EIPP Adoption: 3 Trends Accelerating Electronic Invoicing

- 7 min read

Learn the three major EIPP adoption trends that are accelerating the electronic invoicing process.

Also, see how EIPP future-proofs your accounts receivable department and better serves your customers.

EIPP, or electronic invoice presentment and payment, is fast becoming table stakes at mid- to upper-midsized companies. Consumer expectations of digitization are playing a significant role in this shift.

However, other shifts associated with internal company expectations are pushing firms toward EIPP, too. Here are the three most important intra-company trends changing the finance function and how EIPP offers solutions.

What’s in this article

Trend #1: Finance is central to CX—and it’s doing a poor job →

Trend #2: AR is severely backed up and is increasing costs →

Trend #3: Companies expect finance to offer strategic input →

How EIPP future-proofs your accounts receivable department →

Trend #1: Finance is central to CX—and it’s doing a poor job

Company leaders expect finance to work as a front-office function and deliver memorable customer experiences (CX). However, some financial functions are a CX bottleneck.

A lack of digitization in customer-facing finance functions causes these bottlenecks. EIPP is the solution to eliminating them.

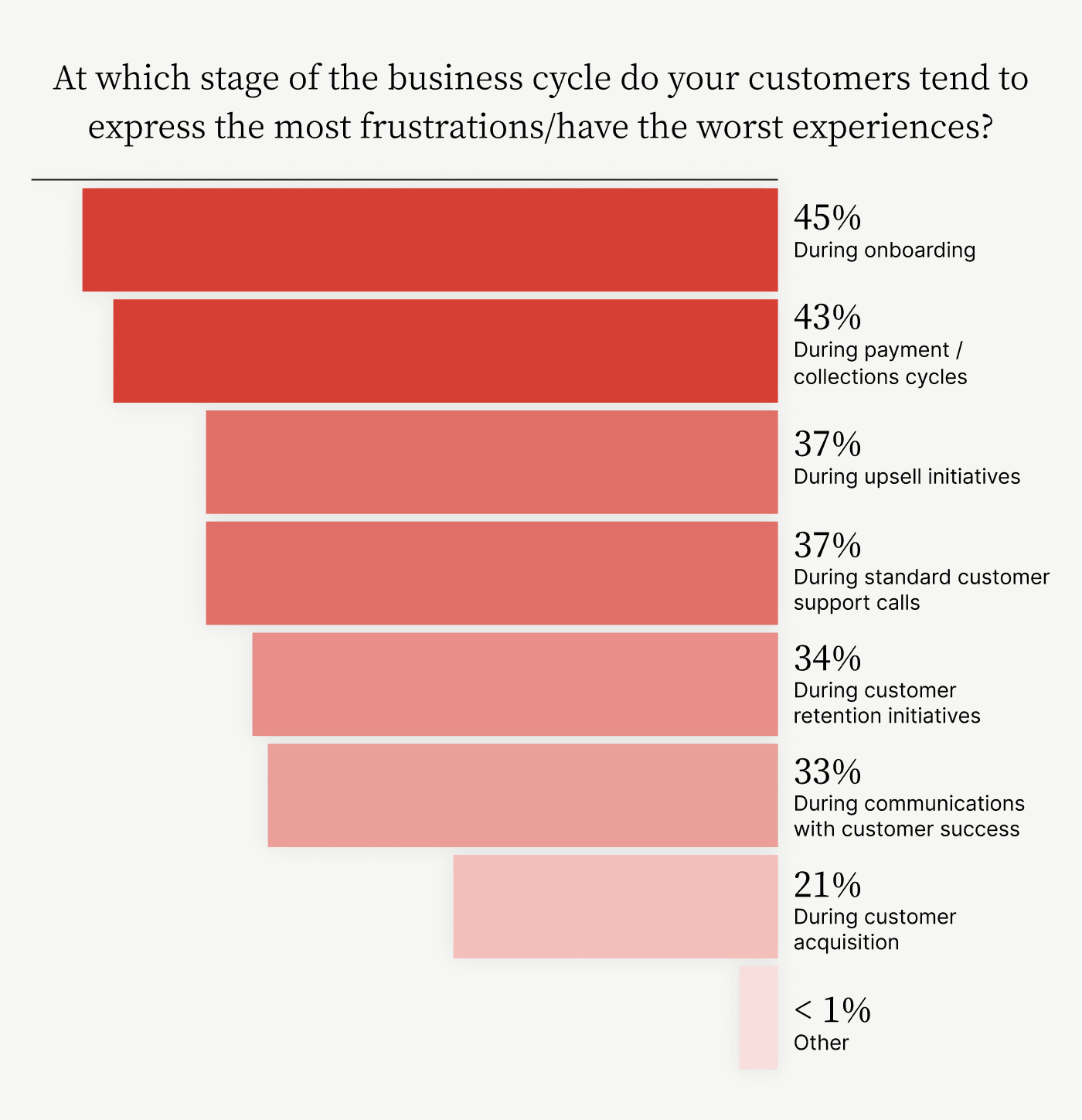

Our survey of 400 business and finance leaders on Gartner's Peer Community Platform highlighted the state of customer relationships and finance's changing role in delivering great CX. When asked to identify the stages where customers experience frustration, 43% of company leaders highlighted payment collection cycles as a pain point.

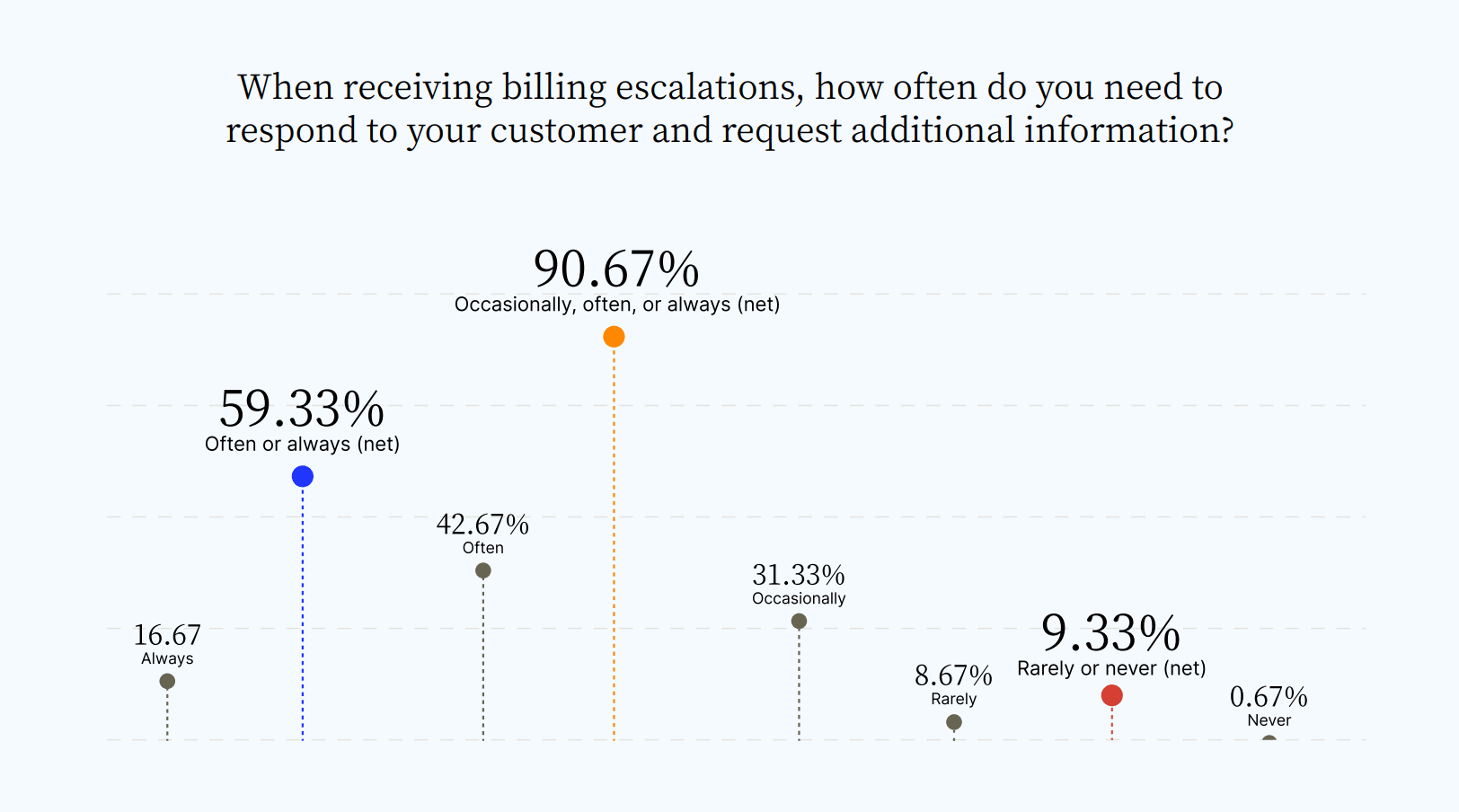

What causes customer frustration in collection cycles? Our research on the State of Digitization in B2B Finance offers an answer. Over 90% of AR teams surveyed admitted they contact customers for additional information after receiving escalated billing issues, potentially increasing customer agitation.

Reaching out after a customer has offered all payment information paints a poor picture of AR efficiency. It also suggests that AR teams are working with less-than-ideal systems that do not centralize invoice data or help them collaborate with other stakeholder departments like sales and order management.

Our research confirms this fact.

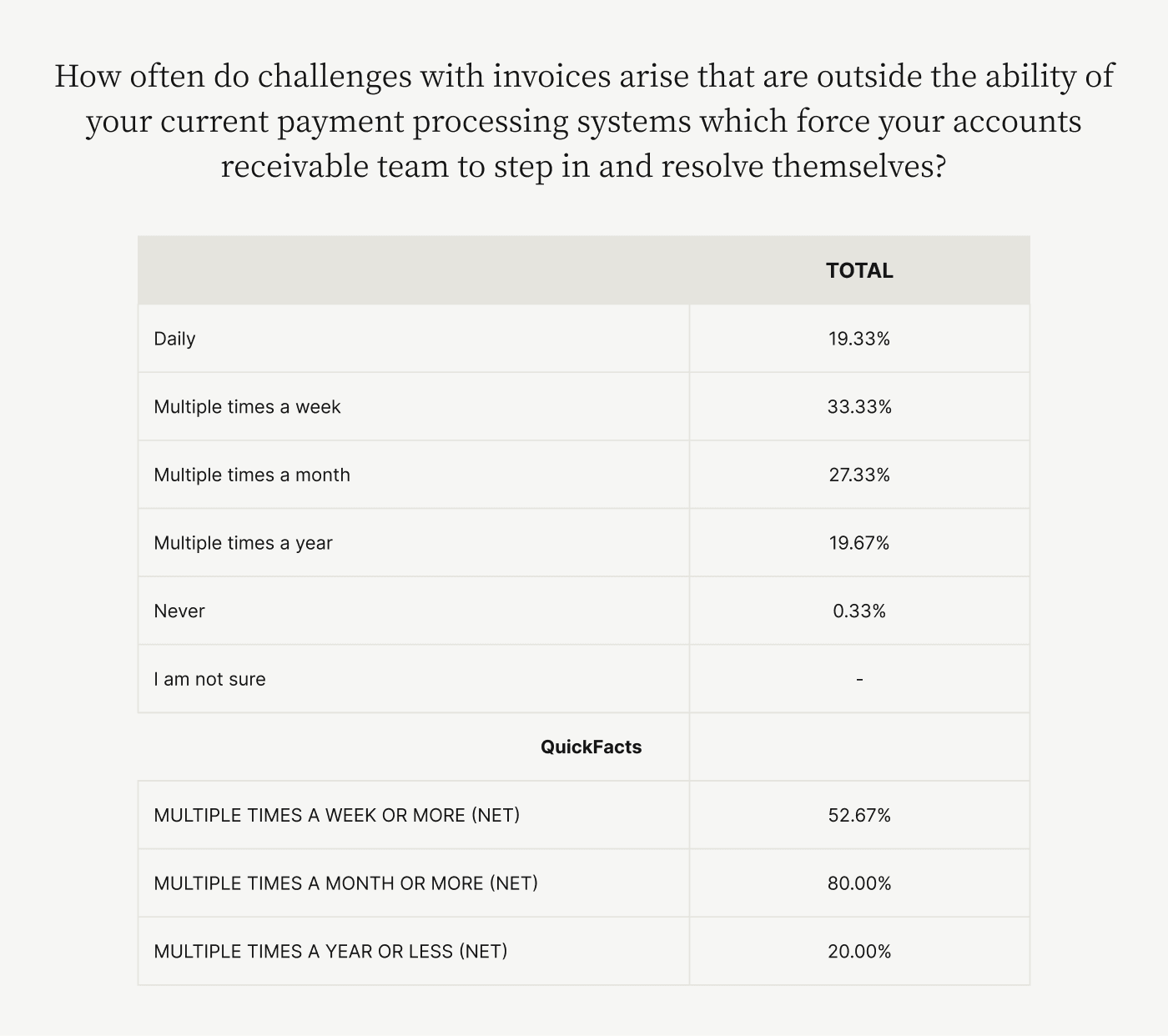

Nearly every respondent noted they deal with invoicing issues their payment processing systems cannot handle. Not only does this lead to a frustrated customer, but it also frustrates AR departments committed to solving customer issues quickly.

Against this backdrop, the shift toward EIPP adoption and digitalization is easy to understand.

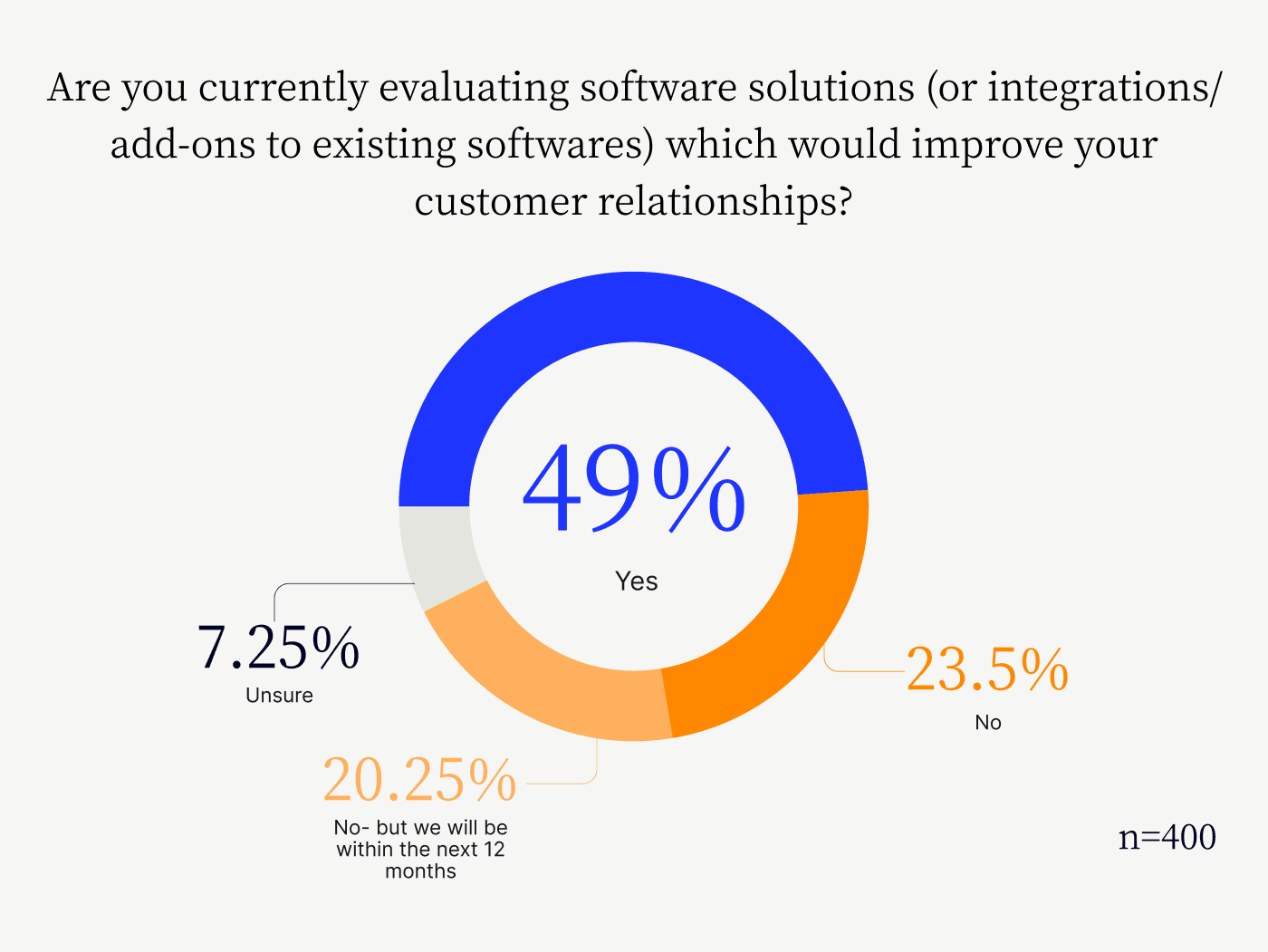

Our survey on Gartner's platform revealed business leaders view software as a critical cog in delivering great CX. Forty-nine percent of executives noted they're actively evaluating CX-boosting software choices, with a further 20% considering choices over the next year.

Russell Lester, Versapay’s CFO, explains these moves. "Digital accounts receivable reduces the slippage or the friction points that can occur in accounts receivable. It’s also an opportunity for the AR team to be viewed as part of what can delight the customer.”

EIPP and digitalization hold great promise for accounts receivable departments and are helping companies achieve a critical goal—to deliver great customer experiences.

Trend #2: AR is severely backed up and is increasing costs

Companies are constantly looking to run their departments in a cost-efficient manner. Our research shows that accounts receivable is lagging in this regard, facing lengthy backlogs that increase operational costs.

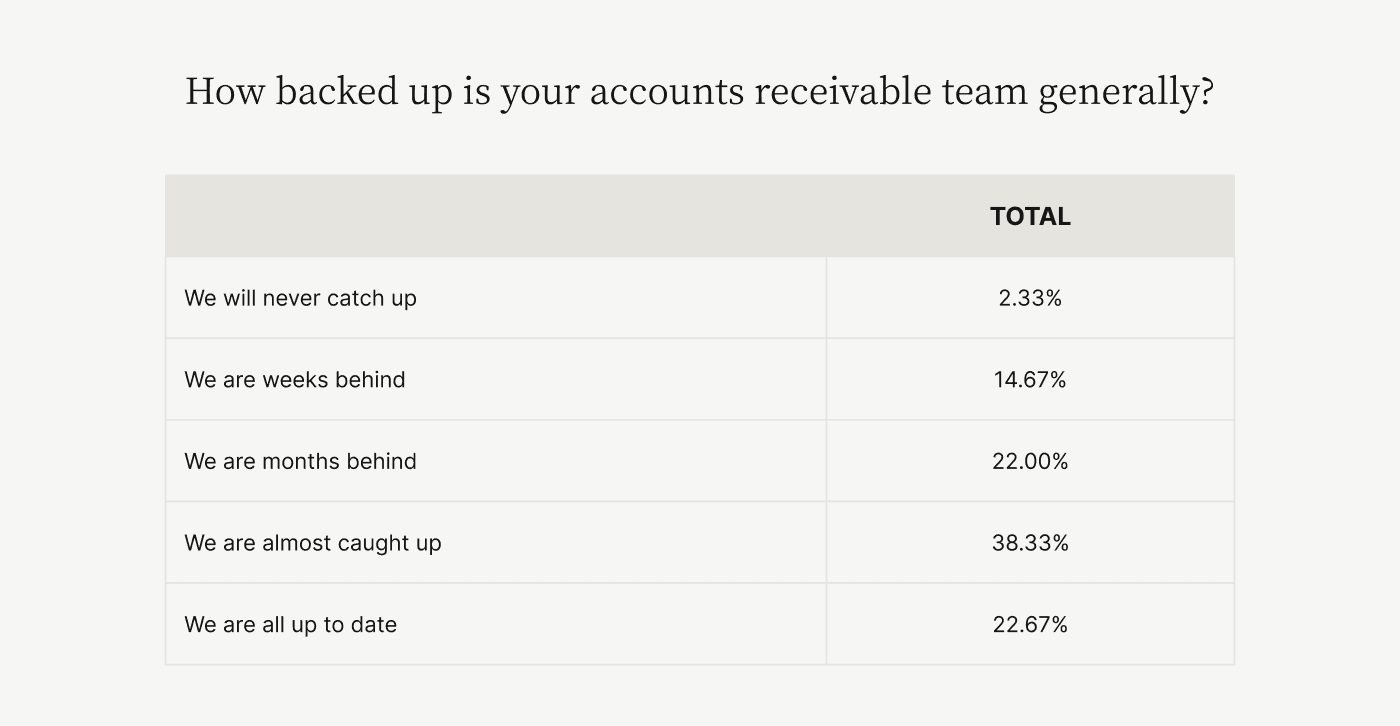

Our research on the state of digitization in B2B finance shows that 39% of AR departments are weeks or months behind, with 24% admitting they'll never catch up.

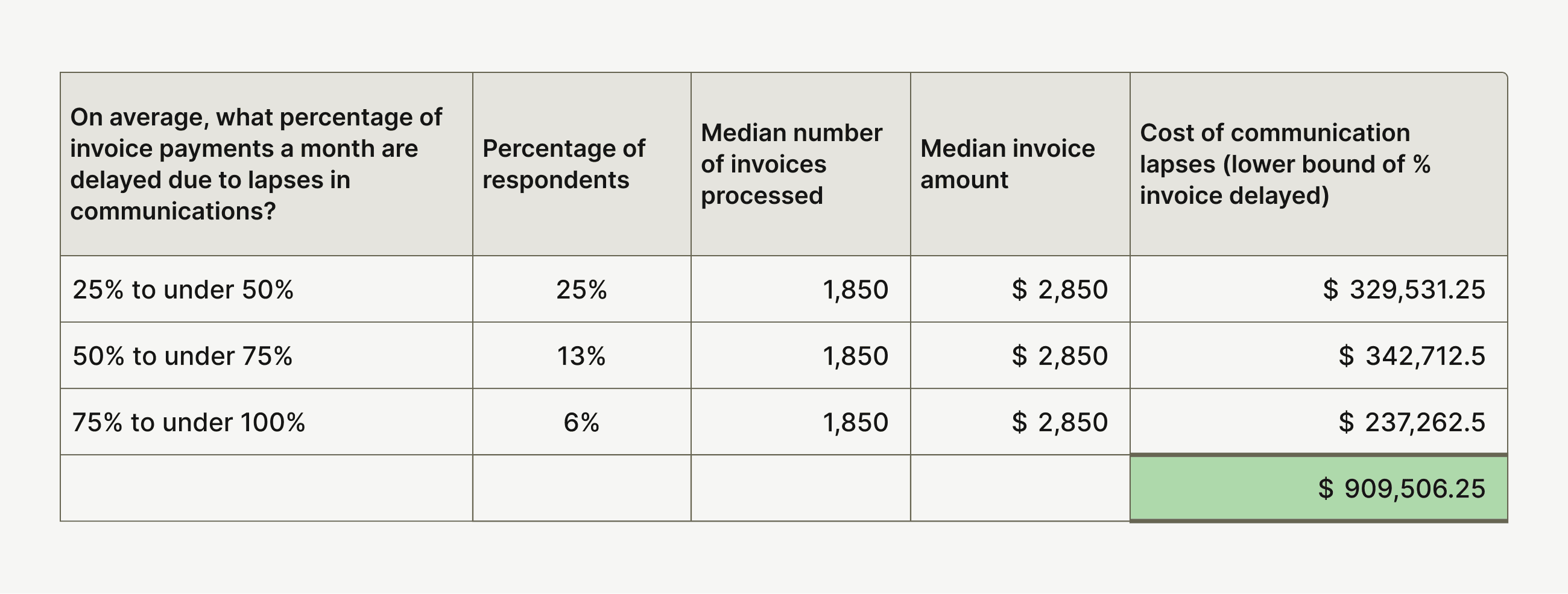

This backlog contributes significantly to payment delays—amounting to at least $909,506 every month.

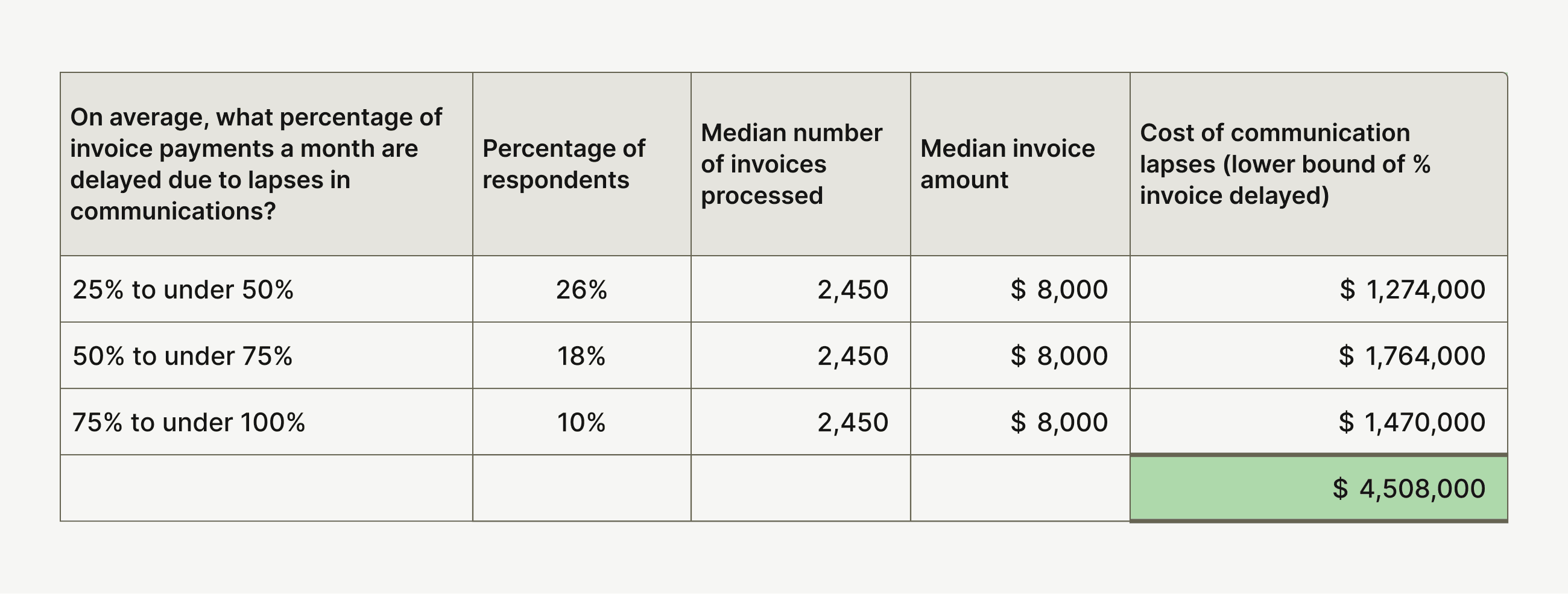

The picture is worse for upper-midsized companies with revenues above $250 million annually. Accounts receivable delays and poor invoice processing are costing them $4.5M every month.

Most of these AR teams spend time chasing paper or resolving easily avoided disputes like incorrect prices or discounts applied improperly. After manually handling those issues, these teams have no time left to perform value-added tasks that boost cash flow and increase efficiency.

EIPP offers a solution to this mess. Unlike manual AR invoice processing, digital workflows automate invoice creation, delivery, and payment reminders. Electronic systems can even pull invoice data from purchase orders and attach relevant documents to invoices.

The result is fewer disputes and more time for AR to focus on complex issues—an opportunity to deliver memorable CX. This is how AR and finance can become difference-makers.

"The finance function can be viewed as a key enabler of growth,” Russell says. “And digitization is a perfect place to either start or continue that journey for an organization.”

Trend #3: Companies expect finance to offer strategic input

According to McKinsey & Company, company leaders expect CFOs to offer strategic business input, not just run reports. And EIPP is playing a key role in pushing companies toward that important goal—of turning finance into a strategic advisor through digital transformation.

This expectation filters through the finance department's structure, with data-driven decisions driving processes. Data is gold, and finance departments need tools to organize it.

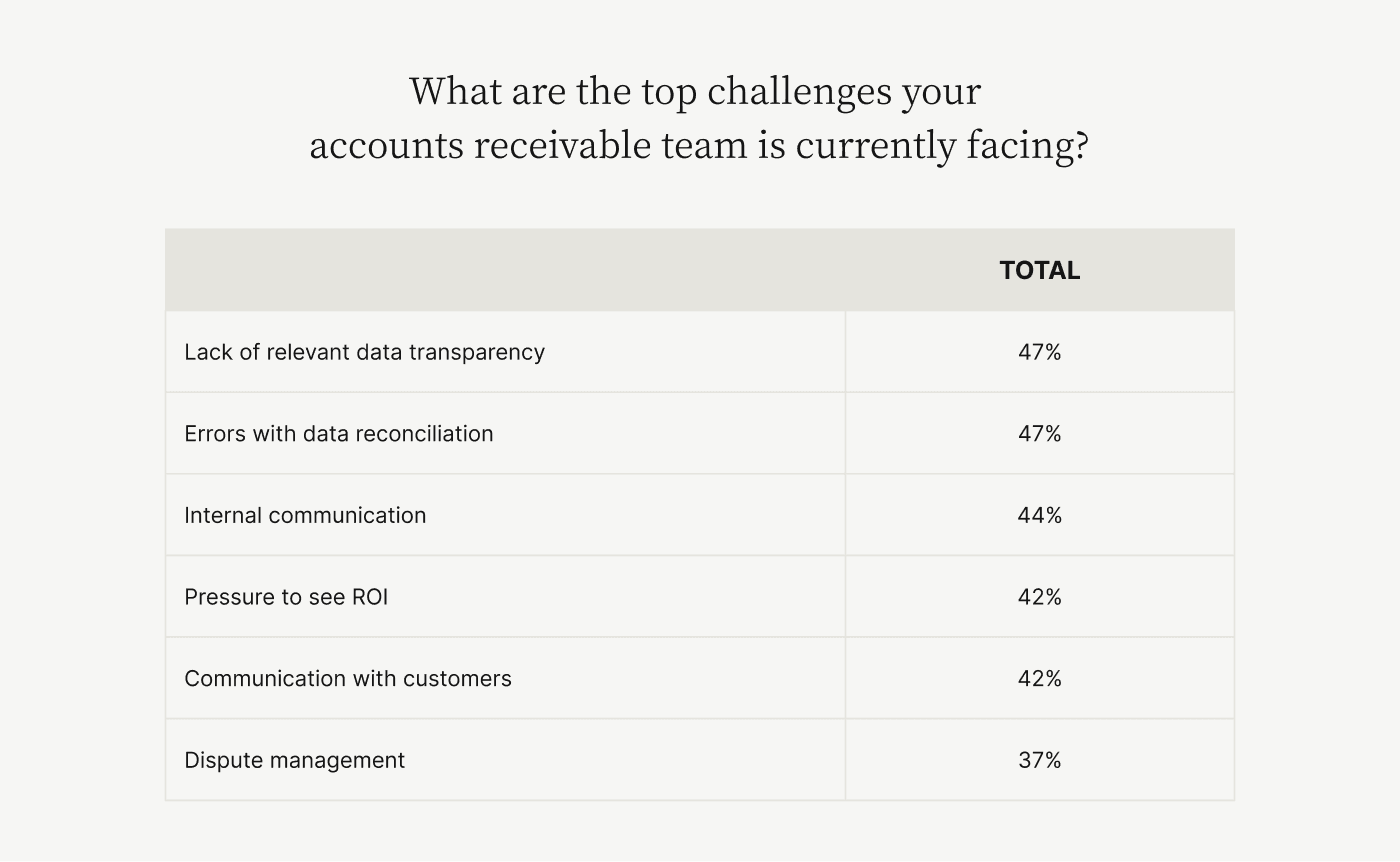

Unsurprisingly, most of the issues CFOs encounter revolve around data, as our research shows. Data transparency and reconciliation occupy the top spots in the list of the biggest CFO challenges.

Software and real-time data are the obvious solutions to these issues. They are also the key to achieving the broader goal of delivering strategic business insights.

“Real-time data allows you to move into the upper echelon of being relevant and proactively persuasive with your insights," Russell says. "If you can arm your AR team with a tool that allows them to be very fast with those insights—even surface insights that the business was not aware of previously—that puts them in a position of being a strategic advisor. It gives them a seat at the table.”

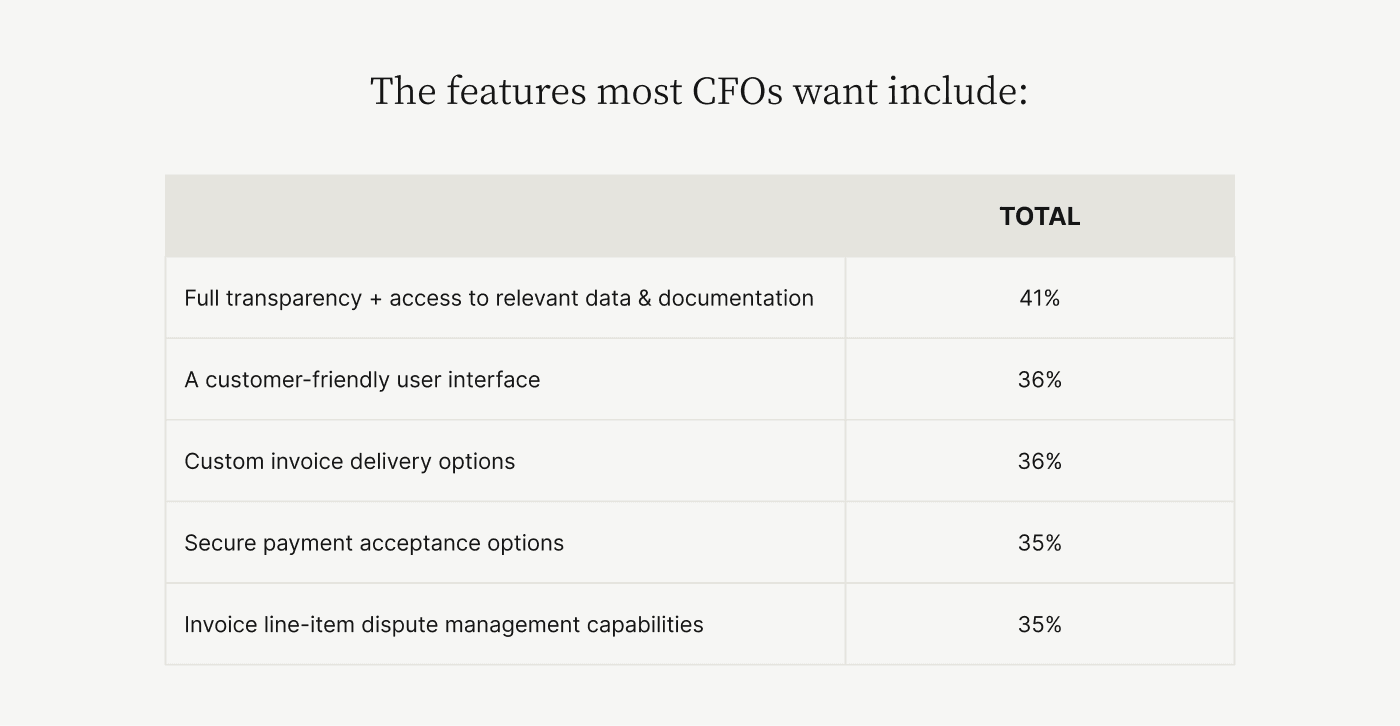

Transparency and fast access to data are critical factors CFOs look for when evaluating software choices. EIPP solutions are helping them achieve these goals, explaining growing adoption trends.

EIPP adoption will future-proof your AR department

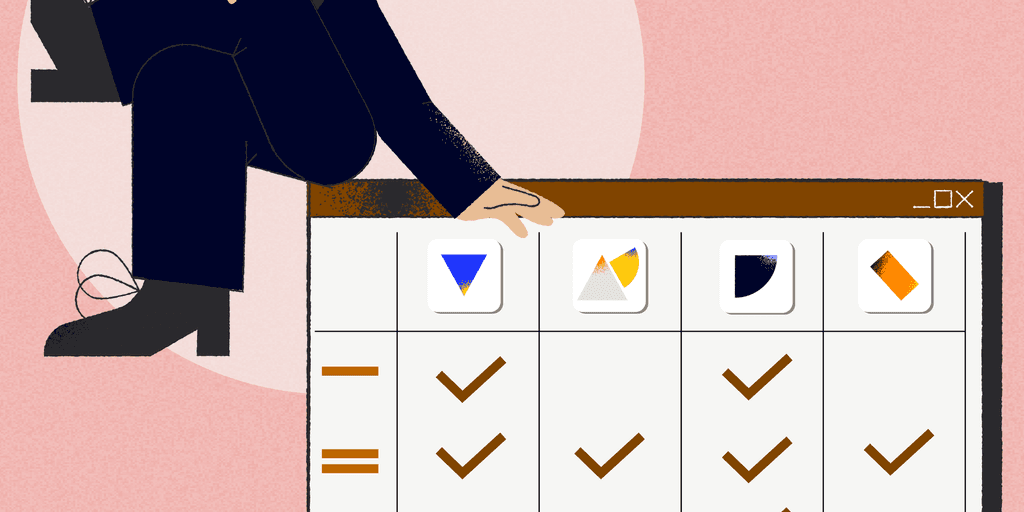

Electronic invoice presentment and payments are critical to accounts receivable teams achieving the strategic goals executives have set for them. Adopting the right digital solution is critical, and you must evaluate your choices thoroughly.

Here's a checklist of what to look for in an EIPP solution (note that these checklists use the term portal in place of EIPP; in this instance, the two can be used interchangeably):

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.