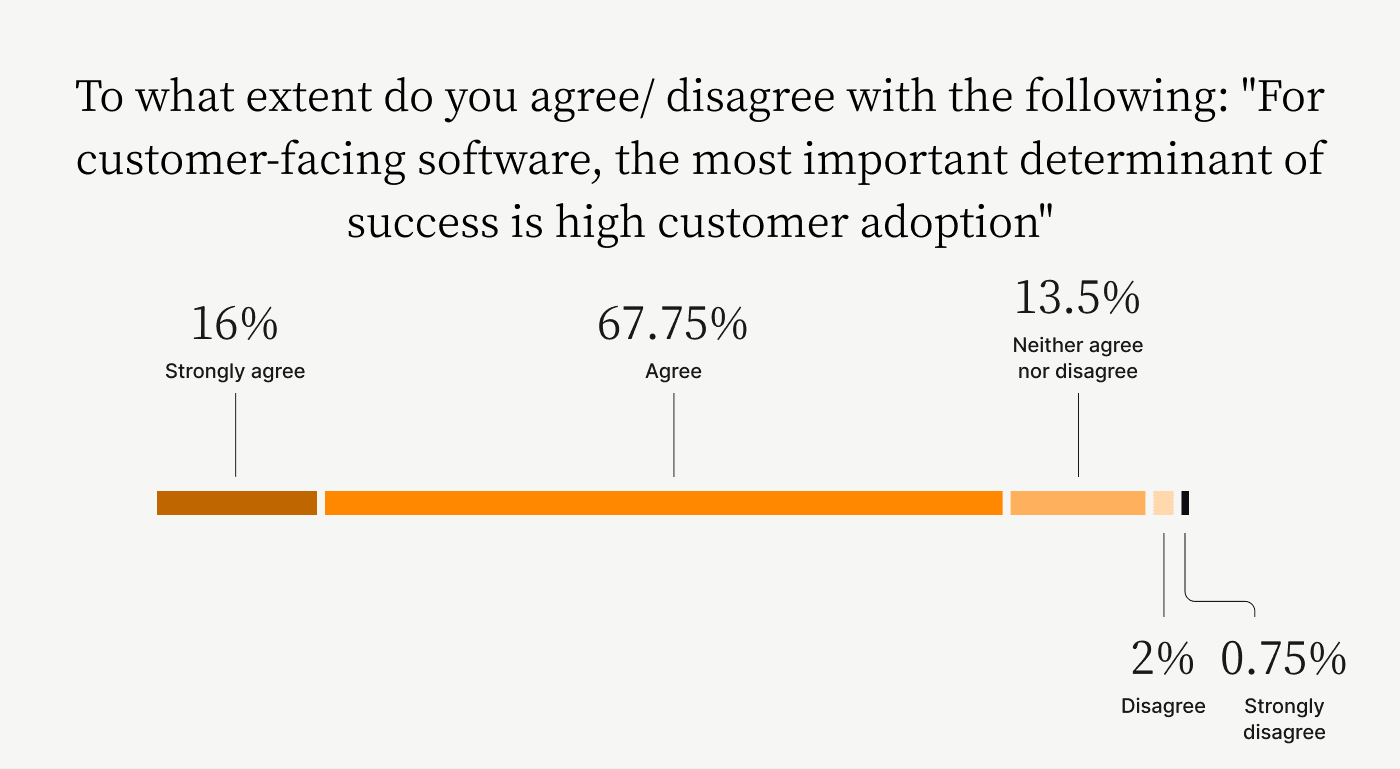

Conversely, Billtrust’s users cannot manage disputes at the invoice level, something that hampers processes when customers wish to raise disputes. User-friendliness might also be an issue due to relatively low customer adoption rates.

We previously examined the role customer adoption rates play in ensuring a successful digital transformation, so despite Billtrust's powerful features, this is something to keep in mind.

Quadient AR by YayPay

Quadient AR by YayPay delivers a standard accounts receivable payment portal that offers plenty of powerful features but lacks the customer experience componentry found in collaborative portals. YayPay’s customer portal does, however, enable self-service.

It also features AI-powered optical character recognition to ingest remittance data and apply cash to open invoices and customer accounts. However, Quadient AR cannot track and manage disputes at the invoice level. Its onboarding experience can be improved, too, so that it may positively impact CX and customer adoption rates.

Quadient AR also needs an integration with your payment processor since it isn’t a payment facilitator. This deficiency means you'll need additional resources—via an external processor—to automate the cash application process. This also slows down how quickly you’ll be able to approve and apply your customers’ payments.

While the platform lacks certain features, it comes with deduction management and the ability to integrate directly with customer AP portals.

Versapay

Versapay is the only collaborative accounts receivable payment platform that offers the benefits of automation and boosts CX. Our platform features automated cash application, invoice-level dispute management, and a communications portal where you can directly message your customers, helping you handle those pesky exceptions.

Versapay also delivers high straight-through processing rates (>90%) on payments made in-portal, meaning it applies payments to your open invoices directly, updates customer account statuses, and pushes data to your ERP to simplify accounting—all without human intervention.

Versapay automates your cash application process with advanced technology like machine learning and OCR to match any payment type with open invoices. The result is less manual effort for your accounts receivable team, accelerated cash flow, and fewer errors in the matching process.

Intelligent cash application is critical for faster cash flow

Cash application used to be a series of tedious manual processes but technology has changed the game. You can help your AR team save time and reduce operating costs with automated cash application.

Learn more about how Versapay's AI-powered cash application automation software increases accounts receivable efficiency in our finance leader’s guide:

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.