Your Guide to Accounts Receivable Factoring

- 13 min read

In accounts receivable factoring, a company sells unpaid invoices, or accounts receivable, to a third-party financial company at a discount for immediate cash.

For cash-strapped businesses with late-paying customers, accounts receivable factoring can help them get paid without chasing down customers. It’s more accessible, gives businesses more control over their finances, and frees up resources spent on collections activities.

If you haven't explored factoring, you could be missing out on opportunities to grow and invest while your competitors turn unpaid invoices into immediate cash.

Table of contents

What is accounts receivable factoring?

In accounts receivable factoring, a company sells unpaid invoices, or accounts receivable, to a third-party financial company, known as a factor, at a discount for immediate cash. When you factor accounts receivable, your company gets immediate payment for outstanding invoices to improve cash flow.

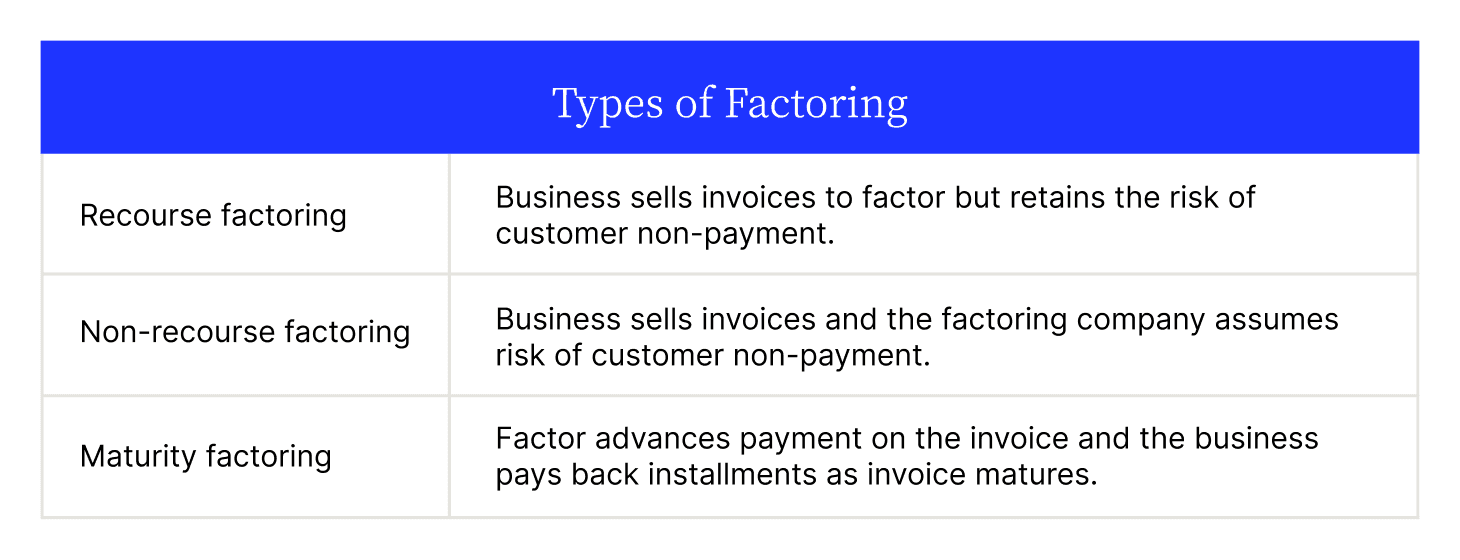

There are three types of accounts receivable factoring:

Recourse factoring

Non-recourse factoring

Maturity factoring

1. Recourse factoring

Recourse factoring is the most common type of factoring for receivables accounting. In recourse factoring, the business selling invoices retains the risk of customer non-payment. If the customer doesn’t pay the invoice in full, the factor can force the seller to buy back the receivable or refund the advance payment.

2. Non-recourse factoring

In non-recourse factoring, the factoring company assumes the risk of customer non-payment. If the customer fails to pay in full, the factor absorbs the loss.

3. Maturity factoring

With maturity factoring, the factor advances payment on the invoice and collects payments from the seller as the invoice matures. This is the least common type of factoring and is typically reserved for long-term invoices and large contracts.

How accounts receivable factoring works

The process for factoring of receivables follows several steps:

Seller submits invoice to factoring company

Factoring company advances percentage (often 80 – 90%) to seller

Factoring company separates resources by holding the remaining advance percentage as security

Factoring company collects payment from customer

Factoring company clears remaining payment amount and completes final payment to seller

Once a selling organization submits its invoices, the factor will verify details and ensure the invoices qualify (more on that in a moment). In most transactions, the factoring company advances 80 – 95% of the factored amount the day the invoice is submitted.

The factoring company then holds the remaining amount of the invoice, typically 8 – 10%, as a security deposit until the invoice is paid in full. Then the factoring company collects money from the customer over the next 30 to 90 days.

After receiving payment in full, the factoring company clears the remaining balance, typically 1 – 3%, to the selling company. The factoring company makes a profit by collecting on the full amount of the invoice. See our example below.

Accounts receivable factoring vs accounts receivable financing

Accounts receivable factoring deals with the sale of unpaid invoices, whereas accounts receivable financing uses those unpaid invoices as collateral. Borrowers will receive financing based on what their accounts receivable is worth. Then, once the invoices are paid—the collections process in this scenario resides with the seller—the borrower pays the lender back, with fees.

Accounts receivable factoring vs business line of credit

Business lines—or operating lines—of credit are another commonly used form of post-receivable financing. This just means it’s financing after an invoice has been generated (purchase order financing is the inverse; it’s a form of pre-receivable financing).

If the seller qualifies for this financing method, they might need to decide which to proceed with. Both has a time and place, best examined through these lenses:

Loan to value — Lines of credit typically advance up to three quarters of good accounts receivable—meaning AR that’s under an aging limit that’s still likely to close; usually 90 days. Accounts receivable factoring companies typically offer advance rates up to 90% of the invoice’s value. While this often comes at a higher cost, the higher advance rate tends to be attractive.

Loan purpose — What the loan proceeds are used for doesn’t much matter to accounts receivable factoring companies. Banks, however, often issue lines of credit for working capital support.

Interest rates — Depending on the borrower’s risk or creditworthiness, the interest rate on a business line of credit could vary significantly. All-in interest rates between 4% and 9% are common. Borrowers will want to compare these rates with the cost of accounts receivable factoring, and weigh their options.

Exposure duration — Accounts receivable factoring tends to last only as long as the seller’s payment terms with its customers (up to 90 days, typically). A business line of credit can more easily be extended or established for ongoing engagements, as long as the lender remains comfortable with how risky the borrower is.

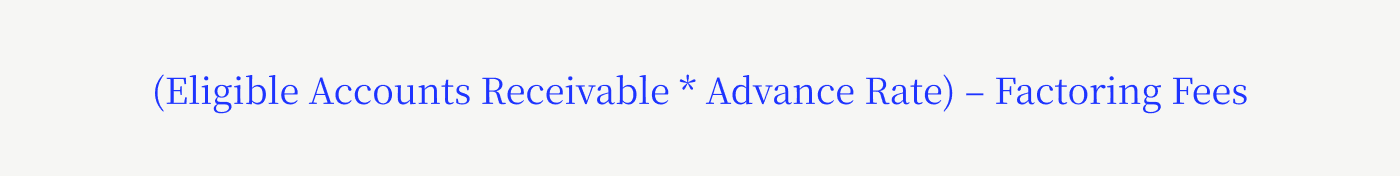

How to calculate accounts receivable factoring

To calculate the funds a business can receive through accounts receivable factoring, the factoring company typically follows a three-step process:

Determine eligible accounts receivable — The factoring company reviews the company’s outstanding invoices. Generally, only invoices that are less than 90 days old and are owed by creditworthy customers are eligible for factoring.

Calculate the advance rate — The percentage of eligible accounts receivable the business can receive upfront. Typically, the advance rate ranges from 80-90% depending on customer creditworthiness and invoice risk.

Subtract factoring fees — Factor fees include a discount fee and service fee. Fees are subtracted from the amount of the eligible accounts receivable. The discount fee is the cost of financing—a percentage of the total factored amount. The service fee is a flat fee for administrative services like invoicing and collections.

The formula for calculating accounts receivable factoring is:

Accounts receivable factoring example

Let’s say a business has $100,000 in eligible accounts receivable and the advance rate is 80%. The business can receive an upfront payment of $80,000.

With a 2% discount fee and a $500 service fee, the factoring fees would be $2,500. Therefore, the business would receive $77,500 in total, and the factoring company would make $22,500 in revenue.

How accounts receivable factoring companies pay for invoices

An accounts receivable factoring company assesses several factors (including the following) to determine how much to pay for an invoice:

Creditworthiness of the customer owing the invoice

Age of invoice

Industry and sector of the selling business

Number of invoices for sale

Overall transaction risk

How credit histories and interest rates influence accounts receivable factoring

When a factoring company decides how much to pay for an invoice, one of the first things they look at is the debtor’s—the customer who hasn’t paid—creditworthiness. If they have good credit histories, the factor will be willing to pay a higher rate.

The prevailing interest rate is the most critical element for factoring companies considering payment amounts. If interest rates are high, the factoring company will likely pay less for an invoice, as they need to factor in the cost of borrowing money to finance the purchase. Conversely, if interest rates are low, the factoring company may be willing to pay more for the invoice because borrowing costs are lower and they can make a higher profit margin.

Benefits of accounts receivable factoring

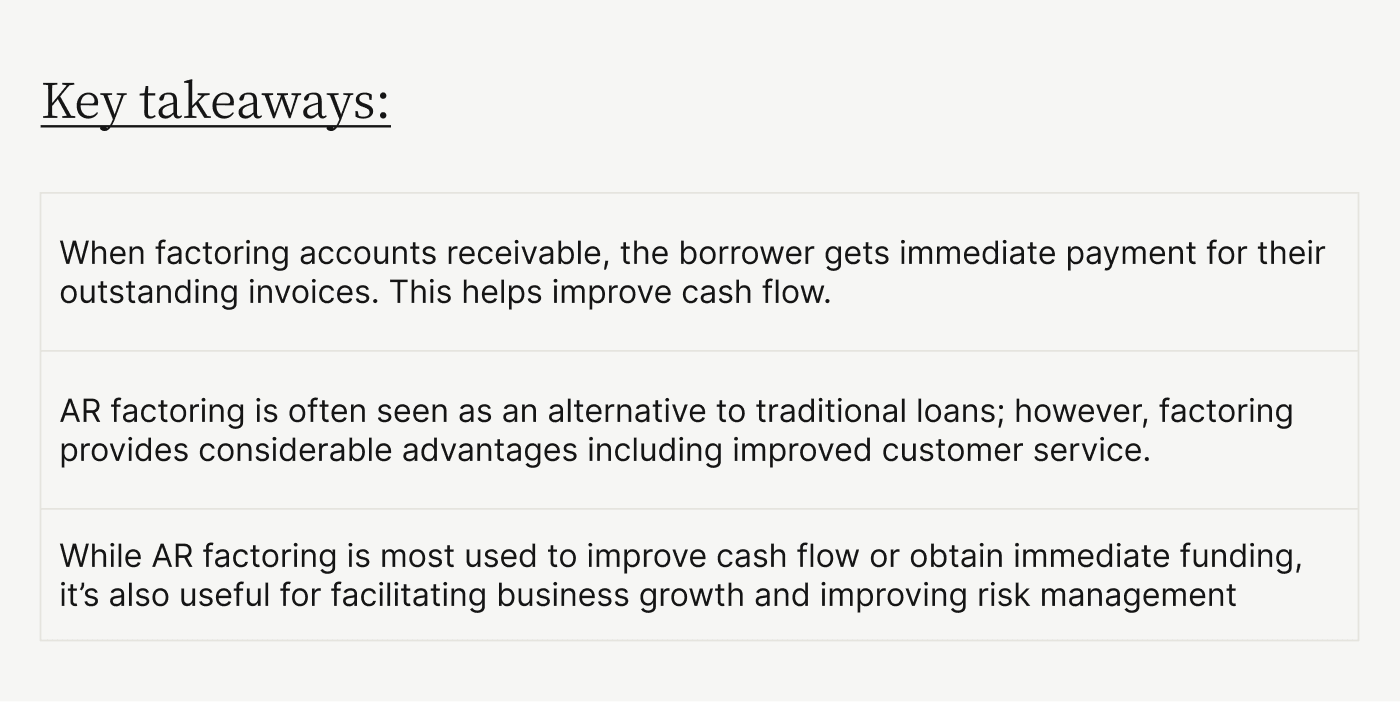

Most companies consider accounts receivable factoring an alternative option to traditional loans, but AR factoring provides considerable advantages, including:

Improved customer service

Easier loan process

Immediate cash flow and capital growth

1. Improved customer service

Accounts receivable factoring can help companies provide better customer service by offering more flexible payment terms and reducing the time and effort required to collect customer payments.

With immediate access to cash flow, companies can offer more flexible options to customers by extending payment terms, offering discounts for early payments, and providing other incentives to enhance customer experience.

By outsourcing accounts receivable collections to a factoring company, businesses can reduce the time and resources spent chasing customers for overdue payments. In reducing the manual collections duties, AR teams are freed to perform more strategic and impactful work, like improving customer service, leveraging data insights, and offering better products.

2. Easier loan process

Accounts receivable factoring doesn’t require collateral or impact a business’s credit rating. Because traditional loans do make those a part of the process, a business with less ideal creditworthiness might desire to avoid a credit impact, or be unable to put down collateral to maintain cash flow.

AR factoring also enables companies to be in more control during the loan process compared to bank lending. Bank loans are often considered a high credit risk. And if the loan requires the company to submit collaterals and recurring payments, it will negatively impact cash flow.

3. Immediate cash flow and working capital

Revenue tied up in unpaid receivables can affect payroll and overhead costs, putting the company in a precarious position. Accounts receivable factoring can be invaluable during these times when companies need immediate cash flow without waiting for customers to pay invoices in full.

AR factoring doesn’t impact a business’ credit rating or loan interest rate. Providing immediate cash flow helps companies build a working capital reserve for future growth and take advantage of new business opportunities.

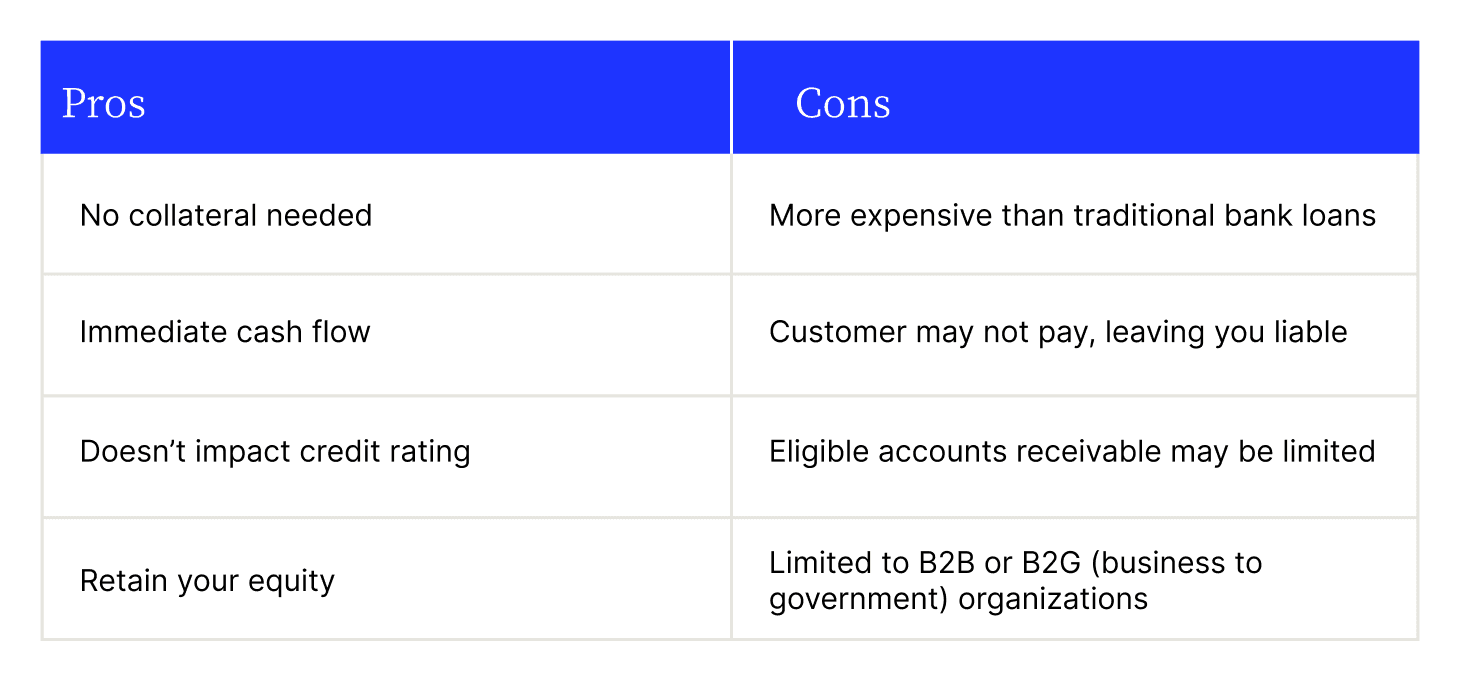

Pros and cons of factoring accounts receivable

Below is a table listing the pros and cons of factoring accounts receivable:

3 reasons to use accounts receivable factoring

Accounts receivable factoring can be useful in situations where a business needs to improve cash flow or obtain immediate funding. Top reasons for factoring include:

To maintain off-season cash flow

To facilitate business growth

To improve risk management

1. Maintain off-season cash flow

Seasonal businesses with fluctuations in cash flow, such as holiday-related manufacturers or wholesale manufacturers, may need additional cash to cover operating expenses during off-seasons. Accounts receivable factoring can be a reliable source of funding to bridge the gap between slow and busy times of the year.

2. Facilitate business growth

Businesses looking to expand into a new location or launch a new product often need additional funding. Factoring accounts receivable can help growing businesses be more flexible and eliminate cash flow concerns.

3. Improve risk management

Manufacturing, wholesale distributors, commercial real estate, and finance companies can leverage AR factoring for better risk management by analyzing the creditworthiness of partners and customers to mitigate non-payment risk. By purchasing accounts receivable from businesses with strong credit ratings and reliable customers, finance companies can reduce exposure to bad debt.

Build a receivables process that fosters cash flow

You can transform your collections processes and turn unpaid invoices into immediate cash through accounts receivable factoring. Yet while cash flow issues often drive businesses to factor their accounts receivable, the best way to overcome these difficulties is to automate your accounts receivable process.

Automation can generate and deliver invoices on time, help you accept and process payments quickly, match and apply payments to open invoices, and ensure financial reporting accuracy without manual intervention. In short, accounts receivable automation software streamlines the entire collections process and accelerates cash flow.

These solutions automate the most tedious accounts receivable tasks, like printing invoices and stuffing envelopes, to the most complex, like cash application and dispute management. Choosing the right software is an important decision as the right tool is valuable beyond just its features and capabilities; it will actually strengthen customer experience and relationships.

Take a few minutes to complete an assessment for a tailored accounts receivable roadmap that benchmarks you against your peers, analyzes your collections processes, and provides tailored recommendations for future receivables success.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.