4 Ways Automation Solves the Issues Behind the Finance Talent Shortage

- 8 min read

Finance is currently experiencing a significant shortage of talent professionals.

Discover four key ways automation helps finance and accounting teams solve the finance talent shortage and improve efficiency.

Finance—and accounting especially—are experiencing a shortage of qualified professionals. The number of graduates choosing accounting as a major has declined since 2016. The WSJ reports that 82% of the accountants who exited the profession in 2023 had at least six years of experience.

As a result, companies are overworking their professionals in finance. The stress this causes is creating a shortage of talent even as demand for finance roles within departments like accounts receivable increases.

Technology is a great solution to overcoming this gap. This article explores how it solves the critical issues driving this shortage. But first, let us look at how staff shortages in critical finance departments like accounts receivable (AR) will impact businesses.

Jump to a section of interest

How automation positions finance as a strategic business driver →

Why embracing automation is the key to solving the finance staff shortage →

How staff shortages will negatively impact businesses

Much of the news surrounding finance staff shortages has centered around the lack of accountants. Shortages in other departments such as accounts receivable, however, will negatively impact businesses too (and perhaps even more significantly).

Here is what a short-staffed AR department will cause:

Short-staffed AR departments will make cash flow management messy — With more work to complete, accounts receivable professionals will have less time to devote to cash flow analysis. Also, AR teams will be less effective at removing the barriers to smooth cash flow such as solving customer disputes, spotting the signs of delayed payments, and applying cash to open invoices. As a result, companies will have less visibility over cash flow, disrupting their projections.

Short-staffed AR departments will create poor customer experiences — Accounts receivable teams can enhance customer experience by delivering smooth payment and dispute-handling processes. However, these need time to execute. For instance, an AR professional cannot solve complex customer disputes if their task list is overloaded. The result? A customer who feels they are not understood, weakening that relationship.

Companies will overwork their AR staff, leading to a talent exodus — Employees can take only so much stress and overworking them will lead to an exodus of talent from accounts receivable. This departure will compound the problems listed above, damaging a company's efficiency even more (not to mention increasing its difficulty in recruiting new future talent).

These problems will also create issues in auditing, compliance, and financial reporting since accounts receivable data plays an important role within each function. So how can automation solve these problems? Let's take a deeper look.

How automation helps firms do more with less talent

With fewer finance graduates entering the workforce, costly errors like the one ride-sharing company Lyft recently experienced might soon become the norm. So, how can companies do more with less talent?

Automation is the solution. Here's how:

- Automation helps companies scale their processes as they grow — The average company's accounts receivable department is saddled with manual processes that need huge headcounts to run. (Yet, these companies often employ a small number of AR professionals.) Automation removes clerical and rote tasks from the invoice-to-cash workflow, giving you an always-on employee. As a result, it gives time back to professionals despite the scale. For instance, this healthcare services provider doubled payment volumes but reduced the time spent applying cash by 75% while increasing cash application accuracy.

- Automation removes errors that damage your reputation — Our research shows that human errors in payment processes are the biggest cause of invoice disputes. Disputes create an accounts receivable time sink for employees, removing them from other critical tasks such as cash flow analysis that boosts working capital management. Repeated disputes also damage customer relationships, creating needless friction between you and your customer. Automation in areas like invoice creation removes easily avoided errors, gives your AR team more of its time back, and helps them focus on disputes that need personalized attention. The result is a happy customer and an efficient AR team.

- Automation boosts talent retention — With less rote work and more opportunities to dive into highly rewarding tasks such as solving complex disputes, automation helps you retain talented employees. Digitizing your AR processes can also help you offer flexible work arrangements, making your company an attractive place to work for potential recruits. It also gives your employees time to upskill themselves and forge career paths. For instance, RPC’s AR Specialist used the time saved by automating cash collections to learn more about Accounting’s strategic role in the business and take courses to assist the Controller with month and year-end closes.

How automation positions finance as a rewarding career

A lot of talk about addressing the shortage has centered around credentialing and education. For instance, in accounting, some people are advocating doing away with the 150-hour rule.

While these changes might address a few issues, the root cause of the talent shortage is the “boring” image finance careers have. Most undergraduates think of finance as a staid career path with little room for development.

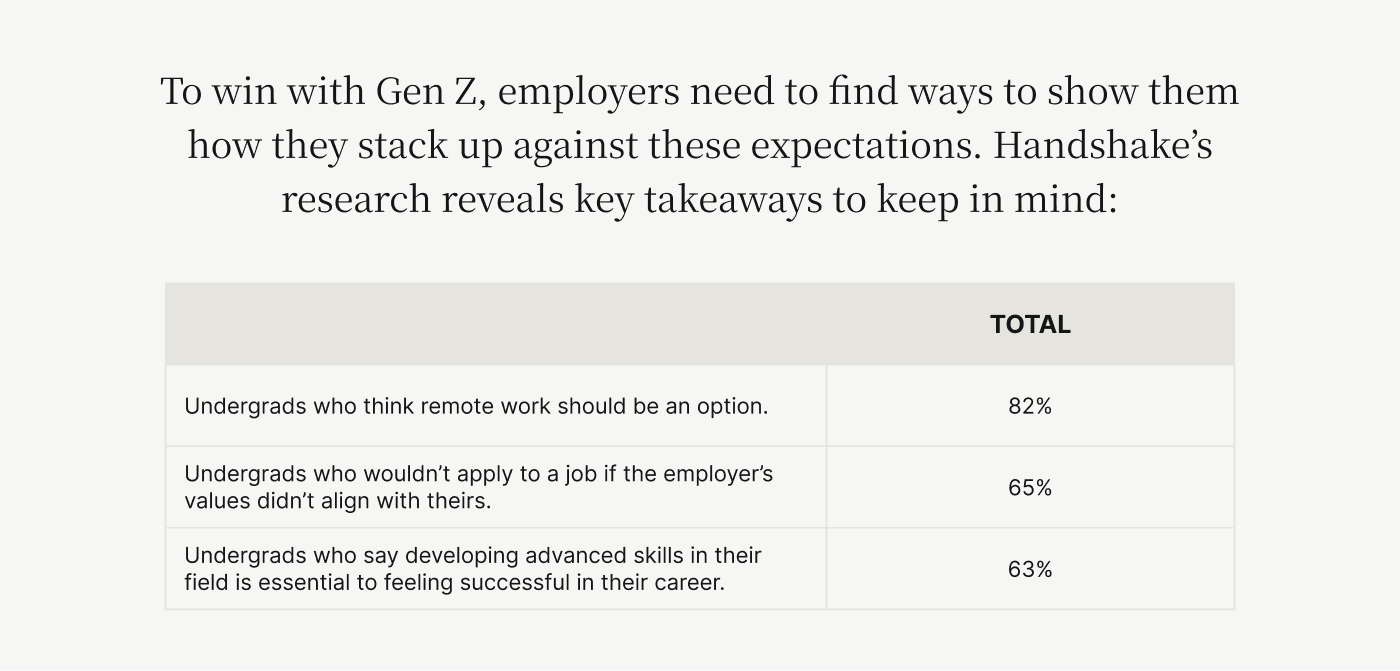

Gen Z’s career priorities also clash with the stereotype of finance. New entrants to the workforce prioritize skill building (63%), values alignment (65%), and flexibility (82%).

Here's how automation can help you meet these demands:

Automation positions finance professionals as key CX drivers — With more time to conduct value-added work, finance teams like accounts receivable can dive deeper into solving customer issues and enhancing relationships. For instance, automation eliminates disputes caused by clerical errors—like incorrect prices or discounts—and gives AR teams time to solve complex issues that need deep analysis. In the process, AR professionals communicate and build relationships with customers, helping the latter feel heard and attended to.

Automation exposes professionals to exciting technology — Automation technology such as AI-assisted Optical Character Recognition (OCR) transforms AR from a "boring" department to one that leverages the latest tech developments. By scanning all types of remittance advice and matching them to open invoices automatically, AR professionals can build more efficiency in their workflows. When coupled with other features like visually intuitive dashboards and direct communication portals with customers, AR transforms into a highly attractive field for talented professionals. For example, Madison Resources replaced legacy lockbox services with advanced cash application technology to transform its collections processes. Technology of this kind also helps you accommodate flexible work requests—something highly attractive to Gen Z.

Automation drives efficiency and emphasizes the human connection — Technological advances, ironically, make the human connection more important. It helps professionals unleash their creativity and gives them time to empathize with people on the other side of a relationship. This human connection makes accounts receivable roles more fulfilling. Instead of moving numbers around spreadsheets, AR teams can take the time to understand customers' underlying issues and solve them, giving them a sense of creating tangible results.

How automation positions finance as a strategic business driver

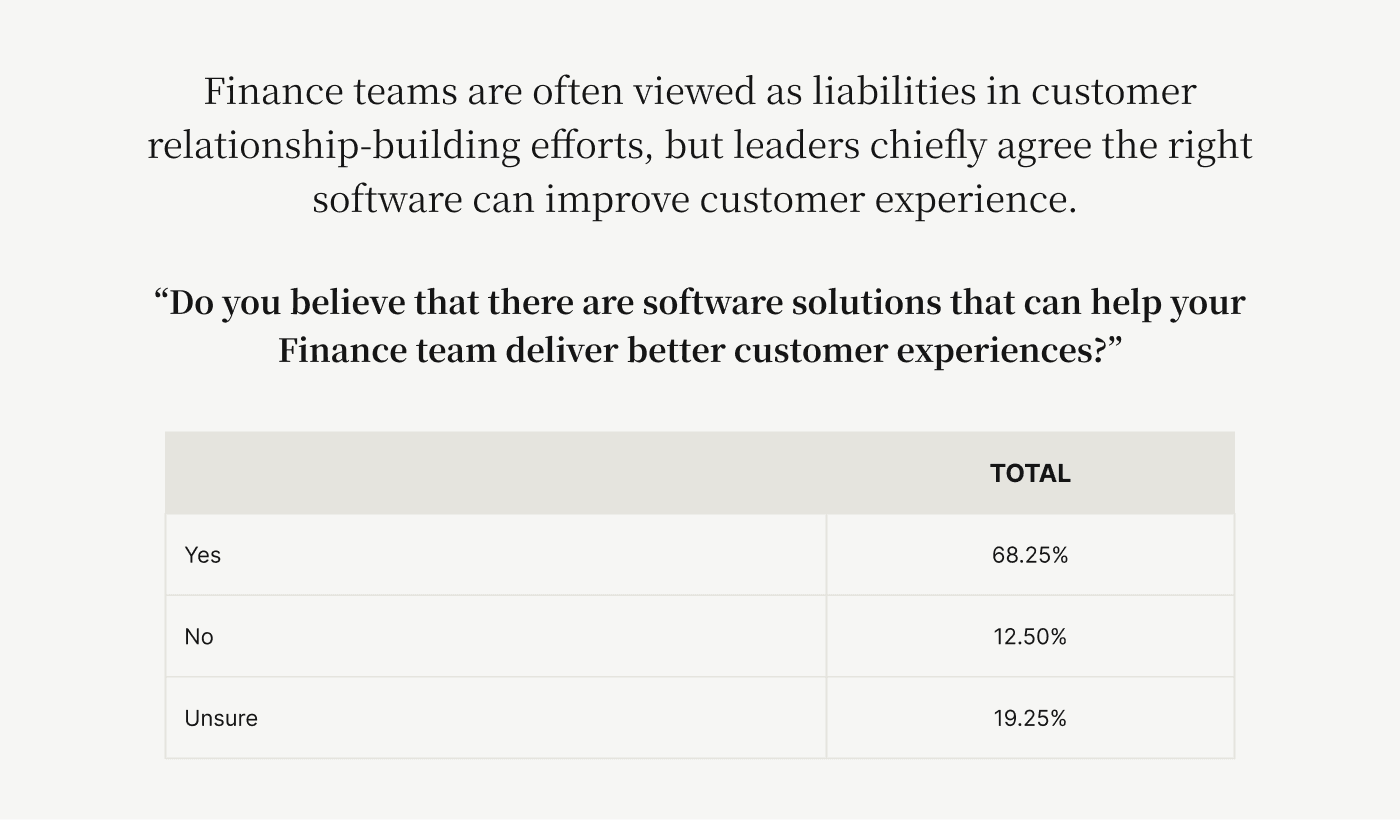

Talented professionals want to have a positive impact through the work they do. However, finance's stereotypical back office image positions the department as an afterthought (and sometimes worse, an antagonizer).

With fewer people willing to pick finance as a career, companies must figure out how to do more with fewer employees. They must also transform finance's image from a back office afterthought to a critical driver of customer relationships. Our survey on Gartner's Peer Community platform highlighted how software can transform finance into a CX powerhouse.

Here's how automation can position accounts receivable and finance as a strategic business driver while doing more with fewer resources:

Automation turns AR into a cash flow enabler — Automation reduces collection times and results in fewer disputes arising. The result is cash gets onto your books faster, fueling accurate cash flow projections.

Automation drives more strategic AR impact — Less time executing rote work gives accounts receivable professionals more time to conduct deep analysis that leaves a strategic business impact. This work is more challenging and has observable benefits to the business such as stronger customer relationships and better working capital visibility. For example, North Atlantic International Logistics unlocked $10 million in untapped revenue and witnessed its AR department strengthen customer relationships thanks to AR automation.

Automation reduces the time to derive insights — Instead of organizing and formatting data, accountants can use—for example—APIs to import, sort, and clean data. They can also use dashboards to better visualize performance, or AI to simplify explanations for a non-financial audience instead of brainstorming ways to write better. In short, automation helps finance professionals focus on the core aspects of their jobs, giving companies greater ROI per employee.

Why embracing automation is the key to solving the finance staff shortage

With fewer professionals choosing finance as a career, companies must embrace novel ways of overcoming this talent shortage. Technology and automation are a solution. Instead of positioning them as a threat to human jobs, embrace and use them to help your incumbent talent execute better. Automation has applications in every finance department, including AR.

Want to get started with accounts receivable automation? Check out our essential guide on the subject and learn how advanced technology can help you.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.