How EIPP Helps AR Teams Accelerate AP Invoice Approval Workflows

- 12 min read

This article explores how electronic invoice presentment and payment can help you deliver smooth payment experiences to your customers.

Invoice approval workflows largely lie in the hands of accounts payable teams—a fact accounts receivable teams become highly conscious of when they aren’t paid on time. And since this approval process plays out externally, you’d be forgiven for thinking that your AR team cannot influence faster payments.

That’s not entirely true.

While you can't control your customers’ internal payable processes, you can minimize invoicing and payment friction points from your end to ensure the AP teams you’re dealing with experience as smooth a payment experience as possible.

For example, by eliminating invoicing errors and delivering invoices through your customers’ preferred channels, you ease their job and increase the odds of a faster payment. EIPP technologies help with this at every stage of the AP workflow.

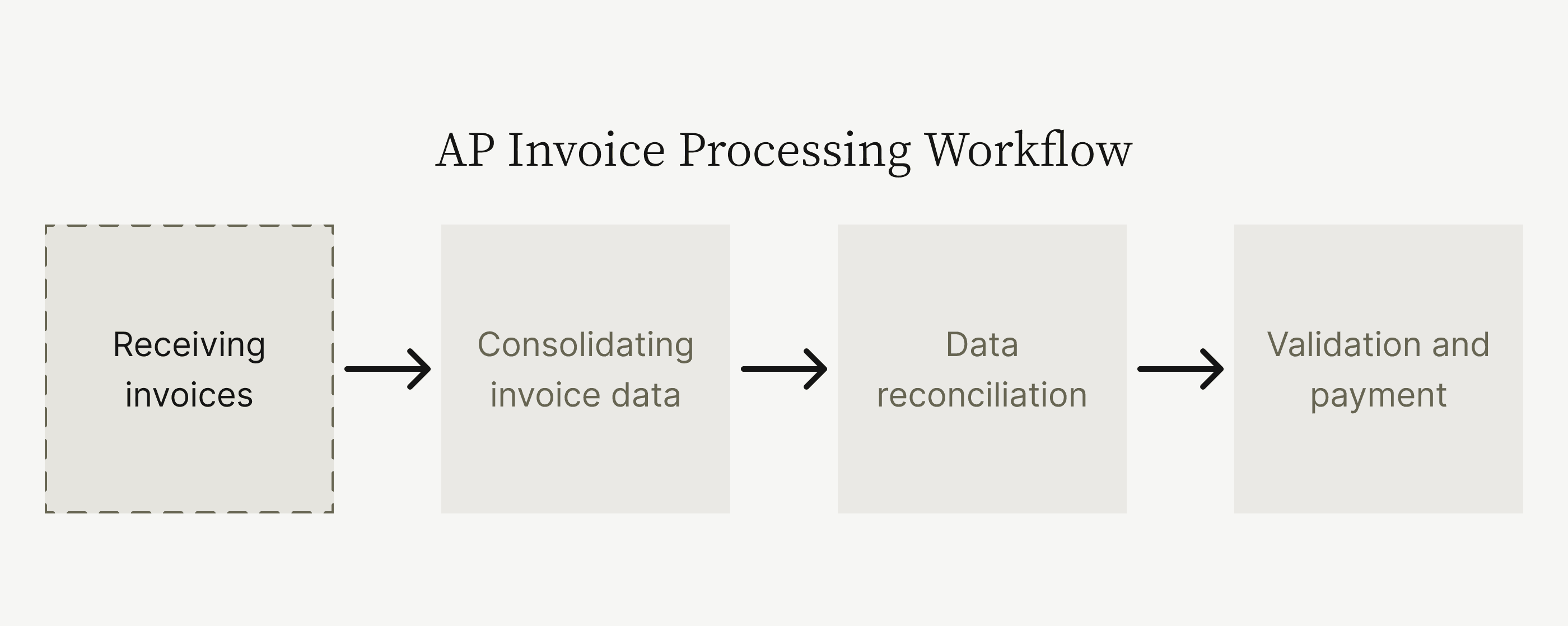

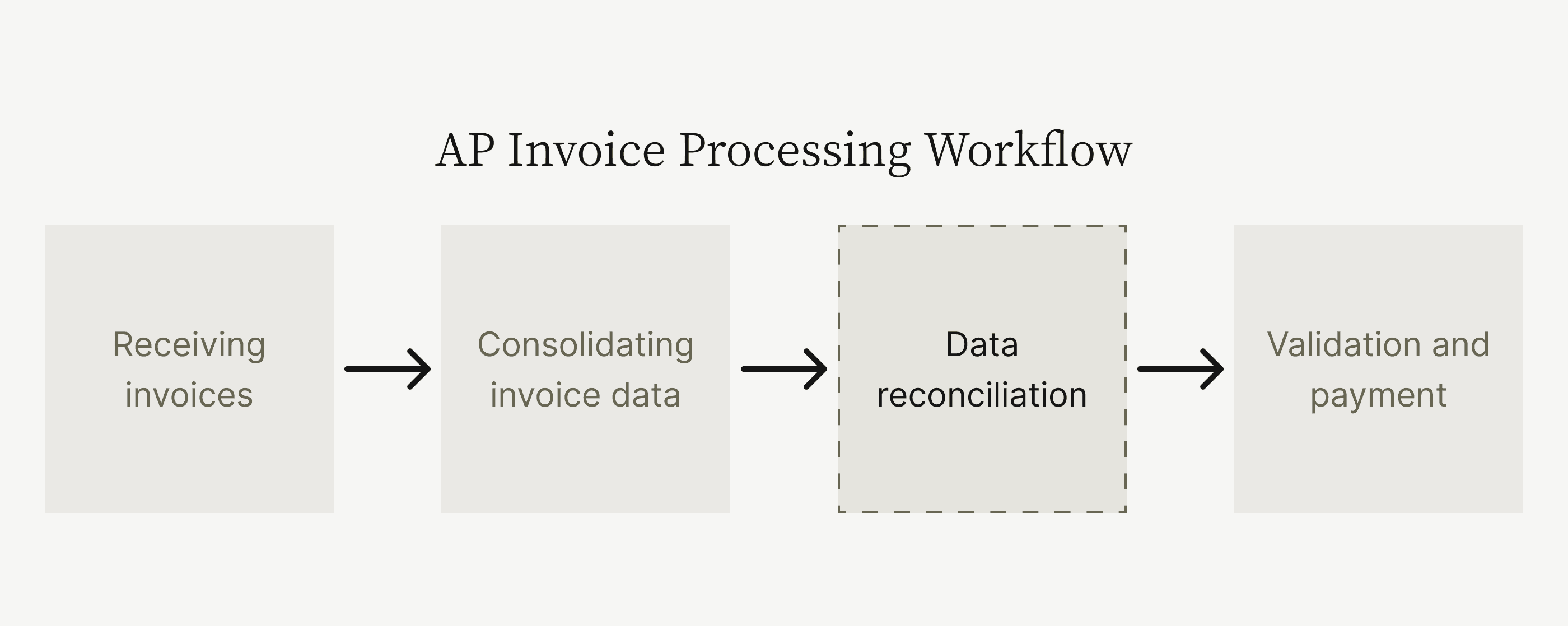

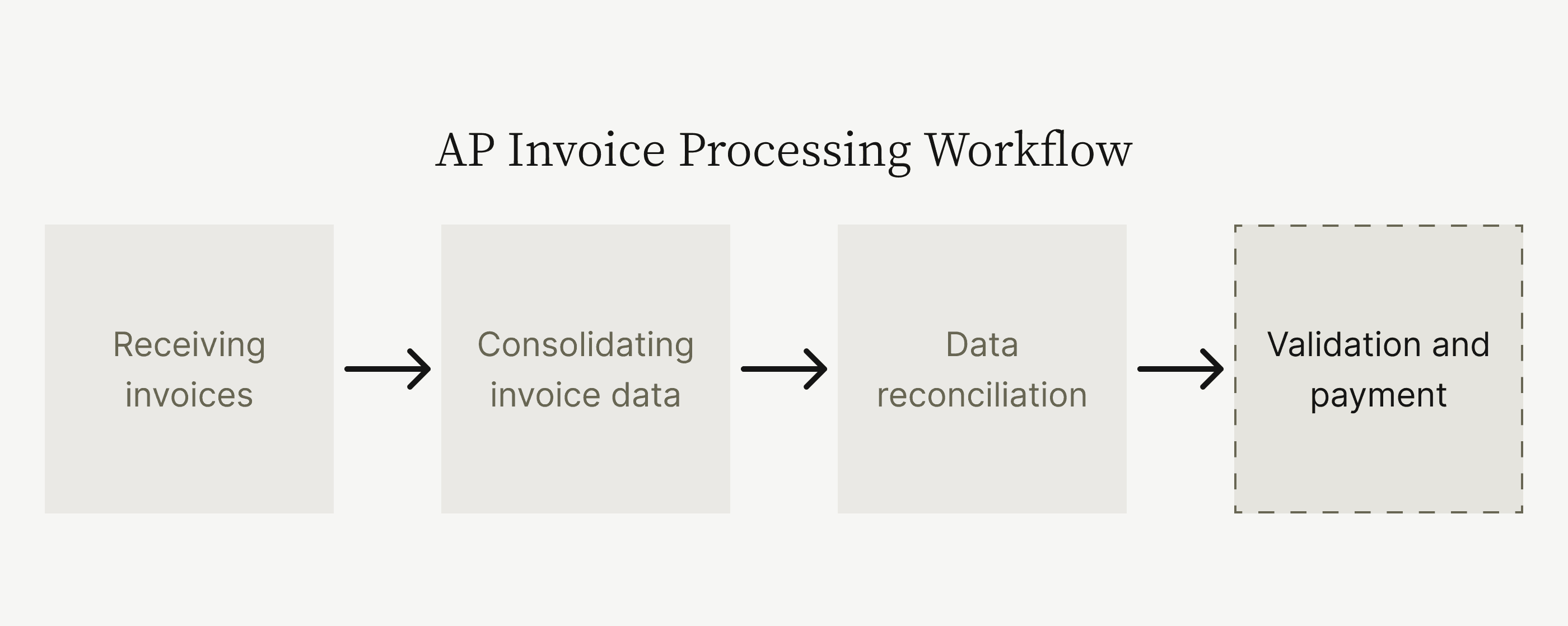

Here’s precisely how EIPP impacts each step in the invoice approval workflow:

Step 1. How EIPP helps with receiving invoices

EIPP automates invoice delivery and delivers them per accounts payable preferences. For instance, if your customer prefers receiving invoices directly in their payables portal, an electronic invoice presentment and payment solution can do so, immediately plugging your collections process into your customer's desired workflow.

Here’s how EIPP transforms this step in the AP invoice approval process:

EIPP helps payable teams centralize invoices

EIPP integrates with AP systems

EIPP automates invoice creation, removes AR errors

EIPP helps payable teams centralize invoices

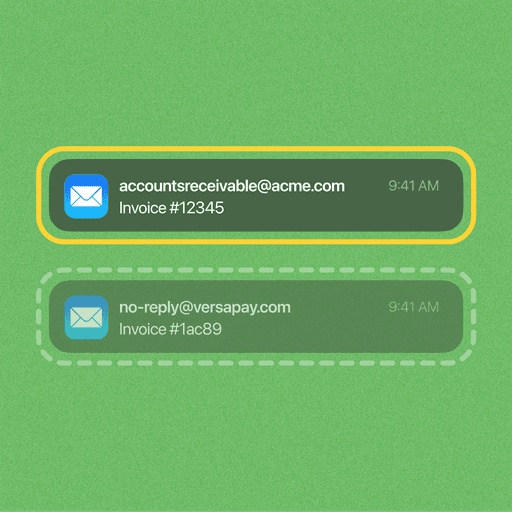

Your customers clear large payment volumes monthly. A single invoice delivery channel helps them track and pay invoices quickly; they shouldn’t be forced to hunt or wait for stray invoices.

Personalized invoice delivery—powered by EIPP—helps accounts payable teams centralize and manage invoices better. The result is greater organization, leading to faster payments.

Centralized invoicing also gives AP teams real-time visibility into account statuses. Compare this to what’s most common in a manual invoice approval process that’s kickstarted through an accounts receivable team’s paper-based invoicing practices. Versapay's customer, TireHub, for instance, used to deliver their customers paper invoices by mail. Those customers were ultimately handcuffed by having to wait for monthly statements to understand what they owed.

From the outset, the first step in the AP invoice processing workflow was damned.

Here's how EIPP overhauled TireHub's invoicing process and gave its customers real-time visibility into account statuses, reduced processing costs, and decreased collection times:

EIPP integrates with AP systems

By sending your customers paper invoices, you're unwittingly creating an AP invoice approval workflow nightmare. How so? Under these circumstances, accounts payable teams must store your invoices or digitize them—both tasks that take AP professionals away from their core functions. Lost paper invoices are also almost impossible to track, leading to preventable back-and-forths between AP and AR.

EIPP delivers your invoices electronically, directly through your customers' preferred channels, eliminating additional work for their AP teams. The result is a great experience that encourages faster payments.

EIPP automates invoice creation, removes AR errors

Paper-based invoicing introduces easily avoided errors that obstruct accounts payable invoice approval workflows. When invoicing manually, your AR team must spend time printing, packaging, and physically reconciling payments from customers. This creates fatigue, and in such an environment, errors are inevitable.

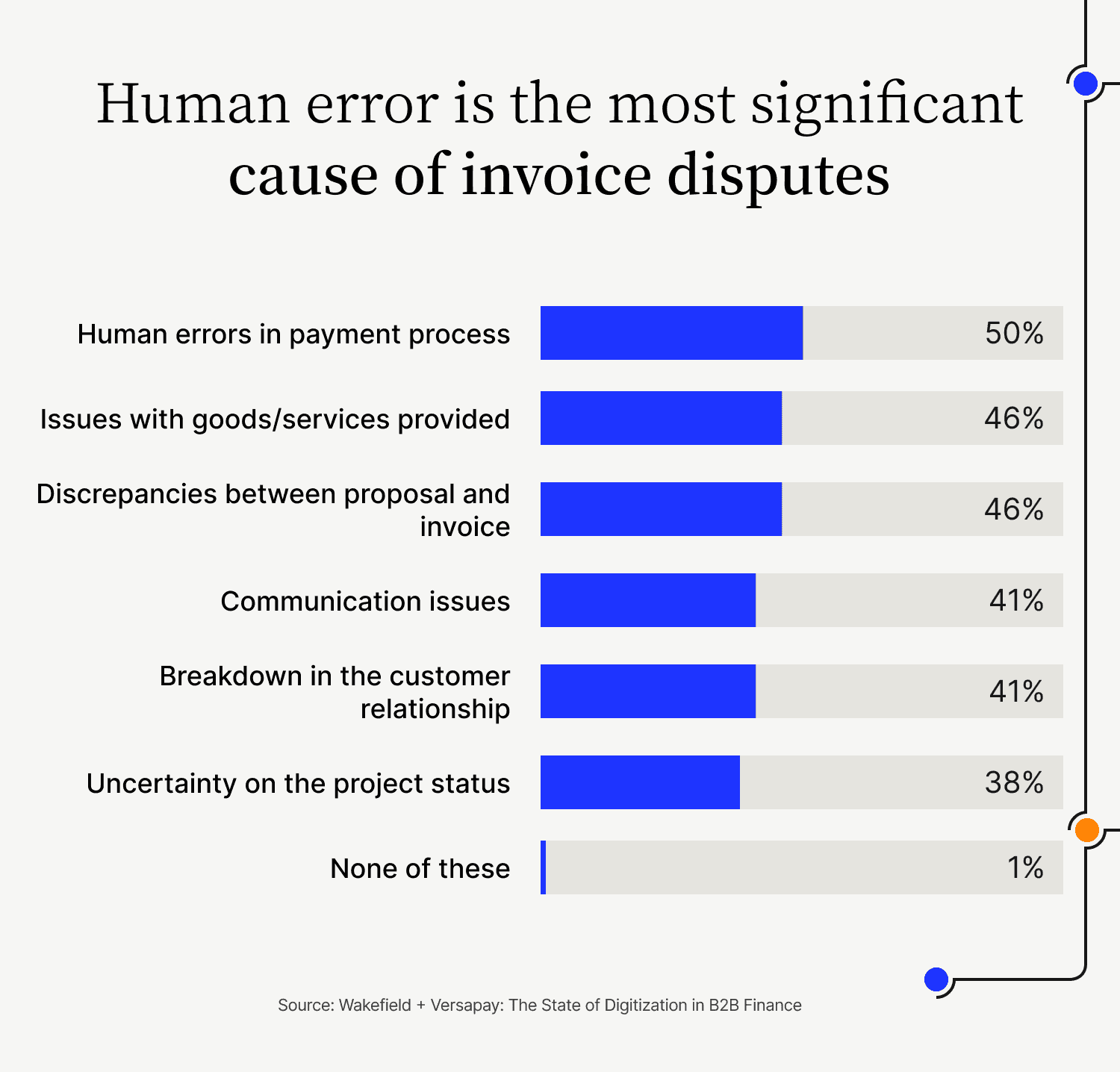

Plus, when paper invoices are manually scanned or entered by the recipient—the accounts payable team—further errors are introduced. And since human error is the most significant cause of invoice disputes, eliminating those instances should be a priority.

Not to mention, paper-based invoices also frustrate AP teams as pricing errors or improperly applied discounts delay approval workflows, negatively impacting their performance KPIs.

Electronic invoice presentment and payment automates invoice creation and delivery by pulling data from your ERP systems and delivering invoices automatically. The result is prompt and error-free invoice delivery that removes any hurdle to your customers paying you quickly.

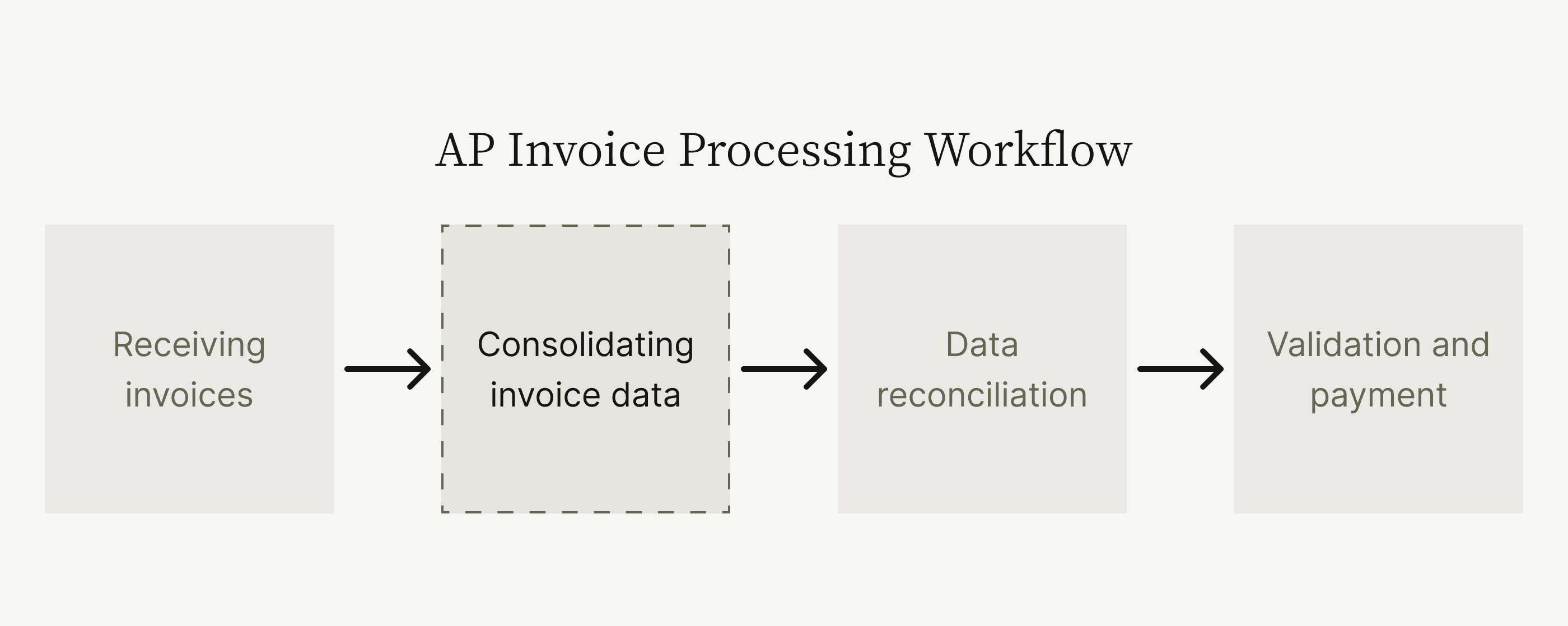

Step 2. How EIPP helps with consolidating invoice data

Once accounts payable receives their invoices, they must then organize the data within them. Poor preparatory organization on accounts receivable’s behalf often creates headaches for AP during this stage in the invoice approval workflow.

Here's how EIPP solves the most common data consolidation issues:

EIPP customizes invoice data as payables needs it

EIPP enables direct customer communication

EIPP reduces payables’ invoice processing costs

EIPP customizes invoice data as payables needs it

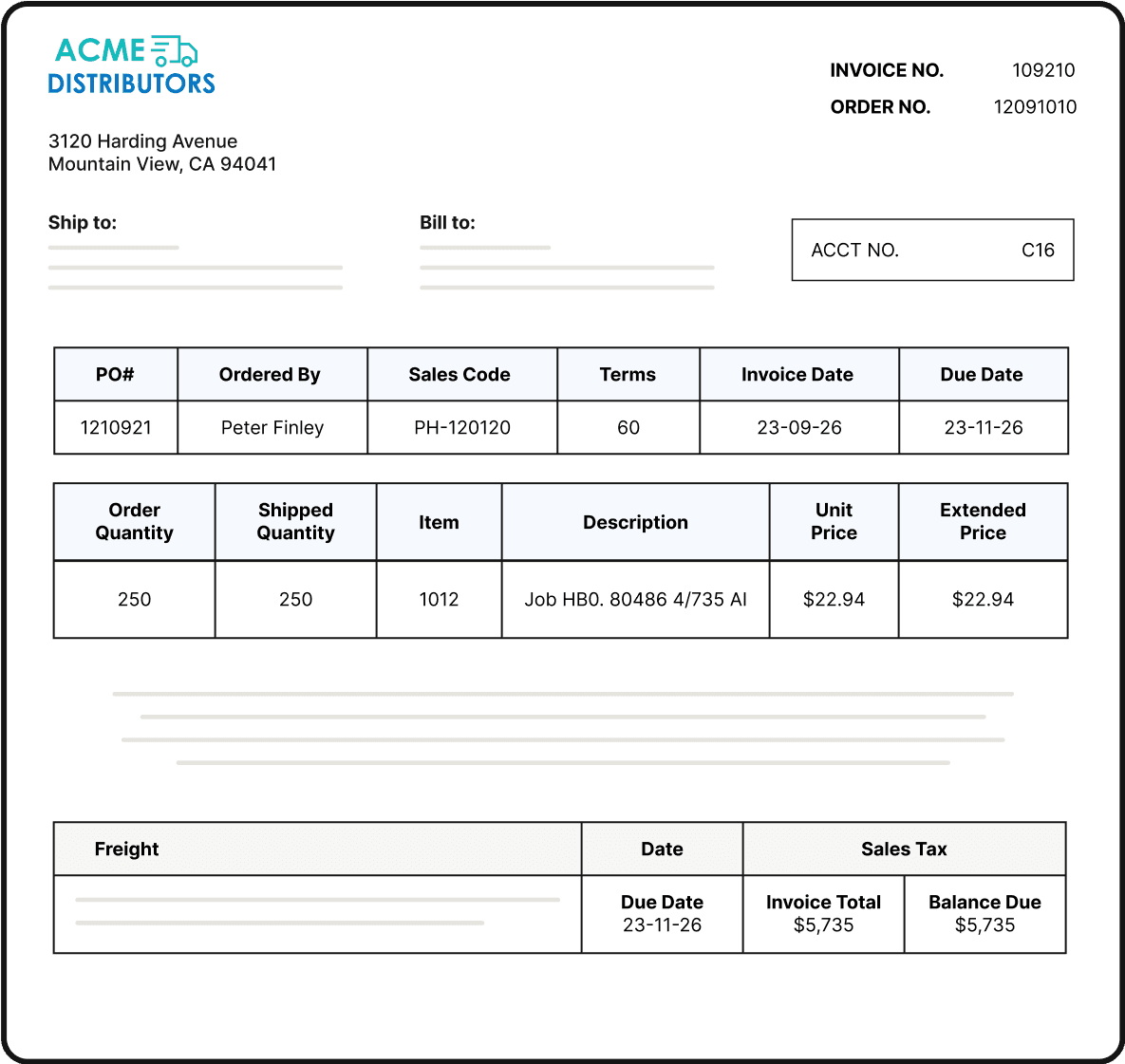

Every accounts payable team has slightly different invoice approval workflow processes, and this leads to accounts receivable making simple invoicing errors. One customer, for instance, might want AR to display PO numbers on the invoice, while another might want AR to attach the PO when presenting invoices. These invoice personalizations can be difficult to execute without the support of an EIPP platform.

Accounts receivable teams invoicing manually will inevitably make mistakes, forgetting to include pertinent data or important documents in your invoices. This leads to accounts payable teams having to follow up, AR having to re-issue invoices, and payments being delayed.

A construction company faced such an issue, before adopting Versapay's EIPP solution. Their end customers would call their AR department to clarify payment dates or ask for the correct amounts due. This led to them spending upwards of 75% of their time on paper mailings, customer calls, and collections.

In implementing an EIPP solution, this company was able to pull relevant data from different sources, cater to custom invoicing needs, and reduce the frequency by which their customers’ AP teams followed up with accounts receivable. This saved both teams valuable time, but especially with regards to the invoice approval workflow.

With accounts payable receiving invoice exactly as they prefer, this construction company has reduced its DSO and time spent on manual, repetitive invoicing tasks.

EIPP enables direct customer communication

Electronic invoice presentment and payment solutions do more than simply automate invoice creation and delivery. They also put your accounts receivable teams in direct touch with your customers.

Many accounts payable teams still rely on email or phone calls to communicate with their suppliers. Yet tracking information and data through these channels is difficult. Consider how often you have, for instance, lost track of important information in an email chain.

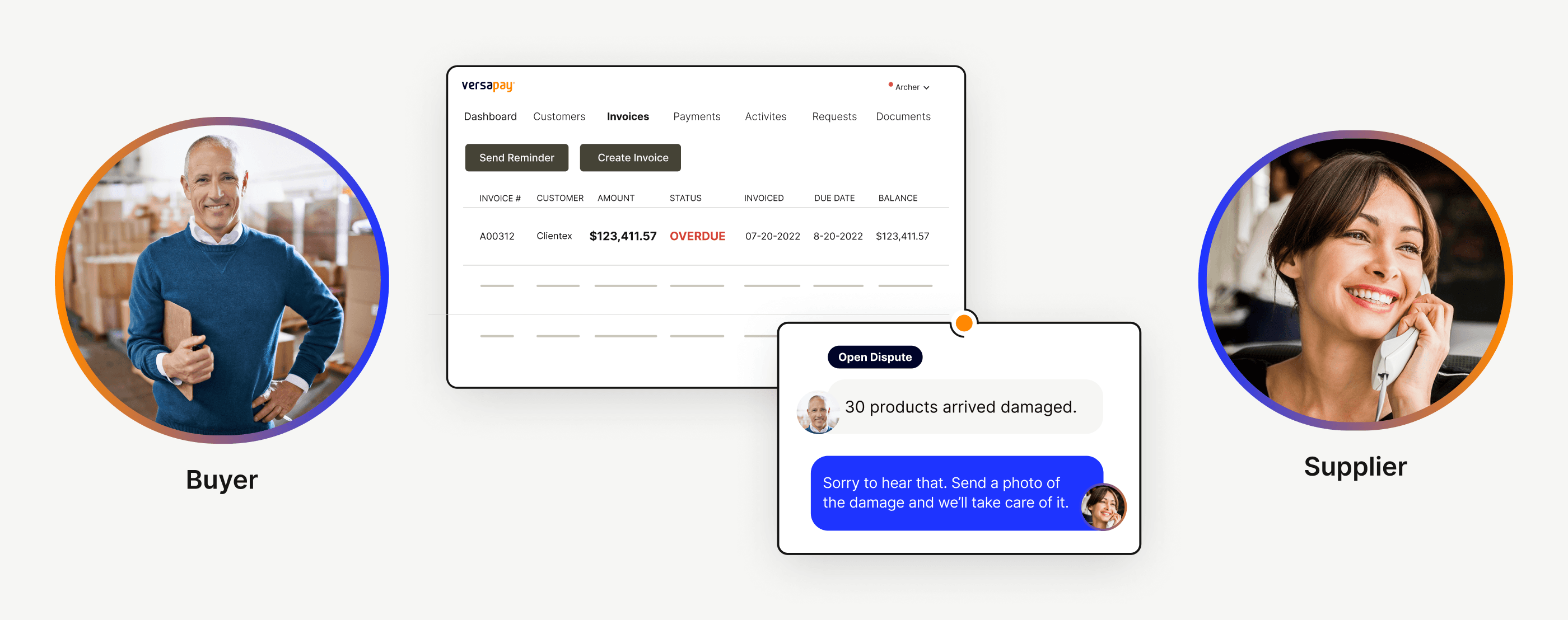

EIPP platforms like Versapay offer a communications portal, where your customers’ accounts payable teams can instantly message accounts receivable for clarifications—or to dispute invoice discrepancies. Your AR team can in turn answer them, resolve disputes quickly, and speed up collection times. The impact this has on the invoice approval workflow cannot be overstated.

EIPP reduces payables’ invoice processing costs

Invoice processing is expensive. Adobe reckons invoice processing costs companies anywhere between $15-$20 per invoice—a significant sum if your customer processes more than 100 invoices weekly. (By the way, mid- to upper-midsized companies process an average of 2,433 invoices monthly.)

EIPP platforms deliver invoices and data in easily read electronic formats. Your customers can easily extract data from these invoices, upload it to their systems, and move forward with their invoice approval workflow more quickly. So, only does EIPP reduce accounts payable invoice processing costs, but it also speeds up invoice processing, resulting in faster payments.

Step 3. How EIPP helps with data reconciliation

In this step of the invoice approval process, accounts payable teams reconcile the data from the incoming invoices with their records. This approval step tends to produce the most disputes since data mismatches often surface here.

Here's how EIPP prevents disputes, ultimately getting you paid faster:

EIPP helps you securely deliver important documents

EIPP boosts collaborative dispute resolution

EIPP offers payables transparency into your processes

EIPP helps you securely deliver important documents

As part of the typical invoice approval workflow, accounts payable teams often request additional documents as proof to supplement your invoice data. Documents such as order dispatch proofs or delivery slips can get lost in email chains (or worse, the mail).

EIPP platforms let you attach these pertinent supporting documents safely, giving payables teams instant access to the proofs they need to process payments quickly. These platforms also offer far more secure data storage facilities than email or paper-based alternatives.

When information lives in multiple places, such as email threads or notes from phone calls, AP teams will find it difficult to confidently make payments. (And receivables teams are more likely to unnecessarily reach out about overdue payments.) EIPP platforms ensure greater visibility for all parties involved, accelerating the invoice approval workflow process, and cutting back on duplicate or clarifying work.

EIPP boosts collaborative dispute resolution

While EIPP eliminates easily avoided disputes through automation, it offers another critical advantage during the invoice approval workflow.

Complex disputes need input from different stakeholders, and manual accounts receivable processes cannot successfully bring everyone onto the same page. For instance, your AR team might need Sales’ input on credit terms. Email chains will inevitably lead to miscommunication—or time-delays—potentially souring important customer relationships. An EIPP solution's customer communication portal will help you include stakeholders seamlessly.

Best of all, through EIPP solutions, your accounts receivable team can interact with their customers’ AP teams directly and trace conversation threads thanks to automated logging. This feature reduces dispute resolution and collection times.

EIPP offers payables transparency into your processes

EIPP's data centralization abilities and communications portal give your customers visibility into account and dispute statuses. With these, accounts payable teams can quickly understand your accounts receivable team’s reasoning behind dispute decisions, since you can offer them data to justify your conclusions.

The result is strong customer relationships and a customer AP team that appreciates your communication.

In turn, these factors speed up AP invoice approval workflow processes, resulting in cash reaching your accounts faster.

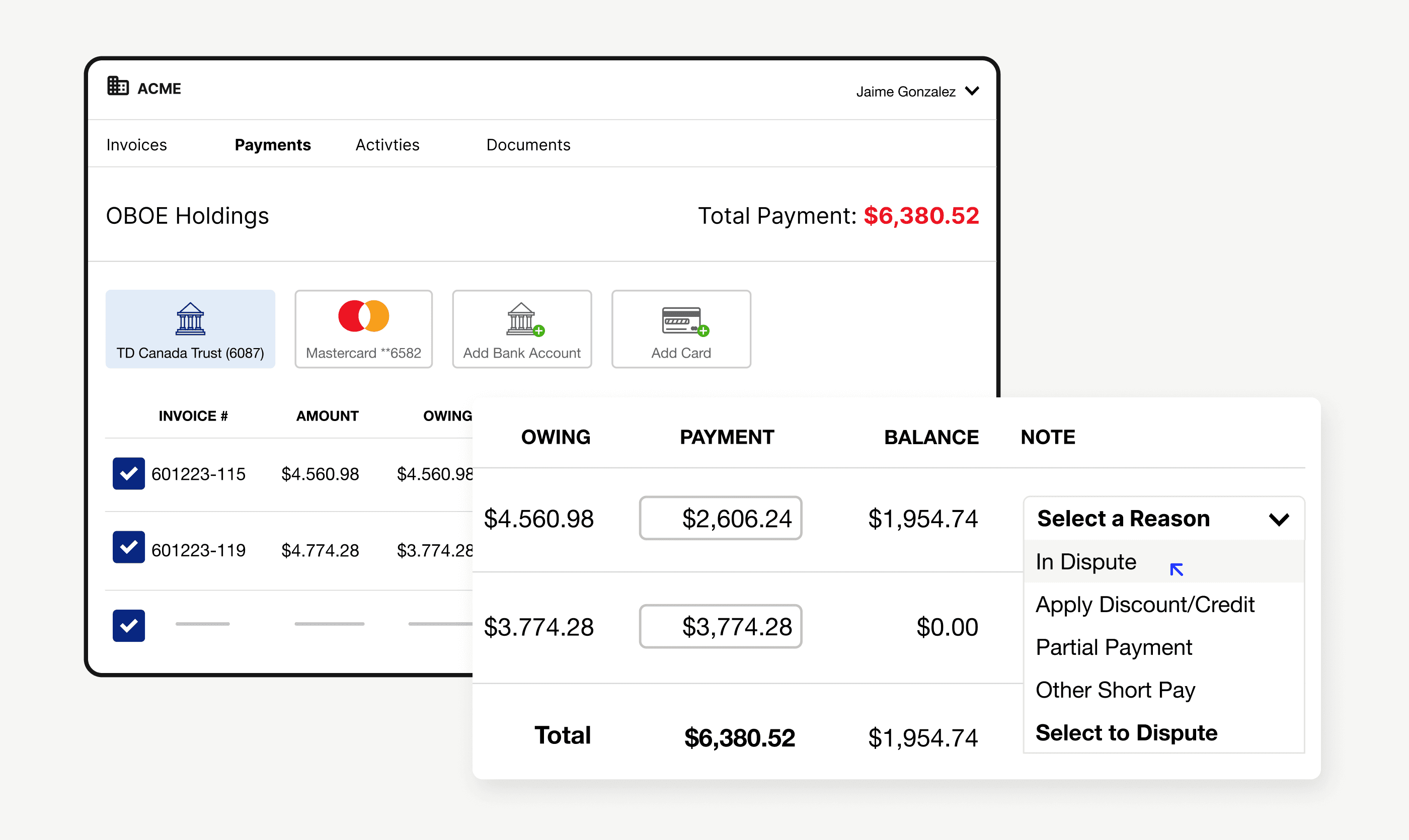

Step 4. How EIPP helps with validation and payment

The final step in an AP invoice approval workflow involves seeking approvals and releasing payment. The advantages that electronic invoice presentment and payment solutions deliver will help your customers arrive at this step much faster compared to manual invoice delivery.

In short, the sum of the advantages EIPP helps you deliver to your customers will automatically speed up this step. This was Boston Properties' experience when they transformed their accounts receivable processes using Versapay.

From helping customers self-serve by paying invoices to forecasting late payment risks, EIPP helped Boston Properties collaborate with their customers and get paid faster.

EIPP delivers significant benefits to your business

EIPP's benefits extend well beyond the ones we've highlighted here. Aside from smoothing accounts payable experiences, EIPP can help you transform the following:

Reconciliation — EIPP solutions can match remittance data to invoices, helping you reconcile cash quickly.

Invoice processing — Issue, deliver, and collect on invoices faster.

Disputes management — Reduce the number of disputes and give AP visibility into resolution workflows.

Cash flow projection — Centralized data helps you plug cash flow leaks.

Employee productivity — With more time, accounts payable and accounts receivable teams can focus on value-added tasks.

Collections — EIPP smoothes AP processes, getting you paid faster.

Customer experience — Automation removes hurdles and helps you customize processes per AP needs.

Cost savings — AP teams can capture early-payment discounts thanks to automated notifications and payment reminders.

—

Learn how automated invoicing with Versapay's collaborative accounts receivable portal gets you paid faster and meets unique customer needs.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.