3 Steps to Reduce DSO and Build Better Customer Relationships

- 6 min read

This blog explores three ways in which the accounts receivable function can be optimized for efficiency, improve business relationships, and outperform against core financial metrics like days sales outstanding, ultimately reducing DSO.

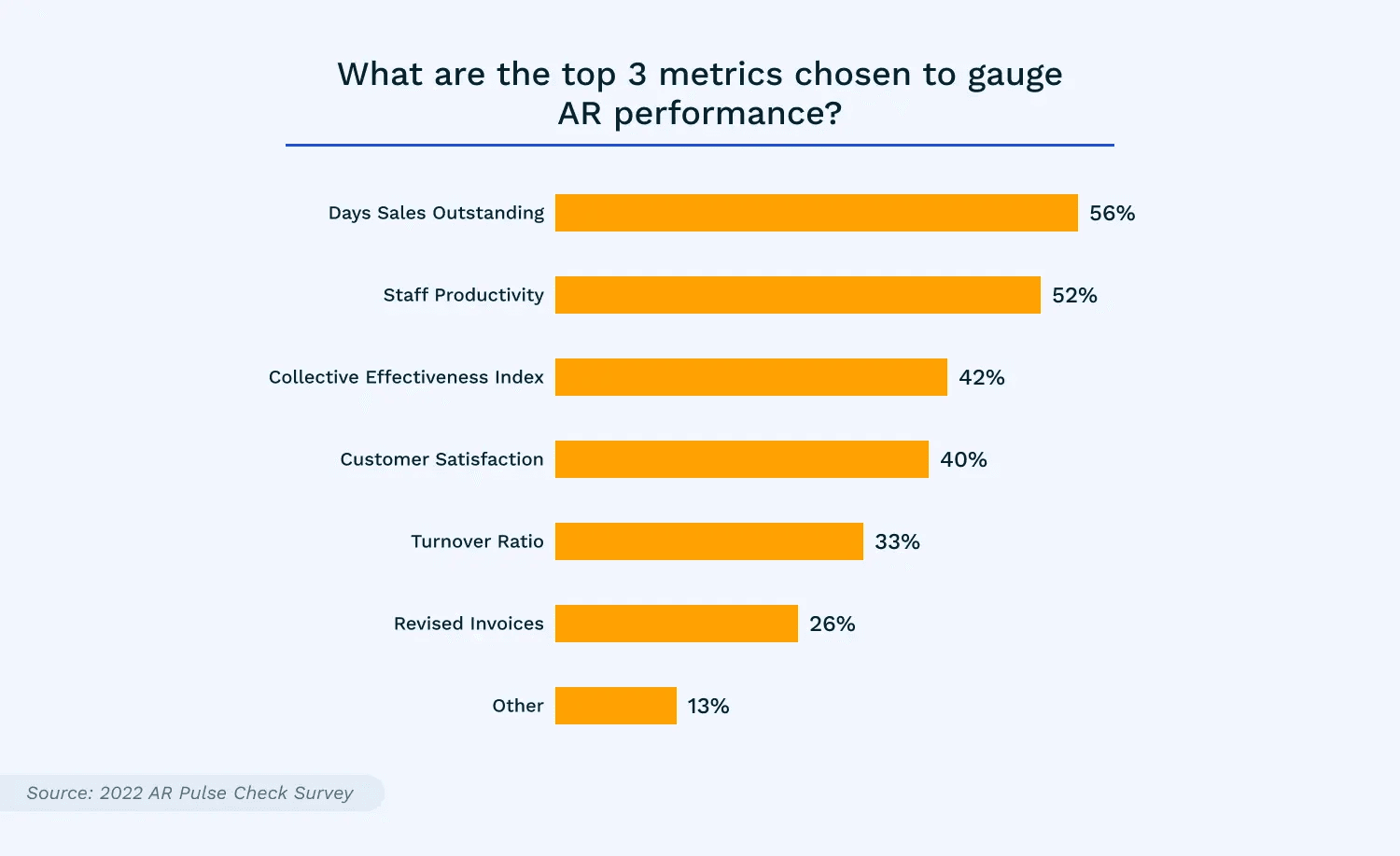

Any Chief Financial Officer (CFO) can tell you how important timely payment collection is to the financial health of their business. In fact, SSON’s 2022 AR Pulse Check survey of 103 Shared Services and Outsourcing (SSO), Global Business Services (GBS), and Finance leaders found that Days Sales Outstanding (DSO) is the top metric chosen to gauge AR performance.

These findings make it clear that Finance leaders value collections and receivables management processes and believe them to be integral contributors to positive business results and reduced DSO.

While getting paid quickly ensures healthy cash flow for covering expenses and investing in growth, accurate application of customer payments is also critical for providing superior customer payment experiences, end-to-end. For both acquiring valuable repeat customers and cementing strong customer relationships, timely and accurate cash application translates to faster credit replenishment which ultimately means more sales.

Additionally, an efficient and precise accounts receivable process means that unnecessary collections calls—which can irritate customers who have paid on time—are prevented.

So, how can your accounts receivable function speed payment collection and ensure that downstream processes improve business relationships and key financial metrics? We talked to our customers about three key ways to position AR, credit, and collections teams for success.

Here’s what they had to say:

1. Offer flexible and convenient payment options (and the ability to pay using online payment portals).

Nearly 40% of businesses plan to expand the number of ways their customers can pay in the next 2-3 years. In business-to-business (B2B), a payment environment that is already complex and peppered with payment types, the reasons for offering even more customer payment options are typically speed and convenience—ideally on both sides of the transaction.

Beyond accepting common payment types like check, ACH, cards, and wire transfers through lockbox and bank channels, think about the ways your customers interact with your business. Do they buy online, visit a store, receive deliveries from sales at their business location? Is your business equipped to accept payments through any of these channels?

Online portals and mobile payment capture technologies enable customers to pay instantly, while their bill is top of mind, from anywhere. These instant electronic payment options reduce DSO for your business and provide flexibility and convenience to customers.

Online portal-based payments empower customers to pay once or schedule recurring payments using the electronic payment method of their choice. By enabling this payment channel, you can accelerate your move away from manual check payments. Many portal solutions also offer opportunities for your business to add its own branding and payment terminology, ensuring a seamless and differentiated experience for your clients.

“All our client-facing staff takes every opportunity to direct clients to the Customer Portal,” said Sara French, Cash Application Manager at Madison Resources. “It's an easy sell because it’s easy to use, provides convenience and the information they need, and the end-users have no idea that Madison Resources is the company providing the service.”

Mobile payment technology can be accessed via mobile phones or tablets in the field. Payment images or other details are easily captured, and payments are deposited and applied.

2. Streamline the post-payment application and matching process to reduce DSO.

Nearly 50% of credit management professionals say that technology that can integrate seamlessly with existing platforms and eliminate manual data entry or upload/download tasks will have the biggest impact in the next 3-5 years.

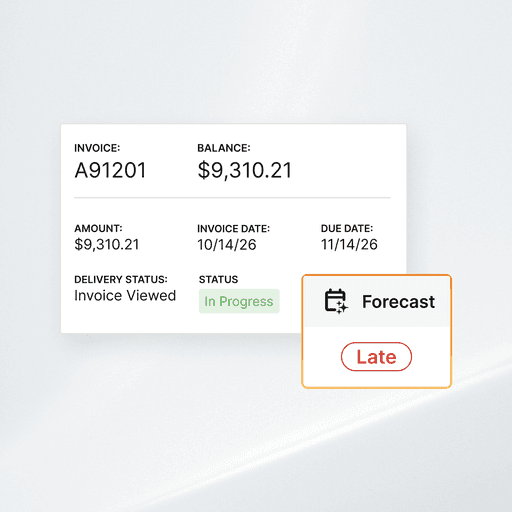

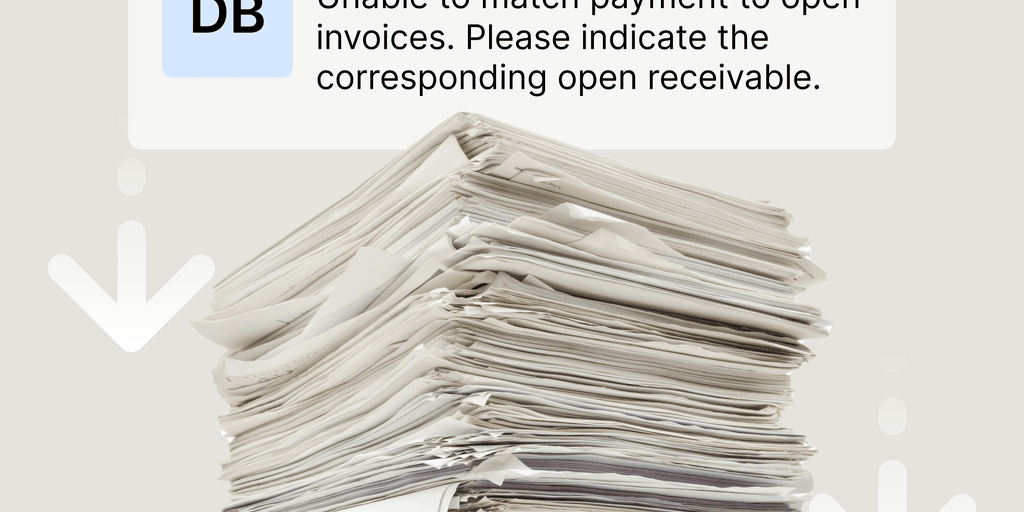

When considering online portal payment solutions or mobile payment capture technology, it’s critical that these payment tools are properly integrated with your billing system/ERP. When AR Automation technologies leverage artificial intelligence (AI), machine learning (ML), and natural language processing (NLP), it’s possible for payments to be processed straight-through, eliminating the need to manually match payments to open invoices and customer accounts. This drastically reduces the likelihood of manual errors and can significantly reduce manual effort—in some cases, increasing efficiency by 75%.

This streamlined cash application process lowers per-payment processing costs, speeds credit replenishment, and puts cash to work faster for your organization.

In the case of field payments collected via mobile devices, salespeople can refocus time previously spent making deposits at branch offices or bank locations on building customer relationships or securing their next order. Mobile payment capture technology should also be an extension of your AR process, where payments are not only received and deposited but also applied straight-through.

3. Empower staff to work on more strategic, impactful initiatives.

Offering more convenient customer payment options and implementing downstream AR automation can address employee job satisfaction and staffing challenges, too. Keeping up staff levels and backfilling positions are real challenges in a competitive hiring market.

With automation, manual payment research—like sourcing remittance advice and identifying relevant documentation—and matching tasks are taken care of, simplifying new-hire training in addition to the processes themselves. Employees are then free to spend their time on more strategic and fulfilling work.

Versapay’s customers find that they can leverage their existing teams to handle even greater payment volumes as their businesses grow. This makes the work their AR teams perform more meaningful, the individuals themselves happier, and leaves their end customers with lasting, exceptional experiences.

Using [Versapay] makes my job so much easier. It frees me up so I can learn more about the strategic part of management accounting

Download Less Resistance, More Collaboration. The CFO’s Guide to Accelerating Collections to learn why how quickly and collaboratively you collect payments is directly related to your financial health and customer satisfaction.