Prepaid Expenses: A Valuable Approach in a Fast-changing Marketplace

- 12 min read

In this blog, we’ll define prepaid expenses, detail the benefits of accepting them, and cover how to record.

But more importantly, we’ll teach you how accounts receivable automation solutions streamline the prepaid expenses acceptance process.

Key takeaways

A prepaid expense is something a company pays for prior to making use of it, such as a lease, insurance coverage, or inventory.

Benefits of prepaid expenses for the buyer include ensuring availability of resources, locking in current prices, and maximizing tax deductions, among other things.

Benefits of prepaid expenses for the vendor include accelerated cash flow, strengthening customer relationships, and facilitating effective financial management.

Versapay facilitates making and accepting prepaid expense payments so you can take advantage of this option with ease.

—

As consumers, many of us are familiar with paying ahead of time for certain expenses in our lives. Prepaying can increase our security, get us discounts at times, and lock in current-day prices.

These and other advantages to this practice also motivate businesses to prepay in various B2B transactions. In the world of business, prepaid expenses are just what they are for consumers: payments made for goods or services that the business has not yet used or received, such as rent on office space, insurance coverage, and equipment rental.

A business pays for these expenses in one accounting period but only recognizes the gains from the payments in a later accounting period. Questions tend to pop up around this idea, such as whether prepayments are assets and whether prepaid expenses go on the balance sheet.

In this article, we will look at:

What are prepaid expenses?

Prepaid expenses are payments that a company makes for something that it will use or benefit from at a future time. The company might be planning to recognize the benefit almost immediately or at some more distant date. But the key demarcation of a prepaid expense is the disconnect between the time of payment and recognizing the benefits from the purchase.

Is a prepaid expense a current asset?

A prepaid expense is typically listed as a current asset on a company’s balance sheet. When you first prepay an expense, the transaction is usually recorded as an asset because you will be getting economic benefit from this purchase.

When you realize the benefits of the expense—for example, spending a month covered by insurance you’ve already paid for—you reduce the asset by the amount of the prepaid expense you’ve benefited from or used.

Are prepaid expenses debits or credits?

Prepaid expenses are first debits and then become credits. At first, prepaid expenses appear in the debits section of the balance sheet because the company is using cash or another asset to pay for a future benefit. This debt increases the assets on the balance sheet.

However, as you use up or consume the prepaid expense, the portion you use in each time period should be recognized as an expense on your income statement. This is done by adding a credit to the prepaid-expense account and debiting the appropriate expense account, such as the insurance account.

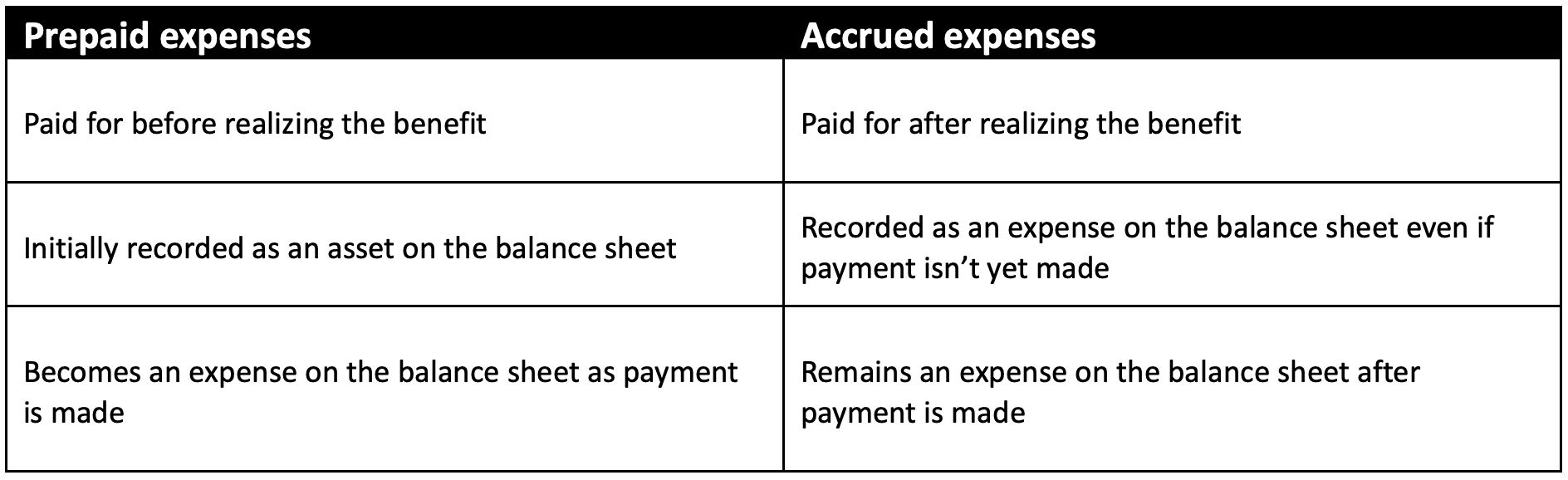

Prepaid expenses vs. accrued expenses

The difference between prepaid expenses and accrued expenses is the timing of when the company pays for something. Prepaid expenses are those that a company pays for before benefitting from.

Accrued expenses, on the other hand, are costs that a company has incurred but they have not yet paid for. These appear as liabilities on the balance sheet because the company is in debt to the seller for the amount due. Therefore, they are recognized as expenses on the income statement even if cash for payment hasn’t changed hands.

Examples of prepaid expenses in accounting

Which expenses a business may want to prepay will depend on their industry, types of payments they need to make, and other factors.

Commercial real estate and distribution are two industries that rely more heavily on prepaying expenses due to the dynamics and requirements of lease agreements, lender requirements, inventory needs, bulk purchases, and supplier relationships.

Some prominent examples of B2B prepaid expenses are:

Lease payments for an office or warehouse

Estimated taxes

Insurance premiums

Subscription fees

Inventory costs

Equipment rental costs

6 benefits of making prepaid expenses

A prepaid expense has a number of potential benefits that may make up for the fact that you’re handing over some of your cash before you see the benefit from that cost. Here are a few of the benefits you can look for.

1. Securely satisfying a future need

This is probably the most important benefit of prepaid expenses since paying ahead of time gives you a desirable amount of security. For example, paying your rent on the first gives you peace of mind that your office space will be secure for the next month.

2. Locking in current prices

Prices may rise at any time for any number of reasons, such as inflation, supply chain issues, market trends, or supplier restructuring. Paying for some of these expenses ahead of time allows you to lock in the current rate.

3. Maximizing tax deductions

By prepaying expenses, businesses can manage future tax deductions because the tactic can speed up the recognition of certain expenses. The result may be reduced taxable income and lower tax liability in the current tax year.

4. Providing a prepayment discount in some cases

Some vendors or sellers may offer you a discount for prepaying. For example, if you rent equipment and pay for six months up front instead of paying monthly, you may get a lower price for prepaying.

5. Gaining the trust of your vendors

Prepaying can show your vendor that your company is financially stable and well-resourced, which can bolster your vendor’s trust in your business and their inclination to give you better rates or terms on future transactions.

6. Streamlining transactions

Prepayment of business expenses is often automated, which can reduce your administrative burden by streamlining the transactions, which can save your company money and time.

3 benefits of accepting prepaid expenses

Accepting prepayments also has many benefits for companies, especially for those in industries whose customers expect to have this option.

1. Boosting cash flow and upfront revenue

Receiving payments ahead of providing goods or services allows businesses to accelerate cash flow and capture more up-front revenue that can contribute to financial stability.

2. Strengthening customer relationships

Accepting prepayments from customers who want this option increases their loyalty to your company’s brand and can encourage longer-term relationships.

3. Facilitating effective budgeting and accounting

Receiving prepayments, especially automated payments for recurring expenses, helps companies budget more effectively, better manage finances, and plan for tax liability.

How do businesses record prepaid expenses?

There are two methods of recording prepaid expenses in a company’s books: the asset method and the expense method.

1. The asset method for recording prepaid expenses

The prepaid expense starts as an asset on the books, then records indicate that the asset is drawn down over the appropriate time period. For example, an accountant might record an annual $120,000 insurance policy in full as an asset on January 1st, then list an expense of $10,000 each month, which decreases the prepaid asset’s value by over time until it is drawn down entirely to zero.

2. The expense method for recording prepaid expenses

The expense method treats prepaid expenses like accrued expenses: The accountant records the total prepaid amount as an expense from the start, and does not even maintain a separate account for prepaid expenses. No further adjustments to the books are necessary for this expense when the benefits are realized over time.

Prepaid expenses and amortization

The process of adjusting the books to turn a prepaid asset into an expense is called amortization, which must be structured to match the pace at which the asset is used.

For example, if a company prepays $1.8 million on January 1st for a year-long lease on a warehouse, that asset will convert into an expense at a rate of $150,000 per month for 12 months. Amortization is complete when the asset’s value is reduced to zero on the balance sheet.

Making prepayments in Versapay

Prepayments benefit both the seller and the buyer in a B2B transaction. Versapay offers a great solution for companies with customers who want to prepay or that operate in industries in which prepayments are common, such as commercial real estate and distribution.

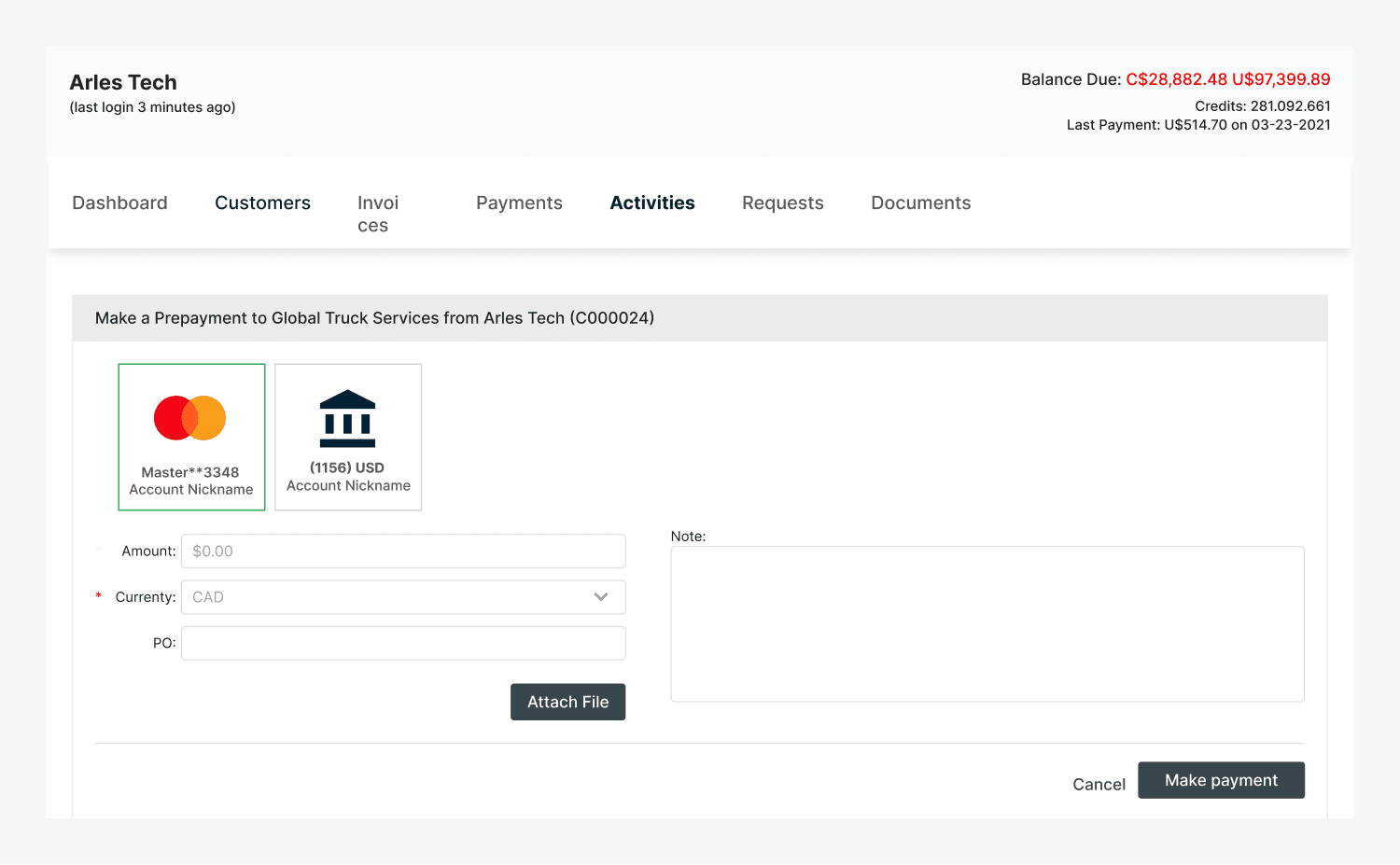

Here’s what it looks like with Versapay when one of your customers makes a prepayment to a supplier:

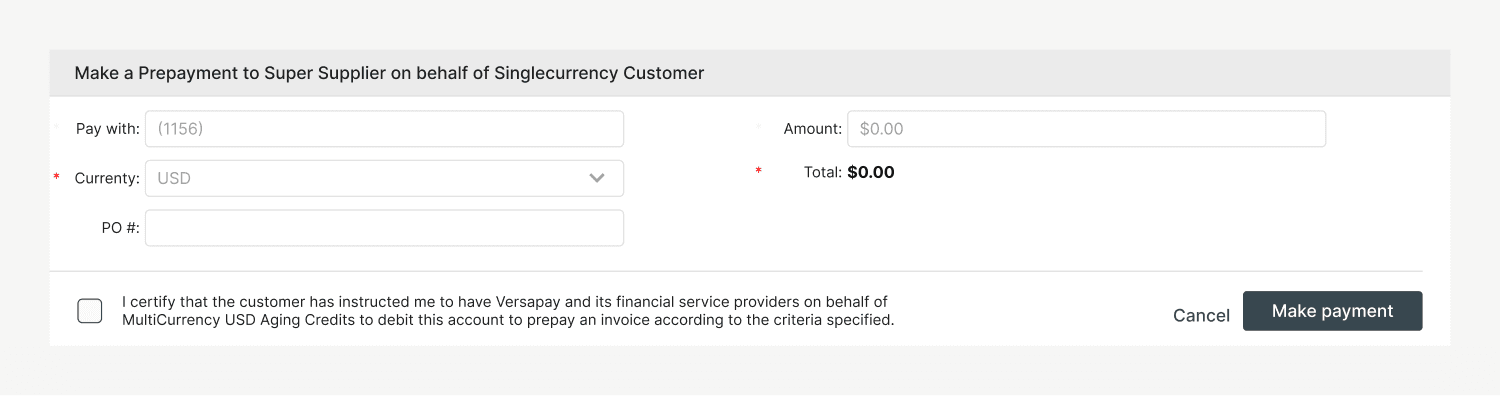

Versapay also allows a supplier to make a prepayment on behalf of a customer:

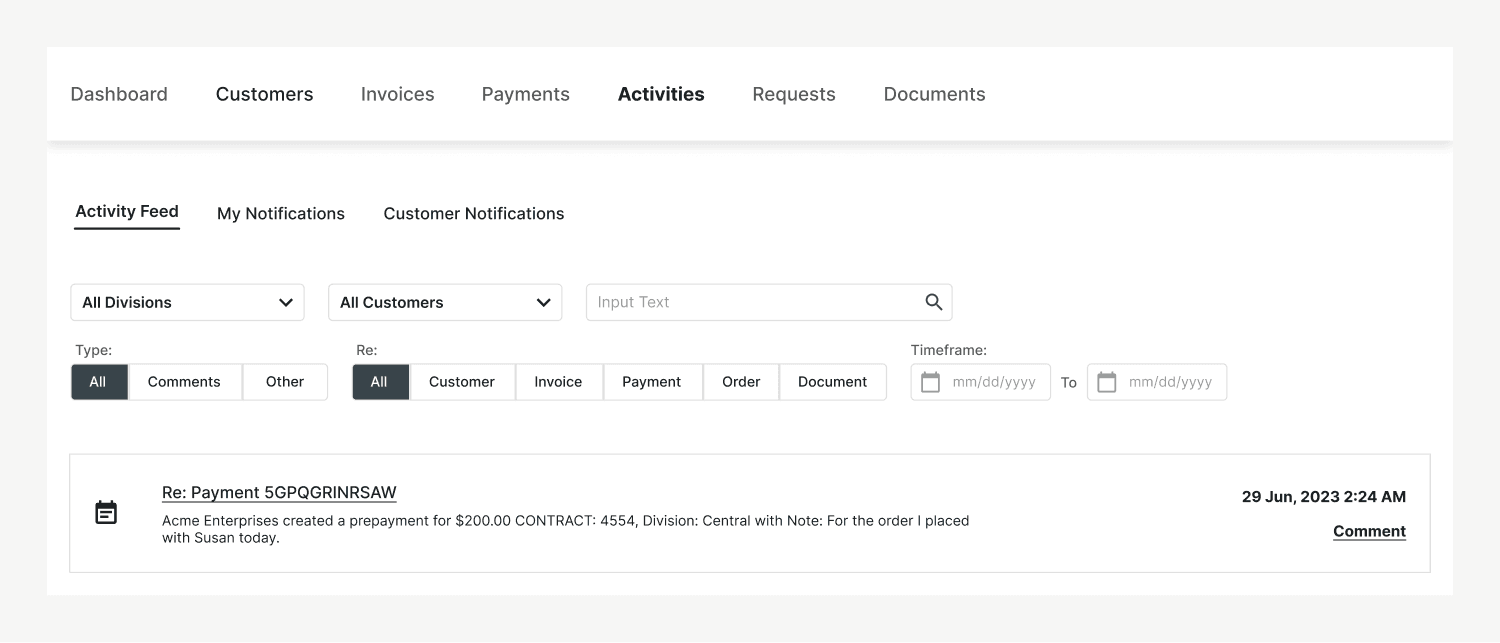

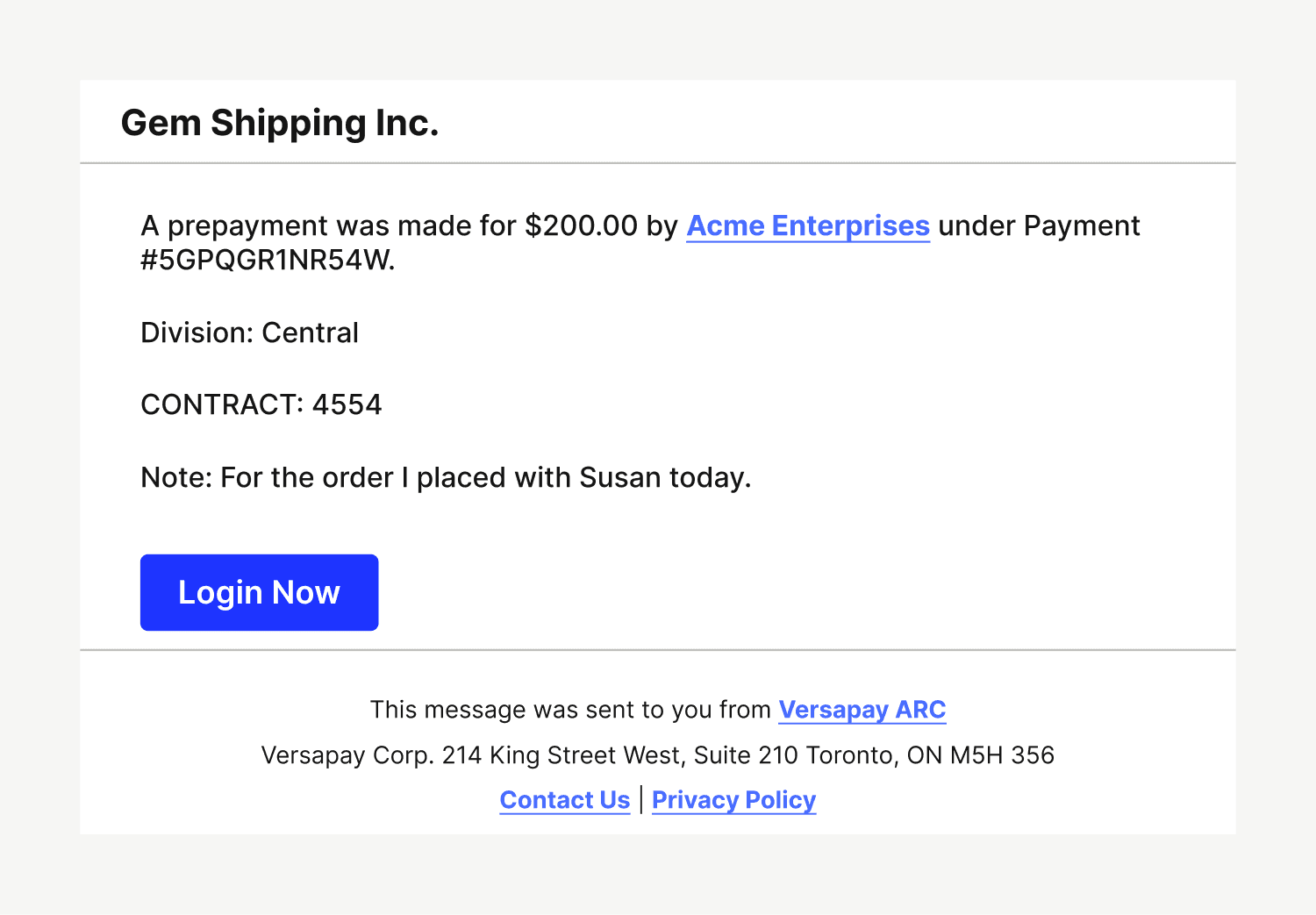

Versapay records a notification when a customer makes a prepayment, with the option for them to leave a note about the transaction. (The supplier can go in and match the payment to an invoice once it is generated.):

Versapay alerts the supplier when a customer makes a prepayment:

Prepaid expenses can be easy to manage

Businesses can benefit both from paying expenses ahead of time and from accepting prepayments from B2B customers.

Using an automated accounts receivable solution like Versapay can help facilitate this type of transaction, so it’s easy to prepay, make prepayments on behalf of others, record prepayments, and match payments to invoices later. The ability to do all of this easily is valuable for fostering financial resilience, good customer relationships, and business growth in today's fast-changing marketplace.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.