Cash Conversion Cycle: Definition, Formula, Calculator, and Examples

- 11 min read

Generating cash quickly from investments in inventory (and elsewhere) is the name of the game. And effective cash flow management is an essential piece of the puzzle.

In this blog, we cover everything you need to know about the cash conversion cycle: one of the most important metrics for unlocking liquidity.

The faster you can generate cash from your investments in inventory and other resources, the more working capital you can use for growth opportunities, risk mitigation, and business operations. That’s why effective cash flow management is essential for maintaining a healthy financial position.

The cash conversion cycle (CCC) is a metric that can help you unlock liquidity. By understanding how long it takes you to sell your products, convert receivables, and pay suppliers, you’ll be able to make adjustments that can improve the financial health of your business.

In this article, we’ll explain the definition of the cash conversion cycle and how to calculate it using the cash conversion cycle formula. Then, you’ll get insight into what a “good” CCC is and how you can use it to assess performance.

Jump to an area of interest:

What is the cash conversion cycle?

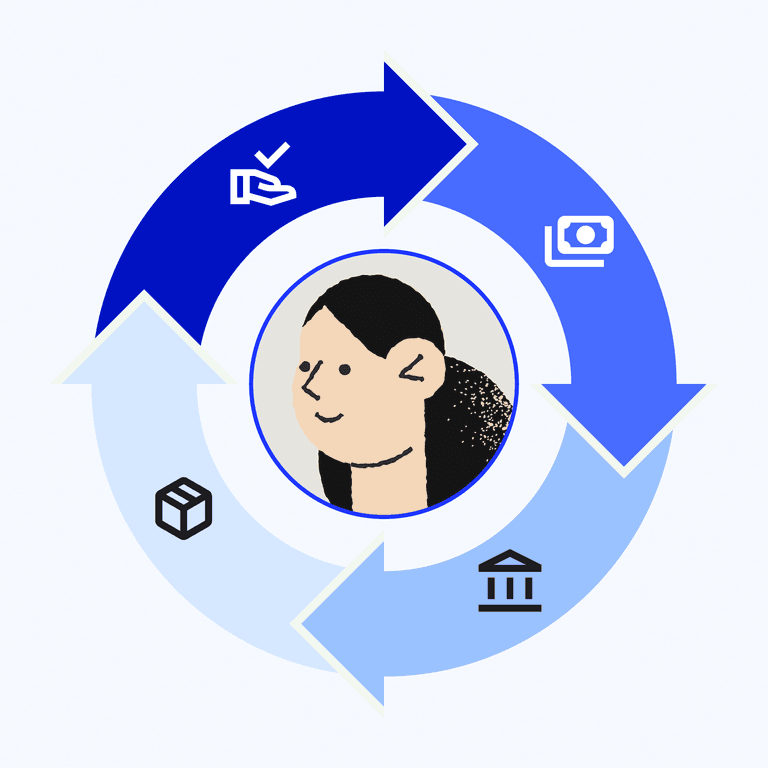

The cash conversion cycle measures the time it takes (in days) to convert investments in production and sales into cash received.

Also known as the net operating cycle, or simply the cash cycle, the cash conversion cycle combines the following three components:

Days Inventory Outstanding (DIO): The average number of days your business holds its inventory before selling it.

Days Sales Outstanding (DSO): The average number of days your business takes to collect payments from customers after completing a sale.

Days Payable Outstanding (DPO): The average number of days your business takes to settle obligations with suppliers, creditors, and financiers.

The cash conversion cycle can depend on a variety of factors, including how you finance inventory purchases, the credit terms you offer customers, and the terms you negotiate with suppliers.

How to calculate the cash conversion cycle + CCC formula

To calculate your cash conversion cycle, simply follow this formula:

Cash conversion cycle formula = DIO (Days Inventory Outstanding) + DSO (Days Sales Outstanding) - DPO (Days Payable Outstanding)

Essentially, you’re adding short-term assets (DIO and DSO) together and subtracting short-term liabilities (DPO). To quickly calculate your cash conversion cycle, use this calculator:

The cash conversion cycle calculator

You’ll need three values to calculate your cash conversion cycle. Here’s what they are and how to calculate them.

DIO formula

To calculate your Days Inventory Outstanding, you’ll need to know your Cost of Goods Sold (COGS). Here’s the COGS formula:

COGS = beginning inventory + purchases - ending inventory

Then use that in your DIO calculation:

DIO = (average inventory/COGS) x 365

Note that using 365 gives you a yearly indication of DIO. You can also use shorter timeframes, i.e., 30, 60, or 90 days.

DSO formula

If you don’t want to type out your inputs on a calculator, head to our DSO calculator. Here’s the DSO formula:

DSO = (account receivable/total net credit sales) x number of days

DPO formula

You’ll also need your COGS to calculate Days Payable Outstanding. Here’s how:

DPO = (average accounts payable x number of days)/COGS

—

💡 Improving the performance of your accounts receivable is a powerful way to shorten your cash conversion cycle and improve your cash flow. We offer reporting tools and other analytics resources that can help you interpret data and effectively communicate what it means for your business.

What does a good cash conversion cycle look like?

While a short cash conversion cycle is better than a long one, a good cash conversion cycle looks different across industries. According to GMT Research, cash conversion cycles range from about nine days for retailers up to 870 days for real estate developers.

After analyzing S&P 1500 companies from 2011-2018, JP Morgan found that the average cash conversion cycle ranges between 61 and 68 days. Large companies generally have shorter cash conversion cycles than small companies, because smaller companies generally have longer inventory and receivables conversion periods. Larger companies may also have better leverage with suppliers. A “greater focus on standardization and automation of their working capital processes” is also a contributing factor.

Some companies, most famously Amazon, have a negative cash conversion cycle. In this scenario, companies move inventory and collect payments faster than they pay their expenses. This generates impressive liquidity that can eliminate the need for investor capital.

How the cash conversion cycle can help you evaluate performance

💡 TLDR: Tracking and analyzing your cash conversion cycle can provide valuable insights into your ability to manage working capital and efficiently convert resources into cash. Regular monitoring allows you to identify and address any bottlenecks in your operating cycle, accelerate your cash flow, and improve your company's overall financial performance.

—

Knowing the length of your cash conversion cycle—and the three components that make it up—can help you evaluate the financial health and performance of your business.

For example, your DIO can give you insights into how efficiently you manage your inventory. A longer DIO indicates slower turnover, which may imply inefficiencies in supply chain management or slow moving products. Carrying excess inventory can also lead to extra storage, insurance, and depreciation costs, so knowing your DIO can help you address those issues. Your DIO can also point out a need for more accurate sales and demand forecasting.

Analyzing how your DSO trends over time can show you if your collection periods are improving or worsening. This information can provide insights into the effectiveness of your credit policies and the efficiency of your collections process. It can also help identify potential issues with customers' payment behaviors and your company's overall credit risk.

And finally, your DPO can be used to monitor your company's ability to efficiently manage its working capital. A higher DPO can indicate that you’re effectively using the money you owe your suppliers to fund operations, which can help improve liquidity and reduce the need for external financing.

How to improve your cash conversion cycle

If your cash conversion cycle is higher than your industry peers, or if you just want to shorten your CCC as much as possible, you can make any of the following adjustments:

Move inventory more quickly

Convert accounts receivable faster

Adjust accounts payable terms

Automate accounts receivable

1. Move inventory more quickly

Quicker inventory turnover can shorten your cash conversion cycle. Improving data forecasting can help predict future inventory levels without tying up cash in unnecessary inventory. Data analytics can identify patterns and trends to help you adjust to market conditions and consumer demand.

2. Convert accounts receivable faster

Accelerating your AR collections will get cash coming in faster. A few ways to speed up collections include—but are not limited to—automating accounts receivable, implementing collections email templates, and optimizing your AR cycle.

Here’s some recommended reading for accelerating your accounts receivable conversion:

Why Collections Email Templates Are Key to Better Accounts Receivable

Accounts Receivable Process Flow Chart: A Guide to Optimizing the AR Cycle

Optimizing your accounts receivable processes can go a long way to shortening your cash conversion cycle. Simply improving your average collection period can have a massive impact on cash flow.

—

💡Ready to increase your collections’ effectiveness? Download the CFO’s Guide to Accelerating Collections and learn how to capture more revenue more quickly with a collaborative approach.

3. Adjust accounts payable terms

Adjusting the length of outstanding accounts payable can increase your flexibility and give you additional time to make payments. This maximizes your cash flow and can shorten your cash conversion cycle. However, doing this is a delicate balance, as suppliers generally favor businesses that pay faster (and on time).

4. Automate accounts receivable

Accounts receivable automation can shorten your cash conversion cycle by improving the accuracy and efficiency of invoicing and collection processes, enabling better cash flow forecasting, and driving exceptional customer experiences via self-service payment portals and online payment options.

Versapay’s automated accounts receivable solution helps reduce errors, get you paid faster, and collaborate with customers over the cloud. Teams that use Versapay spend an average of 50% less time managing receivables and see payments come in 25% faster.

Make the cash conversion cycle work for you

Monitoring your cash conversion cycle on a regular basis can help you assess your business’ performance and catch any cash flow issues before they become major problems. Shortening the cash conversion cycle, even by a few days, can positively impact your company’s financial health.

To do that, we suggest looking for ways to improve your accounts receivable performance. Versapay's Accounts Receivable Efficiency Suite simplifies the invoice-to-cash process by automating invoicing, facilitating B2B payments, and streamlining cash application. These are powerful solutions that contain reporting tools and other analytics resources that can help you interpret data and effectively put your cash conversion cycle in a better place.

Cash conversion cycle FAQs

What’s a good cash conversion cycle number?

The lower your CCC number the better, but a “good” cash conversion cycle really depends on your industry. The average cash conversion cycle across all industries is between 61 and 68 days, but you can always work to make yours shorter for better cash flow.

How can I reduce my cash conversion cycle number?

Since the cash conversion cycle is based on Days Inventory Outstanding (DIO), Days Sales Outstanding (DSO) and Days Payables Outstanding (DPO), making adjustments to how you manage inventory, negotiating more favorable terms with suppliers, and using automated tools to convert your accounts receivables faster can all help shorten your CCC number.

What is a negative cash conversion cycle?

Companies that move inventory and collect payments faster than they pay their expenses have a negative cash conversion cycle. A negative cash conversion cycle generates impressive liquidity that can eliminate the need for investor capital.

About the author

Ben Snedeker