What Is a Credit Policy? How To Create One

- 10 min read

Your credit policy sets the tone for your credit management processes and aligns your finance team around important organizational goals.

In this blog, we explain what a credit policy is and what you should include in it to ease credit approvals and collections.

Credit policies play an important role in your company's cash management process. The more robust your credit policy, the easier it is to safely extend credit to your customers and prevent delinquencies. Good credit policies also help you screen customers for financial suitability before onboarding them.

In this guide, you'll learn more about how credit policies help you achieve these goals. We’ll also explain:

What is a credit policy?

A credit policy defines how your company will extend credit to customers and collect delinquent payments. A good credit policy protects you from late payments and helps you maintain a healthy working capital position.

Your credit policy should cover the following:

- Terms of sale — How much credit you'll extend to customers and what the credit terms are

- Credit extension — Processes to evaluate credit criteria for each customer

- Collection process — Processes for collecting on past-due invoices

Why do you need a documented credit policy?

Some finance teams rely on verbally communicating their credit policy between team members. But, documenting it in a centrally available place offers several advantages.

For starters, you’ll avoid miscommunicating payment terms to your clients and set payment expectations transparently, improving your business relationships.

Second, a documented credit policy ensures everyone on your team is on the same page. The result is a consistent process your team can always rely on, eliminating any ambiguity in the credit management process.

Documenting your credit policy can also save you time and money. A recent study by Panopto and YouGov on workplace knowledge sharing revealed that 60% of employees in large US organizations find it difficult to obtain information from their colleagues.

Most employees also wait an average of 5.3 hours every week for critical information (either searching for the right person to speak to or waiting for a response,) thanks to undocumented processes.

The result of all this is a high degree of frustration, with 81% of respondents indicating dissatisfaction with undocumented or inaccessible information.

When making important decisions like approving credit terms for customers, you can’t afford these kinds of delays.

💡 The bottom line: Always document your credit policy since it saves you time and money.

4 factors to consider before writing your credit policy

Before designing and communicating your credit policy to your customers, consider the following four things:

1. The current economic climate

Make sure to adapt your credit policy for current economic conditions. For instance, if interest rates are set to spike, your customers might have less access to financing. Stricter credit terms may be a good move in this situation.

2. Your cash and working capital position

How robust is your working capital position, and will you experience major cash outflows in the coming months? If your cash flow is in a healthy place, offering more lenient credit terms could be a worthwhile strategy as it’ll bring you more customers and improve existing customer relationships.

3. The size of your customers and their financial position

Larger customers will likely have strong balance sheets, making them good candidates for generous credit limits. However, make sure you screen every customer based on their financial stability and not just their size.

4. Your customers’ business sectors

Some industries are riskier than others. For instance, gambling and cash advance lending are examples of industries that experience volatile cash flow. Minimizing risk by offering stringent credit terms is the best move for these kinds of customers.

How to write a credit policy in 5 steps

Here is how to effectively write a credit policy for your business in five steps:

- Outline your goals

- Define roles and responsibilities

- Define credit evaluation criteria

- Define your terms of sale

- Define your collections processes

1. Outline your goals

Setting goals and objectives might seem tedious at first. Doing this, however, helps align your team around common goals from the very start of the credit management process.

Credit management impacts every financial metric in your organization. Tying your credit policy to these metrics will give you tangible results.

For instance, you could define a goal of "reducing days sales outstanding by 10 percent" and design a credit policy that works towards getting you there. Some action items you’d take away from this goal could be prescribing more frequent policy reviews, creating custom reports, and advocating for better alignment between AR and sales teams.

Other goals you can define include reducing your percentage of past-due accounts, improving customer credit profiles, or strengthening customer relationships.

2. Define roles and responsibilities

Define the role each relevant team (or team member) in your organization has in the credit approval process. For example:

- Your sales department must offer their input to define payment terms that both minimize the risk of late payments and maximize sales

- Your credit department must define criteria for extending credit to customers and conduct the credit review process

- Your accounts receivable department must carry out the day-to-day activities of collecting payments, following up on overdue payments, and recording incoming payments

When you clearly state every team's (or person's) role, you'll avoid ambiguity and misalignment down the road.

3. Define credit evaluation criteria

Credit evaluation is a critical step in the credit management process. When defining your credit evaluation criteria, here are a few critical questions you should consider:

- Will you use a credit scorecard to determine creditworthiness?

- How will you review credit decisions? Consider whether you will allow customers to appeal your decisions.

- How will you remove bias from the credit evaluation decision? For instance, you might mask business identification data to remove unconscious biases in the process.

- What data will you use when evaluating customer credit limits? For example, specify how you’ll use AR aging tables and collections data when making these decisions.

- How often will you revisit your credit evaluation criteria?

Nailing down the answers to these questions will help you focus on the right credit policy areas, avoiding potential ambiguity when your team evaluates credit applications.

4. Define your terms of sale

Extending the same credit terms to every customer might not be the best move. For instance, extending net 45 terms to both a small company and another 10 times that size might not make sense.

The larger company will most likely have more cash resources than the smaller company and you can reasonably expect to collect on its invoices. The smaller company might face headwinds, leaving it in a precarious position and less likely to clear its bills down the road.

Note that you must also comply with trade and antitrust laws before offering customers different credit terms. Consider offering different terms based on order types, deliverable dates, and ticket sizes.

5. Define your collections process

As much as you’d love to avoid chasing payments, late and missed payments will happen for several reasons.

Here are some critical questions to consider when designing your collections process to document in your credit policy:

- When will you send dunning letters and what medium (email, physical letter, both, etc.)?

- With what frequency will you follow up with your customers?

- How will you maintain a strong customer relationship while pursuing overdue payments?

- When will you turn your unpaid bills over to a collection agency?

These questions cover important issues your collections policy must answer. By clearly defining the answers to them, you’ll create a collections process that limits payment delays while maintaining positive customer relationships.

5 important items to clarify in your credit policy

Credit policies can get complex fast. In addition to what we’ve outlined above, here is a sample of credit policy items you’ll want to include to avoid any confusion around your credit decision-making workflows.

- Credit limits

- Payment terms

- Accepted payment methods

- Customer data needed

- Bad debt policy

1. Credit limits

How much credit will you extend to each customer and customer segment? Recording a credit limit per customer segment removes a lot of ambiguity in the credit decision-making process and simplifies AR workflows.

2. Payment terms

List your payment terms (when you expect payment, i.e., net 30, 60, or 90 days) in detail. Include all information about early payment discounts and incentives, too.

3. Accepted payment methods

What payment methods will you accept from your customers? Are there any payments you won’t accept?

This is particularly relevant to whether your company accepts credit card payments. Because of high credit card processing fees, some companies will choose not to accept credit card payments from customers or accept them only under certain conditions (like if the invoice is under a certain amount). Some companies will add a surcharge for credit card payments. Outline your company’s rules around supported payment methods very clearly in your credit policy.

4. Customer data needed

List all the information you’ll need from your customers to evaluate their credit. Here is a list of common items most AR teams will need to begin the credit review process:

- Customer’s legal and Doing-Business-As (DBA) names

- Billing and shipping addresses

- Contact information and designated contact name

- Years in business

- Corporate structure (LLC, etc.)

- Tax ID, if applicable

- Financial statements displaying current liabilities and cash flow

- Last audited date

- Outstanding payments and invoices (if any)

- Insurance details (dollar amounts of general liability insurance, property insurance, and product liability insurance)

- Any credit references

- Asset values and encumbrance details

5. Bad debt policy

At what point will you label an account as “delinquent” or “severely delinquent”? Depending on your payment terms and what’s considered normal in your industry, this might be around the 90 day mark. What actions will you take when a payment becomes severely late? At what point will you write off the payment as bad debt?

Boost your credit management with AR automation

Now that you know what to include in your credit policy, here are some tips that’ll help make it easier to enforce.

You can greatly simplify the credit management process by streamlining workflows and eliminating manual work with accounts receivable automation. It also helps eliminate errors from manual data entry that can cause issues for your credit management team.

Automate your payment reminders

Automated reminders help you gently nudge customers about approaching payment deadlines. With Versapay, you can set up these reminders to go out to automatically in accordance with your collections policy.

Because you don’t have to worry about sending these notices out yourself, you avoid missing critical windows when customers are most likely to respond to reminders (right after the payment becomes overdue).

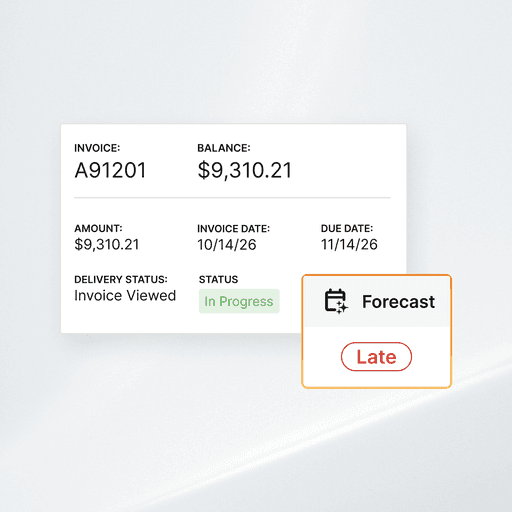

Give your team a centralized view of AR

Giving your credit and collections teams an easy way to view customers’ payment history is also an important boost to credit management. When your team is making decisions about existing customers’ credit, it’s great to arm them with this data.

Versapay’s intuitive dashboard helps you easily track open receivables, highlighting your customers with the most outstanding invoices. This saves your credit manager the time and trouble of retrieving this information from multiple sources.

Automate your cash application

Manual cash application processes are tedious and error-prone. When dealing with a high volume of payments and relying on manual data entry, it’s easy to accidentally apply a payment to the wrong invoice. This can result in delays in replenishing customer credit, leading to lost sales and strained customer relationships.

With Versapay Cash Application, artificial intelligence automatically applies any payment to its related invoice(s). Our optical character recognition helps account for unstructured, illegible, and missing data on remittance documentation. We integrate with your enterprise resource planning (ERP) system so that journal entries get updated without the need for manual data entry—reducing the chance of errors.

Collaborate with your customers over the cloud

Versapay's Collaborative AR Network takes a novel approach to AR management by putting your collections, credit, and sales teams on the same page with your customers.

Your credit and collections teams can communicate directly with customers to solve invoice disputes. You can also bring Sales into the conversation to help identify the source of those disputes.

Your customers can also use Versapay's user-friendly portal to view invoices and payment due dates, reducing the probability of overdue payments. By giving them this transparency and control of their account, you build stronger customer relationships that’ll serve you through turbulent times.

—

In the current economic climate, credit management is more important than ever. Your credit policy sets the tone for your credit management processes and aligns your finance teams around important organizational goals.

Learn how Versapay helps credit and collections teams drive efficiencies, accelerate cash flow, and dramatically improve customer experience.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.