How to Cut Costs and Accelerate Cash Flow with EIPP

- 13 min read

In this article, you’ll learn what electronic invoice presentment and payment is, and how it can be used to drastically lower invoicing costs, improve business operations, and accelerate cash flow.

As commerce constantly accelerates, a slow and laborious invoicing process becomes an ever-increasing liability for growing businesses.

Chief among the many drawbacks of inefficient manual invoicing is its high financial cost. Not only does manual invoicing require unnecessary expenditure on staff time, postage, and other resources, it also slows down cash flow for a variety of reasons.

The superior alternative is electronic invoice presentment and payment (EIPP), a powerful tool for improving business operations and efficiency, cutting costs, and speeding up cash flow. Adopting EIPP to do e-invoicing is a great strategic move for businesses that still use paper-based invoicing.

Jump to a section of interest:

What is EIPP?

Electronic invoice presentment and payment is the process through which companies coordinate invoicing and payment digitally online.

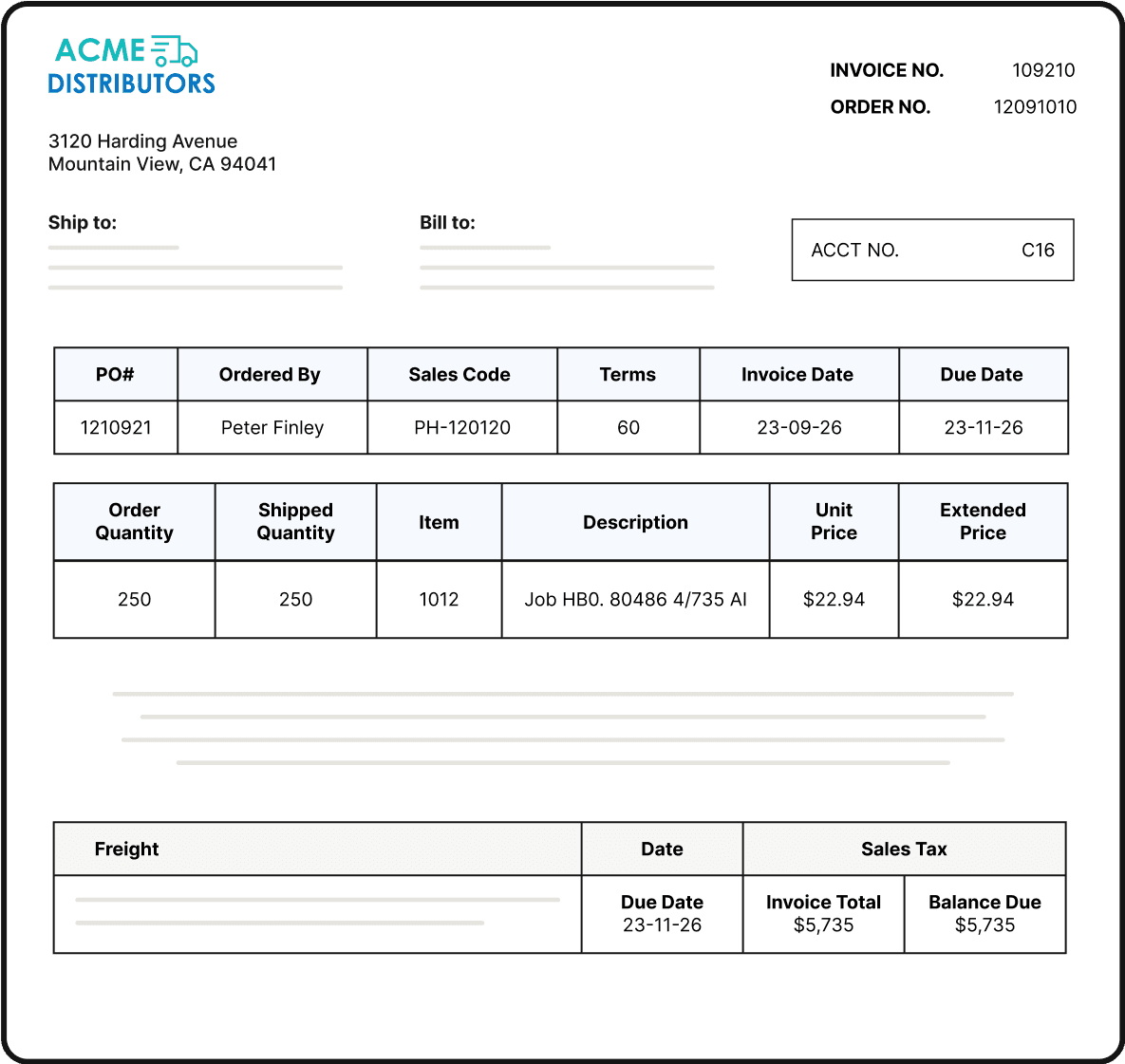

Sellers use specialized software to automatically create electronic invoices with little or no human input. This is often called electronic invoicing, e-invoicing, or automated invoicing. These systems can customize invoices to fit customers’ priorities and payment preferences, which facilitates the payment process. Customers receive and process e-invoices via accounts payable invoice processing software or by logging into a shared online payment portal, where they review the e-invoice and approve payment.

Businesses can execute fully automated online invoicing and payments if they can integrate their invoicing software into their enterprise resource planning (ERP) or accounting platform. A seller’s ERP can use information about a customer’s order to automatically create an e-invoice and upload it to the seller’s AR automation platform.

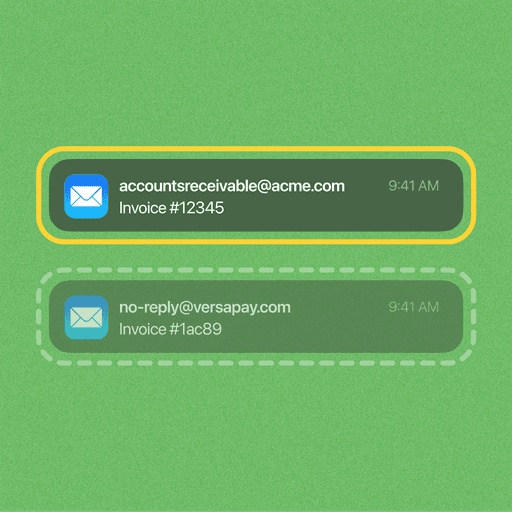

The seller then sends the invoice to the customer via an online payment portal or by pushing it to their AP software. Personalized invoice delivery is a significant driver of better customer experiences, and a unique feature of some electronic invoice present and payment systems.

What is an online invoicing and payment portal?

An online invoicing and payment portal is dedicated to automating and standardizing acceptance and processing of invoices. Such online invoicing portals are often the driving force behind the functionality of EIPP.

When a seller conducts online invoicing via a cloud-based payment portal, the customer can enter that portal to view the invoice, see related documentation, communicate about the invoice, and transmit payment via a preferred digital method.

What is the difference between EBPP and EIPP?

Electronic bill presentment and payment (EBPP) refers to the process by which businesses solicit and receive payment from business-to-consumer (B2C) customers over the internet. This is also called Internet bill presentment and payment (IBPP), electronic bill presentment (EBP), or online bill presentment and payment (OBPP).

IEPP, on the other hand, is a business-to-business (B2B) process in which one company digitally solicits and receives payment from another over the internet.

Both EBPP and EIPP are online invoicing functions. EBPP refers to B2C online invoicing, while IEPP is the B2B equivalent.

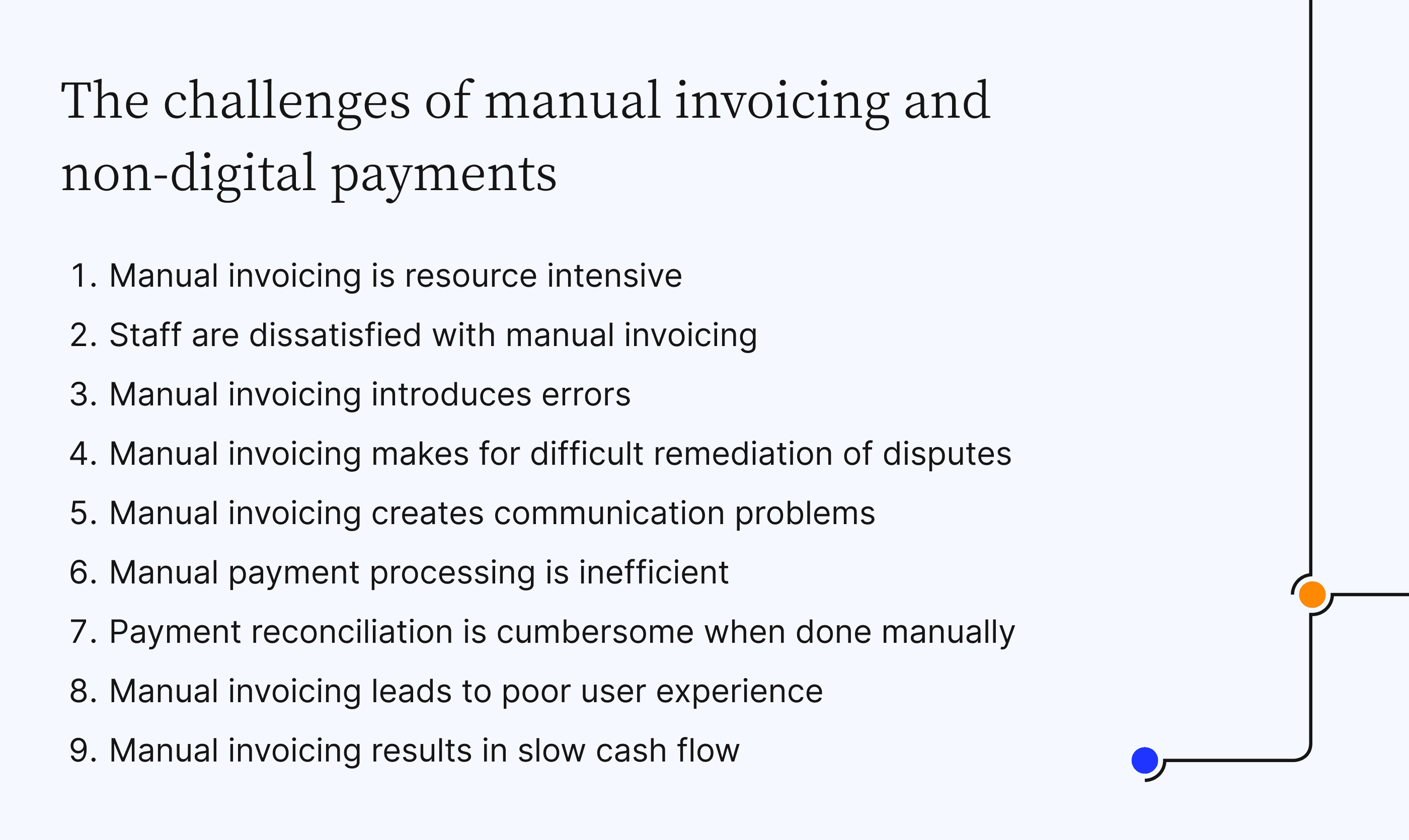

9 drawbacks of manual invoicing and non-digital payments

The disadvantages of using manual invoicing processes and denying customers digital payment options make for a long list (the nine we’ve listed below are not exhaustive). All of these challenges combine to create an expensive, slow payment process.

1. Manual invoicing is resource intensive

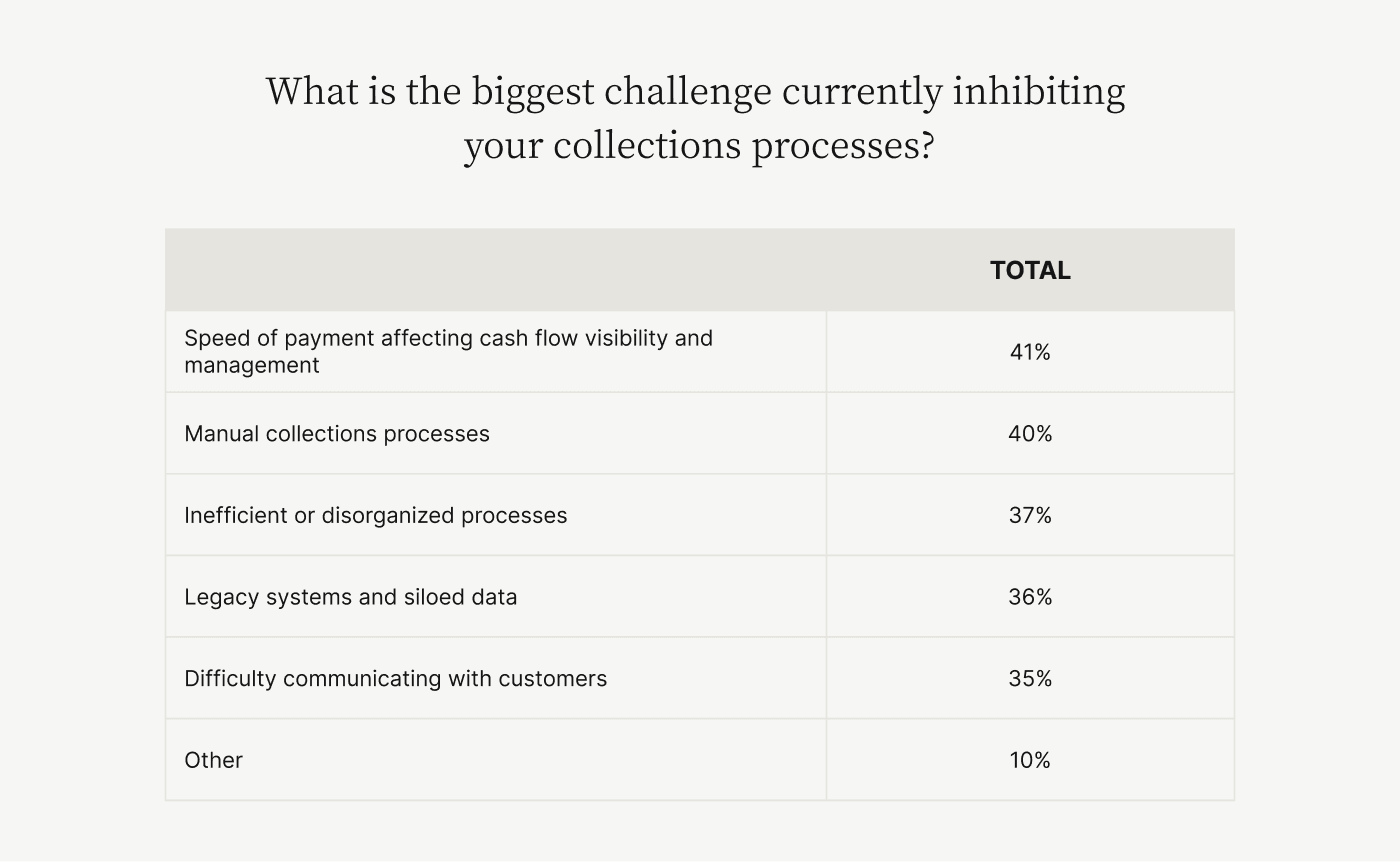

Manual invoicing processes require the input of many staff members; use of paper, ink, and postage; and the intervention of business leaders to help handle inevitable problems. It’s no surprise that 40% of finance leaders say the manual nature of the accounts receivable process is their business’s largest collections challenge.

2. Staff are dissatisfied with manual invoicing

Accounts receivable staff tend to dislike the rote work and hassles of manual invoicing and cash application. Especially when flaws in the manual process create a high volume of disputes, AR staff are likely to be dissatisfied at and leave their jobs.

Seventy-one percent of CFOs we surveyed were concerned that if they didn’t adopt a more flexible operating model (which inevitably would include digitizing the invoicing process, as manual invoicing practices don’t serve remote work well), higher turnover rates were inevitable.

3. Manual invoicing introduces errors

Manual invoicing is error-prone, with 50% of executives agreeing that human error in the payment process causes disputes.

This is especially the case when companies invoice at scale. And considering most mid- to upper-midsized businesses process 2,433 invoices monthly, identifying and fixing errors can be difficult and time-consuming. Errors lead to disputes, which can be expensive to remedy and lead to slower cash flow.

4. Manual invoicing makes for difficult remediation of disputes

Lack of shared visibility into invoices and payment history, past communications, and related documentation is a barrier to dispute remediation. Manual invoicing processes do not facilitate this kind of real-time, information sharing, making handling disputes unnecessarily difficult.

5. Manual invoicing creates communication problems

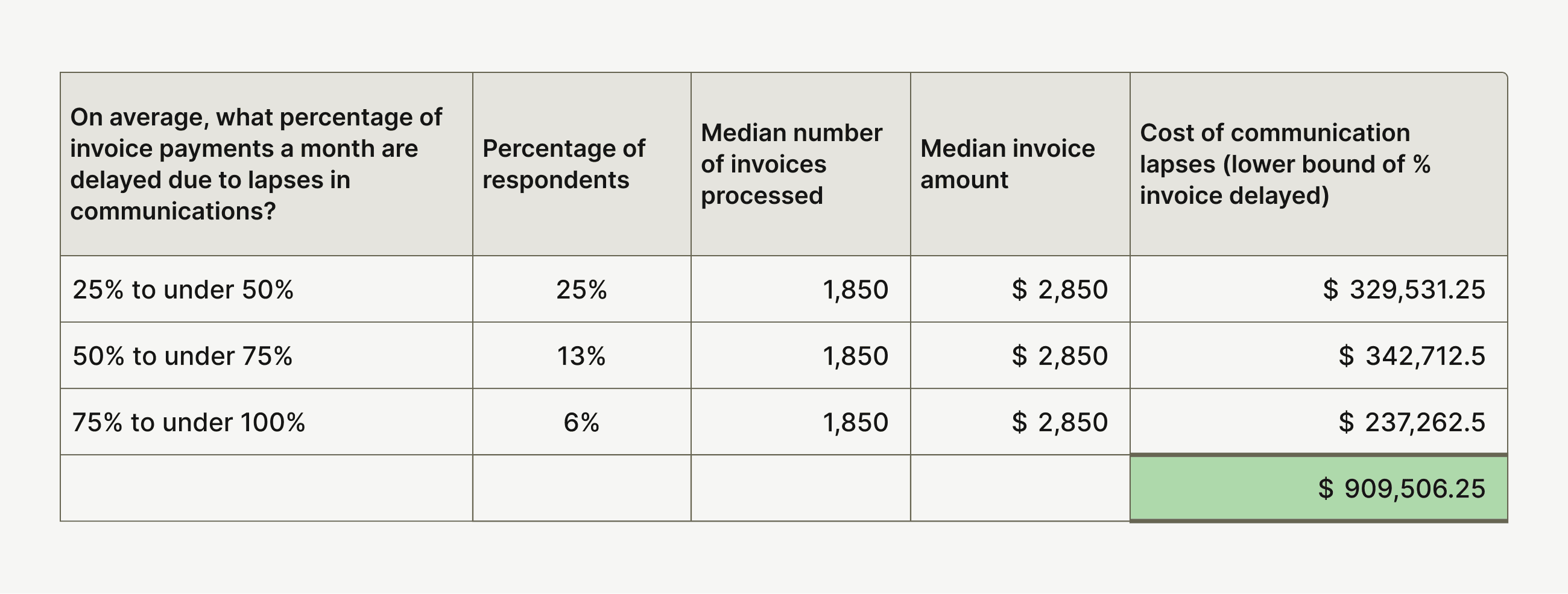

Managing invoicing and payment processing communications manually and ad-hoc leads to mistakes and lapses that delay delivery and payment, and damage relationships with customers.

The numbers are eye-opening: 27% of invoices on average are delayed each month because of communication problems, and 82% of companies report that poor communication has cost them potential future business. These communication lapses are costing businesses like yours nearly $1 million in delayed payments monthly.

6. Manual payment processing is inefficient

While EIPP enables customers to pay digitally, often via an online invoicing and payment portal, manual invoicing procedures are typically associated with more manual payment options. AR teams that don’t accept digital payments must instead use inefficient methods of securing revenue, such as processing checks and taking credit card info over the phone. Almost all B2B organizations (91%) still receive checks from customers.

Checks and accepting credit cards over the phone present a particular problem in the case of small-dollar payments. An example is Sharp Corporation, which spent unacceptable amounts of staff time taking credit card info from customers over the phone for $1 and $2 payments.

7. Payment reconciliation is cumbersome when done manually

Manual invoicing and non-digital payment acceptance means that accounts receivable teams must reconcile payments manually as well, which is cumbersome and time-consuming.

In the case of one company that reconciled payments manually, the AR staff needed to pull three separate reports to do so—one from their payment gateway, one from their ERP system, and one that connected these two reports. The company’s staff spent six hours every day completing the cash application process.

8. Manual invoicing leads to poor user experience

Customers increasingly want to pay digitally directly from an invoice or via a portal. Lack of digital payment options creates a poor user experience for customers and discourages their recurring business.

Almost three-quarters (73%) of executives say that a less-than-ideal invoicing and payments process can have a damaging effect on customer’s experience, according to a survey of C-level executives by Wakefield Research and Versapay. This problem cannot be ignored: A report by PYMNTS and Worldpay found that 85% of B2B companies identify a positive experience working with a vendor to be as valuable as the quality of their products and services.

9. Manual invoicing results in slow cash flow

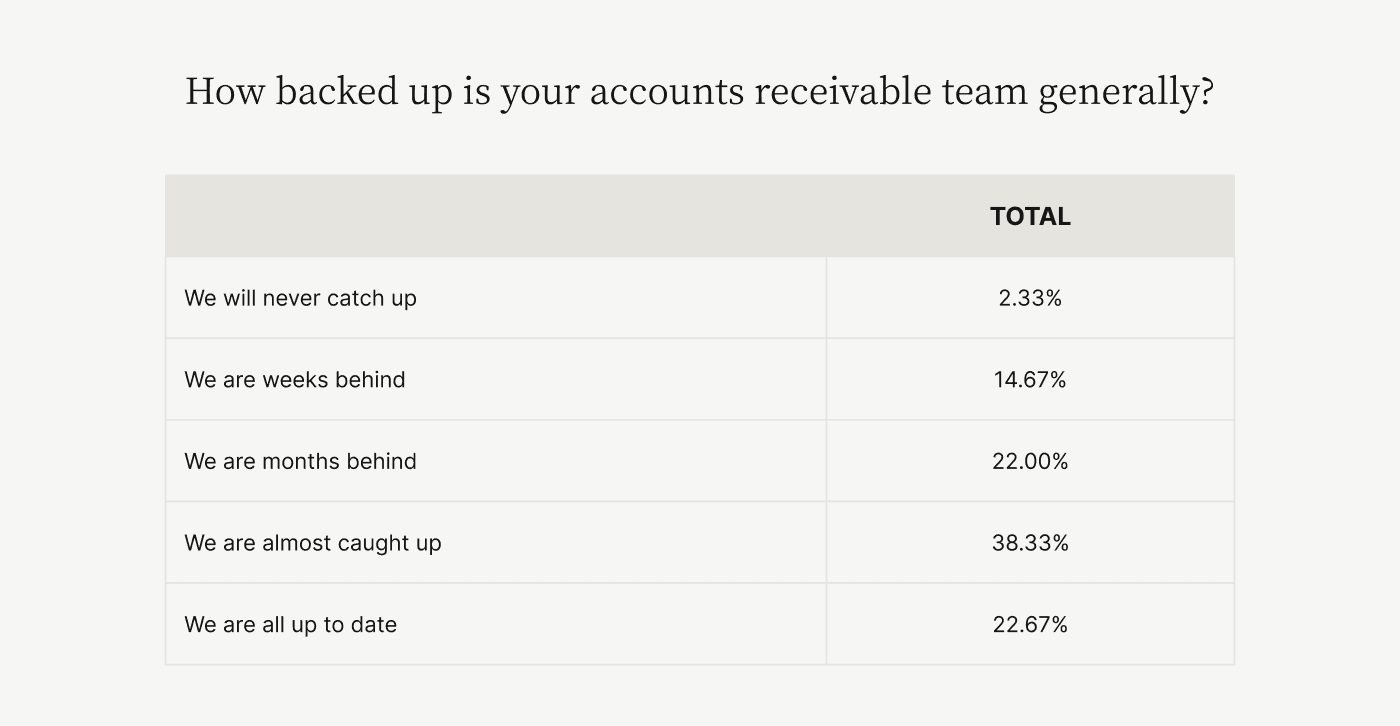

Manual invoicing and payment acceptance is a slow, complex process, and 77% of accounts receivable teams are delayed due to complications that result. Slow processing makes for sluggish cash flow, which affects the bottom line.

6 ways EIPP fixes manual invoicing woes

The good news is you don’t have to languish in manual slow-motion anymore. Electronic invoice presentment and payment helps fix all the major issues with manual invoicing. Here are six specific examples of the benefits of EIPP:

1. EIPP accelerates cash flow

Automated invoicing enables faster, more accurate invoice creation and distribution, which leads to quicker payment and fewer dispute-related delays. Digital payment acceptance also boosts speed of payments, as it is easier for customers to pay.

We surveyed 300 CFOs on the value of invoice presentment and payment portals, and found that having to manually address the aforementioned challenges compounds processing delays and keeps skilled AR teams from focusing on strategic collections efforts.

2. EIPP provides better user experience

Electronic invoice presentment and payment solutions allow accounts receivable teams to easily customize invoices and deliver them via each customer's preferred channels.

Also among the benefits of EIPP is that customers can remit payment more easily via their preferred B2B payment methods and communicate in a streamlined way with AR teams. All of this makes the process far better for users, which improves customer experience and loyalty.

3. EIPP increases efficiencies

Automating accounts receivable makes for more efficient workflows, as teams can dispense with a variety of cumbersome manual processes and instead take advantage of the labor-saving power of automation.

That same survey found that AR teams using collaborative EIPP technology can avoid manually revolving almost $1.7 million worth of invoices monthly. That’s 44% more cash automatically brought in monthly by reducing unnecessary, unpleasant tasks.

4. EIPP cuts costs

Automating invoicing and digitizing payments enable various kinds of cost savings. A major benefit of EIPP is savings on staff time when rote, manual tasks are automated and the burden of unnecessary dispute management is lifted.

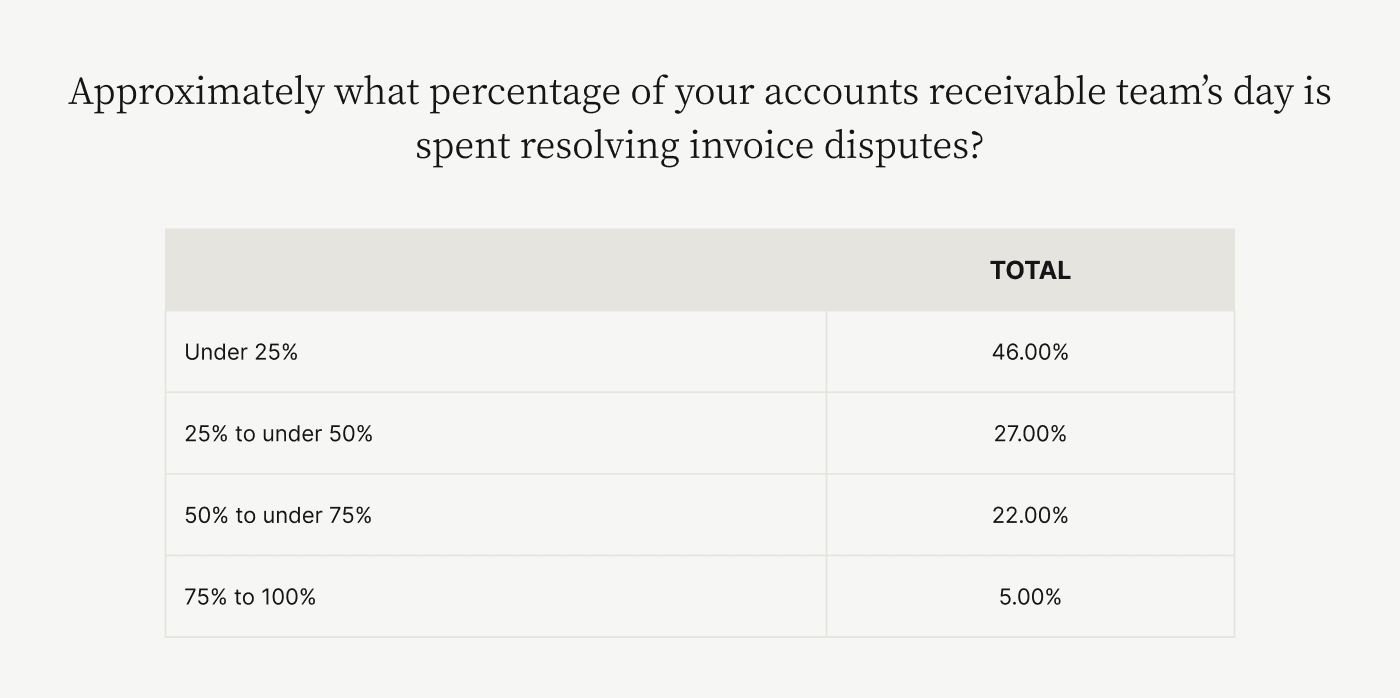

Currently, 54% of accounts receivable teams report spending at least 25% of their day resolving invoice disputes. Imagine the cost-savings and value you stand to gain by reallocating those efforts toward more strategic initiatives.

Also, moving away from paper invoices reduces the need to pay for paper, ink, and postage.

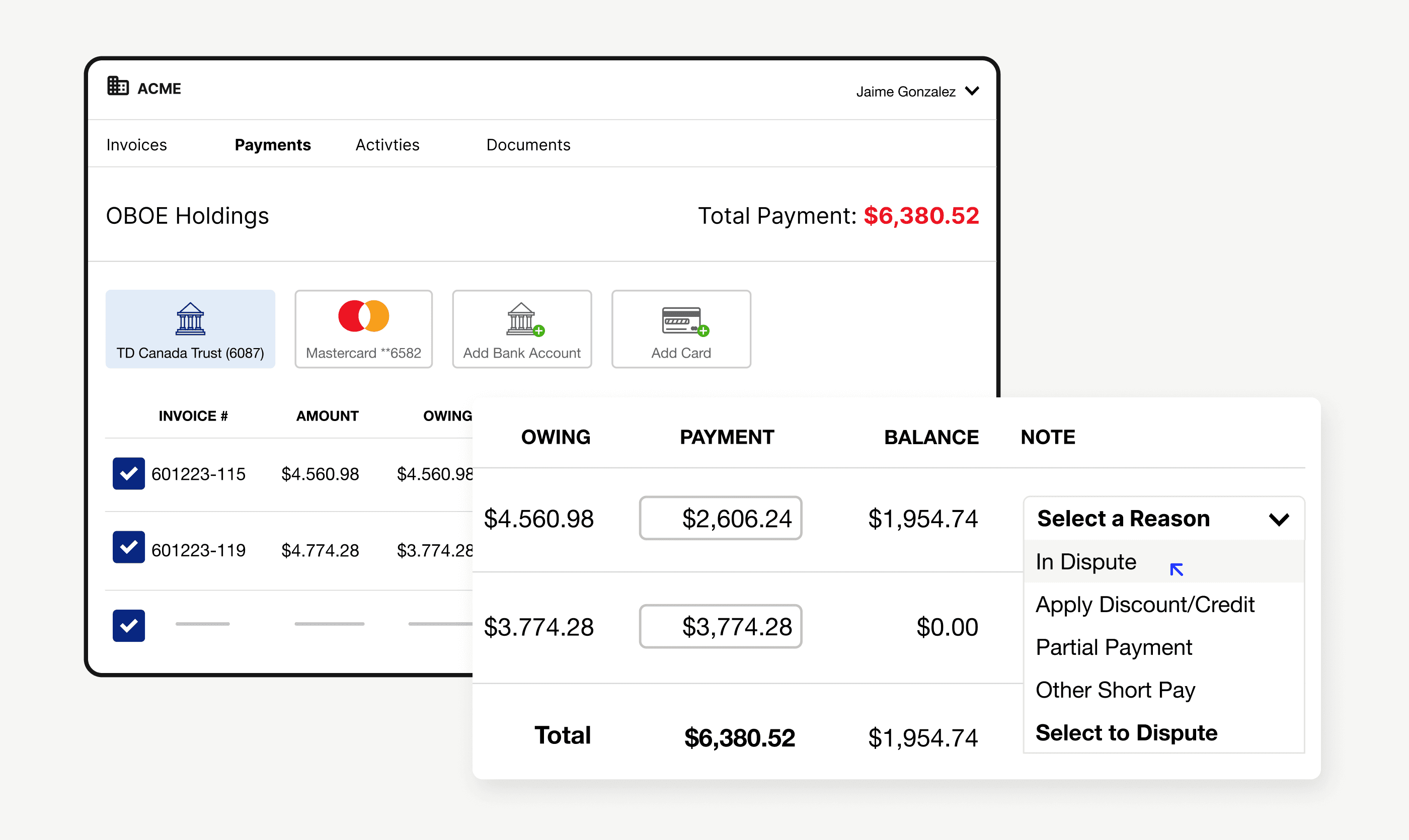

5. EIPP facilitates faster dispute resolution and easier short payments

Better visibility, information-sharing, and communication result in fewer disputes and more streamlined dispute resolution. Electronic invoice presentment and payment also enables easier acceptance of short payments, which helps keep payments on track.

6. EIPP speeds up cash application

Faster cash application results when customers are able to make digital payments directly from invoices posted to a customer-facing, electronic payment portal. Automation can increase the efficiency of cash application by as much as 75%, which ultimately accelerates cash flow.

EIPP promises a better bottom line

Electronic invoice presentment and payment solutions present major advantages to businesses of all sizes, and especially to mid- to upper-midsized businesses that process a high volume of invoices each month.

Electronic invoicing can cut costs, increase workflow efficiency, speed up cash flow, and lead to better employee and customer satisfaction. These benefits can lead to very real improvements in your business’s bottom line.

Read the Executive’s Guide to Electronic Invoicing to learn more about how EIPP can help your business thrive.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.