10 Reasons Why Paper-based Invoicing is Bad for Business

- 9 min read

Paper-based invoicing is manual, tedious, inefficient, and unmanageable at scale.

In this blog, you'll learn 10 reasons why electronic invoicing is a better alternative to traditional invoicing.

Invoicing is an essential function for enterprises, yet many companies are still invoicing in inefficient ways—namely, with paper invoices sent by mail. Managing accounts receivable this way can have a negative impact on business operations and customer experience, leaving companies with a competitive disadvantage compared to others who have modernized their invoicing processes.

Paper-based or ‘traditional’ invoicing has been the norm for many years, but it is a sorely lacking way of managing your invoicing process. A paper-based process involves manually filling out invoices and sending printed copies to the customer by mail or fax. In an era in which so much of our work lives rely on streamlined digital tools, it’s not hard to imagine the many problems a paper-based invoicing process can cause. These issues get increasingly unmanageable as you scale.

If your company still uses a traditional invoicing method, it’s time to rethink how you invoice. All of the problems this process presents can be prevented by modernizing your processes and embracing electronic invoicing.

Not yet convinced that electronic invoicing is a better alternative to paper-based invoicing? Here are 10 of the most significant issues with traditional invoicing practices:

10 problems with paper-based or traditional invoicing

The challenges presented by paper-based invoicing range from introduction of errors to slow payment processing to high costs. Click on any of the topics below to jump straight to that entry.

The laborious process of traditional invoicing is a drain on company resources

Tedious work creating and processing paper invoices leads to staff dissatisfaction

Revising and re-delivering physical invoices is tedious and time-consuming

Higher likelihood of mishandling physical invoices leads to delays in payment

Manual data entry results in slower and less-accurate bookkeeping

High resource requirements for paper-based invoicing drives up cost

Environmental footprint of high paper use can have moral and reputational impacts

Customers are likely to be dissatisfied with standardized, one-way communication

Dissatisfied customers may look for a supplier with more streamlined invoicing

1. The laborious process of traditional invoicing is a drain on company resources

One of the biggest problems with paper-based invoicing is how many of your company’s resources the process takes. Multiple accounts receivable staff members are typically required to create, process, and mail invoices—often a multi-step-or-day process for larger businesses.

This takes finance staff time away from potential higher-value tasks. Additionally, any attempt at personalization or customization of invoices is time-consuming to enact using a manual, physical invoicing process.

🚨 This credit management team spent upwards of 75% of its time on paper mailings, customer calls, and manual collections.

2. Tedious work creating and processing paper invoices leads to staff dissatisfaction

Staff must manually create, print, sort, process, and mail invoices—tedious work that finance teams would be happy to do without. Unwinding errors and dealing with customer conflicts that are a result of this process are unnecessary aggravations.

Staff who spend too much time doing this work or handling the problems it creates may feel dissatisfied with their jobs, especially if they were trained as finance professionals, not clerks.

3. Revising and re-delivering physical invoices is tedious and time-consuming

Manual invoice processing is a highly error-prone process, especially when done at scale. Once errors are introduced into the invoicing workstream, they can be difficult to identify and unwind. They are also likely to lead to conflict with customers. As the chart below shows, human error is the biggest cause of invoice disputes.

Additionally, invoice revisions resulting from issues like clerical errors, administrative adjustments, or dispute management—a key accounts receivable performance indicator—are more challenging when invoicing physically, as staff must create and mail new invoices. Such problems can lead to poor customer experience and resulting customer attrition and payment delays.

💡 If your number of revised invoices is high, this could indicate a deeper invoicing problem that can only be resolved through implementing AR automation technologies.

4. Higher likelihood of mishandling physical invoices leads to delays in payment

Paper invoices are more likely to be mishandled by the recipient’s mail system, received by the wrong person, stuck on someone’s desk, or actually lost in the mail. The same can occur with the payment that comes back.

Chokepoints like these in the invoicing process can cause delays in receiving payment, require repetition of effort, and lead to conflicts with customers. Those impacts can negatively influence cash flow, financial reporting, and staff and customer satisfaction.

5. Processing payments by hand is slow and difficult

Manual invoicing creates more work for accounts receivable staff when processing incoming payments, whether they come in by check, phone, or credit card—or as any other B2B payment method. AR teams need to process and match those payments with their corresponding invoices, but remittance advice may be missing or incomplete.

Supporting documentation is rarely housed with paper invoices in companies’ systems, so AR teams must search email threads, paper trails, and other materials to reconcile payments.

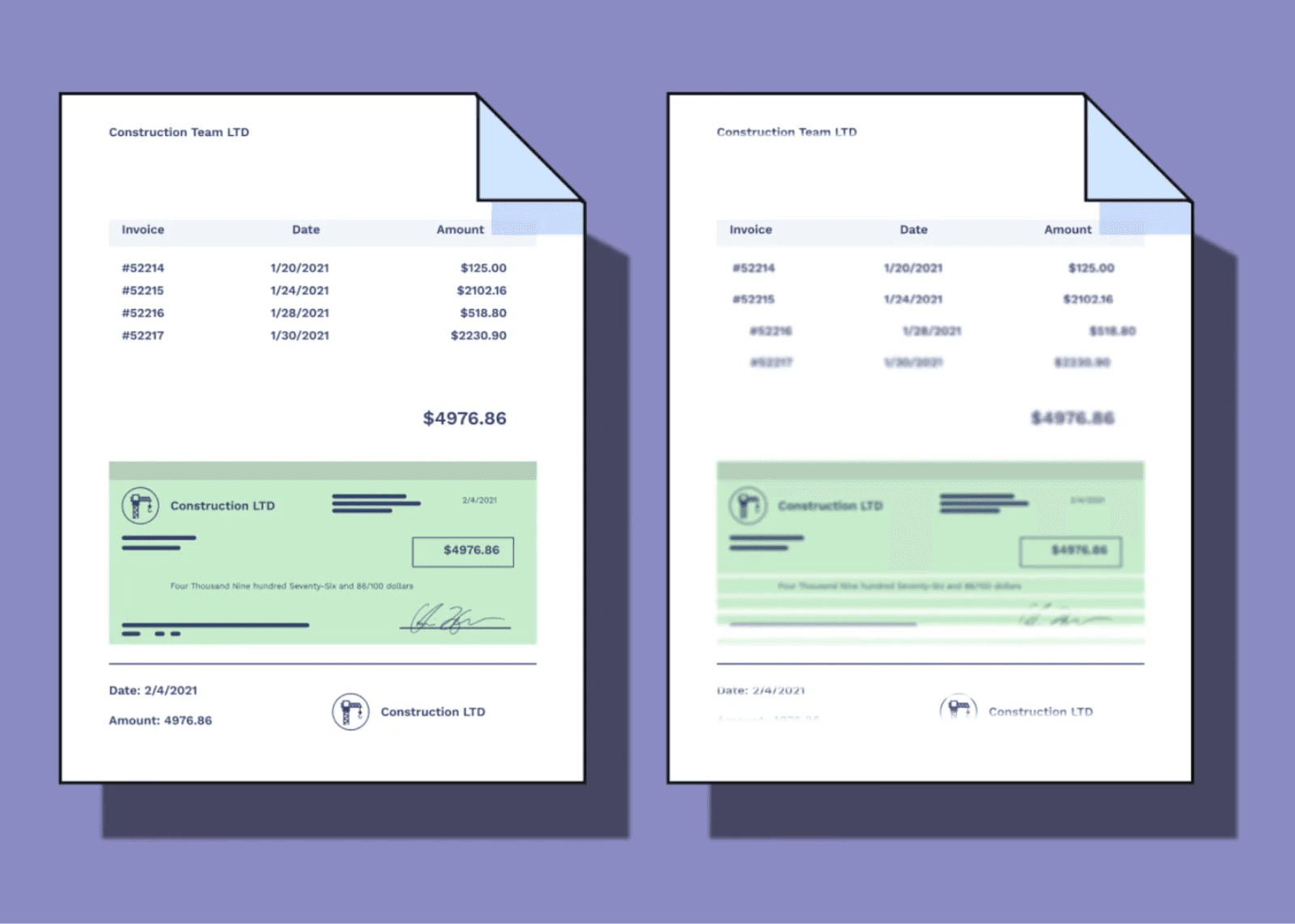

💡 Below is an example of an incomplete remittance advice slip (right) accompanying a payment by check. With paper-based invoicing, payments are subsequently rarely digitized, leading to reconciliation nightmares:

6. Manual data entry results in slower and less-accurate bookkeeping

Finance staff must manually enter data from paper invoices into accounting systems, which slows down the bookkeeping process and has the tendency to introduce errors.

The difficulty of processing and recording payments based on paper invoices slows down the work of getting payments on the books, which can have downstream effects like stalledcash flow and higher days sales outstanding (DSO). A slower and less-accurate bookkeeping system results in delayed or inaccurate financial statements and may prevent timely, informed business decision-making.

7. High resource requirements for paper-based invoicing drives up cost

Manual invoicing processes tend to be costlier than digitized delivery methods. The costs are myriad: staff time, paper and envelopes, printer ink, shipping costs, and floor space for maintaining paper files.

Additional costs come from the work of resolving conflicts due to invoicing errors or loss of customers due to dissatisfaction. Maintaining invoicing as a substantial cost center can be a drag on businesses finances, cutting into profits unnecessarily.

🚨 Distribution logistics company, TireHub, received 3,000 billing inquiry calls a month to their call center—which wasn’t designed for resolving invoice issues. By embracing electronic invoicing, they reduced their dependency on the call center for AR-related queries.

8. Environmental footprint of high paper use can have moral and reputational impacts

Paper-based invoicing has serious environmental impacts, considering that companies of size can send out hundreds of thousands of invoices a month. All of that amounts to a huge amount of paper. A company that sends out 330,000 invoices a month can prevent the use of 38,500 gallons of oil, 1.5 million gallons of water, and 5.6 tons of paper by instead sending invoices digitally for a year.

Not only does the environmental impact of invoicing present a moral or ethical concern, but it can also be a drag on your business’s reputation as companies’ environmental footprints and stewardship are increasingly under scrutiny these days.

💡 Since 2021, Versapay’s clients created 41.5 million invoices digitally. That’s an estimated savings of*:

- 13,530 trees

- 564 tons of paper

- 284,930 gallons of oil

- 14.7 million liters of water

* Along with associated impacts such as checks, receipts, bank slips, statements, follow-up mail, and more.

9. Customers are likely to be dissatisfied with standardized, one-way communication

Physical invoice delivery is one-way communication that gives customers one or only a few manual options for payment. Additionally, customers can’t access invoices and view account statuses in real time, but must sift through past communications or request this information from the accounts receivable team.

Considering that customization of invoices is difficult and tedious, AR teams tend to send the exact same communication to every customer, no matter the relationship, potentially causing poor customer experiences.

10. Dissatisfied customers may look for a supplier with more streamlined invoicing

If customers are dissatisfied enough with your invoicing process they may take their business elsewhere. This is particularly true in cases where your process impinges on the efficiency of your customers’ businesses.

Specifically, in B2B industries, a manual process means that the customer’s AP team must do extra work to process paper invoices. They must manually open, process, and pay said invoices, a time-consuming process. If your invoicing process slows down your customers’ business, they may look for a seller with a more streamlined and modern process.

The answer to problems with traditional invoicing? Going digital.

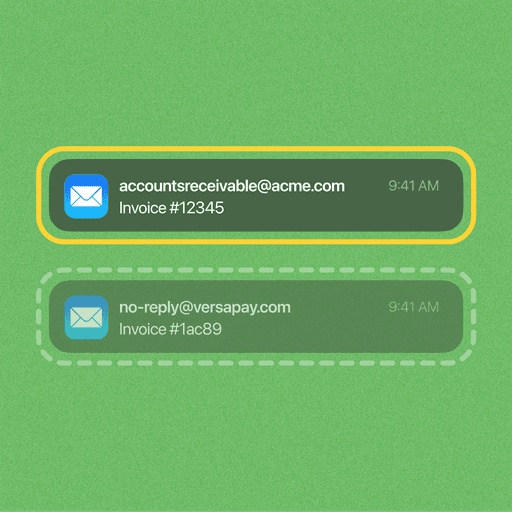

With so many problems with paper-based invoicing processes, all businesses should embrace electronic invoicing (e-invoicing). Many customers prefer to receive invoices through channels like email, basic and/or collaborative portals, or electronic data interchange (EDI).

Electronic invoicing allows for easy customization, fast error-correction and reissuance, and efficient dispute prevention. It leads to faster payments, more robust cash flow, less staff time and energy expended on tedious invoicing tasks, lower costs for AR, and higher customer satisfaction, among other benefits.

—

Learn about how Versapay’s world-class omni-channel invoicing system can help you banish the invoicing blues for good

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.