How to Calculate Working Capital and why Tracking it is Essential (with Examples)

- 11 min read

Working capital offers a quick way to project your company's financial stability.

This article looks at what working capital is, the different ways you can calculate it (using real-world examples), and ways you can improve your working capital position

Every organization needs to quickly understand their company's health. Working capital is a great indicator of this, and learning how to calculate working capital is an essential skill.

Table of contents

Overview: what is working capital, and other common questions answered

What is working capital?

Working capital measures a company’s ability to use its current assets to pay bills due within a year. It is the difference between a company's current assets and current liabilities and is not listed on financial statements.

Working capital can be positive or negative, with a negative number potentially indicating financial risk like defaulting on debt payments—although there are some exceptions, which we’ll cover further on.

Why is working capital important?

Knowing how to figure out working capital is important because it gives you an instant picture of your company's ability to meet its cash outflows. Your working capital calculation quickly tells you if you have enough resources to meet your financial obligations.

Calculating working capital also helps you:

Discover inefficient operations hindering cash flow such as inefficient collections.

Measure current debt obligations and their impact on everyday business.

Measure your company's liquidity — a measure of how well your company can handle shocks from adverse events.

What comprises working capital?

Your working capital is broadly composed of current assets and liabilities. However, current assets and liabilities can have different components depending on the nature of your business. Here is a list of balance sheet entries, along with their definition, that play a role in calculating working capital:

Current assets: Assets that you can quickly turn into cash.

Cash — The amount of cash your company has in its bank accounts.

Cash equivalents — Any deposits that you can quickly sell to receive cash.

Marketable securities — Any investments you can quickly sell and receive cash.

Accounts receivable — The money your customers owe you.

Inventory — The goods in your warehouse that you can sell to earn cash or liquidate (if the goods are in manufacturing progress)

Prepaid expenses — Money you have already paid towards future expenses. This isn't a cash item but reduces your liabilities.

Miscellaneous liquid assets — Any asset that can be sold quickly for cash that doesn't belong in the above categories.

Current liabilities: Expenses you must pay within a year.

Accounts payable — The money you owe your suppliers.

Taxes payable — Sales, payroll, and income taxes you owe the government.

Short-term debt — Loans coming due within 12 months.

Interest payable — Unpaid interest on loans due within 12 months.

Accrued expenses — The operational expenses you owe.

Bank overdrafts and miscellaneous — Any overdrafts and other liabilities that don't fit into the categories above

Positive vs. negative working capital

When calculating working capital, your result will be either positive or negative. Generally, here’s what both results mean:

Positive working capital — this indicates your business can theoretically pay off its current liabilities using its current assets. In other words, a positive working capital indicates financial flexibility.

Negative working capital — this essentially indicates the opposite. When your working capital is negative, to cover your current liabilities, you’d need funds beyond your current assets. Typically, those funds take the form of external financing.

When working capital is negative, it usually indicates that a company lacks the resources to pay short-term bills. However, negative working capital does not always indicate danger. If you collect cash from your customers upon invoicing them instead of offering them credit, and you use that cash to fund growth, your working capital will likely be negative.

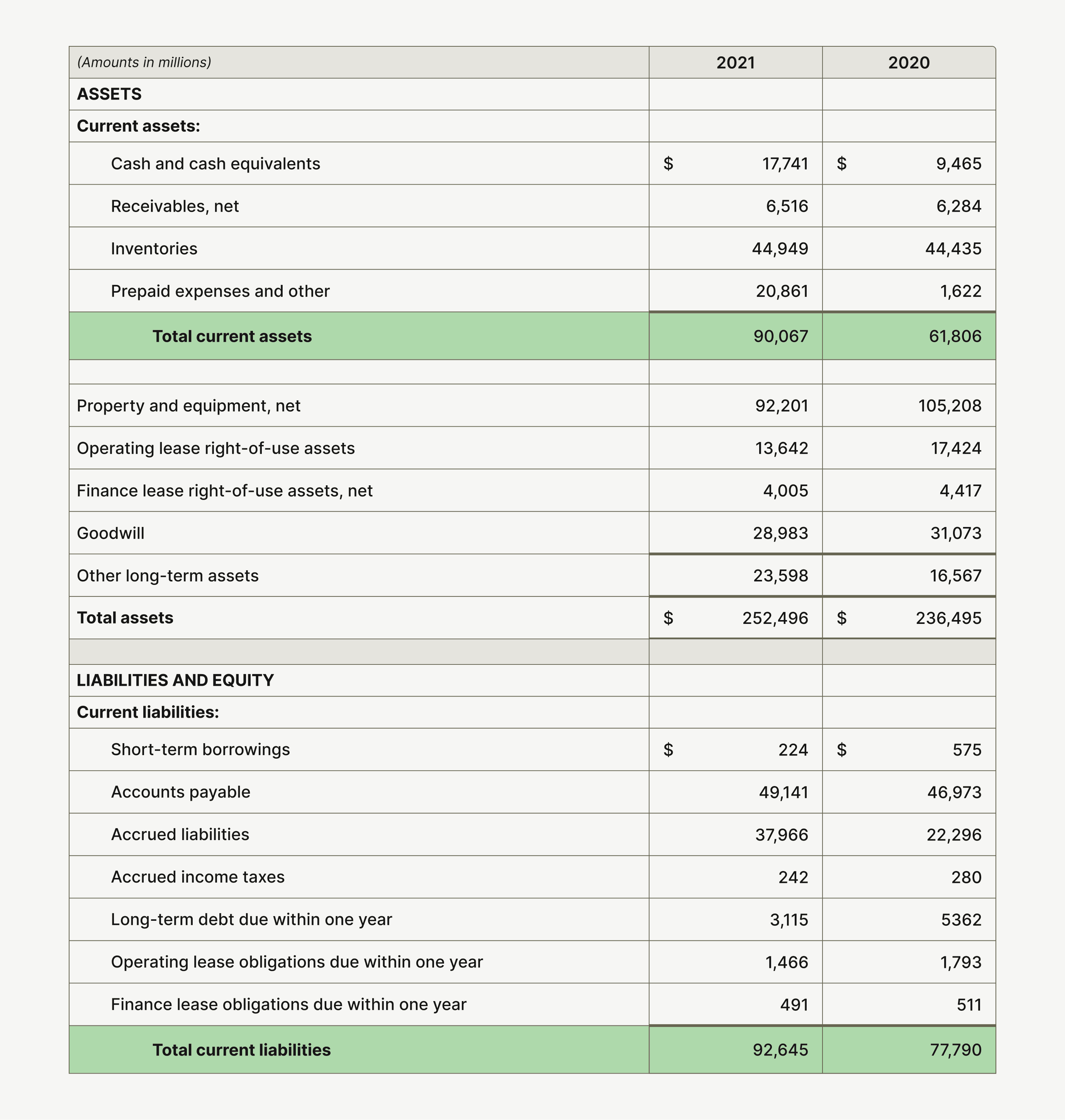

If you can generate a positive return on those investments, a negative working capital position is not a problem. Walmart is a good example of a business that routinely lists negative working capital. Below is a snapshot of Walmart's balance sheet from a few years ago:

Since Walmart's customers primarily make payments using cash, they have low accounts receivable, and excess cash on their books. The company reinvests this cash to fund growth, reducing its current asset levels. Since Walmart generates positive returns on these investments, a negative working capital balance is not a problem.

However, if you invoice customers and offer them credit—creating high accounts receivable and less cash—a negative balance spells danger. For instance, construction companies cannot afford a negative working balance since they have to offer their customers credit as a part of normal business.

How to calculate working capital (real-world examples included)

You can calculate working capital with the following formula:

Working capital formula = Current assets – Current liabilities

Current assets = Sum of current assets from the balance sheet

Current liabilities = Sum of current liabilities from the balance sheet

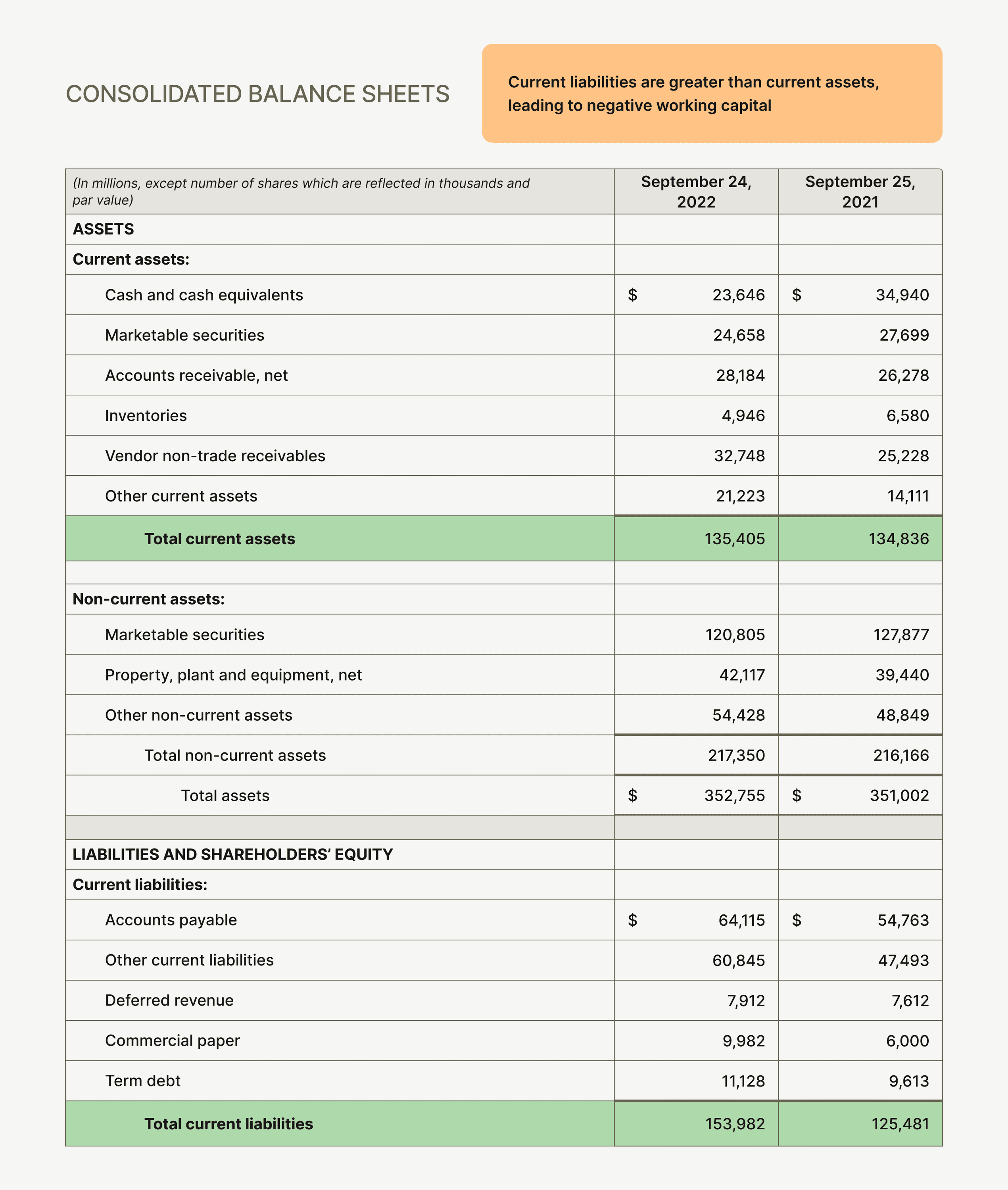

Here's a working capital example calculation from Apple's annual report (10-K) a few years ago:

Apple's 2021 working capital (in millions):

Current assets (135,405) – Current liabilities (153,982) = 18,577

Like Walmart, Apple has a negative working capital balance (of $18.58 billion). However, since its customers also primarily make upfront payments using cash, and it reinvests cash quickly for a positive return, this negative number is not a problem.

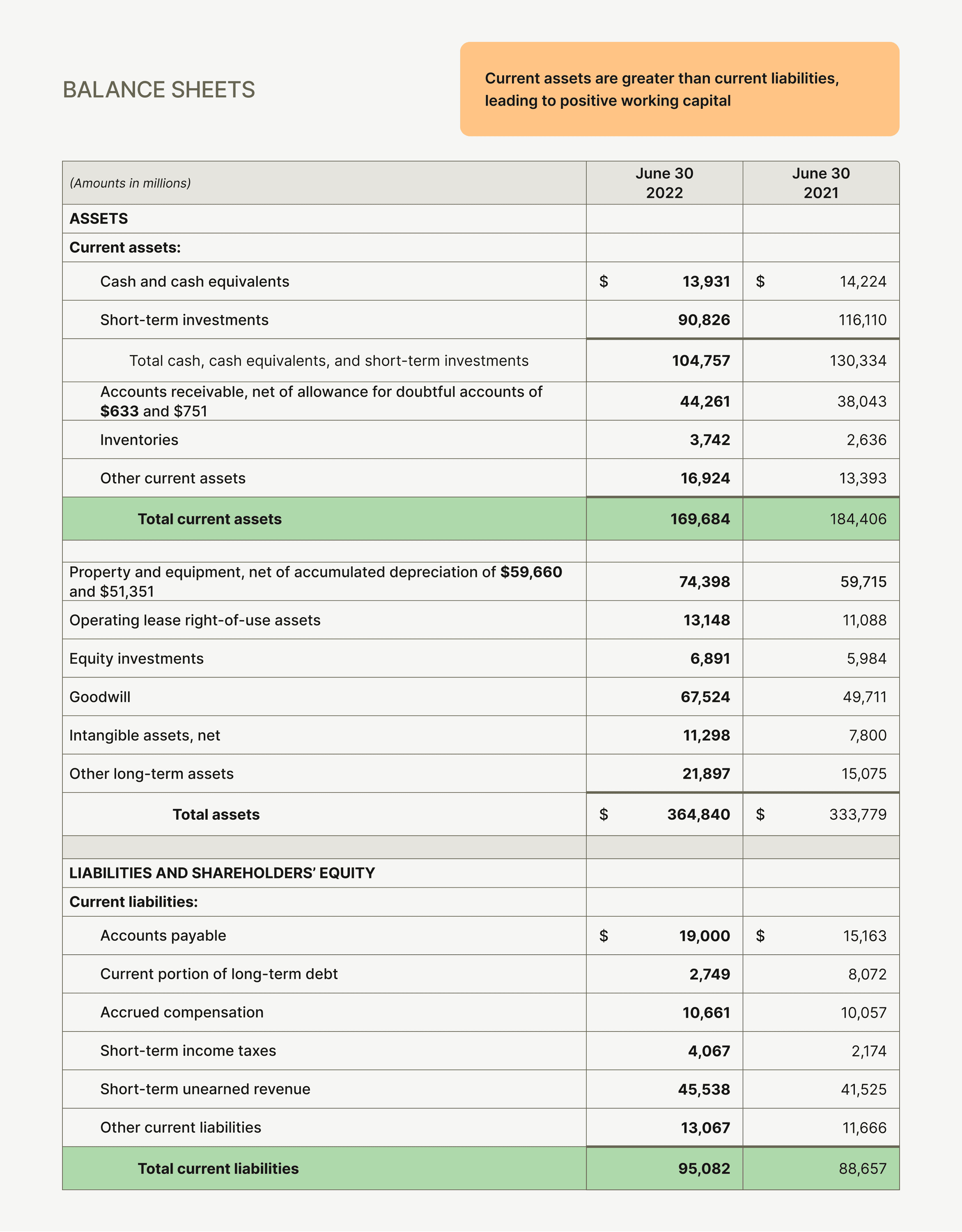

Here’s an example of a company with positive working capital. Microsoft reported positive working capital for FY 22 and 21. The company reported current assets of $169.6B and current liabilities of $95B, giving it a working capital of $74.6B.

How to calculate alternative working capital formulas

You can modify the working capital formula to account for different business scenarios:

Net working capital formula

Net working capital = Accounts receivable + Inventory – Accounts payable

Net working capital is useful for comparing a company's ability to fund its payables using credit sales (receivables) and inventory.

Operating working capital formula

Operating working capital = Accounts receivable + Inventory + Prepaid expenses – Accounts payable – Accrued expenses – Deferred revenue

Operating working capital measures the efficiency of key operating elements in generating cash to cover operational expenses. Cash, cash equivalents, short-term debt, and interest represent the result of past operations and financing activities.

Hence, excluding them makes sense when measuring operational efficiency.

Non-cash working capital formula

Non-cash working capital = Current assets – cash – current liabilities + short-term debt

Non-cash working capital is useful in figuring out if a company is hiding poor performance under a large cash balance.

How to calculate working capital ratios

Working capital ratios quickly compare current assets to liabilities. They're more intuitive to understand compared to traditional working capital numbers since they offer a ratio instead of a whole number.

Current ratio formula

Current ratio = Current assets / Current liabilities

The higher this ratio is, the better. A number less than one indicates potential problems. Values between 1.5 and 3 are considered desirable, but it's best to benchmark against similar companies—this is important, as certain industries (like Insurance Carriers) tend to have higher current ratios, and certain industries (like Non-depository Credit Institutions) tend to have lower ratios.

You can find current ratio benchmark data based on industries here.

Quick ratio formula

Quick ratio = (Cash + Cash equivalents + Securities + Accounts receivable) / Current liabilities

The quick ratio stress tests a company by measuring its ability to meet debts using assets it can use immediately. A ratio greater than one is usually considered good, but similar to current ratio, it's best to benchmark against industry standards.

How to improve your working capital position: 3 quick tips

Improving your working capital position will increase operational efficiency and put your business on strong footing, helping you overcome challenging economic conditions and sustain profits. Here are three tactics for achieving this goal.

1. Increase accounts receivables efficiency

Receivables are a current asset, and the faster you can turn them into cash, the better your working capital position will be. In addition, resolving typical accounts receivable issues, such as disputes or a lack of cohesion between collections process stakeholders—collections teams, your customers’ payable teams, sales teams—will help you collect overdue invoices faster.

Plus, more efficient accounts receivable reduces your allowance for doubtful accounts and bad debt expense, increasing your current asset values.

2. Increase cash velocity

Your credit policy plays an important role in accelerating your business’ cash flow. Pay your suppliers after you've received cash from customers. Examine your credit terms and use accounts receivable data to create policies that increase your cash flow.

3. Increase cash flow visibility

The better you understand your cash flow, the easier it becomes to project and resolve working capital issues. Digitally transforming your accounts receivable will give you insights into customer payment trends, align stakeholders, and help your accounts receivable team overcome common problems that afflict accounts receivable.

—

Working capital offers a quick way to project your company's financial stability. And while accounts receivable might just be one part of the working capital equation, it is a critical one.

Maintaining an efficient and effective collections process can be challenging, especially for businesses relying on outdated methods. Luckily, collections is primed for digitization, making it easy to increase your its effectiveness and improve your working capital position.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.